10 rules for yield hunters

Fixed Income Boutique

Interest rates are likely to stay in their deep hole for some time. Nonetheless, anyone hunting for corporate bonds who follows ten solid rules can still go home with an attractive yield.

Rule 1: Target higher yields with precision

Corporate bonds offer a yield premium compared to government bonds, but it is key that this higher yield compensates the investor for the higher risk they take. In order to weigh this up, it is essential that investors go beyond the credit ratings assigned by rating agencies and scrutinize the issuing companies themselves.

Rule 2: Track down and exploit market inefficiencies

But there’s more to it than just checking credit quality. If you keep a close eye out for the market inefficiencies that occur in all phases of the economic cycle when selecting your investments, you can exploit them to your benefit. They occur in the global investment universe because investors frequently only invest in one region or currency. For example, if a company has bonds outstanding in various currencies, you should always pick the one with the highest yield potential for your chosen maturity. In addition to a great deal of experience, you also need the right tools to be able to track down such valuation differences and identify the most profitable investment option.

Rule 3: Hedge against currency risk and factor in the costs

If the bond identified as the most profitable option is not in the investor’s home currency, an exchange-rate risk arises. The best way that investors can protect themselves against this is by taking out a futures contract when exchanging their own currency into the one needed for the investment in order to “freeze” the exchange rate. However, the entire investment is worthwhile only if the yield left over after deducting the hedging costs is worth it.

Rule 4: Diversify your risks and manage them actively

So far, so good. But what about unforeseen events that can trigger market disruption? So as not to be completely and utterly at their mercy, investors are better off diversifying their risks across a global portfolio rather than just backing a small handful of bets. Also, the positions in a portfolio should never be allowed to rest – they have to be flexibly managed. This is because changes in the market environment can increase risks, but they can also provide investment opportunities. In order to determine which adjustments in a portfolio are needed and when, world economic and political events have to be constantly observed and reassessed, as do investor sentiment and credit ratings. A strong network of reliable experts who know their way around the global investment universe can be worth their weight in gold.

Rule 5: Favor the quick brown foxes

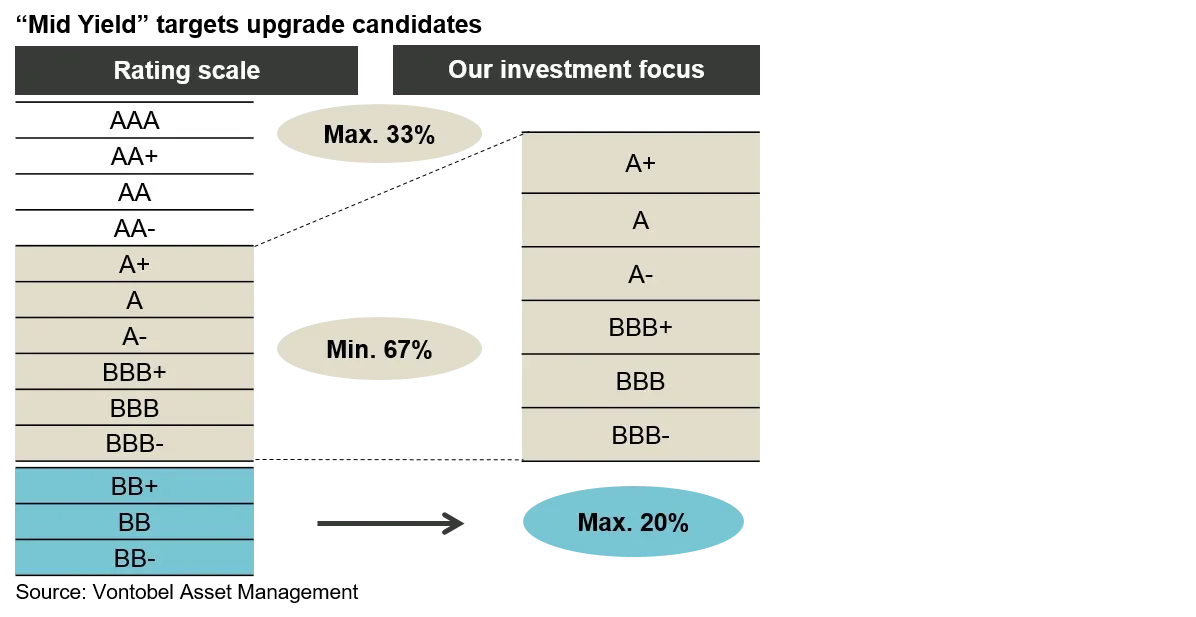

And there’s something else worth knowing about credit ratings. Before the rating agencies upgrade a company, the yield premium on the bonds in question typically drops significantly. When the yield drops, the price rises because a bond’s yield and price move in opposite directions. In this case, the prices of the issuer’s bonds rise in anticipation of the upgrade. You can profit from this if you can recognize the candidates for an upgrade early on. Years of experience are also an advantage in developing this sense. Reclassifications are especially common in the lower investment-grade range, known as the “mid-yield” segment of A+ to BBB- ratings, and at the upper end of the non-investment-grade range for BB+ to BB- ratings. Both segments offer a wide selection of liquid bonds, facilitating broad diversification and ensuring tradability at all times.

