The hidden potential of corporate bonds

Fixed Income Boutique

Key takeaways

- Developed Market Corporate Bonds Provide stable Income: DM corporate bonds, particularly in the investment-grade segment, offer stable income and are supported by strong fundamentals, including solid earnings and credit rating upgrades.

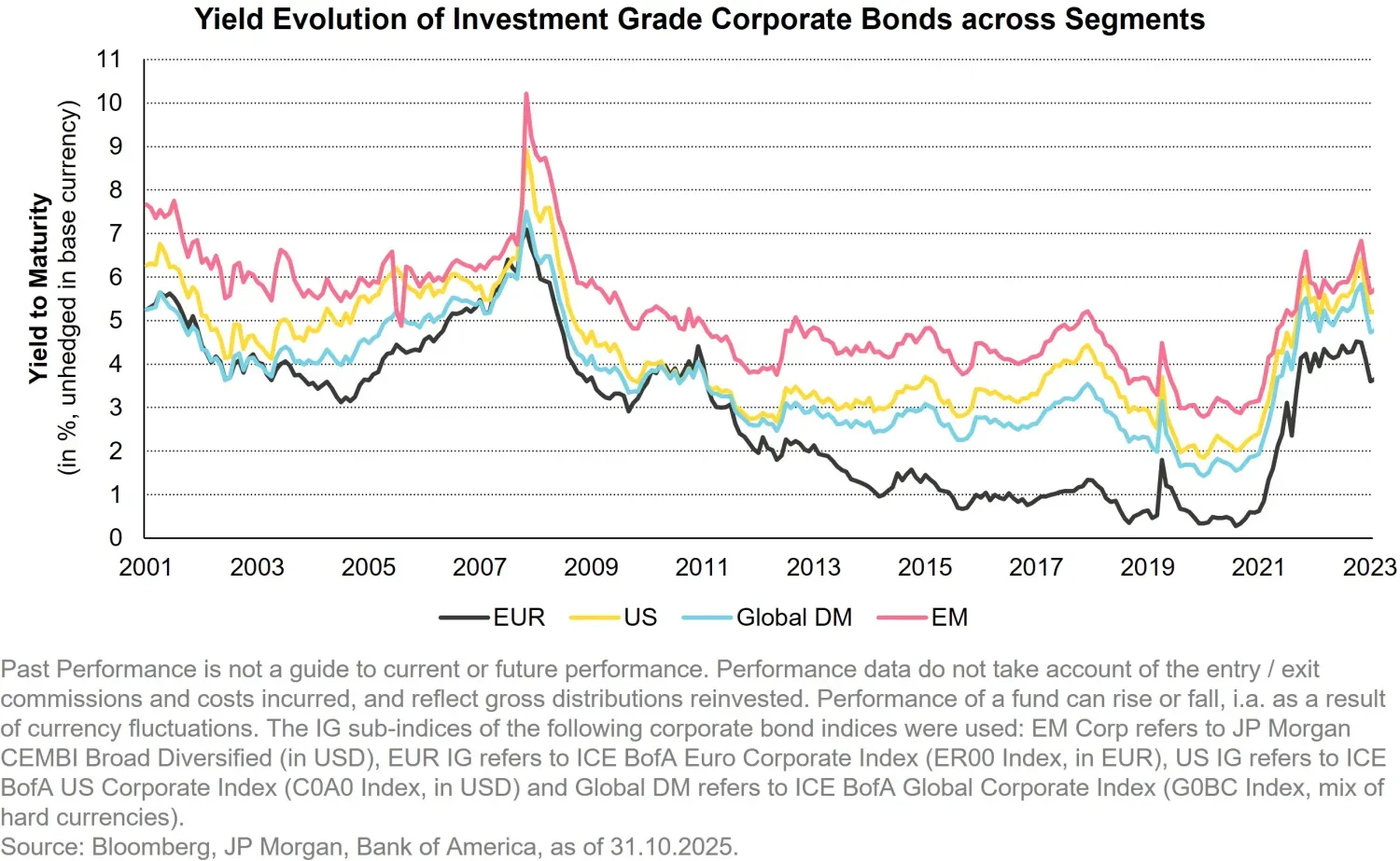

- Yields still near Multi-Year Highs: Yield-to-maturity levels for US and European investment-grade corporate bonds are at their highest in over 13 years, making them an attractive option for income-seeking investors.

- Emerging Market Corporate Bonds Show Resilience: EM corporate bonds have become more robust, with reduced net leverage, improved credit ratings, and higher-quality issuances, potentially offering strong returns with lower risk.

- Diversification is key: Adding EM corporate bonds to portfolios with DM credit may enhance diversification, reduce risk, and improve the overall risk-return profile, making it a valuable strategy for institutional investors.

