The thrill of being consistently boring

Quality Growth Boutique

As an active market participant, you have likely reflected upon the probability of one or more of the following scenarios occurring, and how it would impact global markets and your portfolio:

- The Fed will raise rates more than necessary, sending the US into a recession.

- A new Covid strain more deadly and contagious will emerge.

- The Chinese banking system will face its “Lehman moment".

This list is not exhaustive, not ranked by order of importance and does not consider the events we cannot even begin to predict. Still, the occurrence of any of these scenarios (which is entirely plausible) can have important consequences on the global economy and on individual companies to varying degrees.

If you are struggling to make long-term investment decisions in the equity markets during these uncertain times, in this article we discuss how our approach can help you and why you should consider the merits of diversification with international stocks.

The asset management industry promotes the illusion that smart managers have a crystal ball. In reality, crystal balls glitch frequently and only those that survive make the headlines. The corpses of unsuccessful clairvoyants go unaccounted for the most part. Our crystal ball broke, and it is buried deep in the supply closet. With no fortunetellers in our firm, we decided a long time ago on a consistently boring approach. What do we mean by that?

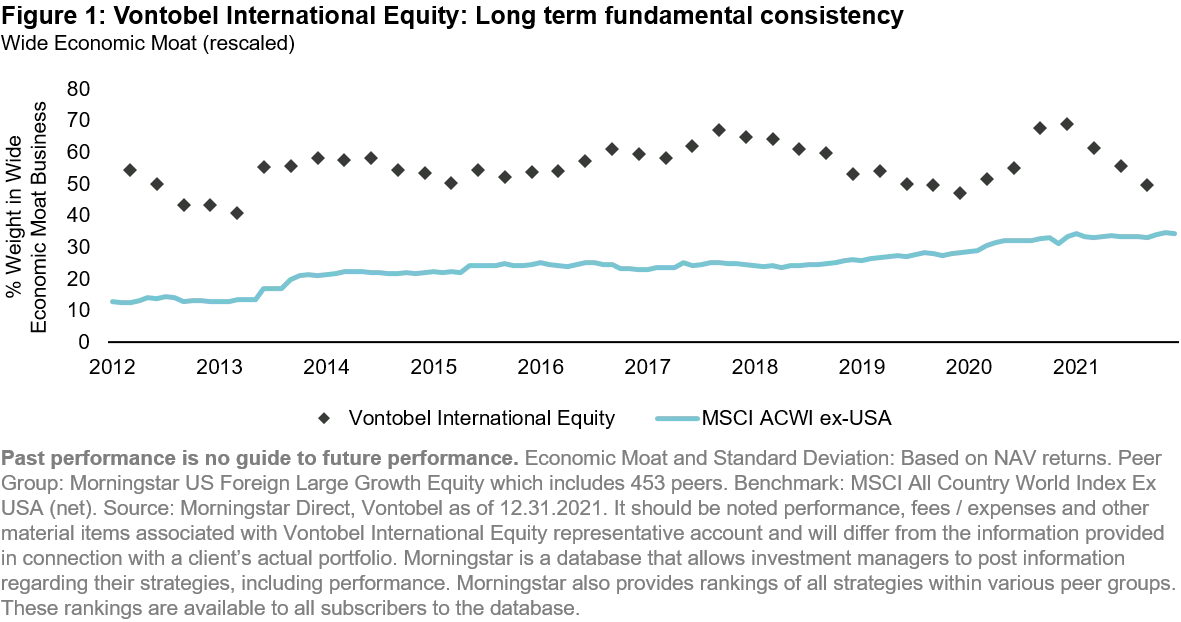

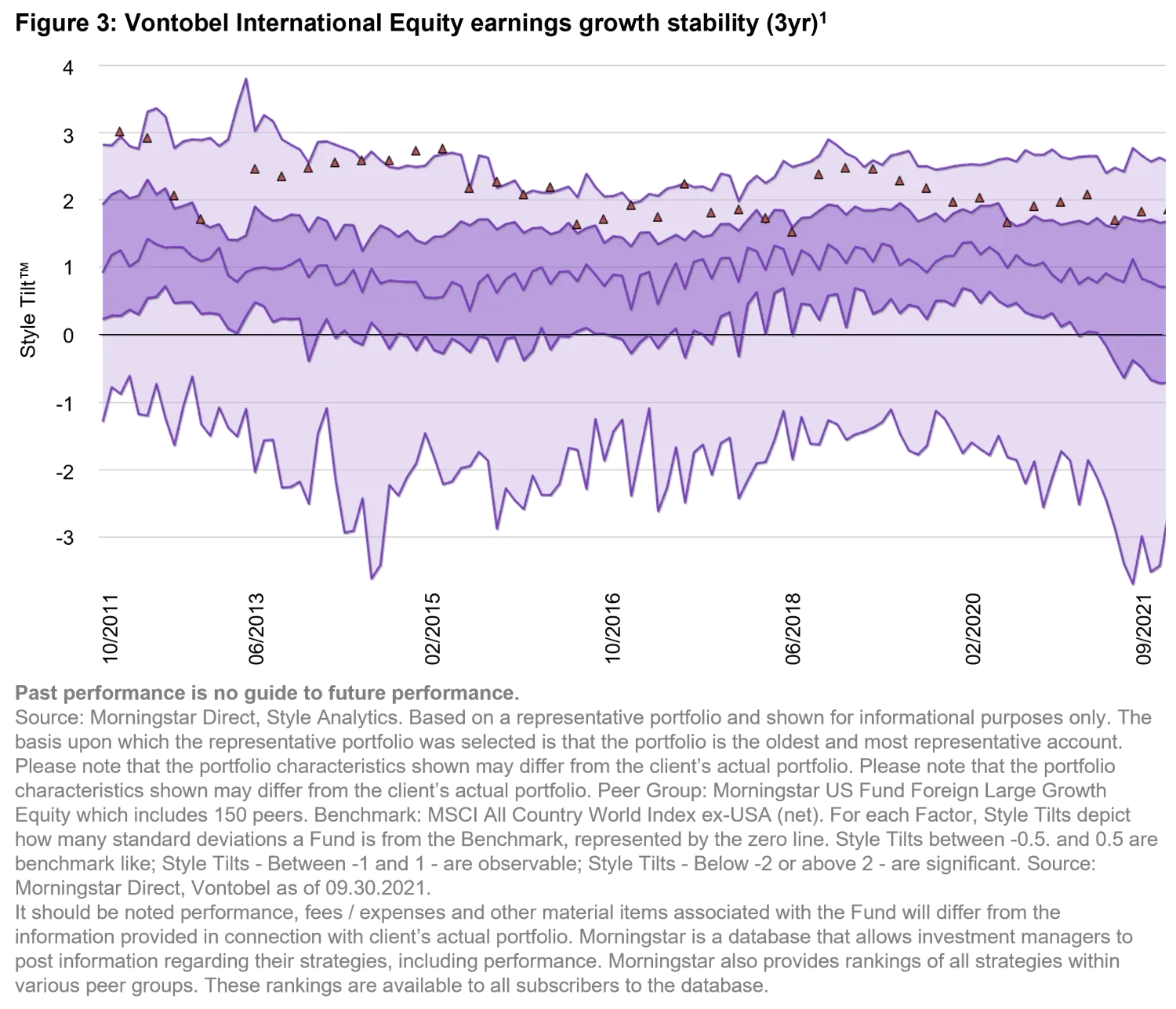

Our approach does not change with the whim of market consensus. Neither snow, nor rain, nor gloom of night steers us from our philosophy – to seek to invest in great businesses with solid economics that can create real wealth for shareholders.

It is boring because it is based on the unglamorous work of researching one company at a time. We examine each business’s track record to identify stress points, we tear apart financial statements to certify the accounting is sound, we meet regularly with managements to learn about their culture and strategy, we engage on ESG issues to help make our companies better, and with the help of investigative analysts, we cross-check all the information above with independent sources.

