TwentyFour

Corp Hybrids Look Attractive at This Stage of Cycle

Corporate hybrids have evolved in recent years into a large and well-established asset class within the European fixed income market, with €185bn of bonds outstanding.

TwentyFour

Pre-Election Bond Outlook

In this short video, TwentyFour CEO Mark Holman outlines what he expects to see from bond markets in the next few weeks, and explains why he thinks fiscal stimulus in the US can be the catalyst for the rally to resume in the medium term.

TwentyFour

More Noise Than Substance on UK Banks

The press can have their sensational headlines, but these stories have little substance when it comes to the impact on the reputation risk of banks or indeed any significant impact on their balance sheets come May 2021.

TwentyFour

Europe’s Lending Machine Fuels ABS De-leveraging

One of the legacies of Europe’s post-crisis lending landscape was a huge retrenchment in risk appetite, amplified by a lack of bank capital and in some instances funding for an extended period of time.

TwentyFour

Mind the Gap

With September set to be the first negative month for most risk asset markets since March, it is worth analysing what has been driving the reversal.

TwentyFour

CLOs Outperform Gloomy Forecasts

Overall CLO and loan performance have exceeded our expectations, though there are still plenty of headwinds for the market, chief among which is the prospect of further lockdowns and more economic disruption as Europe battles a second wave of COVID-19 cases.

TwentyFour

Will The Latest Dip Be Bought?

Overall, in our view there may be some temporary volatility ahead which investors can try to sidestep or even take advantage of, but it’s probably not worth trying to be too cute as our medium term outlook is still constructive.

TwentyFour

BoE Buying Dampens Volatility in GBP Credit

The Bank’s ability to dampen market volatility has certainly been a comfort to fixed income investors; over the last month £ IG spreads have moved in a range of just 4bp and ended tighter than they started, which compares rather favourably to the 5% peak-to-trough swing in GBP-USD over the same period.

TwentyFour

If Anyone Cuts, It Could Be the ECB

A cut by the Fed or the BoE from here would mean negative rates, while the ECB already has its deposit rate deeply negative at -0.5%.

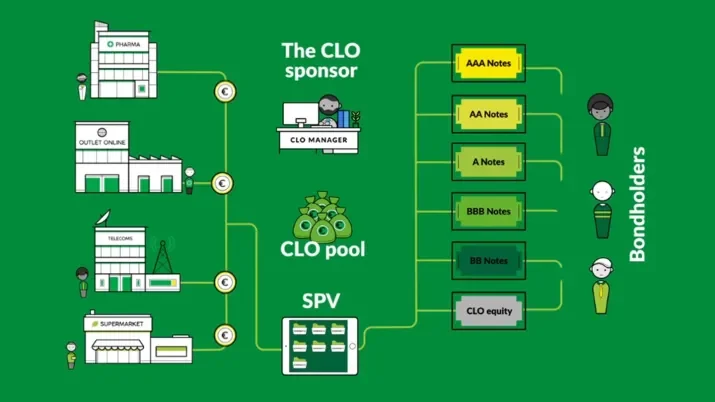

What is a European CLO, and how do they work?

European collateralised loan obligations – or CLOs – are bonds issued to fund a specific and diverse pool of corporate loans to firms of different sizes and in different industries all over Europe.

TwentyFour

The CLO Machine is Slowing Down

There are still plenty of potential bumps in the road (Brexit, the US election, COVID-19 developments and so on) but the positive technical created by dwindling supply has the potential to push spreads tighter in coming months.

Quality Growth Boutique

Time’s up for US-listed Chinese companies

The ongoing trade war and eroding U.S.-China relationship have been a catalyst for making it less attractive for Chinese companies to seek a public listing in the United States. The Chinese government is finally making good on promises to open up domestic markets to foreign investors. Additionally, Hong Kong and China are taking steps to make local listings more attractive, especially to high-tech start-ups.

TwentyFour

Can ABS Close The Gap on Corporate Bonds?

We expect September to be relatively busy with new ABS deals, but there’s a very strong technical developing in favour of ABS and CLOs, which should help performance in the coming months.

TwentyFour

Caixa-Bankia Talks a Step in Right Direction

There are a number of countries in Europe where the banking sector remains very fragmented, and while a lot of work has been done in Spain with the mergers of multiple ‘cajas’ in the last few years, there is still scope for further consolidation.

TwentyFour

Fixed vs. Floating: Where’s The Yield?

If floating vs. fixed is no longer the most pressing question, then investors should be more focused on where they get the best credit spread.

TwentyFour

Fed’s Revised Consensus Statement

The tweak that we will read so much about with respect to the inflation goal is that the new policy can be viewed as a “flexible form of inflation targeting”, meaning that following periods when inflation has been running below 2pc, appropriate monetary policy will likely aim to achieve inflation moderately above 2pc for some time.

TwentyFour

Government Debt Has Exploded. Does It Matter?

Given most countries are going through the same issues and their fiscal expansions are justified, the relative value has not changed that much.

TwentyFour

Ratings Migration Pointing to Lower Defaults

A trend of negative ratings migration has historically been a consistent precursor for a pick up in the default rate of publicly rated debt.

TwentyFour

The US Bond Market Recovery has also Outpaced Equities…with a Twist

Yesterday we showed that for European investors, what we speculated on back in March has come true; that the bond market did recover its losses far more quickly than equities, as shown below.

TwentyFour

The Bond Market Recovery has Outpaced Equities

The clear opportunity within IG credit from our perspective, without having to take excessive risk, is to buy legacy Bank and Insurance IG debt.

TwentyFour

Starved of Income

With BP slashing its dividend this week, we have now seen 52 of the FTSE 100 companies suspend or cut their dividends this year.

TwentyFour

Optimism from the FPC

As expected the Monetary Policy Committee (MPC) kept UK base rates at 0.1% and maintained their current level STG IG corporate bond on the BoE balance sheet at £745bn, with no immediate expectations of a need for further stimulus.

TwentyFour

Are Banks Becoming Less Cyclical?

This week we are right in the middle of the European banks’ Q2 reporting period. Today for example we had results from a diverse group of Europe-listed banks, with Credit Suisse, BBVA, Lloyds and Standard Chartered all reporting. All have very different business models and footprints across varying geographies.

TwentyFour

Coventry Enters RMBS Premier League

Coventry Building Society today priced a well-received £350m 2.5 year UK RMBS deal, and by using a Master Trust style structure (historically the preserve of only the largest UK banks) the issuer has beaten its own path to joining the big leagues of RMBS.