The Road is Long – Navigating through Inflation and Uncertainty

Quality Growth Boutique

“The road is long, with many a winding turn…” is the beginning of a Hollies’ song that reminds me of today's markets. As we continue to make our way through the COVID cycle and have started 2022 in a very volatile way, there are some real challenges that may be seen in on the horizon, “… who knows where?” but let’s take a look.

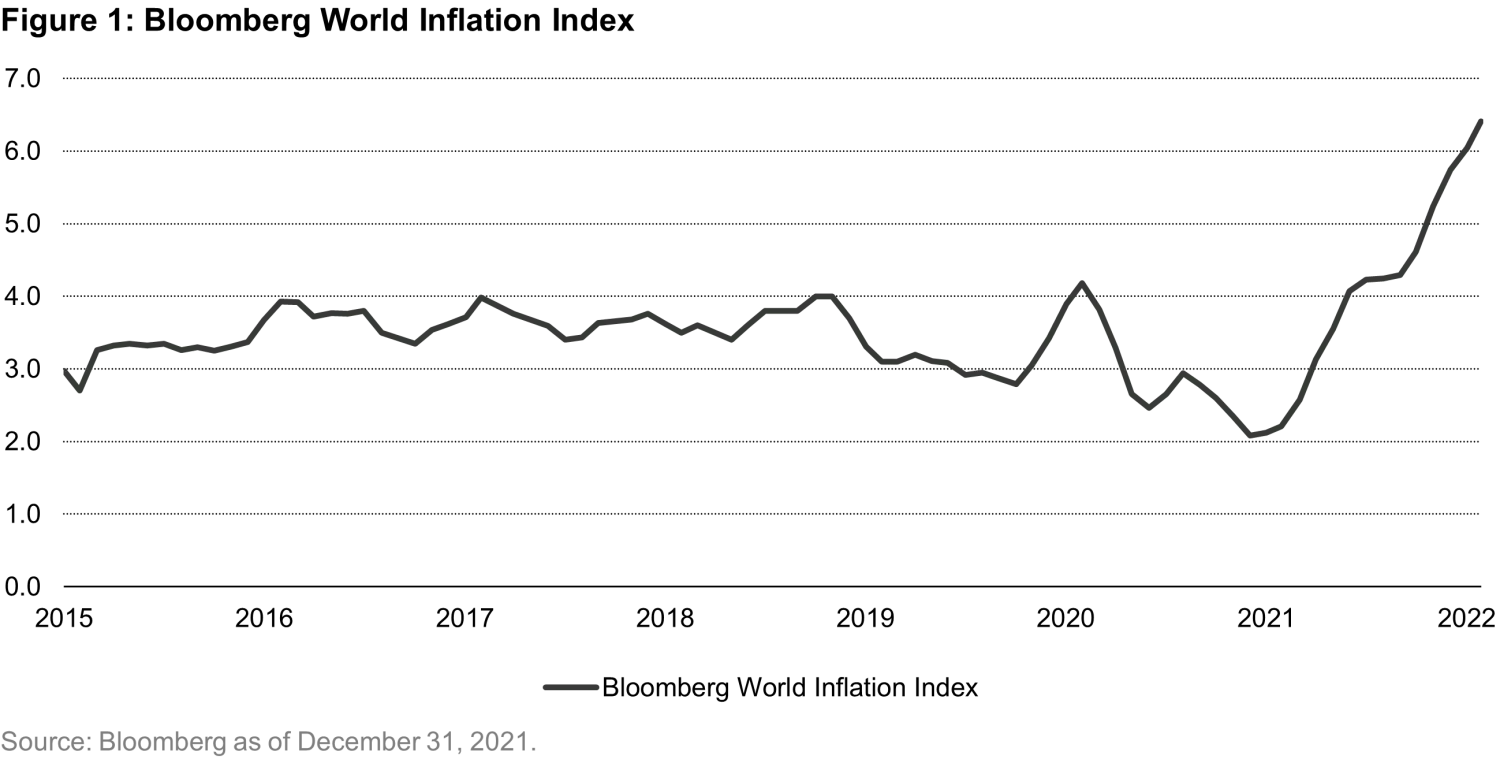

This past year has brought about something often spoken about but never really experienced by most industry veterans in developed markets, inflation. Prices at the pump in the US rose 33% per gallon of regular unleaded gasoline and are just 13% away from all-time highs. Prices for meats, poultry, fish, and eggs increased 12.8%, with beef prices alone rising 20.9%. Used car prices have risen greater than 30%. The average cost of power for delivery in the short-term soared to record levels in 2021 in Europe, rising over 200% in Germany, France, Spain and the UK. Former baseball player Sam Ewing, known for his witty quips once stated, “Inflation is when you pay fifteen dollars for the ten-dollar haircut you used to get for five dollars when you had hair.”

