Who's Afraid of the Inflation Wolf?

Quality Growth Boutique

Bell bottoms are back in vogue, the crime rate is up in New York City and investors are panicked about inflation. It’s deja-vu 1970s-style all over again.

In the last year, governments worldwide pumped huge amounts of emergency funds into their respective local economies to counter the devastation caused by the Covid-19 pandemic. In the United States alone, the Trump and Biden administrations trained a bazooka at the problem, spending a combined $2 trillion dollars to help support millions of households and small businesses.

There’s just one problem: Hardly any of the stimulus made its way into the real economy. According to the US Federal Reserve, most households stowed it away into savings – only about 25% of the Corona Cash stimulus checks have been spent so far. JP Morgan reports that US households in the bottom-income quartile were the only ones to have actually used the financial assistance for daily needs. That means that US banks are holding a record level of cash in checking accounts.

It doesn’t take a PhD in economics to figure out that if this wall of cash suddenly returns to the economy, the rate of inflation could accelerate. Supply chain bottlenecks and rising commodity prices don’t help. But when even the brightest economists can’t come to a consensus about the risk of inflation, we are not going to settle the matter.

If inflation does materialize, it will of course have important consequences for the equity markets. During the 70’s Great Inflation, multiples contracted as nominal rates increased (Figure 1), and the relative performance between the haves (businesses that could protect against inflation) and the have nots widened.

We do not pay much attention to the prophets of the doom. It won’t surprise us, if by year-end, those same prophets will be screaming deflation. The way we see it, instead of trying to predict the hurricane, we would rather put our energies into building the levee to contain the flood.

However, if inflation is keeping you awake at night, we will argue why we disagree with consensus that cyclical stocks (financials, industrials and commodities) are the best defense against inflation, and why a portfolio of quality stocks can be the right approach.

System 2, not System 1

Sometimes human instincts turn out to be wrong. Professor Daniel Kahneman, winner of the Nobel prize in Economics, and author of the best-seller Thinking, Fast and Slow, has done extensive research on the influence of bias in decision making. In his book, Prof. Kahneman explains the difference between two modes of thought: System 1, the fast, instinctive and emotional process that we use for repeatable tasks like driving; and System 2, the slower, deliberative and logical process that’s used for multiplying two large numbers, for example.

Prof. Kahneman enumerates several types of bias mistakes that people make when applying a System 1 approach to a decision that requires System 2. When a car skids on an icy road, most drivers have an instinctive reaction to slam the foot on the brakes. This causes the wheels to lock up and the car to spin out of control. An experienced driver, though, when faced with such a situation, will shift to a System 2 mode and make a deliberate choice to control the car by steering the wheel rather than slamming on the brakes.