- Active Management is Essential: Tight credit spreads and pricing inefficiencies in both DM and EM corporate bond markets create opportunities for active managers to generate alpha through disciplined credit selection and a global investment approach.

Discover how developed and emerging market corporate bonds may offer stability, diversification, and alpha opportunities. As our two experts explain in the below video, with yields at multi-year highs and improving fundamentals, we believe now is the time to unlock the hidden potential of corporate bonds in your portfolio.

As global markets navigate a complex and evolving landscape, in our opinion corporate bonds have emerged as a cornerstone of resilient and diversified portfolios. Both developed market (DM) and emerging market (EM) corporate bonds offer unique advantages, from stable income generation to diversification and alpha opportunities. With yields still being near multi-year highs and credit fundamentals improving, we believe now is an opportune time for investors to reassess the role of corporate bonds in their strategies.

The Stability of Developed Market Corporate Bonds

Developed market corporate bonds or simply global corporate bonds, particularly in the investment-grade space, have long been a reliable choice for investors seeking stability and income. Despite the persistence of tight credit spreads, history shows that such conditions can endure for extended periods without undermining the asset class’s appeal. As for 2025, global investment-grade spreads tightened slightly from 85 to 80 basis points over the first 10 months, while emerging market investment-grade spreads moved from 130 to 128 basis points in the same period. These tight spreads reflect strong corporate fundamentals, including solid earnings, improving credit profiles, and a wave of credit rating upgrades, particularly among BBB-rated companies for year-to-date 2025.

What makes this environment particularly compelling, however, is the level of yields on offer. Yield-to-maturity levels for US and European investment-grade corporate bonds are still substantially higher than they were at any point in time over the last 13 years. These elevated yields seemingly serve as a strong predictor of future returns and provide a consistent source of income through higher bond coupons. For investors, the opportunity cost of remaining in cash or short-term instruments has grown significantly given interest rate cuts and the significant steepening of treasury curves (in the US and in Germany) we’ve seen this year so far, making corporate bonds an attractive asset class for those seeking stable returns.

Emerging Market Corporate Bonds: A Resilient and Overlooked Opportunity

While developed market corporate bonds are often seen as the bedrock of fixed income portfolios, emerging market corporate bonds have been quietly gaining traction. In 2025, EM corporate bonds delivered a relatively solid 8% return over the first 10 months of the year, outpacing the 7% return of global corporate bonds (based on ICE BofA Global Corporate Index, hedged to USD). This performance highlights the resilience of the asset class, which has become one of the least risky segments within EM fixed income (based on the annualized volatility over the period of the last 3 years ending October 2025).

The EM corporate bond market has undergone significant structural improvements in recent years. Net leverage among issuers has decreased, and the market has experienced a positive trend in credit rating upgrades, with more upgrades than downgrades in 2025. Additionally, the reduction in high-yield issuance, particularly in Asia, has bolstered the overall quality of the market. These factors have created a more stable and resilient environment, offering investors the potential for attractive yields with historically lower levels of risk.

The Case for Diversification

One of the most compelling arguments for investing in global corporate bonds into a portfolio is diversification. Moreover, adding EM corporate bonds to a portfolio already invested in developed market credit can significantly enhance the overall risk-return profile. The asset class is less dependent on interest rate movements and exhibits lower volatility compared to other segments of EM fixed income.

In general, corporate bonds are among the fixed income markets that exhibit the most amplified pricing inefficiencies, which active managers can exploit to generate alpha. These inefficiencies often arise from a mismatch between credit quality and ratings, as well as investors’ behavioral constraints, amongst others. For active managers, this represents a fertile ground for identifying undervalued opportunities – both within a benchmarked universe and off-benchmark – and potentially delivering superior returns.

The Role of Active Management in Unlocking Value

In both developed and emerging markets, the ability to generate alpha hinges on active management and disciplined credit selection. With credit spreads remaining tight, the focus must shift to identifying improving credit stories and optimizing spreads across regions, countries, sectors and currencies. A global perspective allows investors to compare issuers and segments across regions, ensuring that portfolios are positioned to capture the best opportunities while striving for diversification.

Conclusion: A Timely Opportunity

We believe the current market environment presents a timely opportunity for investors to capitalize on the hidden potential of corporate bonds. DM corporate bonds may offer a stable and reliable source of income, while EM corporate bonds provide – on a complementary basis – a possible pathway to higher returns and enhanced diversification.

With yields at their highest levels in over a decade and credit fundamentals on a solid footing, corporate bonds are well-positioned in our view to deliver strong performance in the years ahead. For investors willing to adopt an active and disciplined approach, the potential for alpha generation is significant.

The information provided regarding diversification is for informational purposes only and should not be considered as financial, investment, or professional advice. Diversification does not guarantee profit or protect against loss in declining markets. It is a strategy intended to manage risk by spreading investments across various asset classes, industries, or geographic regions.