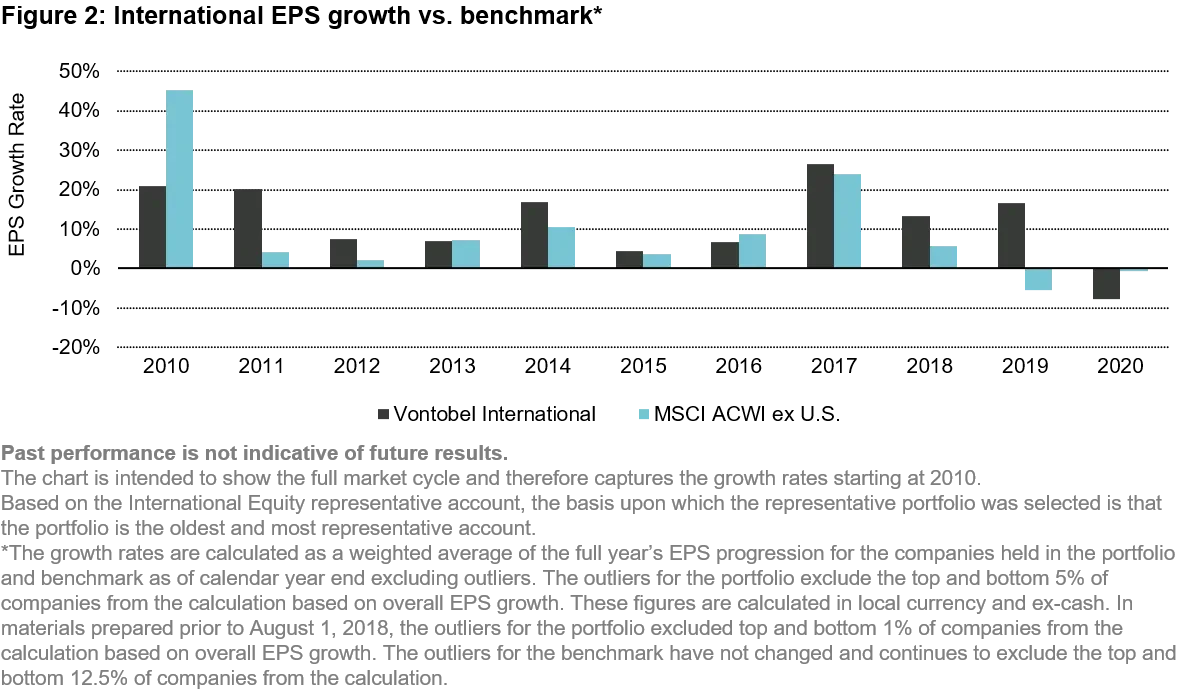

Like most things in life, our approach is simple but complicated. As we have typically seen, stock prices follow earnings growth. If we are right in our assessment of businesses and in earnings forecasts (the complicated part), the underlying earnings growth of our portfolio should outpace the market and with less risk. This has generally been the case over time.

Finding great companies to invest in is half of our approach, the other half is keeping our nose clean. Speculative markets, like the ones we are living in today, awaken the animal spirits of investors looking for easy ways to profit. In the 18th century, John Law, a Scottish economist, came up with a brilliant idea of selling shares in a company to finance the exploration of the riches of the Mississippi valley. It worked until investors realized the hoax. In early 2000, European telecom stocks traded at multiples of 40-50x’s P/E on the belief that they controlled the gateway of the Internet revolution. Today, those same companies trade at a fraction of their value in their heyday. From SPACS to meme stocks, while the names and the stories have changed, it is human nature to succumb to Fool’s Gold.