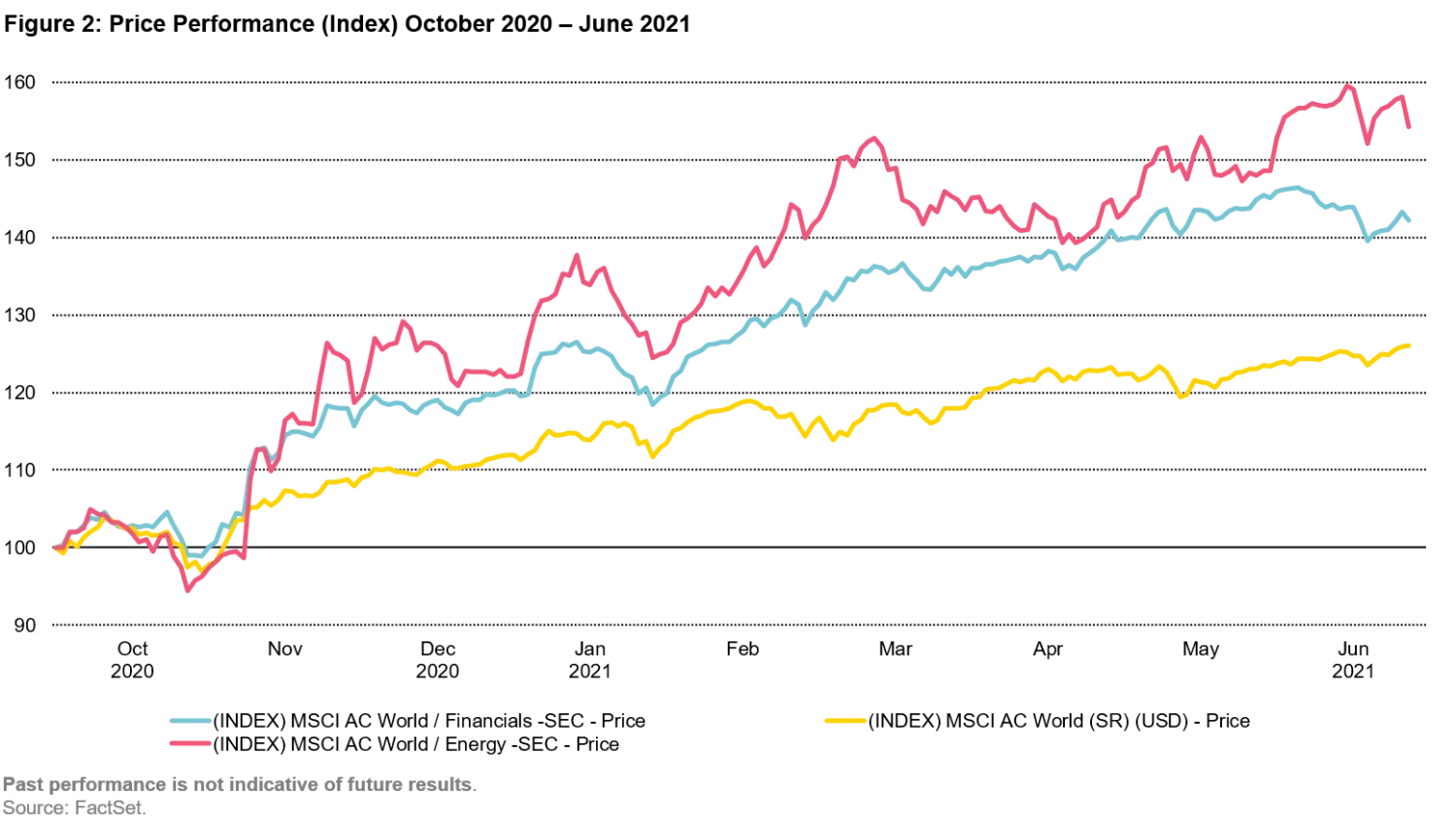

With the risk of rising inflation on the horizon, Wall Street talking heads are recommending that investors pile into cyclical stocks (Figure 2). In some ways it makes sense: banks make more money lending at higher rates and energy companies do, too, when the price of oil goes higher. In the short term, inflation will be a tailwind for cyclical companies, and for those who believe they can time the market, we agree that the so-called reflationary trade still has life left in it.

However, if you take a long-term view, the reflationary trade is a reflexive reaction, in my opinion. This is System 1 thinking. Ultimately, what matters for stock appreciation is real, not nominal earnings growth. People like me in a certain age bracket, those who grew up in the 70’s and 80’s, have a visceral understanding of the corrosive effects of inflation: The failed attempts of the Nixon administration to control prices, the recurrent strikes and the long-lines at the gas station to fuel the car have been seared in our collective memories.

I happened to be in Brazil at that time when peak inflation reached 3,000 percent per year. I remember the mobs of frustrated people in the supermarkets on payday in a rush to exchange their depreciating salaries for staples, just to realize that month after month they could afford less and less. There is nothing good about high inflation. It diverts capital from productive investments to financial speculation, it destroys jobs, it worsens inequality and it destabilizes democracies. High inflation is more than just an acceleration of prices; it is bad for economic growth and prosperity.

