Investors can get income from many sources, from bond coupons and equity dividends to other investments such as mutual funds, exchange-traded funds (ETFs) and investment trusts that make regular payments to investors based on the performance of the assets they manage.

Income is a crucial element of portfolio construction. Without bond coupons or equity dividends, investors would have to regularly sell assets that have risen in price in order to realise capital gains and generate a cash return. If a portfolio has a reliable stream of income, investors can earn a consistent return while holding assets for longer periods.

When markets are volatile, income investing can also help protect a portfolio’s overall returns, since the income keeps coming even if the assets are performing negatively on a mark-to-market basis.

Three reasons to choose bonds for income

Flexible

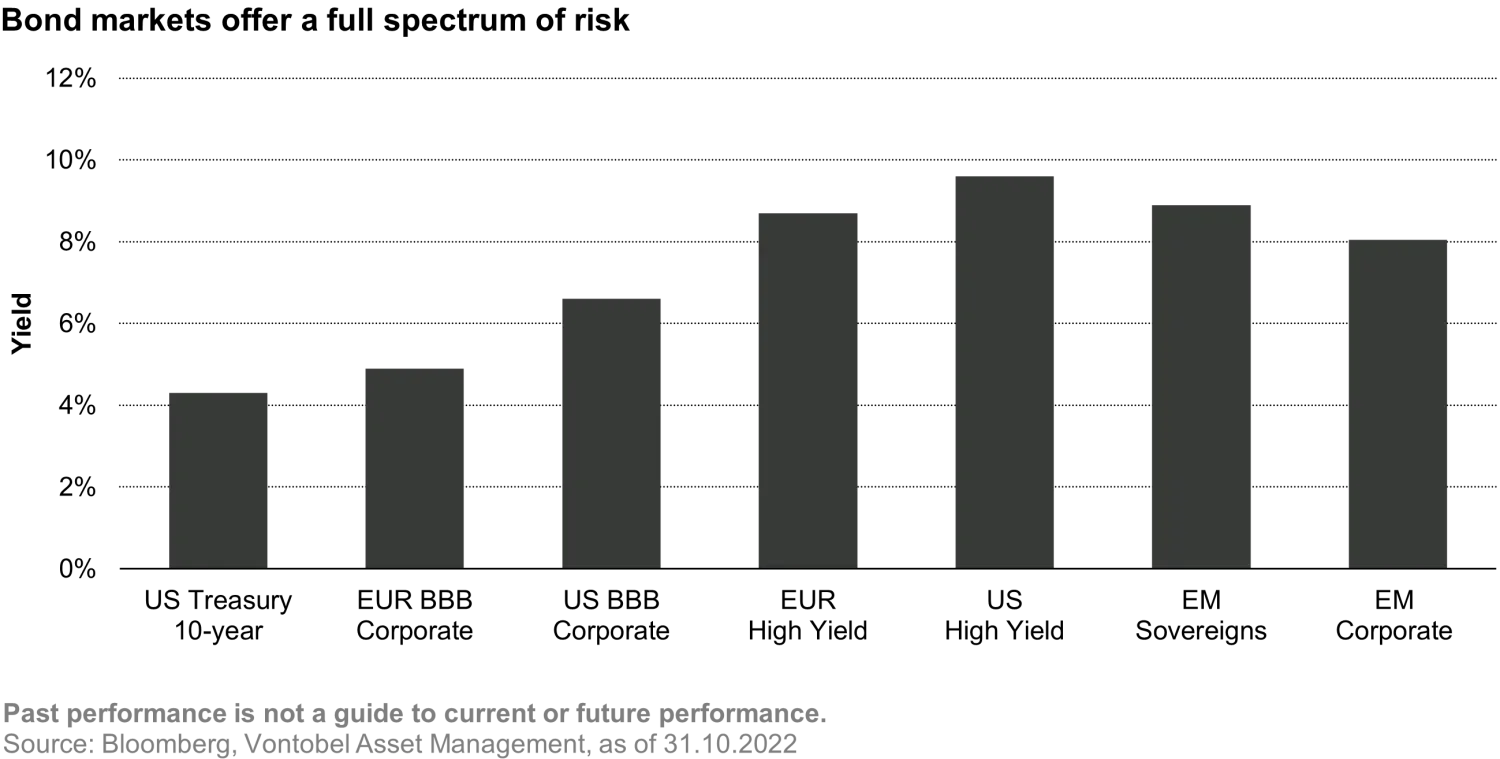

The bond markets offer a full spectrum of risk, from investment grade governments to high yield corporates, across developed and emerging markets, meaning fixed income investors can build an income-producing portfolio calibrated to their desired level of risk.

Predictable

Bond markets are referred to as ‘fixed income’ for a reason. While equity dividends are discretionary (then can be adjusted up or down at the company’s discretion), bond coupons are contractual payments (non-payment would put a company in default). Note that despite the name, a small minority of bonds offer a floating rate, priced related to an index.

