Can EM equities play catch-up in the second half of the year? Spoiler alert: we believe so!

Conviction Equities Boutique

As last year was coming to a close, we believed that emerging-market (EM) equities could experience a strong 2023 on the back of some key cycles that we felt were either troughing or peaking (see “3 cycles to boost emerging-market equities going into 2023” ). While EM stocks posted positive returns of almost five percent in the first half of the year, they still trailed their developed-market (DM) counterparts, which returned just over 15 percent.

To borrow a football analogy, however, it is only halftime, and there is still a lot to play for in the second half of the year. In this brief article, we set out some of the key reasons why we believe EM equities could outperform their DM counterparts between now and the end of the year.

Strong earnings growth

In our article dated February 21, 2023, “Emerging market equities: What follows the lost decade?” , we discussed the reasons behind EM equities’ poor performance from 2011-2022. In a nutshell, EM stocks delivered flat earnings per share (EPS) growth during this period, which set the stage for a decade of disappointing total returns. However, we believe there is a likelihood that earnings will start to meaningfully grow again, particularly within EM Asian economies where there is a growing number of specialized, market-leading companies in areas such as semiconductor and battery production/equipment manufacturing. Given their market leading positions, these companies should be able to continue reinvesting significant amounts in terms of research and development, thereby strengthening their competitive positions and creating an environment for solid future EPS growth.

