Reap what you sow: seek to harvest your "double dividend"

Conviction Equities Boutique

Talking about change is one thing. Bringing about transparent and measurable impact on our planet and society is another. At the heart of Vontobel’s impact investing approach is what we call the “double dividend” concept: the opportunity for you as an investor to generate financial returns while being confident that you are genuinely making a positive and tangible impact on our planet and society. We believe measuring impact requires a systematic and repeatable concept, which we outline below.

Are you sowing the right seeds for change?

Investors are shifting toward more sustainable lifestyles and want their portfolios to reflect this. It’s an area we’ve long been active in: Our sustainability track record began back in 1993 with the creation of the Vontobel Foundation, which focuses on supporting social, medical and cultural activities. We launched our first impact investment strategy in 2008. Since 2009, Vontobel has been purchasing CO2-certificates to offset all operational emissions (Scope1-3).1 Vontobel has been a member of the Global Impact Investing Network (GIIN) since 2020 and actively participated in the working group that defined standards for impact investing in public equities .

Vontobel is a member of the Global Impact Investing Network (GIIN). The GIIN is the leading nonprofit dedicated to increasing the scale and effectiveness of impact investing. Impact investments are made into companies, organizations, and funds with the intention to generate social and environmental impact alongside a financial return. Impact investments can be made in both emerging and developed markets, and target a range of returns from below market to market rate, depending upon the circumstances. Our membership signifies a commitment to deepening our engagement in the impact investing industry.

In the same way that generating a bumper crop requires knowing the correct elements to observe and which techniques to implement, investing for positive impact requires knowing where the opportunities lie, how to cultivate them, and then measuring success. Trust, along with reliable, rigorous, and transparent reporting and measurement, is paramount. Our impact objectives, which we specified with our impact pillars in 2008, all overlap with at least one of the United Nations Sustainable Development Goals (SDGs) that were established in 2015. The SDGs provide a great framework for impact investors from large institutions such as corporations, mutual funds, and pension funds to expand into the public equity space and add their considerable financial clout to worldwide efforts to address humanity’s most pressing problems.

Separating the wheat from the chaff

Under our classification system, for a company to be recognized as “sustainable”, it must contribute to one or more of our impact pillars and generate material revenues through its products and services. In contrast to the impact pillars that we have defined in the global environmental change strategy, the global impact equities strategy also includes social pillars that address the challenges facing humanity: sustainable food and agriculture, equal opportunities, good health and well-being, and responsible consumption.

By investing in companies that address today’s most pressing global challenges on both the environmental and social fronts, we drive change. And in selecting the companies that help to improve our lives, minimize our ecological footprint, and perform financially, we apply a precisely defined set of financial, impact and sustainability criteria. Our criteria are stringent. In many cases, the number of SDGs our impact strategy assigns to a company tends to be lower than what the companies themselves claim or what rating agencies attribute to them.

Impact investing at Vontobel is subject to a stringent appraisal, measurement, and reporting framework. Our endeavor to take measurement beyond the SDGs results in that framework being underpinned by clear, precisely defined terminology and clearly specified impact indicators. The impact indicators track additional data points, support our analysis and help us measure companies’ contributions to the impact pillars.

| Environmental impact indicators | Social impact indicators |

|---|---|

| Drinking water provided | Beneficiaries of affordable medical solutions |

| Water recycled/treated/saved | Patients or people reached |

| Renewable power generated | Education/information provided for a number of people |

| Renewable energy devices shipped | Jobs created through micro loans |

| Waste management | Loans granted to minority of female lead businesses |

| Cargo passengers transported | Underbanked people served |

| Circular economy | Food produced responsibly |

| Potential avoided emissions | Efficiently farmed land |

| Carbon footprint |

Making sure you see the forest despite the trees

We are committed to giving investors full transparency at all times. This means going beyond a general ESG assessment and qualitative mapping against the SDGs. Our approach is to focus strictly on impact that can be measured quantitatively, aiming to provide our investors with a clear, up-to-date, and verified information on the potential impact of their portfolio holdings. We regularly publish an overview of how our holdings match up against our consolidated impact indicators and how they align with our impact pillars, as well as our own activities to engage management to drive greater sustainability. And it’s important to us to try to measure impact where it matters and to showcase solid examples of real-world impact.

