The Conviction Equities Boutique comprises several franchises, each of which implements its own unique approach to incorporating sustainability considerations into its investment processes. Sustainability considerations include management of environmental, social, and governance (ESG) risks.

The Conviction Equities Boutique adheres to the Sustainable Investing and Advisory Policy of Vontobel Group.

Read more about each franchise’s approach.

ESG at mtx - Seeking to invest in leading businesses with high and growing profitability in emerging markets.

At the mtx franchise, we aim to generate long-term capital growth and rigorously manage sustainability risks in our equity strategies. We understand that our investments can affect society and the environment, and that investment returns are also affected by society and the environment. We aim to avoid investments in companies that demonstrate they are underprepared to avoid material sustainability risks, and we seek to identify issuers that include environmental or social characteristics in their economic activities. By integrating sustainability considerations into our investment processes, we can enhance the risk profiles of our portfolios and select companies for their ability to manage their real world impacts.

To be included in our portfolios, a company needs to be in the first quartile in terms of returns on invested capital (ROIC) and industry position, trade at a discount to its intrinsic value, and fulfil our minimum ESG standards. We evaluate all investments against sustainability criteria, including hard thresholds for inclusion in our funds.

We use a proprietary ESG scoring model against which we evaluate prospective investments according to approximately 25 sustainability indicators appropriate to each industry sector. The E, S and G criteria range from environmental commitments, human capital management, data privacy & security, and sustainability issues in the supply chain to provisions against bribery and corruption, as well as various elements assessing strong corporate governance. In addition, we aim to ensure that sustainability standards are met and maintained by employing a number of safeguards; we apply an ESG controversies framework, we exclude companies that breach international norms and standards (unless they take adequate remedial action), and we conduct ongoing monitoring as well as an annual review of sustainability performance. We also take an active role in voting and engagement with companies on sustainability matters of concern.

Finally, we exclude a number of business activities from our funds, including production of controversial weapons, tobacco, and palm oil, and more than minimal revenues from coal (power and extraction), oil sands, nuclear energy, adult entertainment, weapons contracting, and tobacco retailing.

Our in-depth ESG research benefits from a number of specialist data providers, including Sustainalytics, MSCI, ISS, Syntao Green Finance (focused on China A Shares), Bloomberg, RepRisk as well as many sell-side research brokers with ESG expertise. We partner with BMO Responsible Engagement Overlay (reo®), which specializes in the exercise of shareholder rights by providing voting recommendations and engaging with some investee companies via constructive, objectives-driven and continuous dialogue on ESG issues.