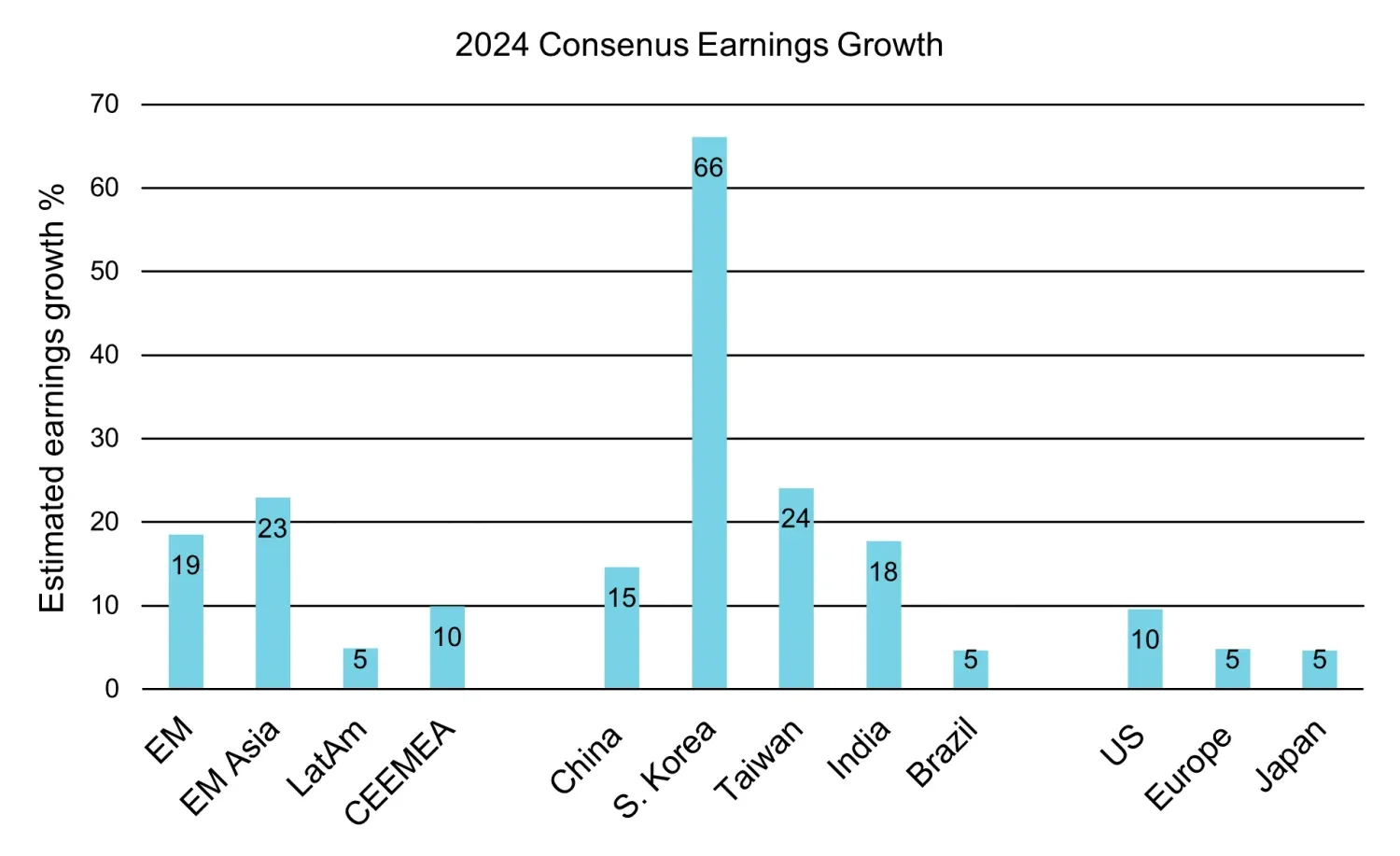

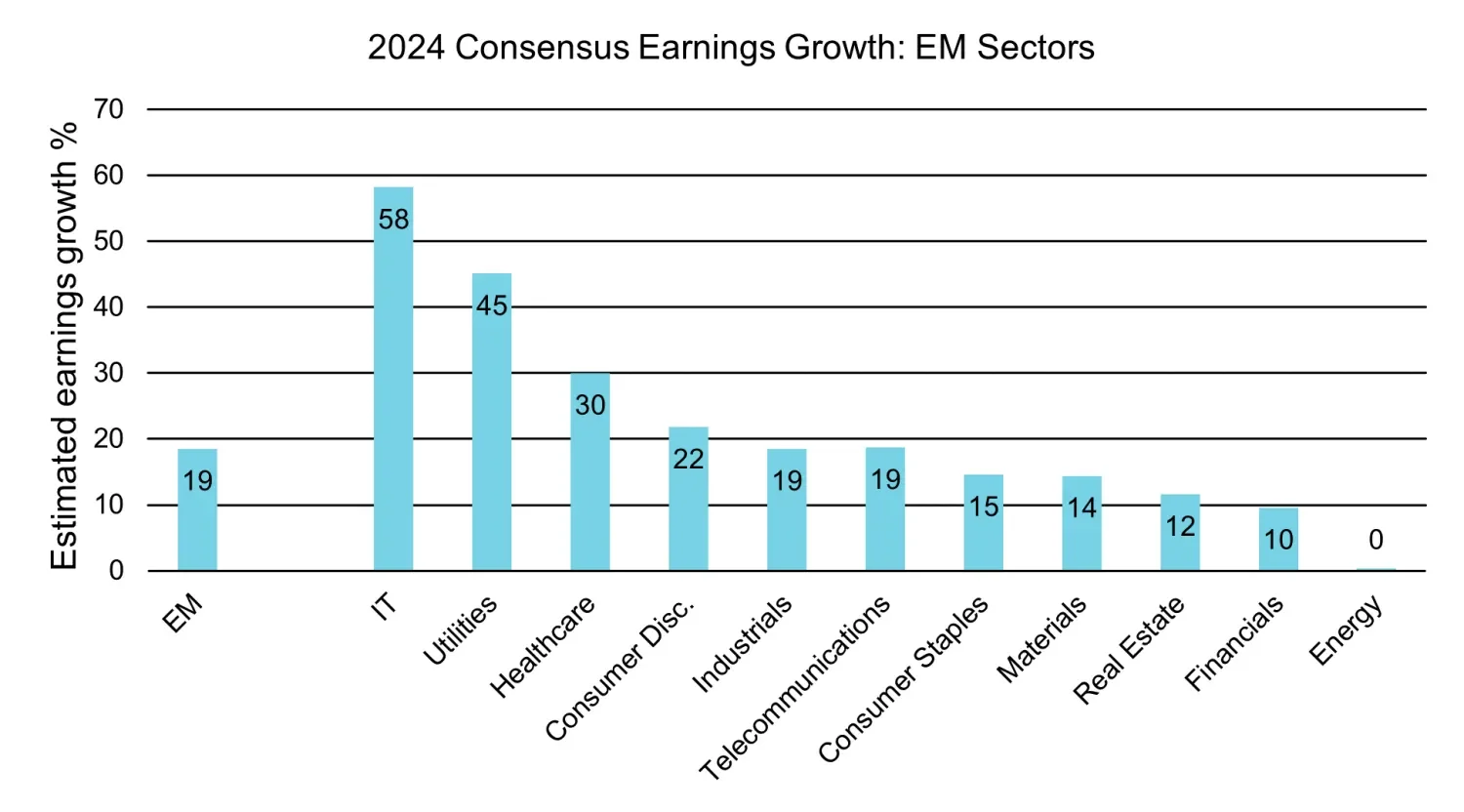

Looking ahead to 2024, EM corporates are estimated to post strong earnings growth, especially within EM Asia. Indeed, 2024 earnings growth in that region is estimated to be more than twice that of US corporates and almost five times that of Japanese corporates, with IT companies tipped to lead the charge. This resurgence in IT earnings is not surprising considering the market’s expectations that earnings in areas such as semiconductors will reaccelerate during the second half of 2023 and into 2024, following a decline in earnings during the first half of this year due to the global slowdown and customers digesting their inventories.

In addition, the earnings growth consensus numbers also show a large dispersion between regions, countries, and sectors, highlighting once again the importance of an active approach to investing in EM equities.

Chart 1: EM earnings are estimated to grow strongly in 2024, particularly within EM Asia

Source: JP Morgan, pricing as of June 21, 2023. Forecasts herein based on our internal / external analysis; not guaranteed; and actual outcomes may differ materially.

