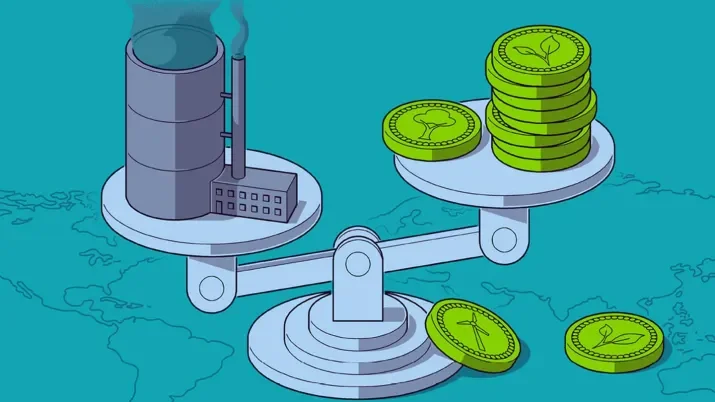

Asset management

Can we put a monetary value on nature?

Nature is our source. Challenges to natural capital are prompting the world to rethink its relationship with nature and the value we place on it. This article provides a bird-eye view of why investors should care about the semantics and monetization and regulation of nature.