Vescore Global Market Outlook January 2024

Quantitative Investments

Key takeaways

- Risk environment: Still in the late 1980s

- Economic outlook: Surprising resilience in 2023

- Equities: Riding the year-end rally

- Bonds: Buying into the Fed pivot

What have we learned in 2023?

2023 has unfolded as a year marked by two significant economic surprises of historical dimension leading to robust gains in both equity and bond markets. First, economic resilience has far surpassed the expectations set a year ago, rendering previous forecasts of a recession in H2 2023 inaccurate, at least as of today1. While growth momentum in the eurozone (Wave: 18%) remains historically weak, and real GDP growth hovers around zero, the US economy experienced a robust third quarter with 2.9% real GDP growth, tapering only slightly to approximately 2.5% in Q4 20232. This resilience can be attributed to the enduring resilience of consumer activity3.

Secondly, inflation has receded more rapidly than anticipated by central banks and prevailing statistical models4, particularly amidst a backdrop of resilient economic growth. While it is premature to declare victory, inflation has dipped below 3% year-over-year in the eurozone. This development is the primary factor behind investors' disregard for central bank attempts in December to temper expectations of rate cuts in 2024 and the year-end rally in 2023.

So, what insights can we glean from the macro surprises of 2023? Perhaps the most crucial lesson is that the strength of an investment process is paramount, necessitating control over our behavioral biases. One common pitfall, as evidenced in 2023, is the confirmation bias that leads economists to cling to preconceived notions, even when incoming data contradicts their initial assumptions. As elucidated in Kahneman's groundbreaking book5, this behavior is inherently human. To counteract such biases in financial markets, it becomes imperative to establish investment rules that are capable of adapting to changing scenarios but that remain immune to biases.

Consider our bond allocation model, for instance, which adeptly adjusted its stance by reallocating to government bonds several months ago after an extended period of being underweight. Similarly, our equity allocation model interpreted the negative sentiment surrounding the global economy (indicated by a negative term spread) as an opportunity for a positive equity allocation. The primary rationale was an understanding that adverse economic news currently translate into positive outcomes for financial markets, given the heightened likelihood of policy easing.

If there's a takeaway from 2023, it's arguably that less emphasis should be placed on forecasting and more on investing in robust processes that can navigate dynamic market conditions.

With this insight, we wish you a good start into the new year.

Risk environment: Still in the late 1980s

Our risk management model projects a 5.4% volatility for a diversified portfolio (50% equities and 50% bonds), reflecting a slightly lower volatility forecast compared to one month ago. This marginal decrease in anticipated volatility is primarily attributed to the equity segment of the portfolio, whereas the bond volatility forecast has remained relatively stable.

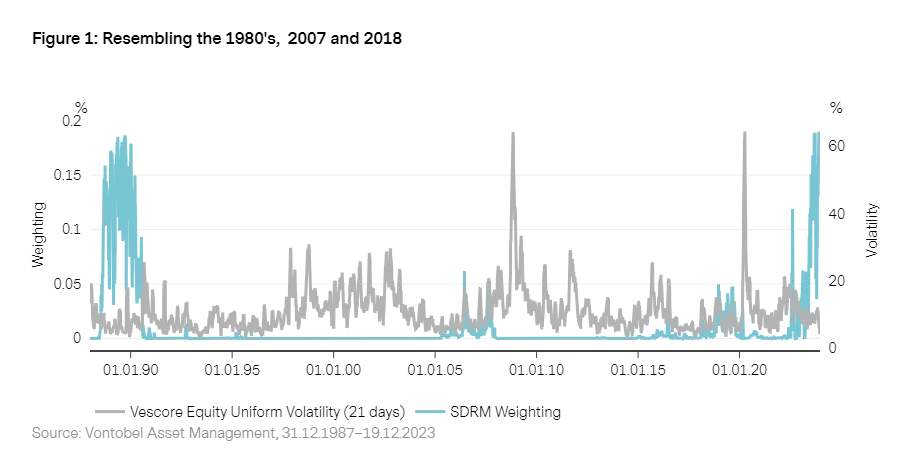

The analysis of the 'nearest neighbor' approach, seeking time periods with the highest similarity to the current risk environment, reveals a few notable parallels. Apart from the late 1980s, our model identifies resemblances to 2007, 2019, as well as of course, recent months (Figure 1). During these periods, a tight monetary policy resulted in a significant economic slowdown, or even a recession, followed by subsequent policy easing.

