Conviction Equities

Concentrated and fundamentally driven high-conviction equity portfolios managed by four teams specialized in emerging markets, impact investing, thematic investing, and Switzerland.

In an increasingly volatile world, both from an economic and geopolitical perspective, energy and other key commodities sourcing becomes more fragmented between geopolitical poles. The recent intervention by the US in Venezuela showed us what a superpower in a world with fewer rules and increasing energy scarcity challenges can do when chased by fears that resources might soon be exhausted.

A more holistic approach that is gaining in importance is the concept of energy sovereignty, which aims to balance sustainability with geopolitics and competitiveness. It is an evolution rather than a U-turn, as it reinforces the urgent need to transition energy systems, making them not only more efficient and resilient but also more self-reliant – reducing dependence on imports.

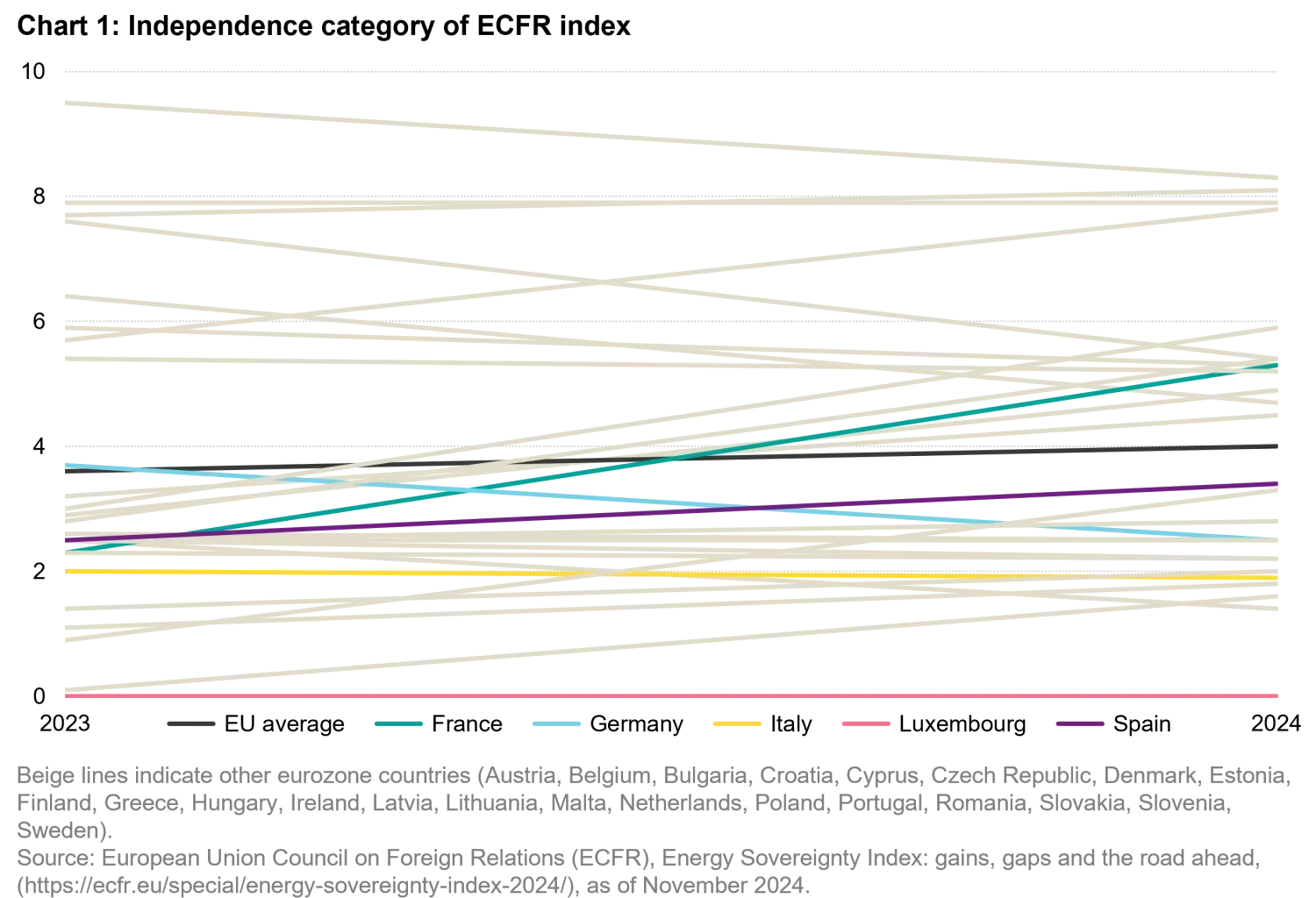

Taking the European Union (EU) as an example highlights that energy independence remains a key issue. As measured by the Energy Sovereignty Index of the EU Council on Foreign Relations, the bloc has slightly improved its energy sovereignty by reducing its dependency on Russian gas but is still lagging in replacing these volumes with domestic energy production. While dispersion among countries is broad, the average level of independence for the EU is low; the respective category in the index only scores 4 on a scale of 1 to 10.