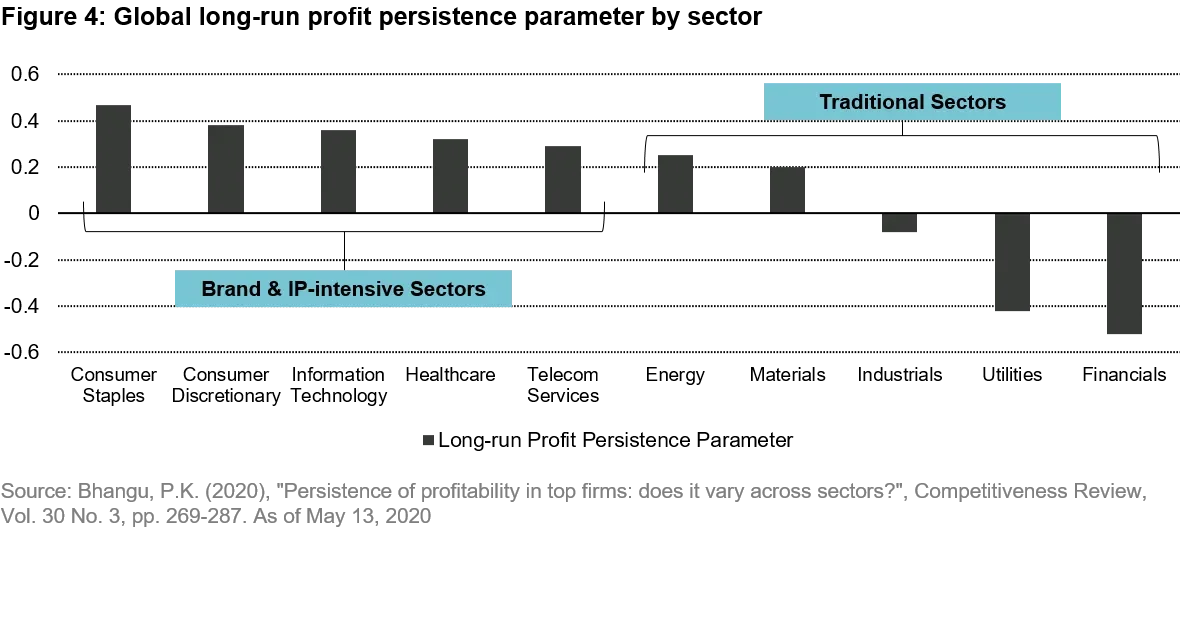

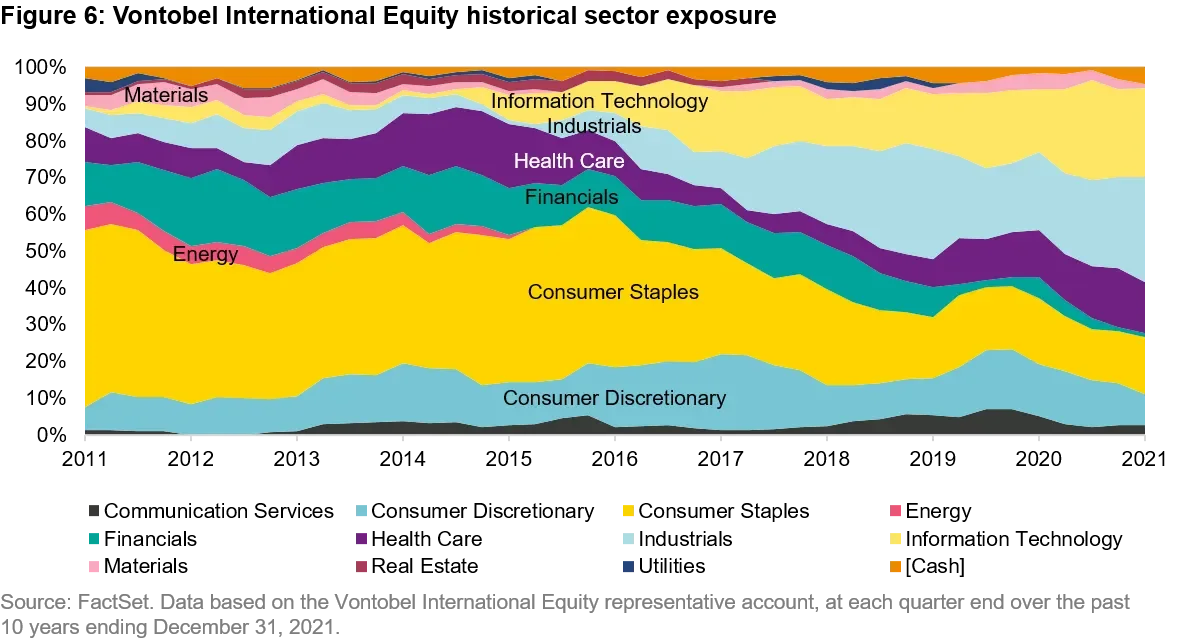

Professor P.K. Bhangu analyzed the persistence of profitability across diverse economic sectors and industries from 1990 to 2014. He concluded that companies in sectors that are brand & IP intensive, like consumer staples, health care, and IT, enjoy higher persistency of profitability than sectors with traditional industries (ex: steel producers), utilities, and energy. We aim to invest in persistently profitable companies, many of which are in the first group. We believe consumer staples company Nestle owns terrific global brands that have been trusted by consumers for generations, like Nescafe, Gerber, Purina among others1.

Our preference for stable businesses is not because we are expecting the worst but because we want to be prepared for it. It is not by accident that our strategy has historically compared favorably on earnings predictability and downside protection.

Consistently boring is different than being eternally stubborn. We favor a buy and hold approach, but having said that, ultimately, we are capital allocators, and the marginal dollar needs to go to the best investment opportunity. We are constantly searching for new ideas, and while often we say no, from time to time something better comes along.

We became shareholders in Alcon2, a global leader in eye-care technology, when it came to the market in 2019 after Novartis spun off the company to its shareholders. Our reluctance to invest in biotechnology companies is due to the difficulties of estimating the odds of drug approval. We believe our research team has identified great companies that can manufacture key components for the production of biotech drugs and can benefit from the growth of the biotechnology industry, regardless of which drug wins in the marketplace.

We struggled for a long time to find investment opportunities in Japan because of poor disclosures and low standards of corporate governance. But we persisted, and in the last five-years, we feel fortunate to become shareholders in four good franchises in our view – Keyence, a global leader in vision automation, Hoya, a global leader in the manufacturing of photomasks for the semi-conductor industry, OBIC, a market leader for ERP systems for small and medium enterprises in Japan, and Kobe Bussan, the Japanese equivalent of Trader Joe’s, a growing category in Japan3.

