Conviction Equities

Concentrated and fundamentally driven high-conviction equity portfolios managed by four teams specialized in emerging markets, impact investing, thematic investing, and Switzerland.

Governments around the globe have been quick to pledge steps towards a carbon-neutral future, but the devil is in the detail. The US is a case in point where every initiative risks falling victim to bipartisan squabbles. To make things more complicated, President Joe Biden’s Democrats, the party theoretically in favor of sweeping, government-led climate-friendly action, failed to galvanize enough support in its own ranks – until recently, that is.

Over the summer months, Democrat Senator Joe Manchin from the coal-rich US state of West Virginia gave up his longstanding resistance to the so-called Inflation Reduction Act1, a slimmed-down version of the previously envisaged Build Back Better bill. The lawmaker’s revised stance enabled the passage of the Act in the Senate, which is evenly divided along party lines, with Vice President Kamala Harris casting the decisive tie-breaking ballot in favor of the proposal. The US House of Representatives, dominated by the Democrats, backed it as well.

The Act, expected to curb the country’s carbon emissions by roughly 40% by 2030, will lead to investments for energy security and climate change-related programs worth 369 billion US dollars. A minimum corporate tax rate of 15%, among other things, will help finance it. Whilst its scope is below previous ambitious targets, the dimensions are still massive. The funding for clean energy ventures exceeds that of a previous similar plan, the Recovery Act from 2009, by a factor of four, according to the Bloomberg news agency.

Following Joe Biden’s signing of the Act into law, companies with proven and scalable technologies in areas such as wind and solar power generation, storage as well as electric vehicles, will start benefiting from tax credits. The general aim is to decarbonize the US power sector. Some USD 37 billion will be used to encourage domestic manufacturing of wind and solar power equipment as well as batteries. This part of the program clearly caters to the American public, raising prospects of “green” jobs.

Even before the final passage of the Act, news of the Democrats getting all their ducks in a row sent shares of companies with environment-friendly products and services soaring. They may continue to do so once the money starts flowing. This puts the spotlight on impact investing, a style that has gained popularity in recent years, broadly defined as the expectation that investing into carefully selected companies will have a measurable beneficial effect on the environment.

Impact investors follow an approach that can be summarized as “intentionality” This means that the investment process starts off by defining the impact objective(s) at the core of the intended positive social and environmental impacts It goes without saying that asset managers offering such products must take special care to provide a convincing and transparent system to measure the impact of the investment. Defining key performance indicators (KPIs) and tracking their development over time, always keeping an eye on criteria as defined by IRIS+, a globally recognized system with standardized impact indicators, is a good way to go about this, in our view.

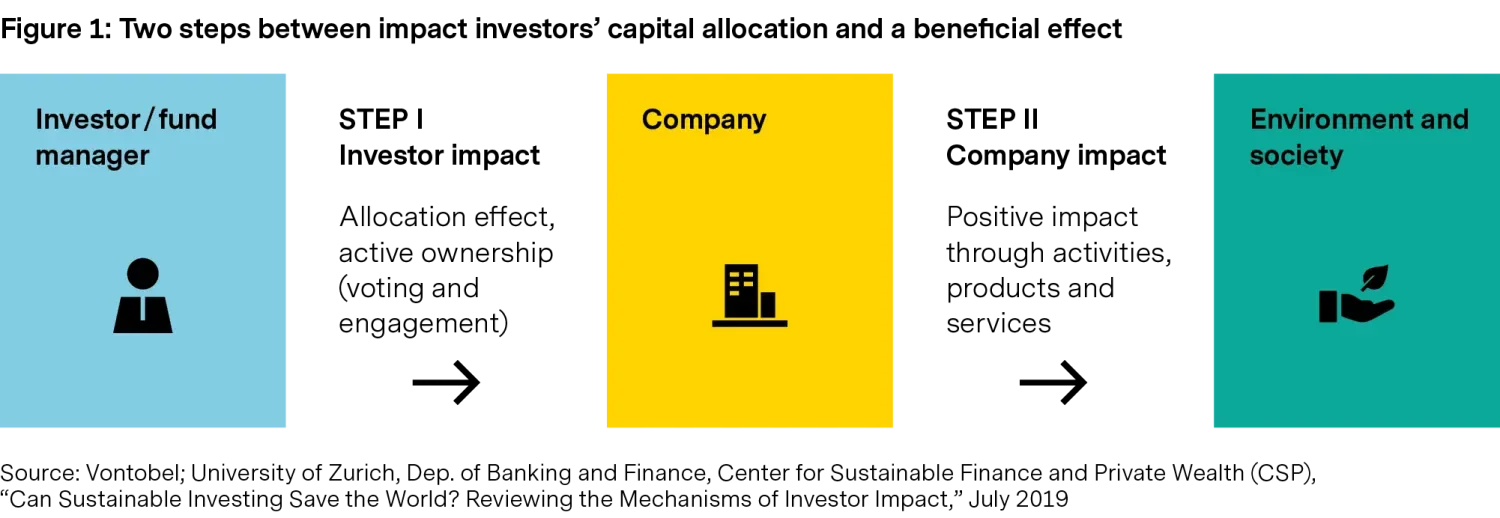

However, it is important to remember that contrary to what some glossy brochures suggest, there is usually no instant gratification. Rather, the beneficial environmental or social impact of an investment typically is an indirect one, happening in two separate steps (see figure below).

With Joe Biden now tipping the scales in favor of a decarbonized future in America, it makes sense to consider possible reverberations in the American corporate sphere. We wouldn’t be surprised to see companies such as First Solar, Quanta Services, and NextEra Energy, enjoy a Washington-produced tailwind. First Solar, an Arizona-based solar module pure-play, focuses on thin-film technology, which is predominantly used for large-scale installations. Quanta Services from Texas constructs and maintains energy infrastructure mainly for power lines used to connect solar and wind power plants to the network. NextEra Energy is one of America's largest capital investors in infrastructure, mainly focused on renewable electricity. The company is one of the largest generators of wind and solar energy in the world.

Looking for opportunities in equity segments set to benefit from the prospect of America going “green” is a rewarding task. It is also the only approach that we think active managers consider sensible. Relying on financial products that passively track a mechanically determined sustainable index seems like a wild-goose chase to us.

Important Information

Companies discussed for illustrative purposes only and should not be considered a recommendation to purchase, hold or sell any security. No assumption should be made as to the profitability or performance of any company identified or security associated with them. Certain information herein may include projections or other forward-looking statements regarding future events or future financial performance of countries, markets and/or investments. These statements are only opinion and actual events or results may differ materially, as such, undue reliance should not be placed on such forward-looking information. Vontobel reserves the right to make changes and corrections to the information and opinions expressed herein at any time, without notice.

1. The name can be misleading because bill covers many different aspects and reflects a compromise hammered out in long negotiations. The inflation reduction part would come from an expected reduction in energy and health care costs, among other things. What the Inflation Reduction Act does and doesn't do about rising prices, National Public Radio, August 11, 2022. https://www.npr.org/2022/08/11/1116229743/inflation-reduction-act-questions-answered