The cocktail that has influenced price rises is no secret. An unforeseen pandemic and the subsequent record stimulus, which increased the money supply in the US alone by 40%, combined with labor shortages and tight supply chains has had an overwhelming impact. As this insight is being penned, further pressure could be felt with the Russian invasion of Ukraine and Brent oil prices breaching $100/bbl for the first time since 2014 and up 500% from April 2020 lows, while inflation continues higher.

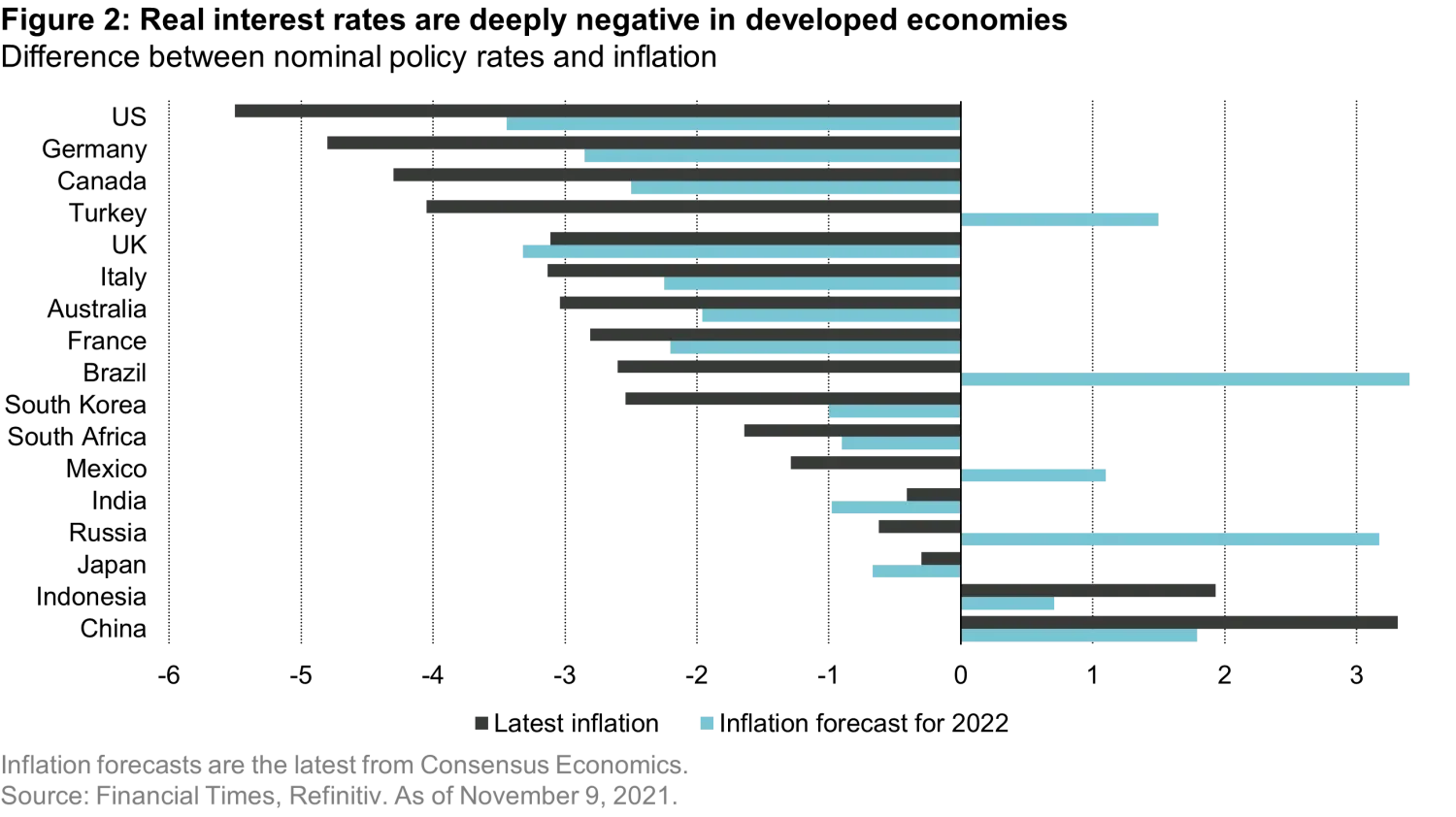

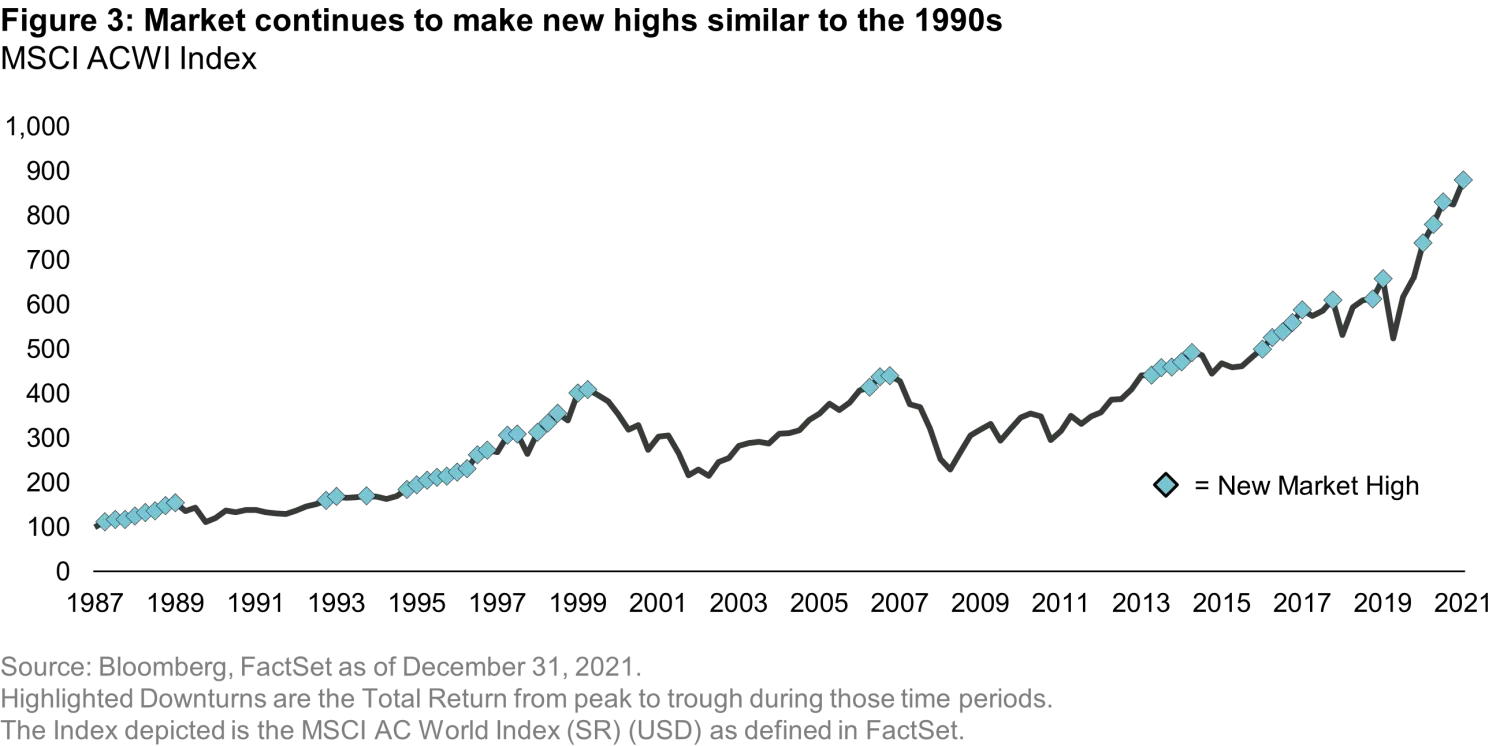