Stable

In the long term, income will likely be the major driver of returns in a fixed income portfolio, which means fixed income returns tend to be less volatile than other, higher risk asset classes. A global, unconstrained bond portfolio might derive around 70% of its total return from income and only 30% from capital gains.

Three fundamental features of fixed income

Bonds possess a very simple feature that make them lower risk than many other assets – a maturity date. In addition to income from coupons over the life of the bond, investors receive their initial investment (their ‘principal’) back on the maturity date.

This means there are only two ways an investor can lose money on a bond; either the bond issuer defaults, or the investor chooses to sell the bond at some point before maturity when the bond is trading below the purchase price.

If you buy a three-year bond yielding 5% today and hold it until maturity, then as long as the company doesn’t default, in three years’ time you will make a total return of 15%, regardless of whether the market price of the bond has fluctuated in the meantime.

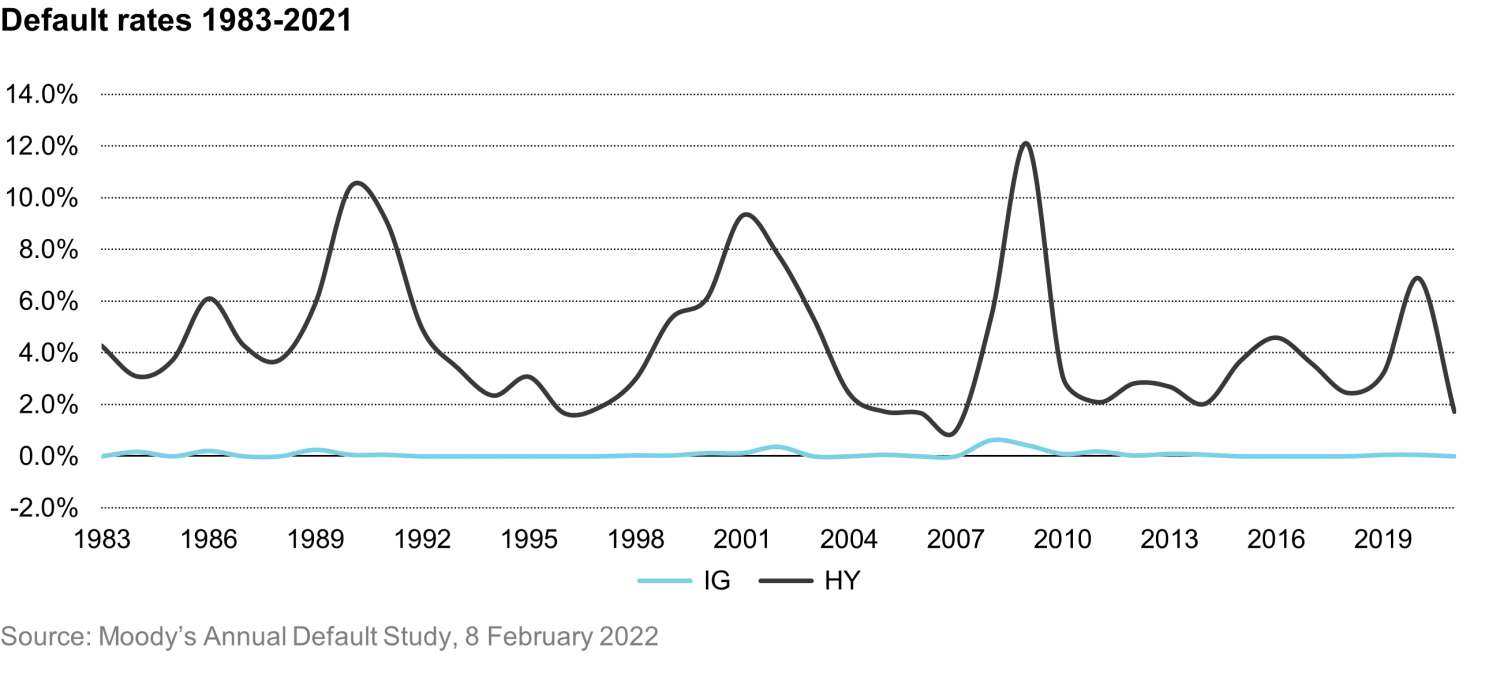

Defaults are extremely rare in investment grade bonds; the historical average is just 0.1%. As the chart below shows, in sub-investment grade bonds (also known as high yield) default rates tend to spike higher in times of severe economic distress, but the historical average default rate is again relatively low at 2.8%. Part of the job of an active manager is to conduct detailed research on high yield bond issuers to avoid the defaults that can occur in the sector.

Another natural advantage of bonds, particularly short term bonds, is ‘pull-to-par’. Pull-to-par reflects the reality that as a bond approaches its maturity date, it will begin to ‘pull’ to its par value as default risk becomes increasingly negligible and the cash price of the bond amortises to 100. Pull-to-par occurs whether a bond has risen or fallen in price since the investor’s purchase, as in both instances the bond would repay at 100 regardless.

