Will A Bear Market Shred A Portfolio?

Quality Growth Boutique

After a decade of easy money and an unabated climb in equity markets, the S&P 500 Index briefly descended into near bear market territory last year – marking the first time investors experienced a decline of that magnitude in ten years. While 2019 ushered in the best start to the year since 1987, it also brought uncertainty and surprise in ample supply – which is not easily digested by investors.

Active Investors with Conviction Can Plot a Steady Course

As the market shifts between optimism and pessimism, investors with conviction in the intrinsic value of a business have the advantage of seeing the market over-or under-value a company. Conviction investors who remain style-consistent through the full economic cycle view predictability in the business outlook and patience as core requirements. Conviction in the ability of an investment to generate cash flow supports the ability to value a business. This, alongside a disciplined approach to valuation, allows active investors to differentiate performance from the index.

We observe the broad indices as spaces often crowded with nervous, low-conviction holders that are capable of selling a company when its price is cheap and buy when it is expensive. Conviction in the value of what you own is particularly helpful in plotting a steady course for long-term returns through areas of both turbulence and exuberance.

Expect Volatile Terrain Ahead for Global Equities

Previously swept along by momentum, global equity markets are now recognizing heightened risks that can significantly impact markets this year:

- Slowing global growth: The synchronized global GDP growth that bolstered investor enthusiasm in 2017 is deteriorating. Even though the U.S. economy remains generally healthy, economic data in Europe and China have reflected cooling growth.

-

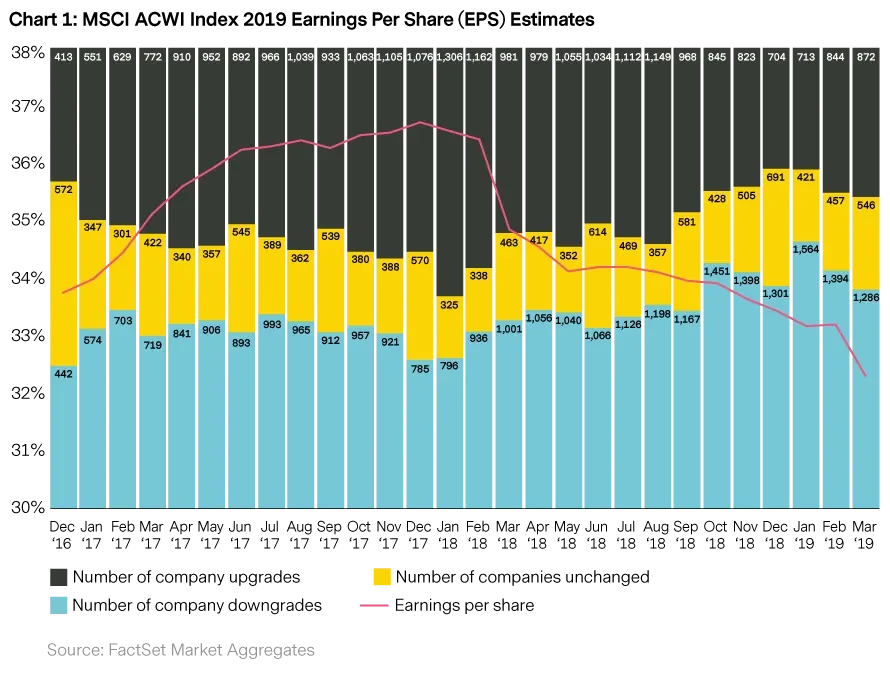

Increasing earnings downgrades: With slowing growth, 2019 earnings per share estimates for the MSCI All Country World Index (ACWI) declined from their peak in the first quarter of 2018. The impact may be even greater on lower quality, more cyclically sensitive companies.

- Unpredictable Monetary Policy: Although the U.S. Federal Reserve paused its rate hiking cycle, providing a tailwind for equity markets, it’s unclear how accommodative monetary policy will be going forward. This is important for equity investors as Fed actions could promote economic momentum and healthier financial conditions or kill a roaring stock market.

- Rising geopolitical tensions: Ambiguity around the outcome of Brexit, anti-establishment parties gaining ground in Europe, and the U.S. taking on China over its evolving trade and geopolitical aims may continue to weigh on market sentiment.

With economists prognosticating a recession, investors can expect a more difficult environment than they have experienced in the past decade – where accommodative monetary policy was the rising tide that lifted all ships. Given this backdrop, maintaining significant allocations to broad market indices leaves investors vulnerable to the impact of weaker economic conditions. It’s true that index investors are exposed to 100% of the market upside, but they are also exposed to 100% of the downside. Now is not the time to simply go along for the ride.

Why Quality & Conviction Matter Now

While it is impossible to time the market, an active manager with a demonstrated track record and a clear roadmap should be positioned to add value during a period of decline.