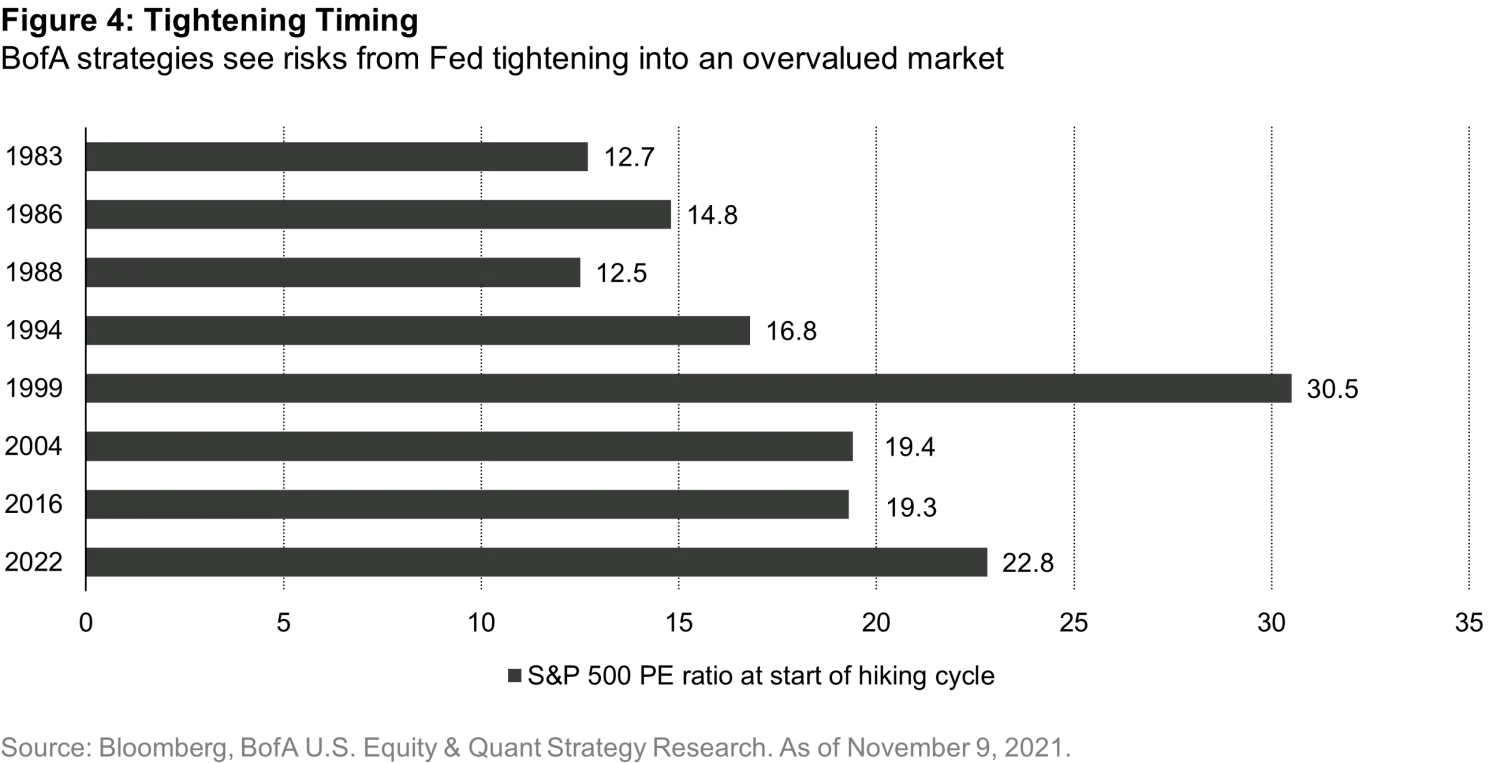

As central banks in developed markets have been aggressively keeping rates lower, real rates are at historical lows and near-term increases are imminent. This comes at a sensitive time as markets have benefitted from artificially low rates and tepid levels of inflation for years. Global markets have been consistently hitting new highs through the end of 2021, similar to the late 1990s.

Thus, central banks must now embark on a path of tempering inflation at a time when valuations are at historically high levels. As if this wasn’t difficult enough, they need to increase rates amidst slowing economic growth, weakening consumer sentiment, an equity market that has been selling off, and a flattening yield curve.

This clearly is not an environment for the faint of heart. Central banks are challenged to thread a needle like quarterback Tom Brady throwing a 25-yard seam pass to his teammate Rob Gronkowski down the middle on 3rd and long. Businesses must navigate issues that have been on the back burner for years: cost pressures, inventory levels, and balance sheet leverage.