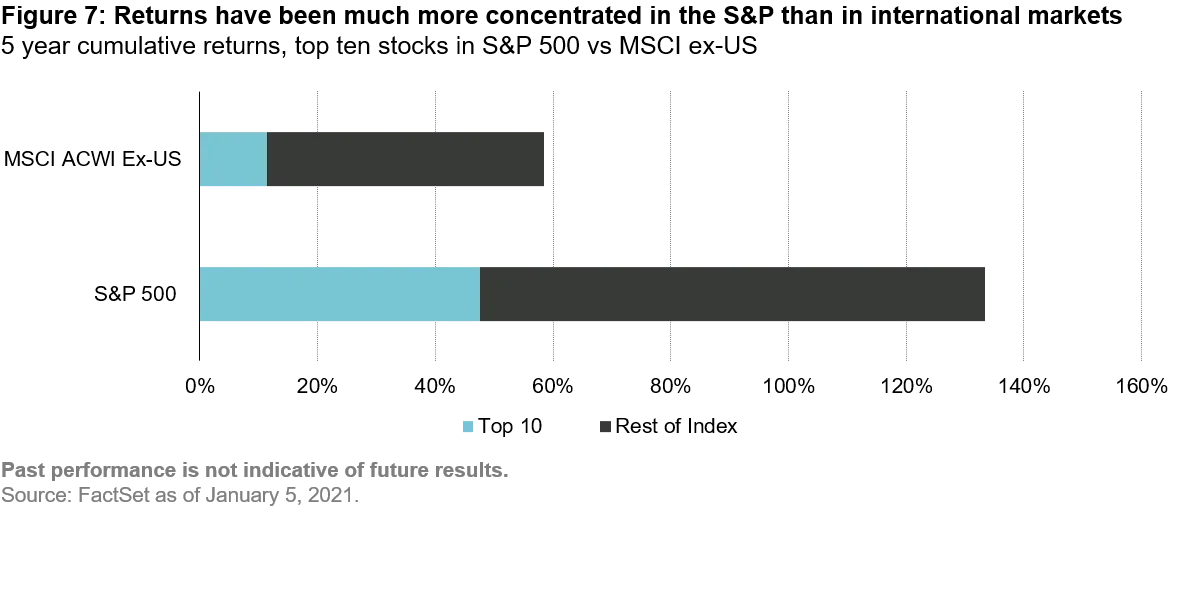

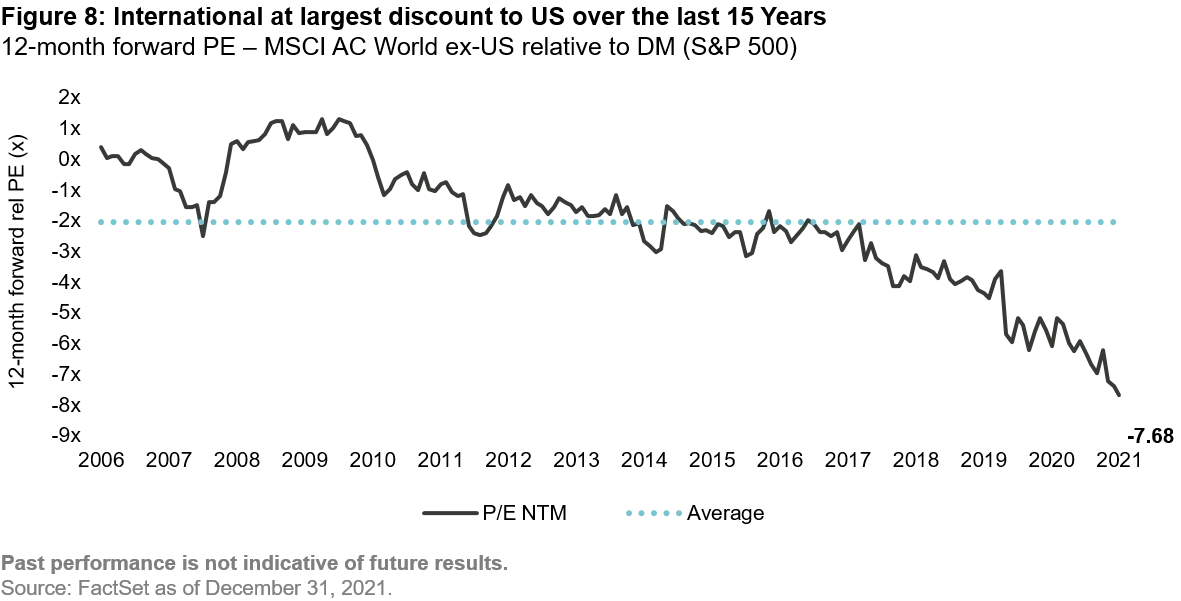

In the last decade, US investors did not have to think too hard about geographical diversification. US equities outperformed international markets and the dollar appreciated relative to most world currencies. There is no law in economics that guarantees that this will continue to be the case. In fact, the US has underperformed in different time periods. For those looking for a “consistently boring” approach to their personal portfolio, we believe exposure to international markets can help reduce risk and improve downside protection considering that: 1. Market performance in the US relied on a smaller number of stocks compared to International markets and 2. The International market trades at a historical discount to the U.S.

In a study known as The Longevity Project, Professors Friedman and Martin followed 1,500 Americans who lived to be over 80 years old. Their research revealed a surprisingly simple formula for a healthy, long life: exercise regularly, keep your mind active, and have a life-long partner and a few good friends. In investing as in life, we feel the secret is the same: consistently boring.

1. Nestle is among the Top Ten Holdings of the Vontobel International Equity Representative Account. The Top Ten Holdings as of December 31, 2021 are: Constellation Software, Diageo, Alcon, Mastercard, Nestle, Tata Consultancy Services, Rentokil, Ashtead Group, RELX, and OBIC.

2. Alcon is among the Top Ten Holdings of the Vontobel International Equity Representative Account. Please see footnote 1 for complete list of Top Ten Holdings.

3. These represent all of the Japanese holdings in the Vontobel International Equity representative account as of December 31, 2021.