To increase energy sovereignty, a broad set of proven and accepted strategies are available. This includes (but is not limited to) accelerating electrification of daily life as well as industrial processes, expanding the share of renewable sources, and improving energy efficiency.

Today, electricity already accounts for approximately 20 percent of global energy consumption. According to the Net Zero Emission scenario of the International Energy Agency (IEA), this share is expected to rise to 50 percent by 20501. Renewables are expected to meet most of the incremental demand, given their lower operating costs, improved self-sufficiency, and lower carbon emissions.

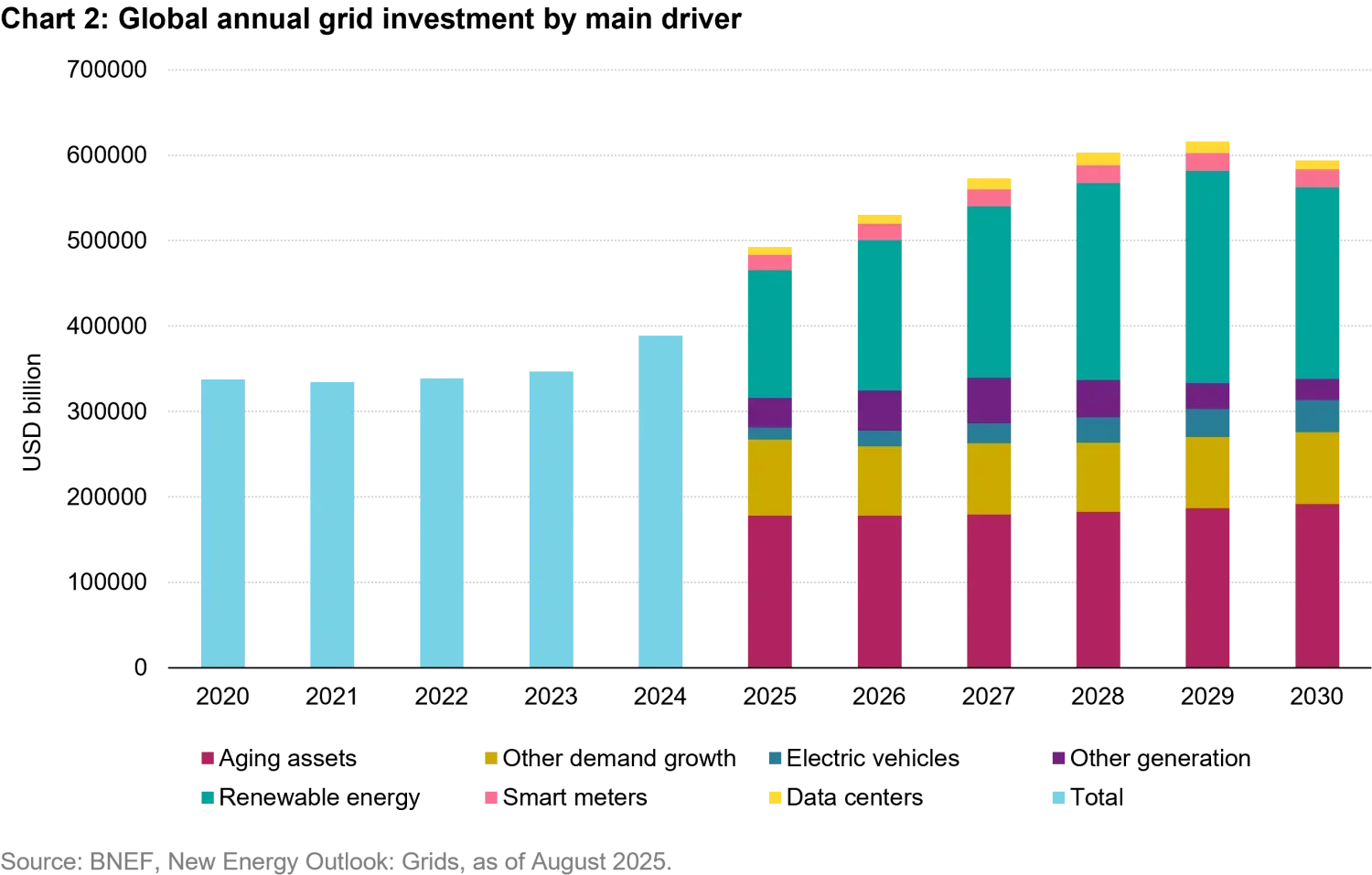

However, electrification with renewables comes with challenges. It creates significant pressure on the existing infrastructure, whose aging grids are becoming structural bottlenecks. For instance, Europe experienced a record 8,645 instances of voltage surges in 2024, a dramatic increase from just 34 incidents in 2015, according to the European Network of Transmission System Operators for Electricity2. These surges highlight the urgent need for grid investments, where replacement of aging assets already accounts for a significant share of spending. Following a prolonged period of underinvestment, the pressure to upgrade infrastructure is becoming critical. Capital expenditure is also driven higher by the need to connect more renewables and reinforce the grid to transfer power from locations with favorable wind and solar resources to demand centers. While grid flexibility solutions – including demand-side response technologies such as smart grids – currently represent a smaller portion of the market, they are expected to grow steadily. In the coming years, grid investments are projected to outpace power demand growth, offering opportunities for solution providers along the entire infrastructure value chain.