So, what about that case for investing in cyclical businesses? First, take banks. Banks are a bridge between the present and the future. They make money when their customers do well. We agree that if the Fed decides to raise rates to fight inflation, in the short-term banks may turn more profitable from the spread between long and short-term rates. In the longer term, this dynamic is not sustainable. In a scenario of higher inflation, customers will struggle to pay off debt and non-performing loans (NPLs) will rise. Furthermore, banks will also face increasing costs to run the business in the form of higher wages and higher depreciation expenses to upgrade their infrastructure.

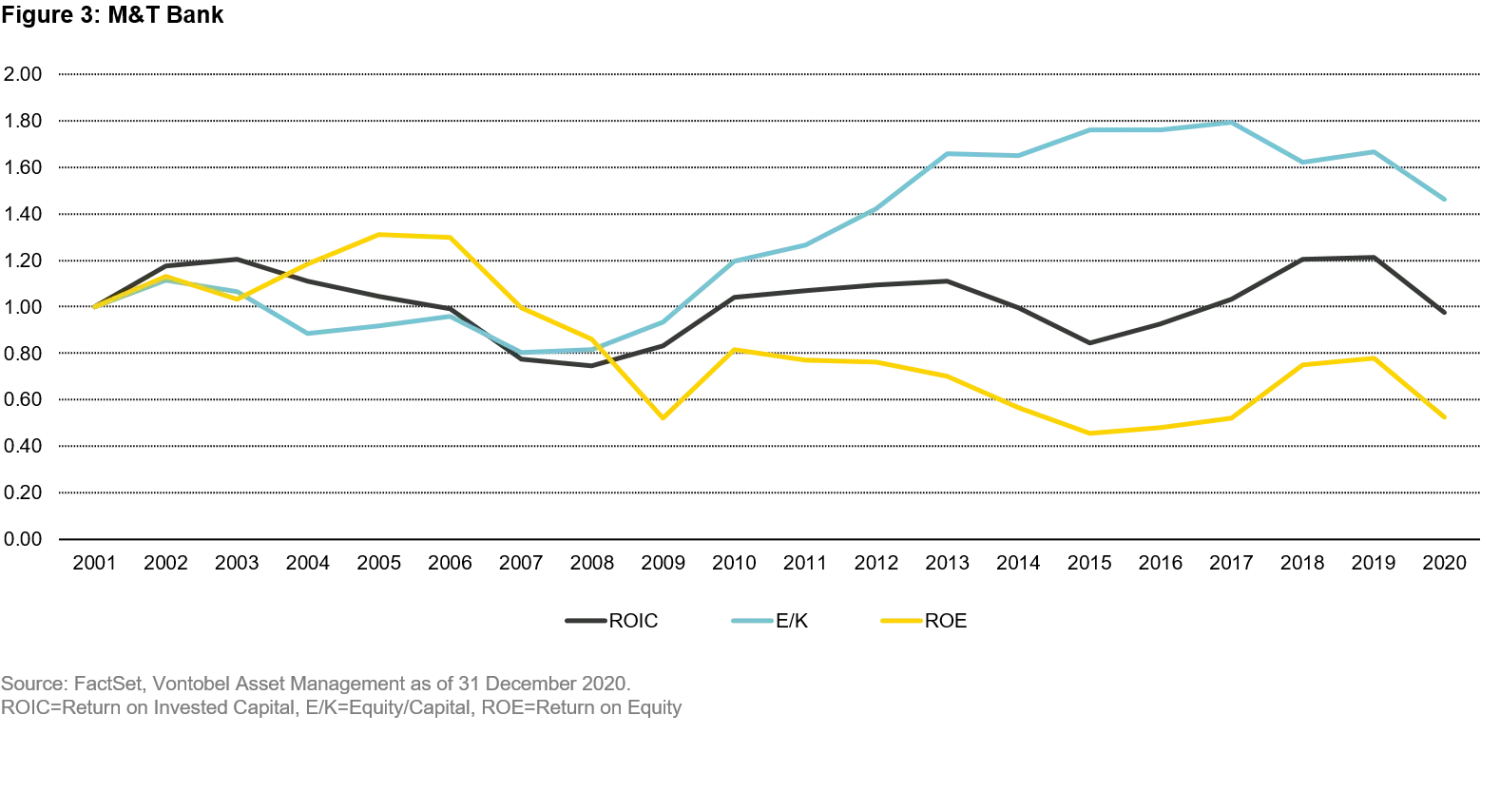

Conventional wisdom says that banks thrive under higher rates, but the argument does not hold water. Since banks offer commoditized products with barely a difference between a mortgage from Bank A and Bank B, customers ultimately just look for the lowest rate. Case in Point: M&T Bank is considered one of the best managed banks in the United States because it has maintained a relatively stable ROA regardless of the level of interest rates. ROE’s, however, moved up and down over time because of changes in the leverage ratio – not interest rates (Figure 3).

And what about energy companies? They thrive under a goldilocks scenario when demand for oil grows gradually with global GDP, and prices move up in line with affordability. Like in our bank discussion above, energy companies may benefit in the short-term as the price of oil rises with inflation. Over the long-term, these companies are walking in place when prices go up in nominal terms and volume growth is muted. Moreover, energy is a capital-intensive industry and when inflation increases, while management may delay maintenance capex to embellish the bottom line, eventually, they will have to re-invest in the business, increasing depreciation and pressuring margins.