Economic outlook: Surprising resilience in 2023

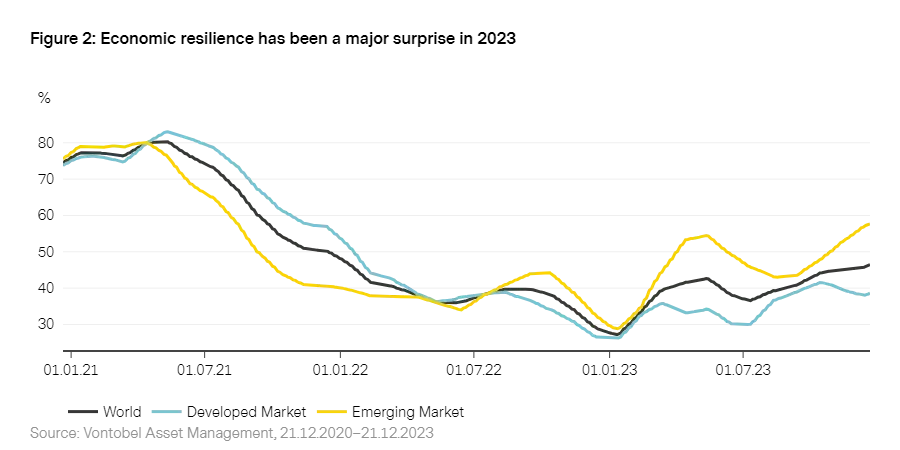

The surprising resilience of the global economy this year has defied historical expectations, given the typical likelihood of a recession following an aggressive policy tightening cycle. As of now, our business cycle model Wave6 suggests that the world economy is undergoing a recovery. However, a closer examination reveals that this recovery is precarious. The Federal Reserve's pivot, thus far, has been confined to the communication level, with global liquidity persistently tight, and central bank balance sheets continuing to shrink. The growth disparities among covered countries and the persistently weak key components of the Wave are legitimate concerns for the growth outlook as well.

Persistent growth divergence between developed and emerging markets

A substantial divergence in growth momentum persists, with the emerging market Wave expanding while developed markets contract. A major contributing factor to the improved condition of emerging market economies is the forward-looking approach adopted by policymakers since the COVID crisis, in contrast to the protracted policy easing measures witnessed in developed markets. Emerging markets took decisive action much earlier, with some central banks initiating policy tightening as early as 2020, while in the US the tightening cycle started only in March 2022. This proactive stance allowed key emerging markets to smooth business cycles more effectively, concluding the policy tightening cycle ahead of developed markets.

Depressed key components of the Wave

Critical building blocks of the developed market Wave indicate that the policy tightening cycle is slowly biting into the economy. For instance, banking sector activity in developed markets remains near historical lows at 7%, significantly affecting smaller corporations, for which the banking sector serves as a vital conduit. This is a key reason why the eurozone economy (Wave: 18%), dominated by smaller corporations ("Mittelstand") more than the US, is currently experiencing more pronounced challenges. Housing remains weak in developed markets as well, although the remarkable resilience of the US housing sector is noteworthy. Given that housing serves as a crucial wealth pillar for households, consumption may face negative effects as long as house price weakness persists.