As quality growth investors, we are mindful of risks throughout the entire economic cycle, regardless of market despair or exuberance. We seek to invest with conviction in solid businesses that are consistently profitable and not dependent on a strong economy, and we steer clear of highly cyclical, heavily indebted boom-bust companies. Our focus on companies with predictable and sustainable growth that is superior to the market helps protect our clients’ assets on the downside but can also generate faster cumulative earnings growth over the longer term.

Returns and Risk: Looking at the Complete Picture

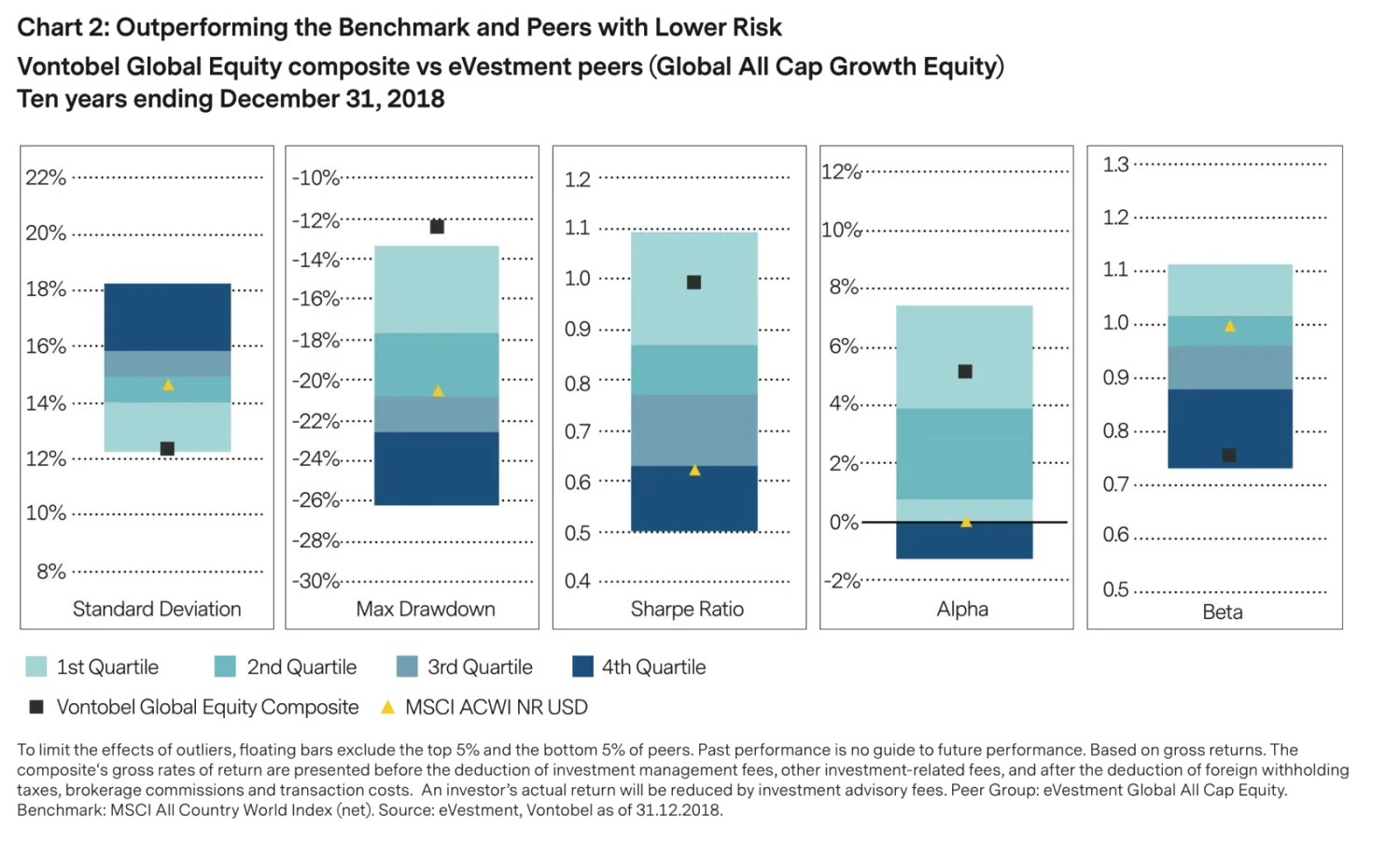

Over the past 10 years, the Global Equity strategy has delivered outperformance compared to its benchmark. However, just as interesting, this performance has been achieved by taking lower risk than our benchmark and our peers. These risk statistics illustrated in Chart 2 – lower standard deviation, lower drawdowns and lower beta – are what we believe will enable our strategy to generate even more alpha in the potentially volatile and uncertain markets ahead.