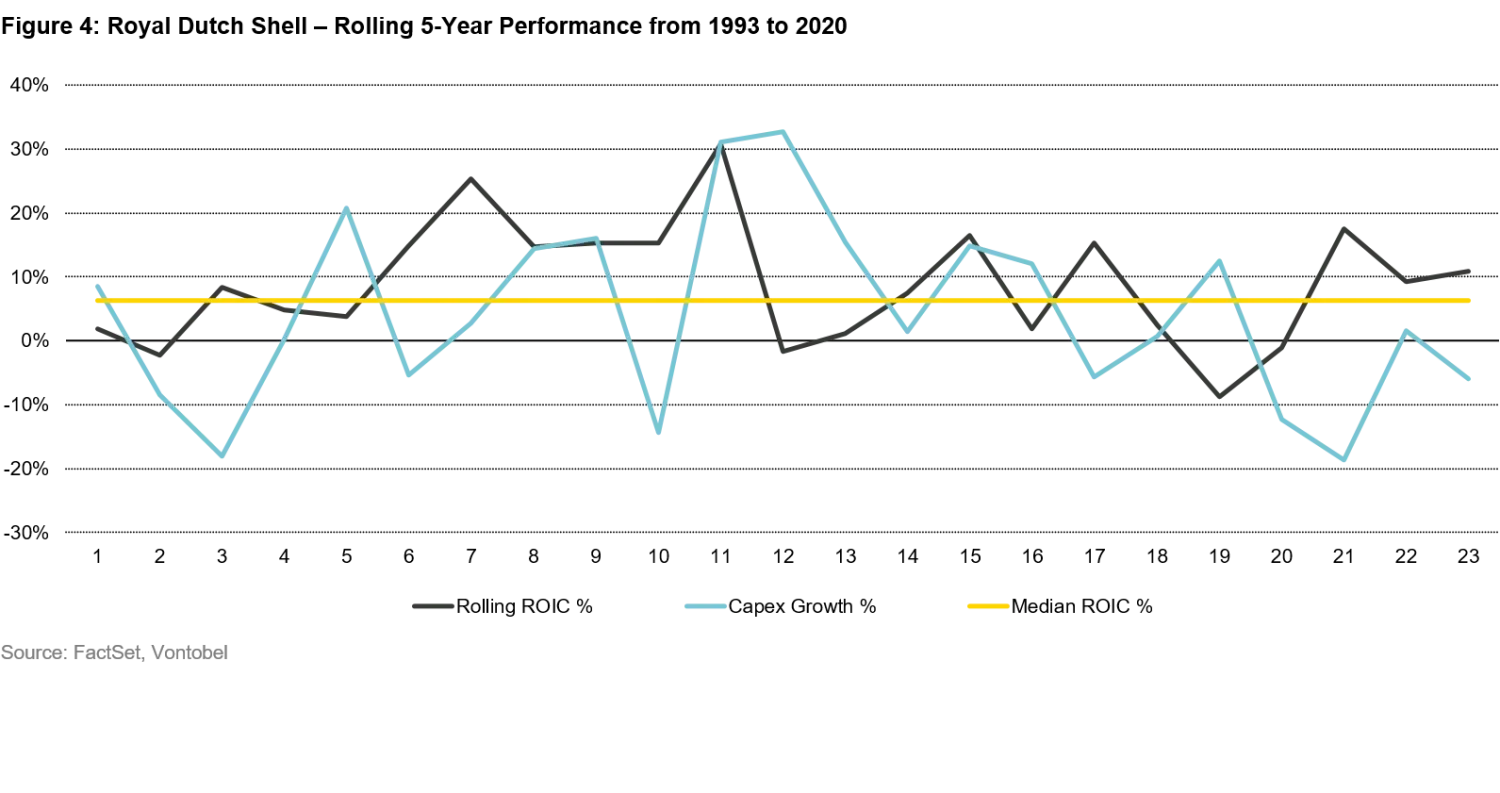

Investors should consider the historical returns of Royal Dutch Shell over the last 30 years in periods with high and low oil prices. It is difficult to get excited about a business when capital allocation depends on forecasting the price of oil. In the chart below, we can see that Shell tends to accelerate investment at the peak and vice-versa. In the world of asset management, the equivalent is buying high and selling low. The net result is unimpressive. Over the long-run, Shell achieved a return on capital of mid-single digits, not much better than a regulated utility but with more volatile earnings (Figure 4).

Why Quality can help protect against inflation

As we discussed above, a scenario of high inflation is not conducive to economic growth. Inflation transfers wealth from low income households to those in a position to invest their money in assets linked to inflation.

The same applies to corporations. In the bigger is better world of supply chain management, those with leverage will squeeze their suppliers and protect against inflation. The weaker ones will eat through their margins. As an investor, where do you want to be?

In a scenario of high inflation, at a minimum, investors should consider companies that can protect against it. It is even better if you can invest in companies that can actually thrive under inflation, such as those that have one or more of the following characteristics: 1. A unique product/service that customers rely on or cannot switch to a cheaper version, 2. Revenues that are linked to inflation, 3. Scale and market leadership to influence prices. Inflation or not, those are the businesses we think investors should focus on. Here are a few examples:

Ferrari is a premium brand accessible to an exclusive group of high-net worth individuals, with an entry price of $200 k for the Ferrari Roma, its low-end model. Customers do not typically buy a Ferrari as a means of transportation; in fact, a typical customer drives a Ferrari less than 50 miles per week. They buy a Ferrari for its history, its drivability and status symbol. Ferrari operates a controlled supply business model with production of less than 15,000 cars per year and a waiting list of 12 to 18 months. This is part of the company’s philosophy coming down from its iconic founder, Enzo Ferrari, who said: “We will always sell one less Ferrari than the market wants.” Ferrari has successfully increased prices of new cars in the mid-single digit range over the long run and the brand protected the value of its cars in the secondary market.

