Your World, Wide Open

Perspective creates potential. With diverse views, our goal is to design better investment outcomes for you.

Investors are seeing signs that the Fed’s painfully aggressive tightening cycle may finally be reaching an end. As a new fall season that is upon those in the northern hemisphere, we think fixed income markets may be poised for exciting returns in the coming months.

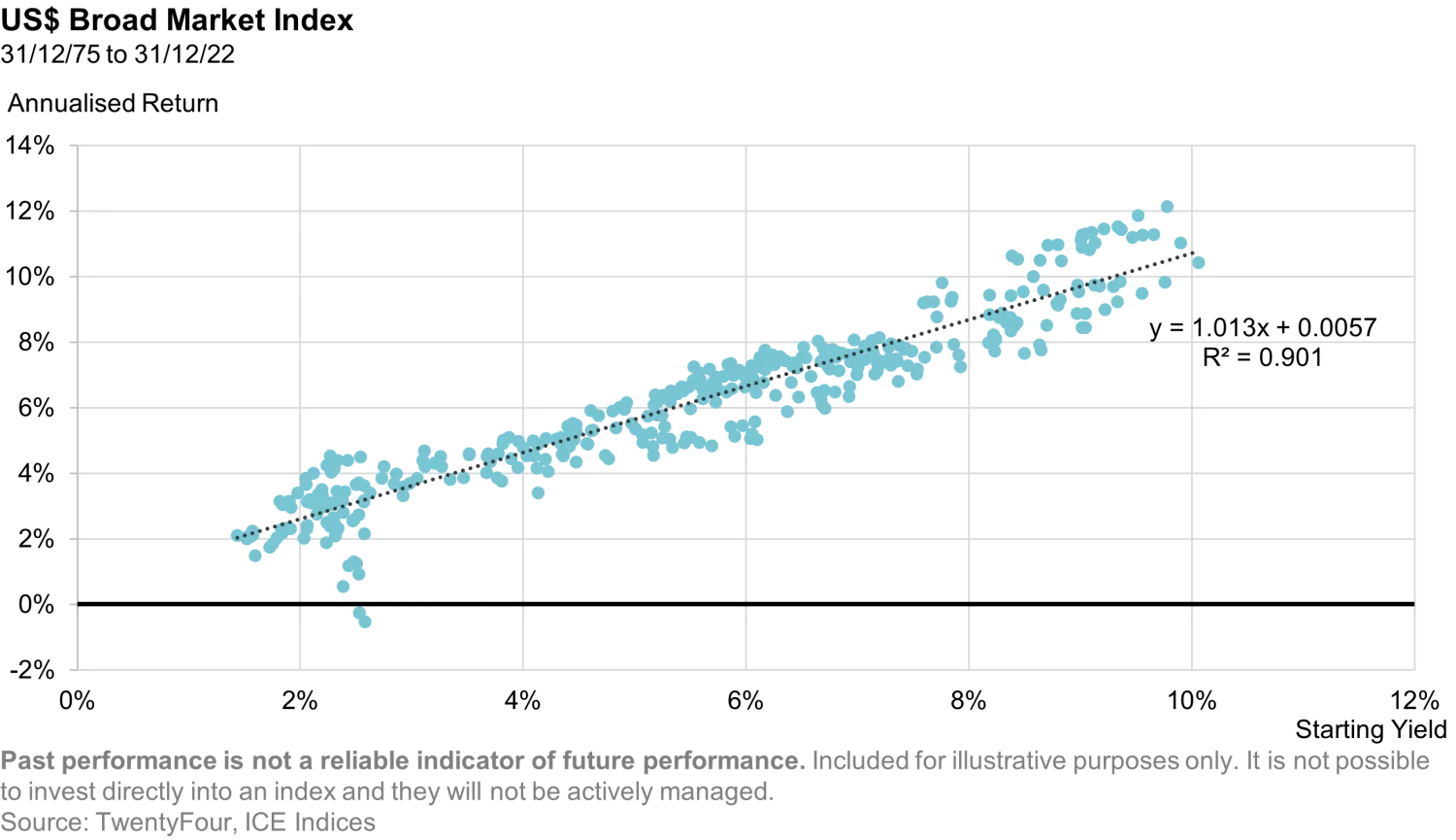

Many fixed income sectors today offer higher yields compared to recent history. Given starting yields have historically been the biggest determinant of future performance, we believe there is sufficient opportunity to enjoy close to double digit returns in fixed income, which is itself unusually high compared with historic averages. For example, less than 2 years ago, the European High Yield Index had a yield of 2.29%. Its current yield has increased to 7.31% (in euros), which is nearly 9% after hedging it back to US dollars.

Growth data, particularly in the US, has been more robust than expected. At the same time, inflation globally is continuing to move towards major central banks’ targets, even if the pace is somewhat suboptimal in our view. As a result, central banks have been less aggressive in their guidance, which has contributed to investors’ confidence that the painful adjustment to QT and higher rates may be ending.