Rule 6: Don’t forget any of the rules

When hunting for yields, the above rules can make a crucial difference in your investment success. I also follow them all systematically in the Vontobel Fund – Global Corporate Bond Mid Yield. This has proven its worth, as reflected in the fund’s track record to date.

Rule 7: Know your hunting grounds

The Vontobel Fund – Global Corporate Bond Mid Yield is a compact portfolio of corporate bonds from issuers with solid credit quality from various industries all over the world, whose yield premiums more than compensate for the risks taken. Its investment universe covers the entire investment-grade universe (AAA to BBB-), where I focus investments in the “mid-yield” segment (A+ to BBB-), and the upper non-investment-grade range (BB+ to BB-) where I am allowed only limited investment. I also hold emerging market and subordinated bonds to a modest extent. I hedge exchange rate risks in full.

Rule 8: A strong hunter network with two strongholds

In order to assess both the macroeconomic environment and the value of companies in the global investment universe with the utmost care, I rely on my colleagues in our specialized Corporate Bond team who possesses immense knowledge while having one foot in Zurich and another in New York. We are seven portfolio managers and analysts in total. The criteria by which we assess the quality of the companies issuing the bonds we look at include:

- financial strength and credit indicators

- capital structure solidity

- business model dynamism

- business strategy vision

- earnings stability

- global competitive capability

- management expertise

- ability to recognize forward-looking trends

- consistency across the economic cycle

- resistance to unforeseen disruptions

We work like a bank’s credit department, which also conducts extensive analysis before approving an application.

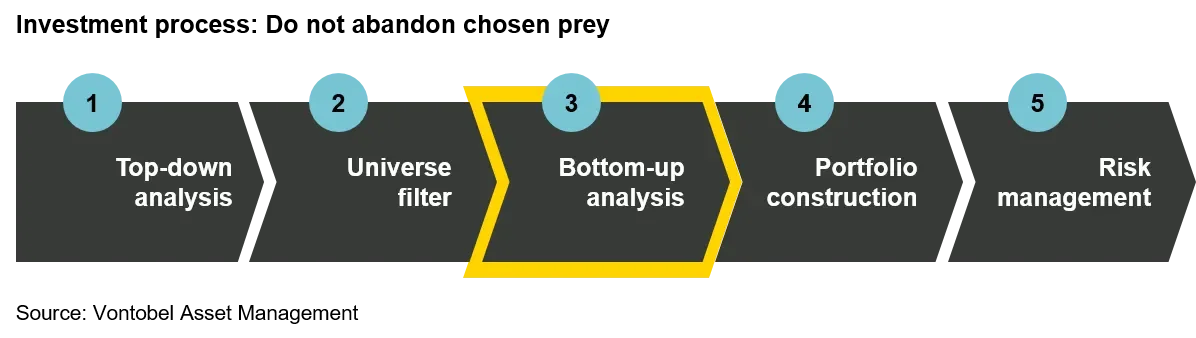

Rule 9: Systematically pursue your goal

The goal of our far-reaching analysis is to identify companies that benefit from forward-looking industry trends on the one hand and, on the other, to identify inaccuracies in the valuation of bonds from the same issuer and to exploit them profitably.

Rule 10: Keep calm

I always make my investment decisions for the Vontobel Fund – Global Corporate Bond Mid Yield from a long-term perspective, and I carefully make adjustments to the portfolio if changes in the investment environment throw off the ratio of its risk and reward potential. And when unexpected world or financial market events occur, I just remember one thing: don’t panic. Experienced yield hunters stay cool and stay on the trail of their chosen prey.

Opportunities

- Broad diversification across numerous securities.

- Possible extra returns through single security analysis and active management.

- Gains on invested capital possible.

- Use of derivatives for hedging purposes may increase fund's performance and enhance returns.

- Bond investments offer interest income and capital gains opportunities on declining market yields.

- Investment universe is diversified across global bond markets.

- Investments in bonds with medium and lower investment grade ratings may offer an above-average yield compared with investments in first-class borrowers.

