Sustainability

Your investment objectives, your ESG choices.

In the face of geopolitical escalation, societal division, inflation, and a looming recession, one might ask, “Who cares about climate change?” Irrespective of investors’ views on this topic, many turned their eyes to Dubai to watch the COP28 negotiations late last year, where representatives of close to 200 countries sat at a roundtable to set the agenda for the next five to 30 years. We believe that the topic has become too big to ignore for any investor looking to capitalize on emerging opportunities associated with the biggest climate change challenge yet: the energy transition. Positioning for the energy transition may flip the switch between winners and losers for the next decade.

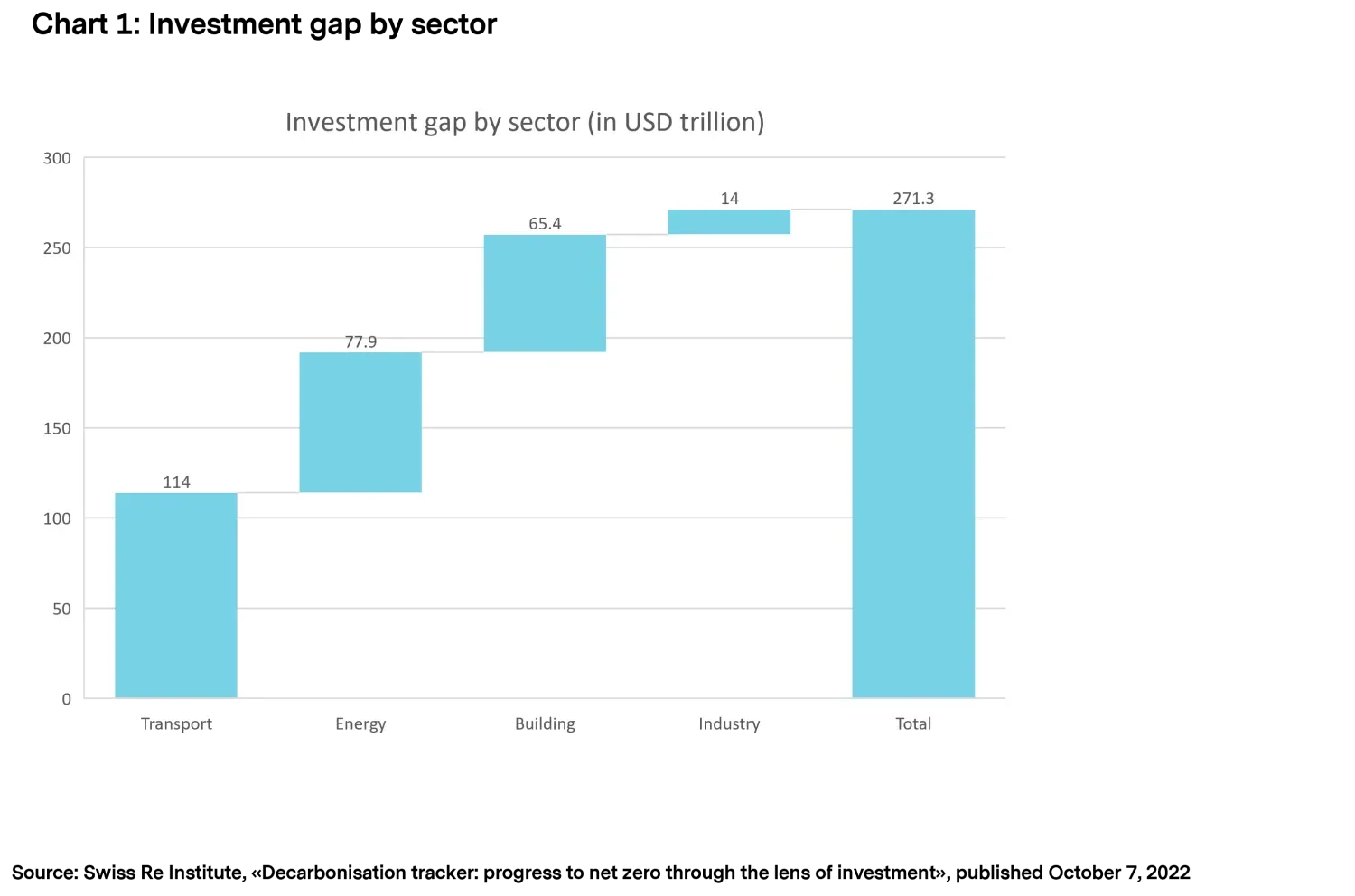

The United Nations Conference of Parties held in 2015 (COP21) marked a remarkable milestone in climate change negotiations with the Paris Agreement, where parties agreed on limiting global warming to 2 °C and set commitments to achieve it. As 2023 marked a midpoint on the road to 2030 targets, the ambition is far from being achieved. Many believe that COP28 could have been considered a success if governments agreed on bolder actions: more than USD 270 trillion in investments, equivalent to twice the size of global annual gross domestic product, are needed in the energy, transport, building, and industry sectors between now and 2050 to achieve the Paris Agreement goals (see chart 1).

Many called for urgent action and strong commitments, while others were more cautious and raised energy security concerns caused by geopolitics ahead of winter. The main focus was on the top 20 countries contributing to 80 percent of global emissions, with China, the US, and India leading the way. Despite the criticism of COP 28, two important landmarks have been achieved, namely, the first "global stocktake” of the road to achieve the Paris goals and the agreement on operationalization of “loss and damage fund” to help nations recover from climate change impacts. Many observers expected progress to be made on a package to accelerate the energy transition. The outcome of the negotiations was that the worlds needs to transition away from fossil fuels, double energy efficiency and triple renewable energy capacity by 2030.