Chart 2: IT names are expected to lead the charge when it comes to earnings

Source: JP Morgan, pricing as of June 21, 2023

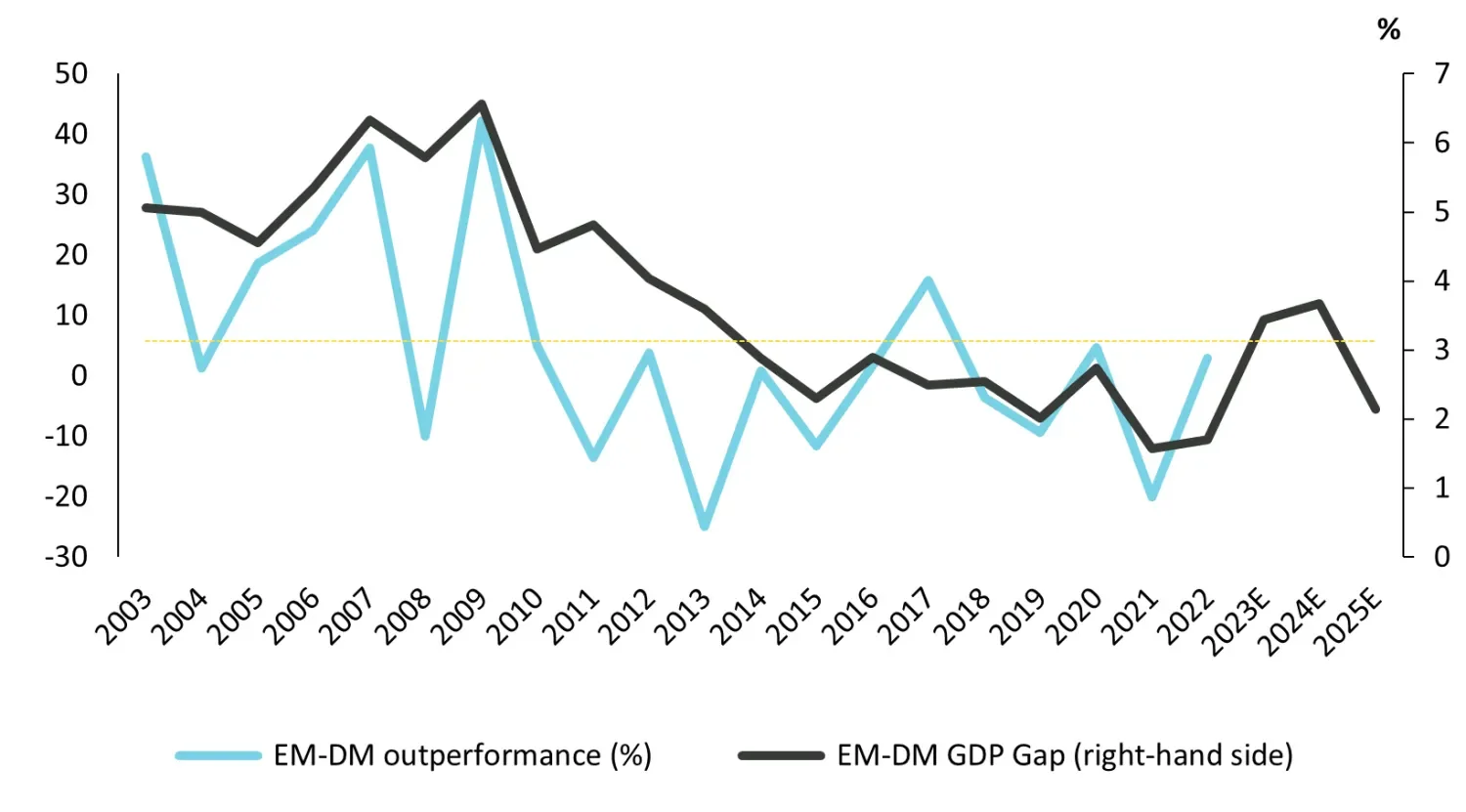

Widening GDP growth differential

Real gross domestic product (GDP) in EM economies is predicted to grow more than four percent in both 2023 and 2024, while expected GDP growth in developed markets is sluggish at approximately one percent in both years. This type of growth trajectory should result in a widening gap between EM and DM economies to a level (>3.1 percent) where EM equities have historically outperformed DM stocks. From a country perspective, EM Asia leads the way, with economies like India, China, and Indonesia predicted to grow five percent or more in both 2023 and 2024. It is important to note that these figures are simply expectations and that countries such as China face strong headwinds to growth. Nevertheless, EM growth certainly has the potential to outstrip DM in the coming two years.

Chart 3: Real GDP growth in EM is set to pull away from DM

Source: IMF, Refinitiv Datastream. Note: EM equity market performance is recalculated based on the current weight of the countries in the Index. UBS GEM Equity Strategy, May 16, 2023.