- Investments in bonds with non-investment grade rating may offer an above-average yield compared with investments in first-class borrowers.

- Benefits of investing in ABS/MBS tranches that offer different prepayment and credit risks that better suit the investor are possible.

- Investments in foreign currencies might generate currency gains.

Risks

- Limited participation in the potential of single securities.

- Success of single security analysis and active management cannot be guaranteed.

- It cannot be guaranteed that the investor will recover the capital invested.

- Derivatives entail risks relating to liquidity, leverage and credit fluctuations, illiquidity and volatility.

- Interest rates may vary, bonds suffer price declines on rising interest rates.

- Investment universe may involve investments in countries where the local capital markets may not yet qualify as recognized capital markets

- Mid-yield bonds may be more speculative investments than bonds with a higher rating due to higher credit risk, higher price fluctuations, a higher risk of loss of capital deployed.

- High-yield bonds (non-investment-grade bonds/junk bonds) may be subject to greater market fluctuations, risk of default or loss of income and principal than higher-rated bonds.

- The structure of ABS/MBS and the pools backing them might be intransparent which exposes the subfund to additional credit and prepayment risks (extension or contraction risks) depending on which tranche of ABS/MBS is purchased by the subfund.

- Investments in foreign currencies are subject to currency fluctuations.

Disclaimer

This marketing document was produced for investors in Switzerland. This document is for information purposes only and does not constitute an offer, solicitation or recommendation to buy or sell shares of the fund/fund units or any investment instruments, to effect any transactions or to conclude any legal act of any kind whatsoever. Subscriptions of shares of the fund should in any event be made solely on the basis of the fund's current sales prospectus (the “Sales Prospectus”), the Key Investor Information Document (“KIID”), its articles of incorporation and the most recent annual and semi-annual report of the fund and after seeking the advice of an independent finance, legal, accounting and tax specialist. Furthermore and before entering into an agreement in respect of an investment referred to in this document, you should consult your own professional and/or investment advisers as to its suitability for you. In particular, we wish to draw your attention to the following risks: Investments in the securities of emerging-market countries may exhibit considerable price volatility and – in addition to the unpredictable social, political and economic environment – may also be subject to general operating and regulatory conditions that differ from the standards commonly found in industrialized countries. The currencies of emerging-market countries may exhibit wider fluctuations. Investments in riskier, higher-yielding bonds are generally considered to be more speculative in nature. These bonds carry a higher credit risk and their prices are more volatile than bonds with superior credit ratings. There is also a greater risk of losing the original investment and the associated income payments. Investments in derivatives are often exposed to the risks associated with the underlying markets or financial instruments, as well as issuer risks. Derivatives tend to carry more risk than direct investments. Investment universe may involve investments in countries where the local capital markets may not yet qualify as recognized capital markets. The structure of ABS/MBS and the pools backing them might be intransparent which exposes the subfund to additional credit and prepayment risks (extension or contraction risks) depending on which tranche of ABS/MBS is purchased by the subfund. Money market investments are associated with risks of a money market, such as interest rate fluctuations, inflation risk and economic instability. Interested parties may obtain the above-mentioned documents free of charge from the authorized distribution agencies and from the offices of the fund at 11-13 Boulevard de la Foire, L-1528 Luxembourg, the representative in Switzerland: Vontobel Fonds Services AG, Gotthardstrasse 43, 8022 Zurich, the paying agent in Switzerland: Bank Vontobel AG, Gotthardstrasse 43, 8022 Zurich. Refer for more information on the fund to the latest prospectus, annual and semi-annual reports as well as the key investor information documents (“KIID”). These documents may also be downloaded from our website at vontobel.com/am. Past performance is no indication of future developments. Except as permitted under applicable copyright laws, none of this information may be reproduced, adapted, uploaded to a third party, linked to, framed, performed in public, distributed or transmitted in any form by any process without the specific written consent of Vontobel Asset Management AG (“Vontobel”). To the maximum extent permitted by law, Vontobel will not be liable in any way for any loss or damage suffered by you through use or access to this information, or Vontobel’s failure to provide this information. Our liability for negligence, breach of contract or contravention of any law as a result of our failure to provide this information or any part of it, or for any problems with this information, which cannot be lawfully excluded, is limited, at our option and to the maximum extent permitted by law, to resupplying this information or any part of it to you, or to paying for the resupply of this information or any part of it to you. Neither this document nor any copy of it may be distributed in any jurisdiction where its distribution may be restricted by law. Persons who receive this document should make themselves aware of and adhere to any such restrictions. In particular, this document must not be distributed or handed over to US persons and must not be distributed in the USA.