Finding alpha in geopolitical uncertainty

Fixed Income Boutique

Alpha generation in fixed income requires:

- Broad diversification

- Low duration

- Solid credit fundamentals

- Attractive valuations

- Higher spreads

Many people yearn for the “good old days”, when the markets were aflush with free money and interest rates sauntered ever lower. But that’s coming to an end and right now we are in a world of rising real rates and increasing economic and geopolitical uncertainty. We believe that active managers can prove their worth in a world where benchmark (beta) returns are likely to be lower. Especially now, bond markets are looking decidedly fragile.

The driver for the negative returns at the start of the year has been the increase in US Treasury rates. As inflation rates continued to move higher, expectations of central bank interest rate increases shifted the yield curve upwards. As bond prices move inversely with yields, prices of fixed income securities declined across the board.

The Russian-Ukrainian conflict, led to a surge in commodity prices, which will drive inflation rates even higher. At the same time, increasing economic uncertainty due to the conflict spurred investors to demand higher remuneration for taking on credit risk, thereby driving up credit spreads. The increasing rates and widening credit spreads have led to an across the board sell-off in fixed income including emerging markets.

Laying the foundation for generating returns

Emerging market corporates are still treated as an exotic niche by many investors, this perception is wrong. We believe that investors should exploit the possibilities offered by the diversity of the EM corporate asset class. The asset class is nearly three trillion US dollars in size, making it one of the largest segments within emerging markets fixed income. As the asset class expanded in recent years it is now much more liquid than many people think. Furthermore, there’s a global pool of countries and industries to choose from so that investors can construct a widely diversified portfolio – this is of utmost importance in the face of the current economic and geopolitical uncertainty.

At the same time, the asset class is very inefficient. Because there is always something happening somewhere in the world and news outlets like to focus on negative news (nothing to report if all goes as expected) there is a perception that emerging markets corporates must be risky while in fact it is the least volatile way to invest in emerging markets. As many corporate issuers are perceived to be risky, so they cannot issue bonds with the same long maturity as sovereign issuers, for example.

