TwentyFour

How ESG scoring really works

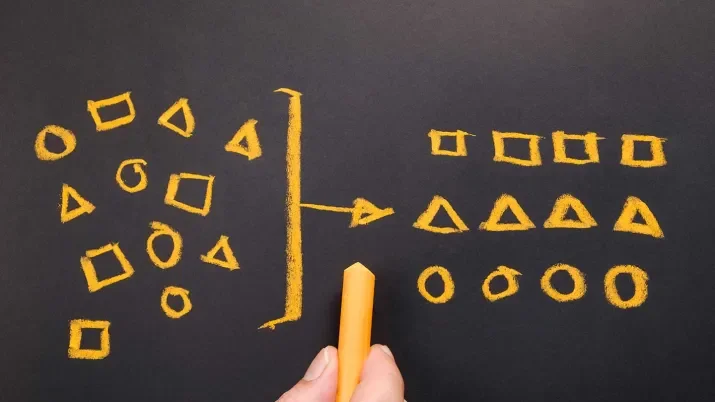

Here we lift the lid on how typical ESG scoring models work in fixed income, with the help of some real-world examples that will help explain why some companies score well and others poorly. Some of the results will surprise you.