Asset management

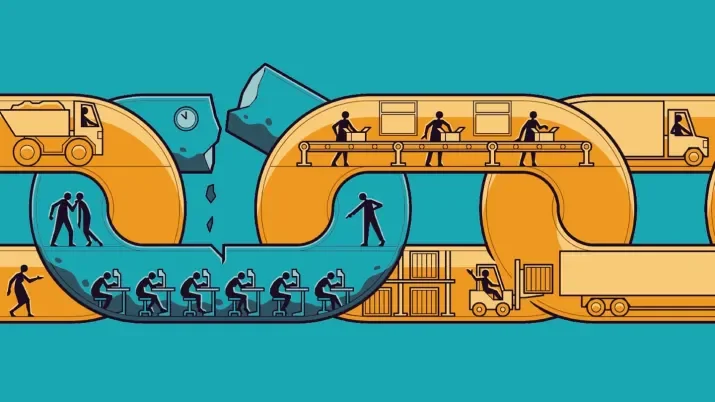

Knowing your supply chain is crucial for investing in a new era

For a single company, supply chain oversight can be complex. For professional investors with multiple companies in their investment portfolios, this task can become massive. Complexity, however, is not something to hide behind.