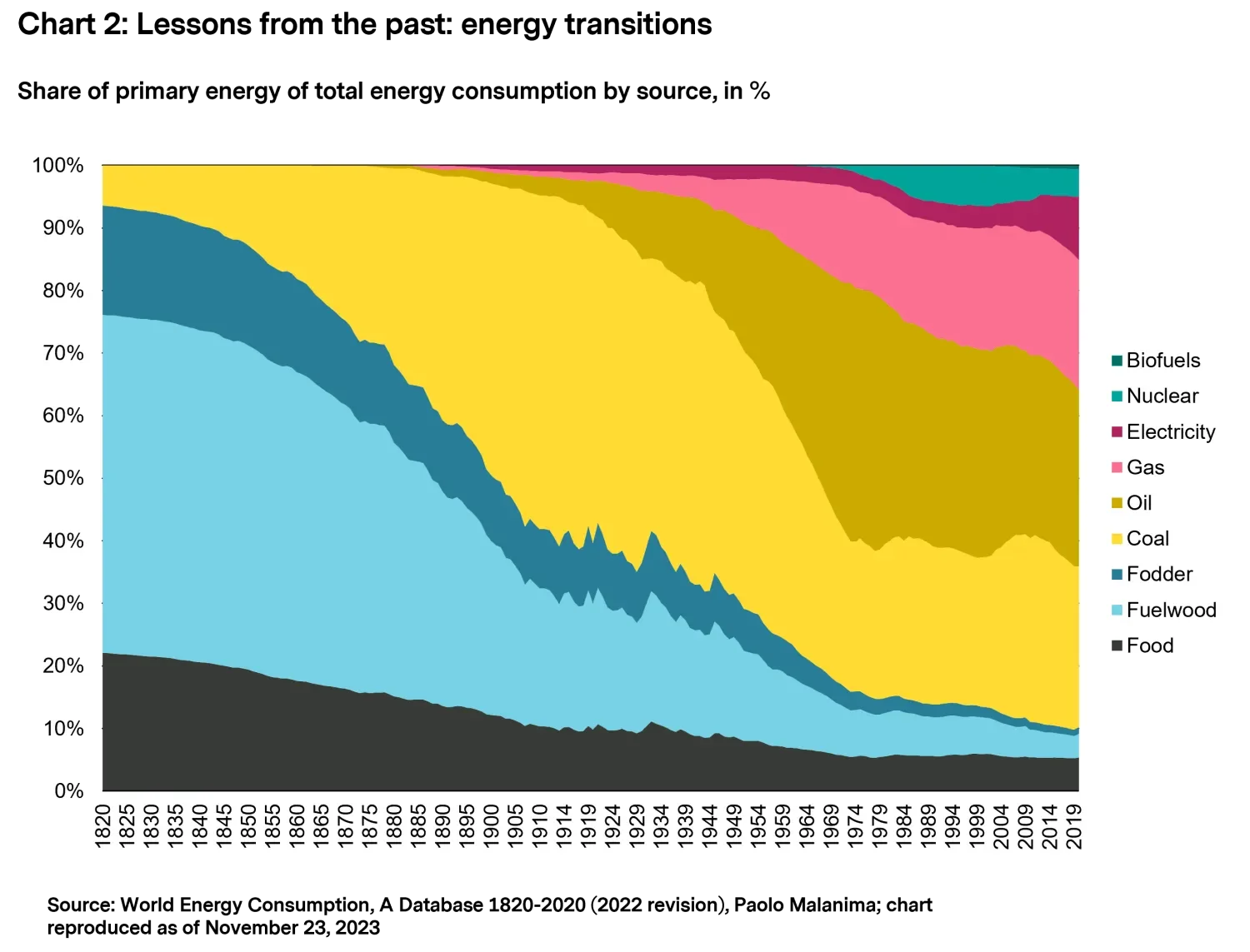

We believe that in the wake of current energy security concerns, the energy transition has gathered impressive momentum and is now at an inflection point. The share of renewables in the global energy mix has increased dramatically in the last decades, with the European Union (EU), China, and the US leading the way, resembling the drastic change in the consumption of coal, oil, and natural gas, as was the case of the industrial revolution and passenger car adoption (see chart 2).

If history is any guide, given the right incentives and technological breakthroughs, energy transitions happen fast, and both are now at work. Why? Low-carbon technologies have been developing at a fast pace, and the costs associated with them have dropped dramatically over the last 10 years. Government incentives are the “elephants in the room”: the US, boosted by the Inflation Reduction Act (IRA) and commitments to clean tech; China, with accelerated electric vehicle (EV) adoption and a new ambitious five-year plan on renewable energy generation; and the EU, with the Green Deal Industrial Plan aiming to support clean energy technology manufacturing. All these policy commitments took place within the last year and illustrate a strong support for decarbonization and regulations striving to achieve the goals of the Paris Agreement.

We believe that positioning for the energy transition should build on three main pillars: investors’ time horizon, regional focus, and themes.

Time matters. In its recent outlook, the International Energy Agency (IEA) forecasts that the energy transition is happening faster than expected, creating winners and losers. Such forecasts factor in a high degree of technological adoption, making an investment case for climate technology companies. For instance, all “net zero by 2050” pledges rely on the emergence of carbon capture and storage (CCS) technologies to achieve that goal. Hence, investments in CCS may, at some point, are expected to deliver high exit returns. Investors with lower risk appetite should consider hedging their fossil-fuel exposure against potential losses or write-downs resulting from the transition to a low-carbon economy. Moreover, investments in climate laggards (companies in CO2-intensive industries lagging on climate metrics but with strong CO2 reduction commitments or developing climate solutions) could be a potential fit for those who seek investments in mature, established companies that contribute to the energy transition.