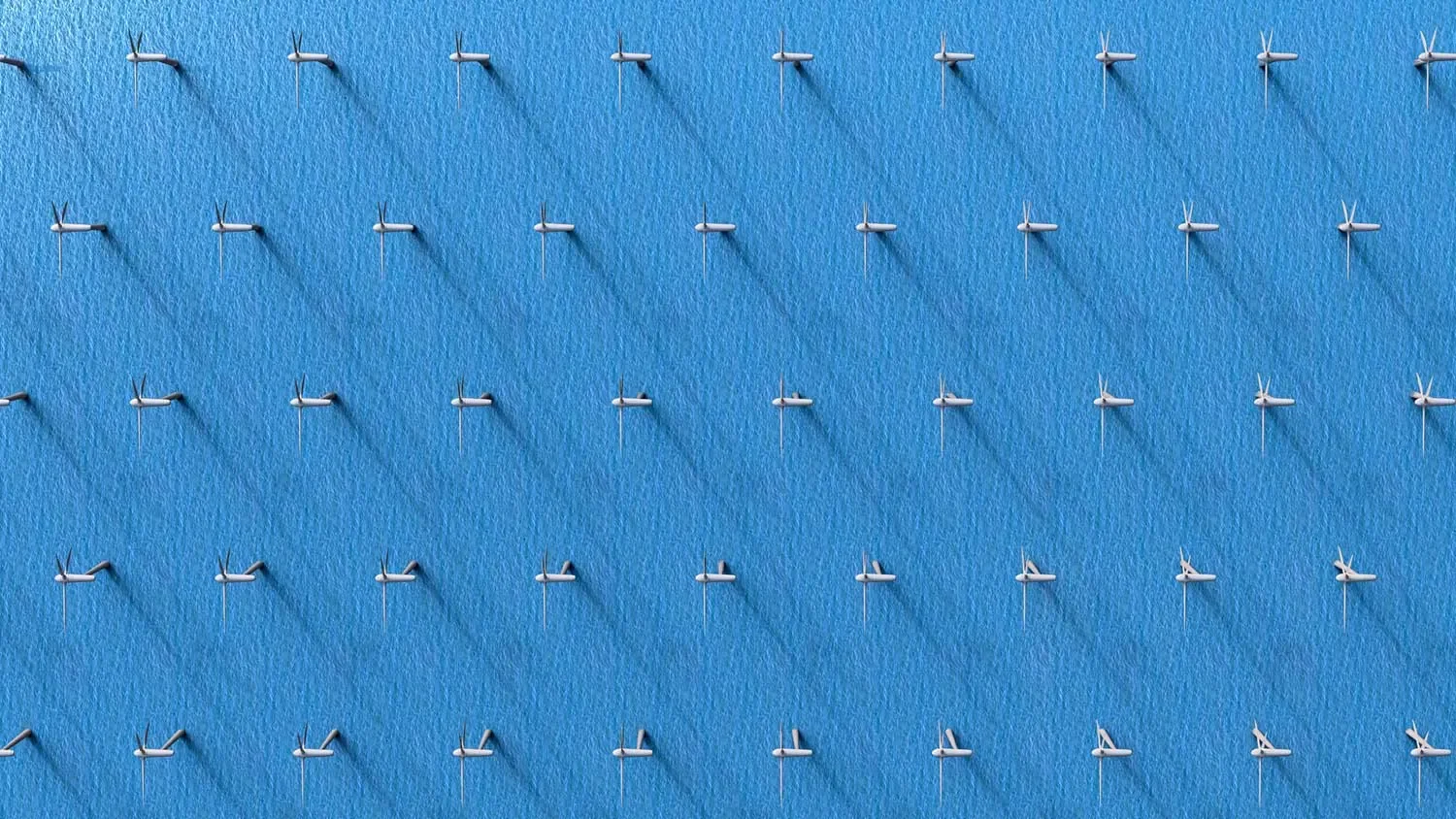

ESG at Impact Investing – Focusing on environmental and societal benefits without forgoing performance.

Our target companies address challenges such as climate change, resource scarcity, population growth, food distribution, or rising inequalities, and help to minimize the impact of human activity on the planet. We believe increasing demand for such solutions will lead to market share gains, pricing power, and rising stock prices. Moreover, such companies face a lower degree of regulatory scrutiny compared to their competitors.

Making sustainability a business objective can pay off. Stocks of such companies have the potential to beat their peers and the general market, in our opinion. As part of our investment process, we also integrate information on companies’ handling of issues related to environmental, social, and governance (ESG) criteria.

Apart from a thorough sustainability assessment, we engage with companies on material sustainability issues or risks that can impact their future success and potential to invest. Such a systematic engagement process with investee companies raises their awareness and should facilitate positive change.

The companies we pick for our portfolio contribute to at least one of our impact objectives (“impact pillars”) and one or more of the United Nations’ Sustainable Development Goals (SDGs). We also track the impact of our holdings using specific key performance indicators to illustrate the impact. These include, for example, tons of carbon emissions potentially saved, the amount of cargo/number of passengers transported by rail rather than by road, the number of patients reached, or the amount of food produced sustainably.

We do not consider companies that produce controversial weapons and or those with a meaningful revenue share of nuclear or coal-based power generation. In addition, we exclude companies that derive more than a marginal percentage of revenues from uranium mining, coal extraction, alcohol/tobacco production, or that are involved in gambling, pornography, and fur production.

We aim to ensure that our portfolio holdings are aligned with the principle of “do no significant harm” as defined by the EU Taxonomy framework for sustainable investing. We assess this by following their critical business involvements and environmental controversies, using data from external ESG data providers as well as our own research.

We also evaluate minimum social safeguards to ensure the alignment with OECD Guidelines for Multinational Enterprises, and the UN Guiding Principles on Business and Human Rights. Our investee companies are also expected to observe the principles and rights set out in the eight fundamental conventions identified in the Declaration of the International Labour Organisation on Fundamental Principles and Rights at Work, and the International Bill of Human Rights.

Important Information:

Environmental, social and governance (“ESG”) investing and criteria employed may be subjective in nature. The considerations assessed as part of ESG processes may vary across types of investments and issuers and not every factor may be identified or considered for all investments. Information used to evaluate ESG components may vary across providers and issuers as ESG is not a uniformly defined characteristic. ESG investing may forego market opportunities available to strategies which do not utilize such criteria. There is no guarantee the criteria and techniques employed will be successful. Unless otherwise stated within the strategy's investment objective, information herein does not imply that the Vontobel strategy has an ESG-aligned investment objective, but rather describes how ESG criteria and factors are considered as part of the overall investment process.