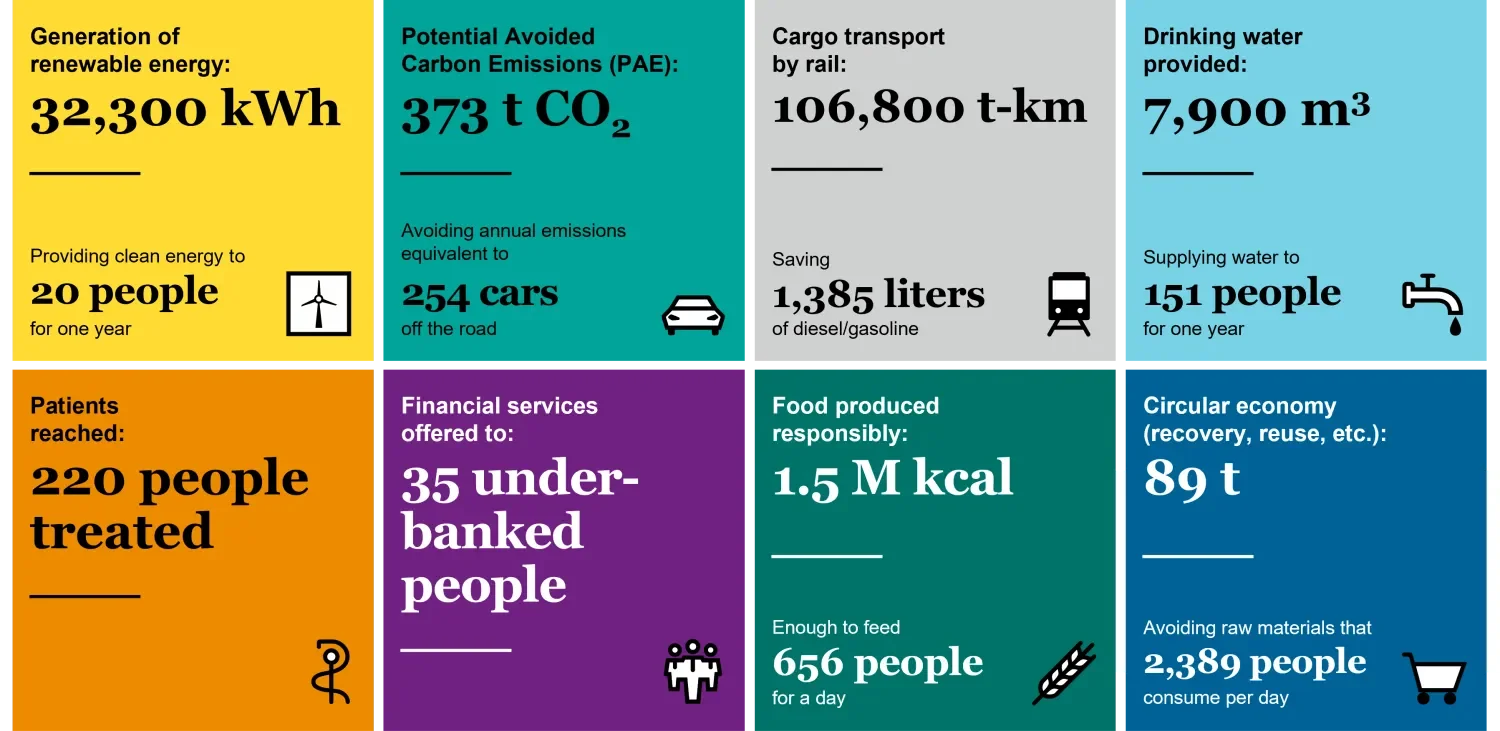

Potential avoided emissions are one way to show how a company’s products and services have a positive impact. Combined with our other impact indicators, we have our own Impact Calculator, which presents the summary of all our portfolio holdings’ potential impact. Our calculator provides investors with illustrative figures in terms of, for instance, cubic meters or kilowatt hours, or we can compare the carbon footprint with potential avoided emissions.

While it is simpler to measure potential impact on the environment than on society – like access to medicine – we don’t shy away from painstaking efforts to include both in our calculator (as illustrated in the box). We collect that data through our regular engagement and interaction with our investee companies and thorough assessments of their reports, which result in complex aggregate measurements as a summary.

What is the potential impact of the companies you invest in?

This illustrates the potential of an investment of one million euros.