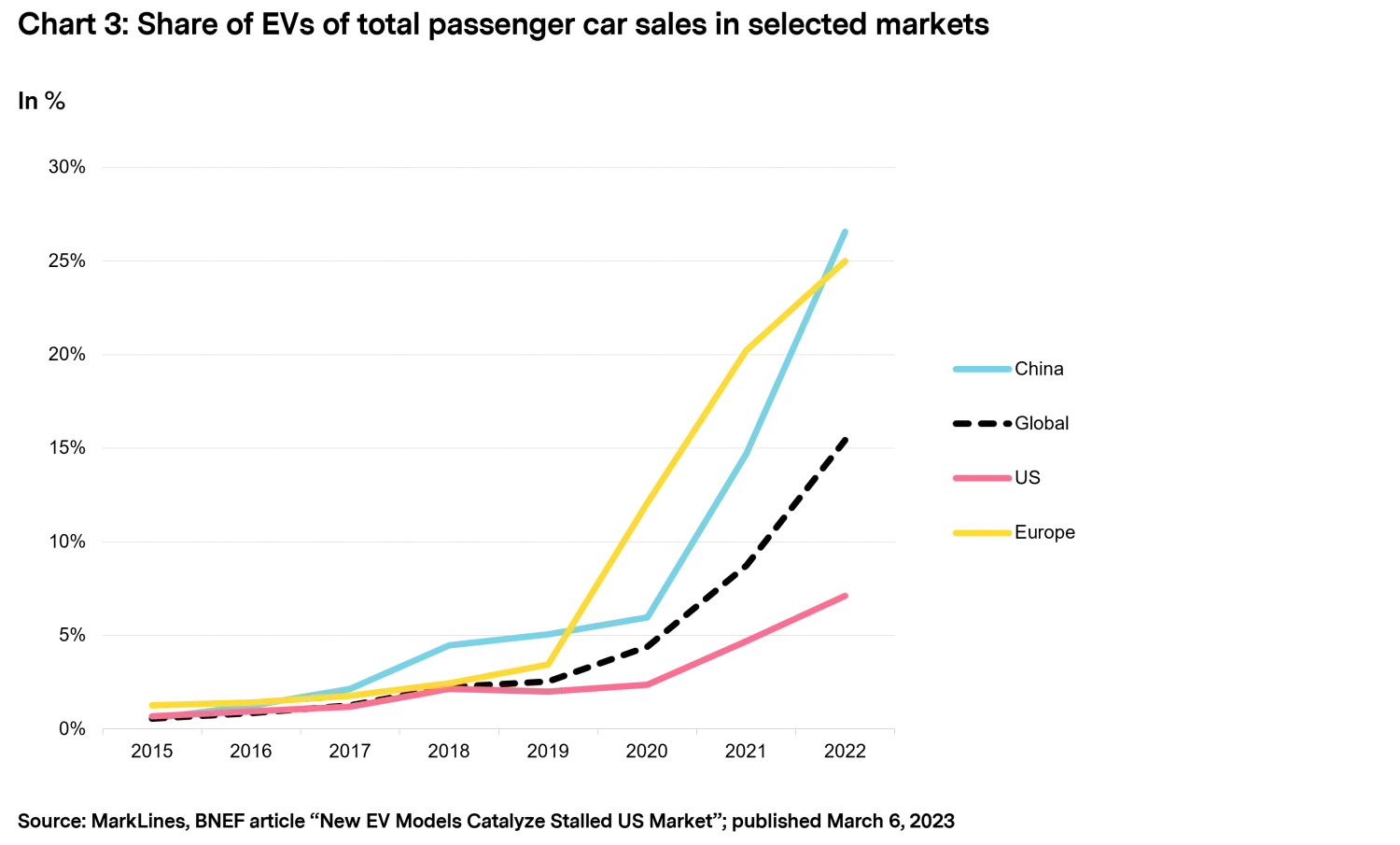

Critics argue that all measures taken are not enough to curb emissions, and the world’s appetite for fossil fuels remains strong. Recent data show that oil, natural gas, and coal output grew 4 percent in 2022, and a USD 814 billion decline in fossil-fuel investments is now needed between 2022 and 2050 to align with the Paris Agreement. The forecast is grim so far: to reach net zero by 2050, oil, natural gas, and coal would need to fall by more than 20 percent by 2030, according to the IEA. In addition, many fear that the upcoming US presidential election may overturn the energy transition agenda. A Republican president is almost certain to put the brakes on the speed of the energy transition. Nonetheless, even in such a scenario, we believe that regional themes will persist. For instance, EV demand should remain strong, in our view. China has experienced sharp growth in EV share of car sales across all segments since 2020, from economy to luxury cars. In the EU, 65 percent of all cars sold are estimated to be electric by 2030, according to the IEA’s World Energy Outlook 2023, citing the Stated Policies Scenario, which paves a path towards wide EV adoption and expansion of the charging infrastructure (see chart 3).

Navigating the rough waters of the energy transition is both exciting and a challenging task. To succeed in this endeavor, investors need to set a time horizon for a journey and be equipped with the right tools for navigation. These tools—government incentives and technological breakthroughs—are robust, and we believe that the wind of change is strong. The map is set by the policy agenda. The road to choose is up to the investor, but the time to choose is now to sail with ease in the direction of investors’ investment goals. As history shows, there is no one-size-fits-all investment, but in difficult and uncertain times, new opportunities arise, and we believe that the time has come for investors to take a stand on the energy transition.