6. For further detail see “ The Vescore Wave – a superior business-cycle model ”

Equities: Riding the year-end rally

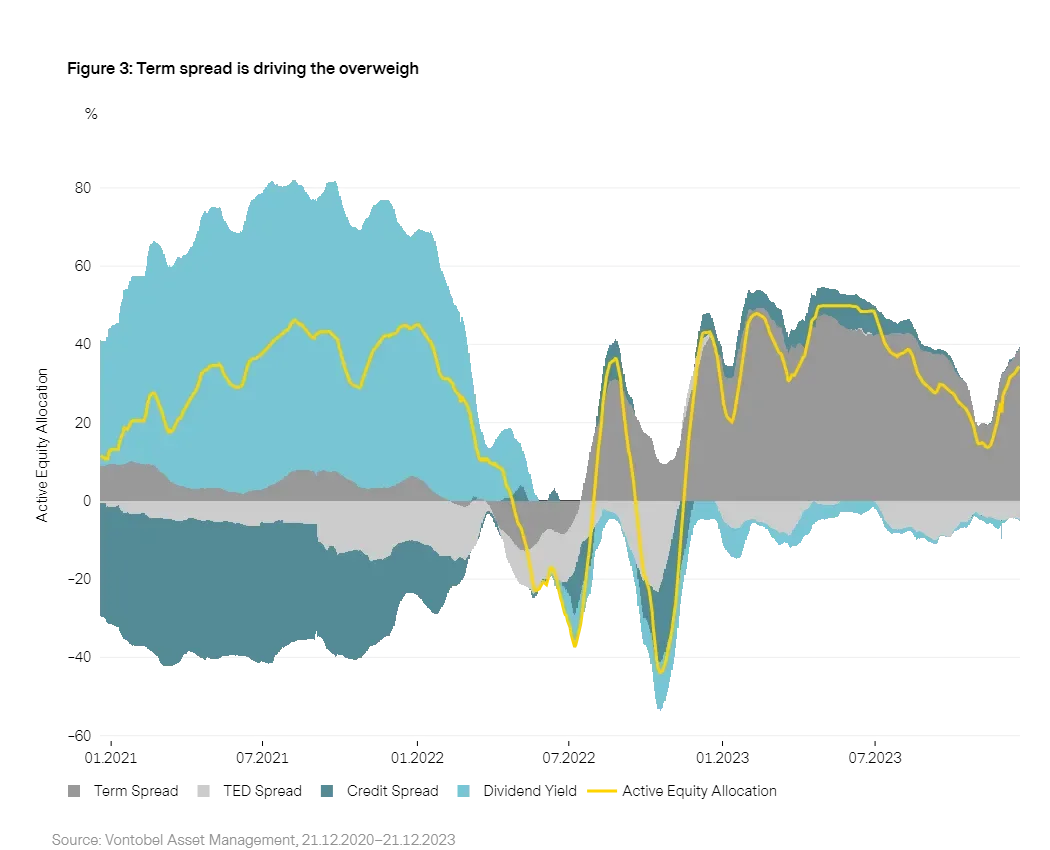

Our equity allocation model has further increased the overweight to 33%. In our sample mandate (50% cash, 50% equities), this results in a total equity exposure of 83%, reflecting a 20-percentage-point increase since early November. The term spread continues to be the primary contributor to the overweight (figure 3). While the dividend yield and the credit spread make nearly zero contributions, the Ted spread negatively impacts the equity overweight.

The negative term spread translates into a positive allocation, given that market sensitivities to the term spread are also negative. This clearly indicates that the market interprets bad news as good news. This interpretation is further supported by the negative correlation between economic data surprises and market sentiment, where weaker data leads to higher expectations of policy easing in the medium term.

Bonds: Buying into the Fed pivot

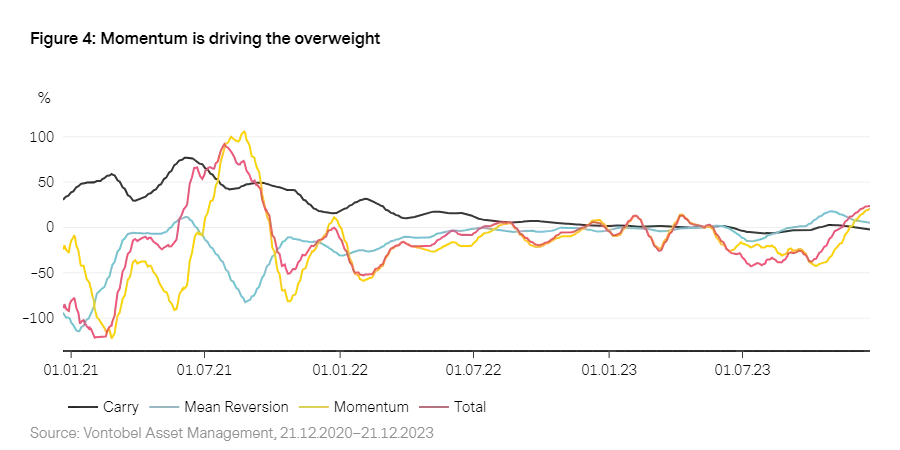

Our bond allocation model has further increased the overweight to 23%, marking this the highest overweight since September 2019. This shift follows a period of being underweight in government bonds until early November. Despite the recent rally in government bonds, which has diminished the positive contribution of the valuation model to the overall allocation, it indicates continued mean reversion potential. Concurrently, market momentum has strengthened, more than compensating for the declining valuation support (Figure 4). The contribution from our carry model is currently close to zero.

From a country perspective, our allocation model currently favors more cyclical markets, such as the UK, Australia and Italy. Momentum has gained traction in recent weeks, driven by a dovish surprise from major central banks like the US and the eurozone, with futures markets now pricing in the possibility of first-rate cuts for both countries in the first half of 2024.

1. In the

August edition of our GMO

we showed that most of our models signal that we are slowly approaching the phase in which a recession becomes more likely.

2. The Atlanta Fed now casts estimates that the US economy has been growing between 2 and 3% in November and December.

3. See the

July edition of our GMO

.

4. We highlighted in the

October edition of the GMO

the risk of sticky inflation the risks of the second wave of inflation

5. Kahneman (2011) “Thinking, Fast and Slow”

Important Information: Past performance is not a reliable indicator of current or future performance. Indices are unmanaged; no fees or expenses are reflected; and one cannot invest directly in an index. Any projections or forward-looking statements herein are based on a variety of estimates and assumptions. There can be no assurance that estimates or assumptions regarding future financial performance of countries, markets and/or investments will prove accurate, and actual results may differ materially. The inclusion of projections or forecasts should not be regarded as an indication that Vontobel considers the projections or forecasts to be reliable predictors of future events, and they should not be relied upon as such. Diversification and/or asset allocation neither assures a profit nor eliminates the risk of investment losses. Vontobel reserves the right to make changes and corrections to the information and opinions expressed herein at any time, without notice. This document is for information purposes only and does not constitute an offer, solicitation or recommendation to buy or sell any investment instruments, to effect any transactions or to conclude any legal act of any kind whatsoever.