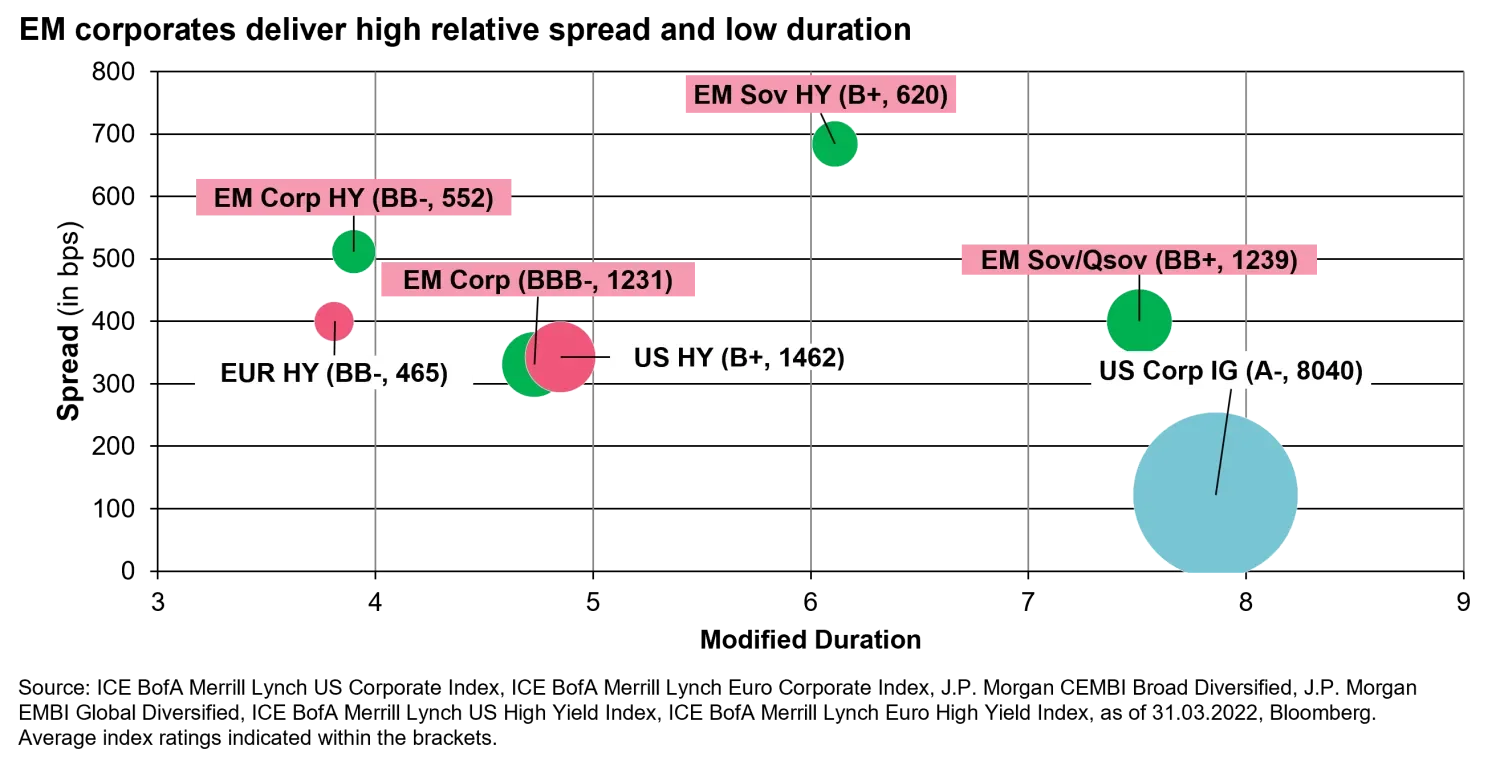

This means that the interest rate risk as measured by the duration is low compared to other fixed income markets. We need to emphasize the duration point here as today people are scared of duration. The longer the duration the more susceptible a bond is to interest rate changes. With interest rates increasing, one of the best buffers to counteract this is lowering your portfolio’s duration – emerging market corporates typically offer lower duration as a default. Lovely, right?

Not only is the duration lower, credit spreads are excessive relative to the objective credit risk (see below). Emerging market corporate investment-grade bonds now yield around the same as US high-yield bonds, so you get a similar yield with a superior credit rating If you’re hungry for more yield, you can head to the high-yield segment where the spreads are higher, duration lower and you still get a better rating (see chart) compared to euro (and other developed markets) high yield.

So, about that alpha, how to squeeze it out of the ripe fruit that is emerging market corporates? This is where active investing comes in. While the asset class looks attractive, the price movements on the bonds of individual companies can be brutal. This is exactly why we believe a widely diversified portfolio is so important and also why the emerging market corporate asset class is an active manager’s paradise. For capable investors, the asset class offers enormous opportunities and volatile periods offer excellent opportunities for managers that understand the asset class and know when to act. It all comes down to credit selection. On the one hand, violent price actions lead to prices deviating from their underlying value and, therefore, to opportunities with price upside. Indeed, any investor worth their mettle will attest that price and value are very different things.

Not only overreaction to specific events lead to attractive opportunities. As emerging market countries tend to be high-growth countries, companies that do well and have bonds outstanding can see the credit-risk premium decline rapidly and this can generate strong returns and lead to another form of capital appreciation.

Conclusion

After decades of lowering rates, bond investors have been spooked by the sudden resurgence of inflation and the start of a hiking cycle by the Fed and other central banks. Both these factors are a genuine concern for investors, however, in our view, they just require investors to broaden their horizons and educate themselves on segments of the fixed income universe that perhaps they have only glanced at previously. We believe that with a wide spectrum of solid companies, lower duration, solid credit quality, and higher yields on offer, now is the time to get active and allocate to emerging market corporate bonds.

Important Information

Fixed income securities are subject to certain risks including, but not limited to: interest rate, credit, prepayment, call and extension. International investing involves special risks including, but not limited to currency fluctuations, illiquidity, and volatility. These risks can be heightened for investments in emerging markets. Diversification does not assure a profit or protect against possible losses.