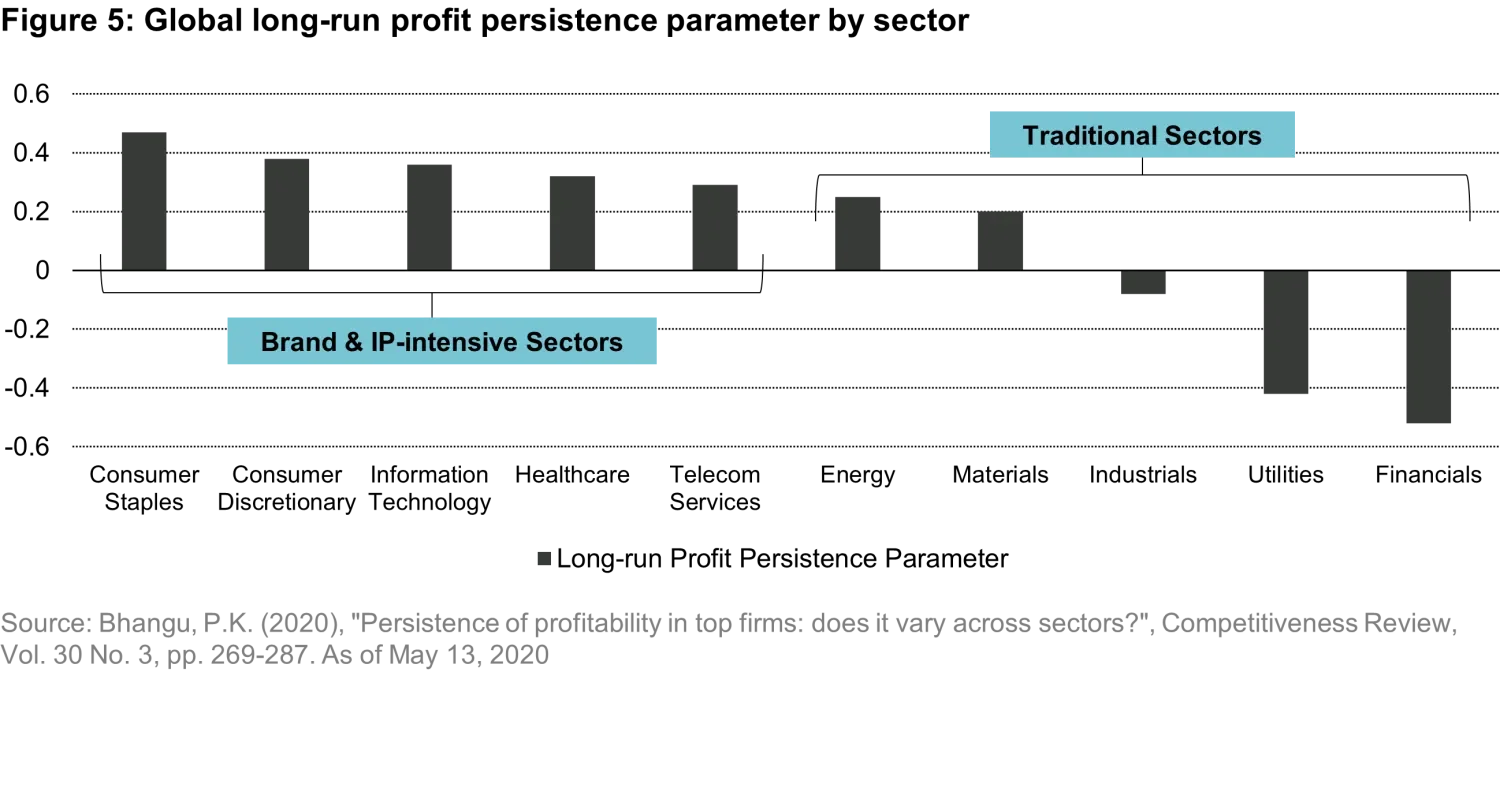

What are the types of companies that investors should own at this point in the cycle? In our view, not capital intensive, commodity businesses – while these have benefitted hugely from Russia’s invasion of Ukraine and resulting price increases, gains are largely priced in, so profits going forward will be limited, or may evaporate if, as we all hope, Russia and Ukraine are able to reach a peaceful negotiated settlement.

Our view is that over the next few years, finding returns will be a challenging task, so we think investors should focus on businesses with wide moats, intellectual property (IP) advantages, strong brands and robust balance sheets. The road ahead looks nothing like the 1990s or the last few years where one could hold pretty much anything and make money. In times like these, the old Peter Lynch line “Know what you own and why you own it” is as relevant as ever.