Maintaining Perspective is Critical

Over the past 100 years, there have only been a handful of recessions and they have typically been shorter and less painful than investors have expected. It’s important to remember that a crisis could mark a recession, as it did in 2008, but not every recession is a crisis. In fact, active managers see a recession as an opportunity to buy great companies at discounted valuations.

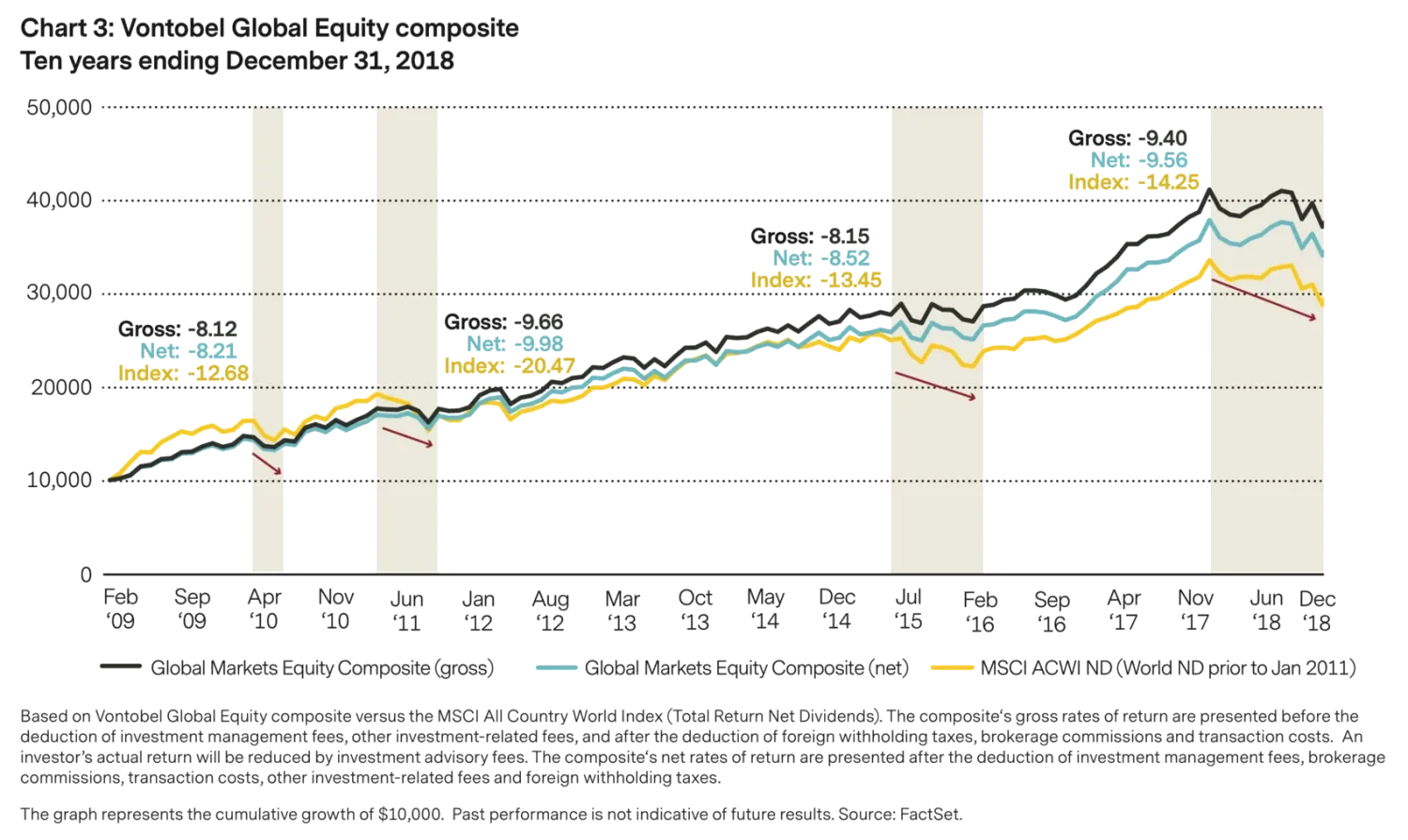

Capitalizing on mis-pricings in times of market declines, combined with strict adherence to a quality growth discipline, has helped equip the Global Equity strategy for success throughout the cycle, as shown in Chart 3.

The Vontobel Quality Growth Research Team: There’s No Substitute for Experience

Also key to navigating uncertain markets is an investment team with depth and breadth of experience. We are convinced that this has been among the key factors that have allowed us to historically deliver strong risk-adjusted returns and what will help enable us to continue to do so going forward.

- Globally diverse team delivers broad perspectives in its bottom-up, fundamental research approach.

- 31 investment professionals with 24 years average experience

- Global equity track record since 1994

- $8.4 billion in global equity AUM