With a soft landing narrative taking hold, or at least the probability of a hard landing making its way out of economic forecasts, and monetary policy rates at or nearing their expected peaks, the balance of risks might be shifting in fixed income. This adjustment in macro forecasts is occurring at a time when yields are the most attractive they have been in over a decade, and not just in the US. In Europe, we can find double digit yields in banks and insurers’ subordinated bonds. Similarly, in European CLOs and RMBS there are double digit yields available at the BB level and even at the BBB level in some cases.

If there is no hard landing, spreads should be well supported as we don’t think default rates are likely to climb significantly above their long-term average; whether spreads in a particular market will rally is a factor of the strength of the macro environment as well as valuations. So what if the macro picture does in fact end up being better than expected, but spreads are already close to their long-term averages? This scenario should be positive for High Yield, however, total returns in other markets would likely still be quite attractive, although mainly due to carry.

In particular we think asset classes in global developed markets, such as European CLOs and AT1s, might have significant space to rally in this soft-landing scenario. Their spreads are significantly wider than their long-term averages and they enjoy supportive fundamentals. Both these asset classes have double digit dollar yields for short-dated debt available, look very attractive on a relative value basis compared to domestic credit in our view, and can add diversification benefits to a portfolio.

As a hard landing looks increasingly more improbable, default risk and credit risk should be lower than previously expected. But what about duration risk? Risk free assets globally (except for the Japanese Government Bond market) currently exhibit inverted curves. Investors anticipate that central banks will cut rates in the not-too-distant future as monetary policy rates are in restrictive territory, growth is markedly below trend, and inflation seems to finally be on a downward trajectory. However, at current levels the 10Y+ bonds in most of these curves are still above what is considered the respective neutral rate. Therefore, a scenario where central banks eventually take rates to neutral might leave curves with their normal upward slope with not much action in the long end. It goes without saying that the aforementioned is only possible if the neutral rate has not shifted dramatically upwards and inflation is in fact close to central banks’ targets.

It is quite possible in this scenario of a soft landing/mild recession, that the long end of government bond curves trade in a range. Usually, the short end and long end move in the same direction but with different magnitudes which results in changes in the shape. In this scenario, we would expect the front end to rally significantly more than the long end. Consequently, the 10Y+ typical government bond is likely to perform well, but the potential for a rally might be capped by the fact that the curve is already inverted.

Investors who were drawn by the high yields available in T-Bills might find themselves in a situation where the yield at which they can reengage in fixed income assets once their existing investments mature is lower than the yield they were enjoying. This is an issue that asset managers have been grappling with since yields spiked higher – do you lock in these yields for the medium/long term, which should ultimately provide attractive, long-term returns, but with the risk that volatility could remain elevated, or focus on shorter dated rates, with more predictable returns, with the knowledge that investors have already endured a tough environment?

With a growing chorus that the US is now heading for a soft landing, we think the attractiveness of short-dated treasuries should be called into question. While a soft landing shouldn’t necessarily result in a sustained rally in longer-dated treasuries (as the higher-for-longer narrative is equally compelling if the Fed is missing a catalyst to cut rates), if you are in the soft landing camp, longer-dated treasuries shouldn’t underperform, while credit should perform strongly given the yields on offer. If, however, you believe the risk of a harder landing is being underestimated, then longer dated rates should rally and help give you a degree of protection, which isn’t provided by shorter dated rates.

To complicate the decision further, we know that market changes can occur rather quickly. While we understand the argument for short-dated government bonds and can understand why they, and money market funds, have attracted significant inflows, we find the longer dated options much more compelling, even with the knowledge that there could be further volatility ahead. Given the attractive yields available across fixed income, we would argue that rates duration is no longer your enemy, particularly in the US, while holding selective credit, from short to long dated maturities, can ultimately reward investors much more handsomely than shorter dated government bonds.

Investing is about identifying risks and pricing them correctly in the context of a prescribed time horizon. The reward an investor ought to expect from taking a certain kind of risk should vary depending on market conditions and the macro environment, amongst others. With an inverted curve and a soft-landing narrative making its way into analysts’ forecasts, the largest risk in a fixed income portfolio might become reinvestment risk. Paradoxically, the riskiest position to hold if that is the case could well be very short dated, credit risk free assets, such as T-Bills or Gilts.

Rates appear to be approaching their peak and credit spreads look to be normalizing – reflecting the greater chances of a soft-landing. We believe that fixed income is now a compelling proposition given current yields. And, as investors start to look at fixed income in this improving light, they should always remember that history indicates starting yields are the main ingredient for future returns.

Important Information: The views expressed represent the opinions of TwentyFour as at 16 August 2023, they may change and may also not be shared by other entities within the Vontobel Group. TwentyFour, its affiliates and the individuals associated therewith may (in various capacities) have positions or deal in securities (or related derivatives) identical or similar to those described herein. Past performance is not a reliable indicator of current or future performance. Any projections or forward-looking statements regarding future events or the financial performance of countries, markets and/or investments are based on a variety of estimates and assumptions. There can be no assurance that the assumptions made in connection with such projections will prove accurate, and actual results may differ materially. The inclusion of forecasts should not be regarded as an indication that TwentyFour or Vontobel considers the projections to be a reliable prediction of future events and should not be relied upon as such. TwentyFour and Vontobel reserves the right to make changes and corrections to the information and opinions expressed herein at any time, without notice.