Source: Vontobel Asset Management. Portfolio as of June 30, 2023. Figures are rounded. The Global Impact Equities calculator is provided for informational purposes only to illustrate the potential impact that an investment in the strategy may represent. The companies in which the portfolio is invested fit in at least one of the eight core impact pillars of the strategy and not all companies will have an impact on all of the eight environmental and social indicators. Impact investing must take into consideration the capital allocation and engagement strategies of the portfolio. Link to our Impact Report .

Our methodology and results are verified by an independent third party. Our impact reports outline the full methodology, provide all assumptions used and disclose the limitations of our impact calculator.

Cultivating the crop

Regular and systematic evaluation of companies within the portfolio creates a high level of transparency for investors while helping us better engage with the company’s management on the potential benefits of the company’s activities and the risks it is exposed to.

To ensure that our holdings always remain aligned with the impact goals we have set ourselves, we regularly perform a six-point impact strategy assessment for each of our portfolio companies. This covers aspects such as the company’s corporate culture, capital allocation, growth plans, targets and risks related to their impactful activities.

We also consult management whenever controversial issues emerge from independent ESG rating agencies or in the news, requesting additional data so that we can form our own opinion. This is an integral part of our research activities prior to an investment and during the holding period.

Concerns about “greenwashing”?

So why do some investors still hesitate to commit to sustainable investment strategies? Our 2023 Impact Investing Survey reveals that some 45 percent of investors are wary of increasing their allocation to impact strategies due to concerns about “greenwashing” that affect the industry. They are correspondingly cautious, and attach considerable importance to transparent information on holdings, measurability of impact outcomes and a company's overall credibility in the field.

The need for increased transparency was also cited as a barrier to confident investing. For example, respondents found the jungle of various terms and definitions used in the impact investment field – many of which are used to mean different things by different companies – confusing. Insufficient understanding of how performance measurement and reporting is carried out within the sector can only serve to compound investors’ concerns about transparency.

Trust is paramount

The evidence shows that clients value our rigorous approach, transparency, and long-term commitment. Several ESG rating agencies evaluate our products and services, and their outcomes are used by clients, asset owners and financial advisers. To increase our transparency, we not only report our own impact data but also show a selection of ESG, climate and impact ratings from external sources. In addition, our data is reviewed and verified by Institutional Shareholder Services (ISS), a leading provider of corporate governance and responsible investment solutions, market intelligence and fund services for institutional investors and corporations globally.

We are convinced that people can make a difference and achieve a positive effect through their investments, not least via listed equities. We strive to help you reap the "double dividend": drive change, achieve your goals and deliver tangible and measurable influence in the process.

1. We base our operational carbon emission calculations on the Greenhouse Gas Protocol. Scope 1 comprises emissions from heating (natural gas, biogas and heating oil), refrigerant leakage as well as business travel (vehicles owned by the company); Scope 2 emissions are counted according to the market-based approach, which takes account of electricity purchased individually by Vontobel (e.g., electricity from renewables) in locations in which information is available about the energy mix purchased; in our scope 3 operations emissions we include energy-related emissions not included in Scope 1 or 2, business travel with external vehicles, commuting, food, paper, printing, mailings, waste, and water. Other Scope 3 emissions are not included. The CO2-certificates are provided by South Pole. The selected projects run under the Verified Carbon Standard (VCS).

This document is for information purposes only and nothing contained in this document should constitute a solicitation, or offer, or recommendation, to buy or sell any investment instruments, to effect any transactions, or to conclude any legal act of any kind whatsoever. Decisions based on information contained in this document are the sole responsibility of the reader. You must not rely on any information contained in this document in making an investment or other decision. This document has not been based on a consideration of any individual investor circumstances. Any projections, forward-looking statements or estimates contained in this document are speculative and due to various risks and uncertainties, there can be no assurance that the estimates or assumptions made will prove accurate, and actual events or results may differ materially from those reflected or contemplated in this document. Opinions expressed in this document are subject to change based on market, economic and other conditions. Information in this document should not be construed as recommendations, but as an illustration of broader economic themes. Past performance is not a reliable indicator of current or future performance. The return of an investment may go down as well as up, e.g. due to changes in rates of exchange between currencies. The value of the money invested in a fund can increase or decrease and there is no guarantee that all or part of your invested capital can be redeemed.