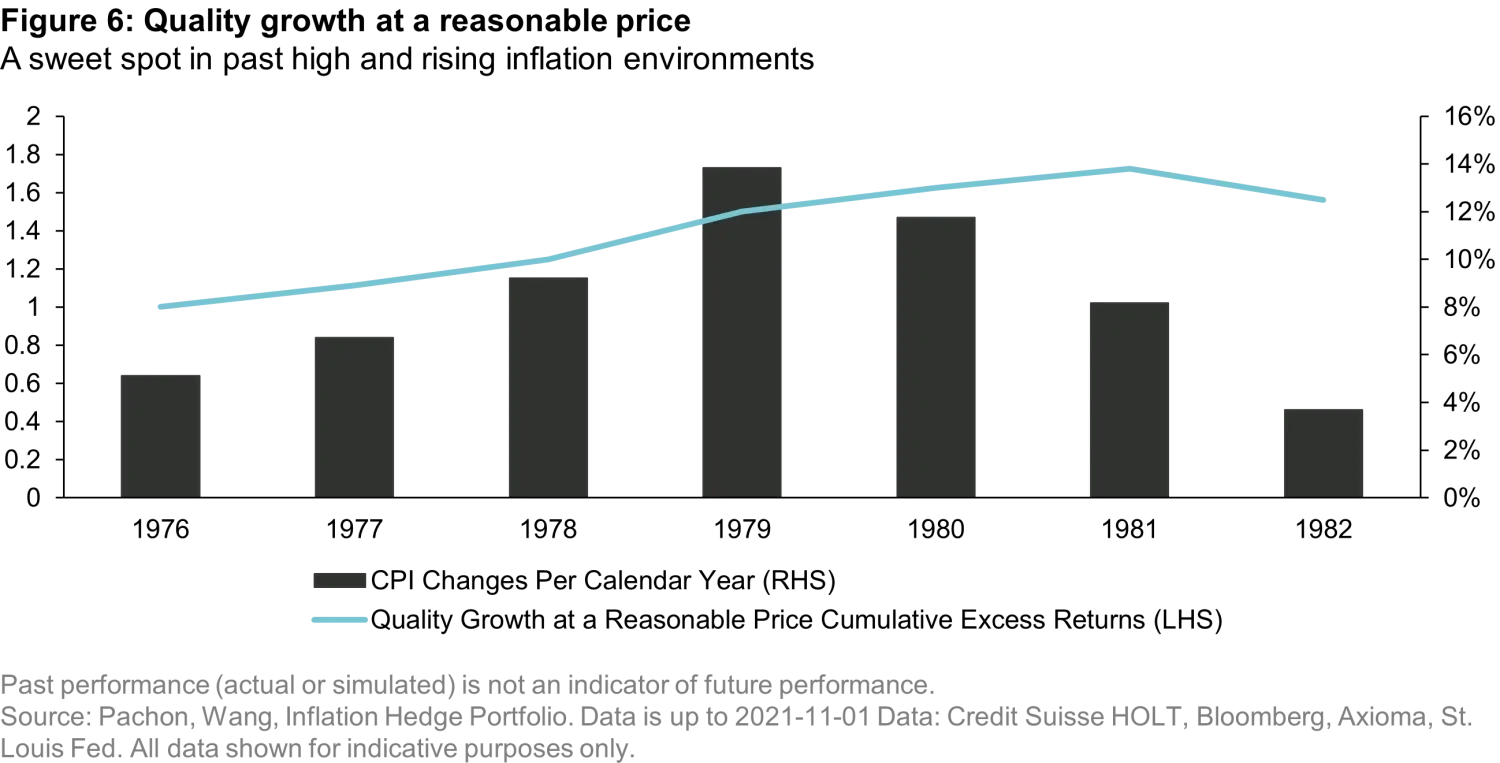

If history is a guide, and you have to go back pretty far for persistent inflationary times, exposure to quality businesses can help. Quality Growth businesses were relative winners during persistent inflation from the mid 1970’s to early 1980’s.

Lately, markets have been oscillating between momentum stocks that benefitted from record stimulus to value stocks benefitting from rises in interest rates and commodity prices. However, as the economic hurdles become more difficult, a focus on quality businesses can act as ballast to stabilize a portfolio. Just as the Hollies’ song goes, “He ain’t heavy, he’s my brother…”