Have Bonds Ever Been This Expensive?

TwentyFour

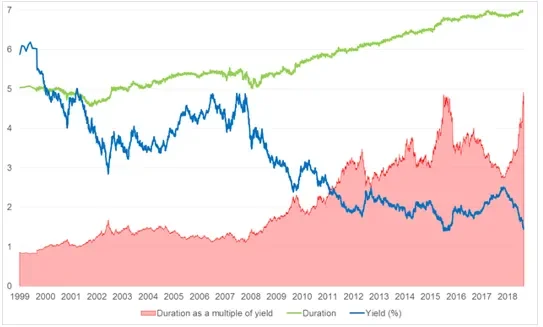

The average yield of the bond market today is 1.46%, while its average duration is 7.05 years, going by the widely used proxy of the Barclays Multiverse Index.

Dividing one by the other gives the following chart.

Chart 1: Duration as a Multiple of Yield, 1999-2019

Source: TwentyFour, Bloomberg, August 20

While fears of a global economic slowdown, rate cuts from the Federal Reserve and the prospect of a renewed balance sheet expansion from the European Central Bank have pushed yields back down to previous lows, duration has continued to edge higher, sending duration as a multiple of yield to all-time highs (surpassing the peak of 2016).

Is this an opportunity, or a threat?

Central bank activity, or the prospect of it, can of course drag yields lower, and possibly through the convexity effect alone also take duration higher. That could lead to further capital gains as income is further squeezed out of the bond market. But that is the key point with government bonds right now – they might just as easily be described as offering return-free risk rather than risk-free return. They offer no yield (increasingly they offer negative ones), and owning them only makes sense if either further capital gains are expected, or they are held in a balanced portfolio as a risk-off asset acting as a counterbalance to credit risk.

At this very late stage of the cycle, we believe now is not the time to be reaching for yield by increasing credit risk, and consequently prefer to keep our credit spread duration low and our credit quality high (though rates duration has been taken higher in our multi-sector portfolios as a counterbalance). By maximising breakeven yield, often through the front end of the UK curve, we have favoured credits that give bondholders the largest protection against future yield volatility, while keeping current income as high as possible – but always with an acceptable credit quality.

Government bonds can still be a useful risk-off hedge here, provided they deliver negative correlation in times of stress. Will Gilts act in this manner? There could be scenarios for the UK in the relative near term where Gilts could actually sell off in a period of stress, and as such, for mandates that allow more flexibility we prefer US Treasuries as a risk-off hedge. Here correlations should remain negative and USTs still yield enough to deliver a positive yield, even when hedged back to sterling.

Where the duration-yield multiple ultimately peaks is anyone’s guess, and as Q4 2018 showed, corrections in risk assets can be swift and painful. As such, we are more comfortable having dialled down credit risk across the board, and staying in those bonds that offer good income now, with principal due to be returned soon enough that we believe potential losses are minimised.