Why EM hard-currency bonds can perform well during a US tightening cycle

Fixed Income Boutique

Why inflation and rising rates can be a positive for EM bonds

- Recent history shows that EM hard-currency bonds can perform well during US Fed tightening cycles

- Market panic ahead of a tightening cycle produces higher initial EM spreads and yields, which tend to result in higher total returns in the period ahead due to higher carry.

- EM bonds remain attractive because they offer higher yields for a similar credit rating compared to developed market peers

- Techniques like spread optimization and inclusion of ESG considerations can further boost yield and reduce risks

When rates rise, emerging market bonds drop. That’s the general perception. It’s not wrong either, in the short term.

This is how it tends to happen in real life: Interest rates begin to rise, flighty EM bond investors get worried and exit their positions. This drop in bond prices provides ample fodder for financial news headlines, until the next story comes along. What you get is a short-term blip that generates a perception for the quick-buck in-and-out investors.

The reality is that long-term EM bond investors have in fact benefited in a rising rates environment. The key is that the initial sell-off (ahead of the Fed’s dreaded hiking cycle) translates into a much higher carry. As the hiking cycle progresses, fear dissipates, and EM spreads tighten, generating capital gains for bondholders.

EM spreads widen ahead of the hiking cycle, and then tighten while the Fed hikes

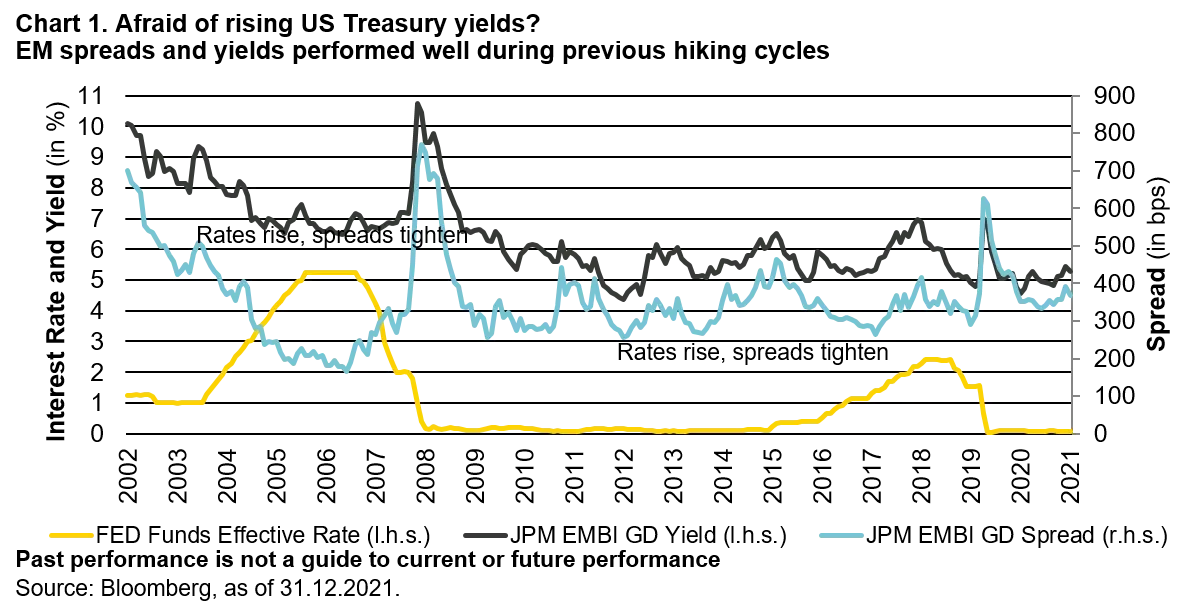

Let’s look at the last two Fed hiking cycles. US rates began rising in December 2015, all the way to 2018. Yet, EM spreads tightened during 2016 and 2017 (see chart 1) and the EMBI global diversified index delivered more than 10% total returns each of these years. It was not until 2018 when spreads widened again when the US and China started their trade war and there were currency crises in Turkey and Argentina. Even when spreads began to widen in 2018, they peaked at 100 basis points below their previous peak at the beginning of the cycle, losing 4.2% on the year.

This was not a one off, if we look further back in history, to the previous hiking cycle of 2004 to 2007, we can see that EM spreads also tightened significantly, delivering total returns ranging from 6.2% to 10.2% per year in the period. In our view, it is a myth (and a stubborn one at that) to believe that rate hiking cycles imply poor EM bond returns.

These were happy days for those EM bond investors who were invested for the long-term, allowing them to pick up bonds with a superior yield and also profit from the capital appreciation generated by the tightening in spreads.

Rate hikes offer active and long-term investors an opportunity to exploit the short-term noise that rate hikes generate. They result in bouts of volatility that are opportunities to pick up bonds with good yield and potential for capital appreciation. For example, EM sovereign bonds have never had two years in a row of negative returns (see chart 2). And, when there was a year of negative returns, the following year produced significant turnaround.

This is not by chance, there’s a clear causality. After the initial sell-off (ahead of the Fed tightening cycle) EM yields are unusually high, which implies an unusually high carry in the period ahead. Once the fear dissipates, investors take notice of the higher-than-usual yields and return to emerging markets. These inflows cause EM spreads to tighten, generating capital gains on top of a large carry for those who entered early on.

Spread optimization enables additional returns

Lingering misconceptions around EM bonds results in market inefficiencies as some investors act based on those misconceptions causing price swings. As a result, EM bonds can offer higher yields, wider spreads, with lower duration than their developed market peers. In our view, this makes EM bonds an active manager’s paradise. To help maximize returns in EM bonds, investors should aim to maximize the spread for any given level of risk. With an active approach, investors can seek out those bonds that provide the best spread for a given level of risk – we call this “spread optimization”.

For example, passive index trackers only buy the bonds in the underlying index. However, bonds from the same issuer, not included in the index, often have a stronger yield as tracker funds blindly push up the price up of those bonds included in the index. This provides a savvy investor with the opportunity to buy a bond with a similar credit risk (same issuer) for a better yield. This approach can be extended to identify bonds which are relatively cheap for other reasons, and lead or lag market trends.

By repeatedly selecting these bonds, investors can optimize the spread they achieve. We believe this approach can offer an additional 150 to 300 basis points of additional spread, whilst retaining a similar rating and duration to the EM FI benchmark.

ESG plays an important part in optimizing spread and should be included in the credit analysis. Right now, EMs are playing catch up in the ESG space and investors are increasingly demanding bonds and issuers that adhere to ESG standards. By identifying those EM issuers who are implementing ESG standards, there is a significant possibility for spreads to tighten as investors begin to reward them by buying their bonds.

Conclusion

There is a lingering misconception that tightening cycles cause poor EM bond returns. In fact, EM bonds tend to perform very well during Fed tightening cycles because these periods typically follow an initial period of market panic that occurs before the actual hikes begin. We believe this stage of fear is now behind us as a faster tightening cycle has been priced in.

Moreover, with global growth still on track, we believe now is an opportune time for long-term investors to allocate to EM bonds. When aiming to maximize returns, taking an active approach and focusing on spread optimization can offer an efficient way to increase yield and generate overall returns over the cycle.