Compelling relative valuation

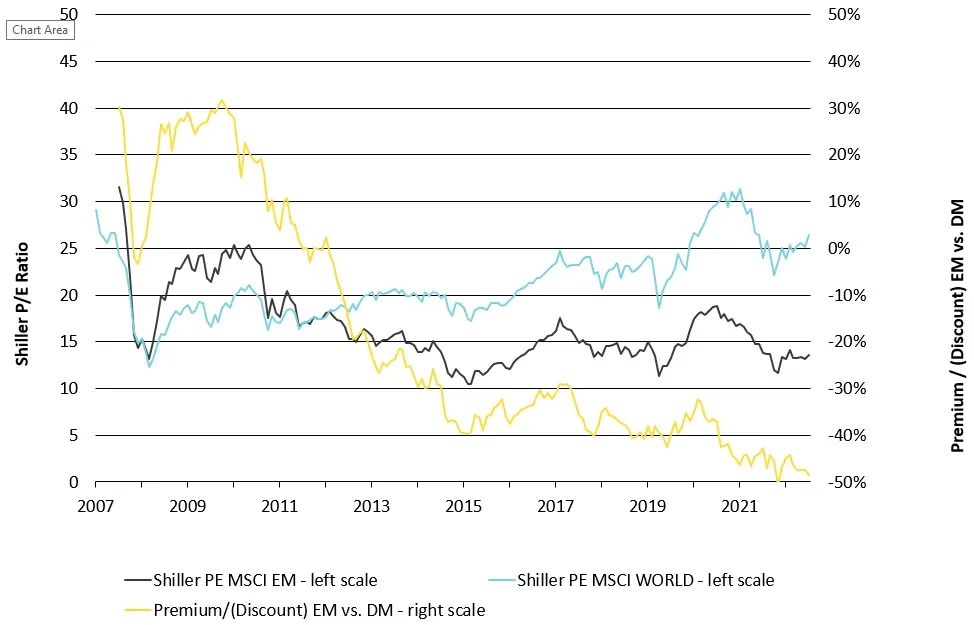

As active investors, we believe that an investment’s valuation at the point of entry is a key determinant of long-term returns. With that in mind, EM equities are currently trading at incredibly attractive valuations when compared to their DM counterparts. Indeed, on a Shiller P/E basis (the cyclically adjusted price-earnings ratio that adjusts 10 years of earnings for inflation), EM stocks are trading at a discount to DM equities of almost 50 percent. Although Shiller P/E does not tell us much about the short term, we believe it is a powerful signal that long-term investors should not ignore given that it has demonstrated strong explanatory power for longer-term asset returns*.

* CAPE Fear: Why CAPE Naysayers are Wrong. Research Affiliates, January 2018.

Chart 4: EM equities are trading at a discount to DM equities of almost 50%

Source: Vontobel Asset Management, Bloomberg, Factset; data as of June 30, 2023

Conclusion

The first half of 2023 has been difficult for investors to navigate, with macroeconomic data often throwing up conflicting signals and markets heavily driven by sentiment. EM equities are back in positive territory on an absolute basis; however, they have once again significantly underperformed DM equities.

We believe that EM equities could yet be poised for a strong finish to the year, particularly relative to DM equities, and we have summarized some of these key reasons as our conclusion. Before we cover these points, it is vital to recognize that the direction of the US dollar will play a pivotal role in how EM equities ultimately perform during the second half of the year. For example, in a scenario where the US enters a short-lived but significant enough recession (perhaps the largest probability scenario), one could reasonably expect future rate cuts by the US Federal Reserve, which would likely prove positive for EM equities. However, a long and deep recession in the US would present much more difficult conditions for global equities, including EM.

With that said, we believe there are some compelling reasons why EM equities could outperform DM equities in the second half of 2023, including:

- Earnings growth is predicted to come through strongly in 2024, particularly within EM Asia. This level of earnings growth is far greater than that of other major regions throughout the world, including the US, Europe, and Japan.

- In a world of slowing growth, EM offer the highest levels of real GDP growth. What is most important is the level of divergence between EM and DM growth (more than 3.1 percent), which historically has resulted in EM equity outperformance.

- Relative valuations are compelling, with EM equities currently significantly discounted against their DM counterparts.

Important Information: Past performance is not an indication of future results. There is no guarantee investment objectives will be achieved and all investing involves risk, including possible loss of principal. No representation is given that any securities, products, or services discussed herein are suitable for any particular investor.

Any forward-looking statements and forecasts regarding future events or the financial performance of countries, markets and/or investments based on a variety of estimates and assumptions. Opinions herein based on our analysis; not guaranteed; and actual results may differ materially. Further, we reserve the right to make changes and corrections to the information and opinions expressed herein at any time, without notice.