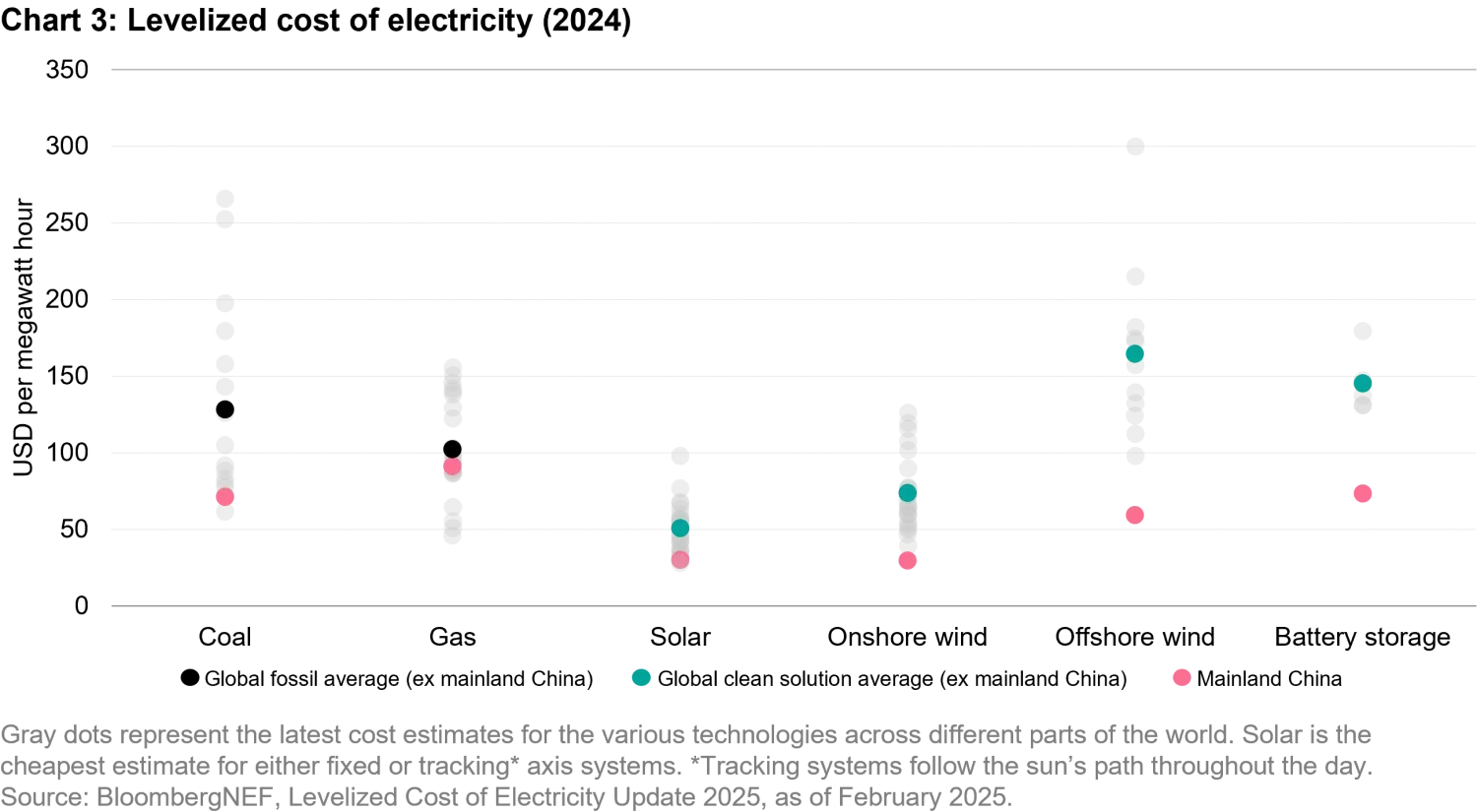

The traditional energy system, reliant on a complex network of pipelines and trade routes, is increasingly giving way to domestic renewable energy production. This shift is driven not only by energy sovereignty efforts but also by the green transition reaching a crucial inflection point: the cost of renewable power has fallen below that of newbuild fossil fuel generation in many countries, making the economics of renewable energy a primary growth driver.

No country has embraced the energy transition as strongly as China. With more than 40 percent of global renewable energy capacity, China is positioning itself as a leader. In 2024 alone, the country invested more than USD 600 billion in clean energy projects, further solidifying its dominance in the sector3. While this leadership has propelled the transition forward with cost reductions and technology adoption, it has also created new dependencies for other nations – particularly in the West, where concerns about China's control over critical supply chains are growing.

The energy transition is also heavily reliant on critical minerals, such as lithium, cobalt, nickel, copper, and rare earth elements. These materials are essential for producing wind turbines, solar panels, batteries, and the vast network of cables required for a zero-carbon electricity system. Rapidly rising demand is expected to lead to structural shortages of several critical metals. Meanwhile, the production and processing of these materials are highly concentrated, with China once again dominating. This concentration might pose significant geopolitical risks. As countries move away from fossil fuels, they risk replacing one form of dependency with another. Trade restrictions, export bans, and resource nationalism are already emerging as tools of geopolitical leverage, with the potential to disrupt global supply chains and create price volatility. For example, China's recent restrictions on the export of critical minerals, including but not limited to rare earths, highlight the vulnerabilities of concentrated supply chains.