Mastercard, in my view, is at the sweet spot of volume growth and pricing power. I would have guessed, based on all the Amazon boxes piling up outside peoples’ homes in the last 18 months, that cards finally account for most purchases these days. But cash is still king, accounting for more than half of global transactions as online shopping—for as big and as fast growing as it is—still lags purchases in the real world with a global e-commerce penetration in the low-teens. In addition, businesses are still in the dark ages when it comes to payment acceptance, relying mostly on checks and wire transfers. Cash loses value faster when inflation is high and a scenario of high inflation will further accelerate the shift from cash to cards (more likely via mobile transactions). Mastercard charges a percentage on every transaction and revenues are automatically linked to inflation. Thus, Mastercard’s fortunes ride along with inflation. Even better, given that it is mostly a fixed-cost business, inflation also bolsters operating leverage.

Finally, when it comes to inflation, companies in emerging markets have a lot of experience in dealing with it. For example, Asian Paints has been operating in India since 1942, before the country’s Independence. Despite all the turbulence in India’s politics and economy during the last almost 80 years, Asian Paints not only protected against volatility, it thrived to become a $38 billion company with revenues of more than $3 billion. Asian Paint is the largest decorative painting company in India with 40% share of the market, more than 3x’s the size of the second competitor. Asian Paints manages an exclusive network of third-party distributors which gives it influence on prices at the retail level. Paint is a heavy product with a large content of water, making it uneconomical to transport over long-distances, which protects it against imports. Furthermore, Asian Paint enjoys a tremendous amount of brand recognition among professionals. Even in India where labor cost is relatively cheap, paint accounts for less than 30% of the total cost of a job. For professionals, quality is more important than price. It improves productivity, it yields a nice finishing which minimizes repainting and improves customer’s satisfaction.

Leverage, inflation’s collateral damage

We have no reason to doubt the Fed’s intention to take all the necessary steps to prevent inflation, should it rear its ugly head. With higher interest rates, I think that risky corporate lending and leverage could turn into a pressure point.

Investors should be closely watching the balance sheets of corporates with low credit ratings which have now collectively reached an EV/EBITDA ratio of 6.5x, a 35-year high. Despite the shock from the pandemic, defaults among high-yield corporates have been under control because of the flood of stimulus money and loan forbearance. According to Moody’s, in the hunt for yield, investors lowered the covenants standards for junk credit, as it’s called, both in terms of maintenance (right to seize the assets) and incurrence (restrict borrowers to issue debt and pay dividends). In 2020, the recovery of first-lien loans was 55% compared to a long-term average of 77%. But so far, so good: Moody’s also estimates that less than 9% of high-yield corporates went into default during the pandemic, compared to 14% during the Global Financial Crisis. The default rate has gradually dropped to below the long-term average of 4.7% with the re-opening of the economy.

To be clear, I’m not saying the world is on the verge of another Global Financial Crisis. The global financial system is in much better shape than in 2008. High-yield debt accounts for less than 10% of corporate leverage globally, of which less than 20% is in Collateral Loan Obligations (CLO’s). Nevertheless, a spike in the default rate with a low recovery rate will not bode well for economic growth. A portfolio with downside protection needs to be top of mind, as explained in our recent article Shades of Quality .

Taking a long-term view

In another recent piece I wrote called Where is Your Umbrella , I caution against making long-term investment decisions based on short-term headline news. We understand that it is hard to go against the crowd. Today, inflation is the center of attention, but economic cycles come and go, as do the scaremongers. Shifting tactics to low-quality cyclicals might work for a time, but ultimately stock prices tend to follow earnings and we think a portfolio of quality growth stocks can stack the odds in your favor.

Disclosure

Any investments discussed are for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments are presented for discussion purposes only and are not a reliable indicator of the performance or investment profile of any composite or client account. Further, the reader should not assume that any investments identified were or will be profitable or that any investment recommendations or that investment decisions we make in the future will be profitable.

Certain of the information contained in this presentation is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. VAMUS believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.