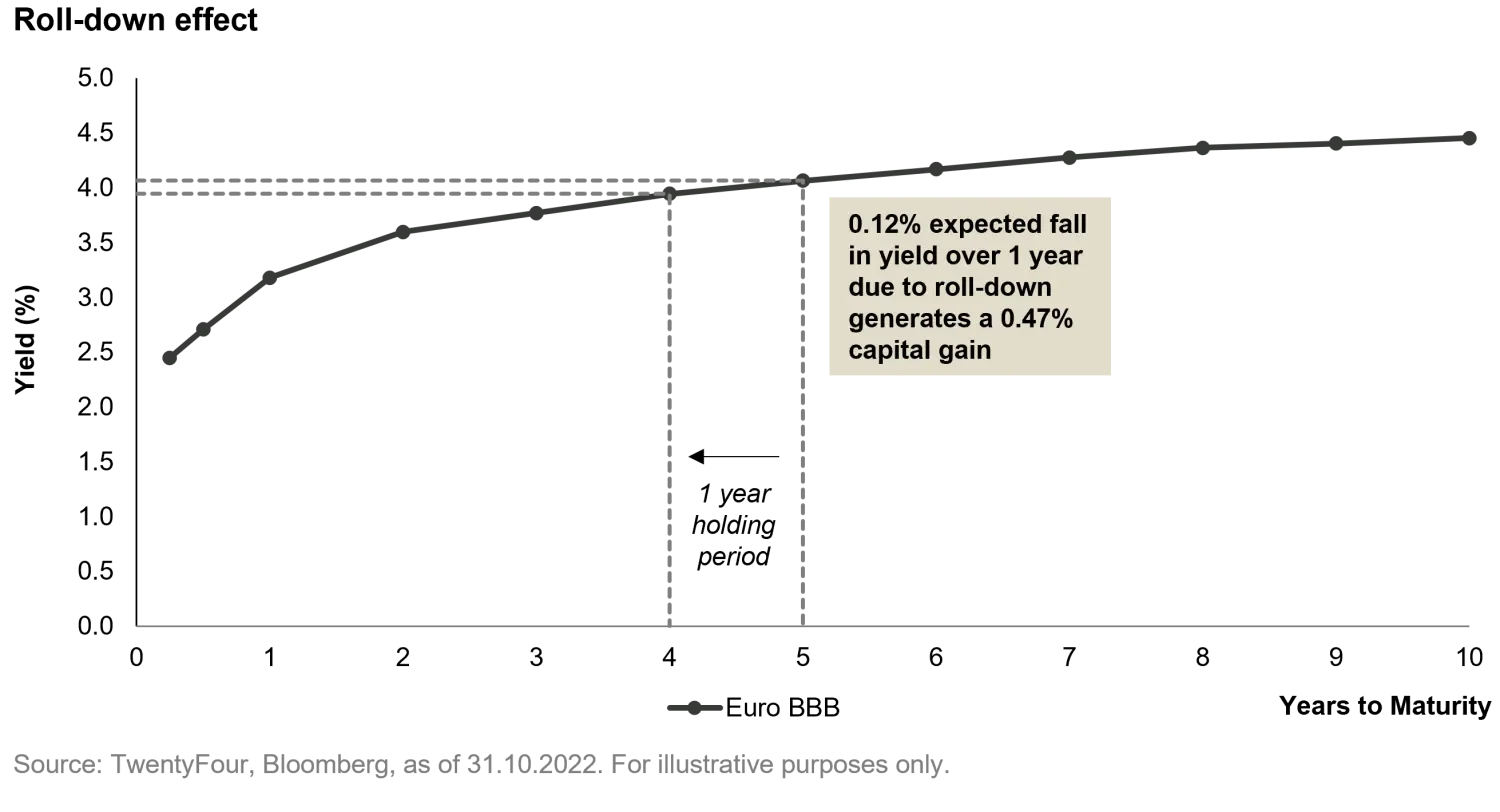

Roll-down is the capital gain created by the natural fall in a bond’s yield as it approaches maturity. The steeper the curve, the bigger the potential for roll-down gains, since the bond’s yield has further to fall (generating a bigger capital gain) with each passing year of maturity. Roll-down potential is generally much larger in short term bonds than in longer maturities because yield curves tend to be much steeper at the short end.

An approach to suit your needs

Through our two specialist investment boutiques, we can provide you with a variety of actively managed fixed income strategies, each supported by a consistent investment philosophy and process.

These investment profiles range from those targeting an attractive level of income with a focus on capital preservation, through to those targeting higher returns from more specialist assets and a dynamic, research-driven approach.

Fixed Income Boutique

TwentyFour

Insights

An introduction to global CLOs

European fixed income offers value, not just diversification

Tariff turnaround resets the outlook for fixed income

Flash Fixed Income: Are markets complacent on tariff risks?

Lottomatica reopens high yield for right names

Fixed Income Quarterly: “Your overconfidence is your weakness.”

Corporate sector on solid ground entering 2025

Flash Fixed Income: Three big themes for 2025

How do higher Gilt yields impact banks and insurers?

Gilt yields gap higher

Flash Fixed Income: Credit correction coming?