To mitigate these risks, governments and companies are exploring strategies to diversify supply chains, invest in domestic mining, and focus on developing recycling technologies. Especially the latter can address supply chain vulnerabilities and capitalize on growing demand. Metals are an example of how recycling can offer a promising solution. Unlike plastics, metals can be recycled without losing their properties, making them ideal for a circular economy. Scaling up recycling could help reduce reliance on geopolitically exposed producers, while supporting the energy transition. Boosting supply without the need for fresh mining also offers positives in terms of emissions, land degradation, and water use.

Fostered by energy sovereignty efforts and competitiveness, the transition from an energy system based on finite, extracted resources with volatile prices to one centered on generated technologies (where costs decrease as production scales) is accelerating. The opportunity lies in the sheer scale of this shift. However, it is not a straight path; uneven speeds, fast-changing policy environments, and geopolitics add to complexity.

Ultimately, the green transition is not only about deploying renewables; it depends on a broad ecosystem of enabling resources, technologies, and industrial capabilities. Understanding this web of upstream and downstream interdependencies is essential to assessing how energy sovereignty, resilience, and decarbonization evolve together. Investment opportunities in upstream pillars – such as mining, processing, and recycling – include enabling materials which are critical to supporting the shift, as well as low-carbon energy solutions that ensure a balanced and responsible move toward sustainable energy sources. Attractive downstream pillars provide exposure to mitigation strategies, including clean power infrastructure (where renewable energy continues to dominate new capacity additions) alongside the critical need to upgrade and expand power grids.

Equally important are energy efficiency solutions across various sectors. In buildings, this involves sustainable materials, energy-efficient construction, as well as advanced systems for heating, ventilation, cooling, lighting, and controls. In transportation, the focus is on low-emission alternatives, equipment manufacturing, and battery technologies, while for industrial production, digitalization, automation, and functional materials are key to reducing energy consumption and carbon emissions.

Investing in the full spectrum with an active approach offers the opportunity to accelerate the transition and share in its rewards.