ESG: Why purpose drives returns - not the opposite

Quality Growth Boutique

What is the purpose of your company? Not what it does, but its purpose. Its goals. Its compass. A meaningful answer is usually pretty short, understood by a layman, and can provide a light to follow through tough decisions. The pressure for companies to rethink their purpose, and the sharing of rewards across a company’s stakeholders, has risen sharply.

The simple 7 letter word “Purpose” carries an enormous range of meanings, from describing the uses of a shovel to explaining the rationales perpetuating communism, democracy and autocracy. Purpose, or more significantly “change-in-purpose”, could represent a heavy cost swing for businesses and have a negative impact on equity owners. What could be done in the name of change-in-purpose gives us cause for pause.

Profits are the residual from offsetting much larger numbers, including sales, costs of goods sold, employee costs, taxes, etc.1 Small shifts in the big numbers from the shifting of stakeholder rewards could have a big impact on profits.

The spiking pressure on companies’ treatment of stakeholders has arrived alongside the widening of the wealth gap in the U.S. and increasingly apparent change in weather patterns and global warming. Companies have been blamed for indifference in the myopic pursuit of shareholder returns. With an estimated 84% of U.S. equity wealth held by just 10% of households (20162,) strong stock market returns have been narrowly spread. The chorus of discontent around the lack of balance has led to regulatory risk in both the U.S. and the U.K.

Regulatory risk is highlighted by the Accountable Capitalism Act3 proposed by Presidential candidate Elizabeth Warren in the U.S., and the more extreme proposals by the Labour Party in the U.K. Both could radically reshape the reward balance for shareholders.

Business leaders have belatedly recognized that they need to react before the negative public sentiment turns into regulation. In August, the Business Roundtable, a respected U.S. CEO talk shop chaired by Jamie Dimon, CEO/Chairman of JP Morgan, caught the headlines with a short ‘Statement on the Purpose of a Corporation4. This stated, “While each of our individual companies serves its own corporate purpose, we share a fundamental commitment to all of our stakeholders.” This was signed by 181 CEOs representing some 44% of the S&P500 by market capitalization. Importantly, there was no mention of shareholder primacy, a fundamental shift.

Does rebalancing rewards to all stakeholders mean less for shareholders? Is it a zero sum game?

Social activists

Change could open the door to social activists with a broad range of demands, which was the original trigger to Milton Friedman’s famous 1970 article rejecting ‘social conscience’ spending as ‘pure and unadulterated socialism’.

We do not believe businesses will contribute more to the economy or society by becoming subservient to social activists or punitive new regulations. It’s not charity that delivers sustainability through stakeholder balance. There are many examples of sustainable businesses that serve as illustrations of how rewards to stakeholders can be lifted to industry leading levels while creating value for shareholders. Business leaders since Robert Owen in the 1800s (New Lanark Mills), William Lever in the 1900s (Unilever today) and James Lincoln (Lincoln Electric still today) have shown that profits are driven by the unforced demand for value-for-money products and professional service.

Sustainable profit growth follows demand – not cost cutting.Value mirage

For so long, companies running sustainable businesses have been made to look sluggish compared to their hell-for-leather growth peers happy to rip out investment, lift leverage, and beautify their financial statements. The managers and owners of these rocket ships have been protected in the market by the infuriating lack of visibility of a company’s long-term strengths or weaknesses – until something goes wrong.

The chances of a negative outcome from rebalancing stakeholder rewards should be higher for companies that have stretched their stakeholders to deliver maximum payouts. But even if a weak company improves its long-term value through recalibrating its priorities, the visibility of this improvement would likely be overshadowed by a less attractive (and more visible) near-term outlook. Over the years we have seen many businesses we regard as overstretched, traditionally roll ups seemed more likely to stretch stakeholders, although more recently a number sold by private equity funds have caught our eye.

Shareholder primacy vs balanced

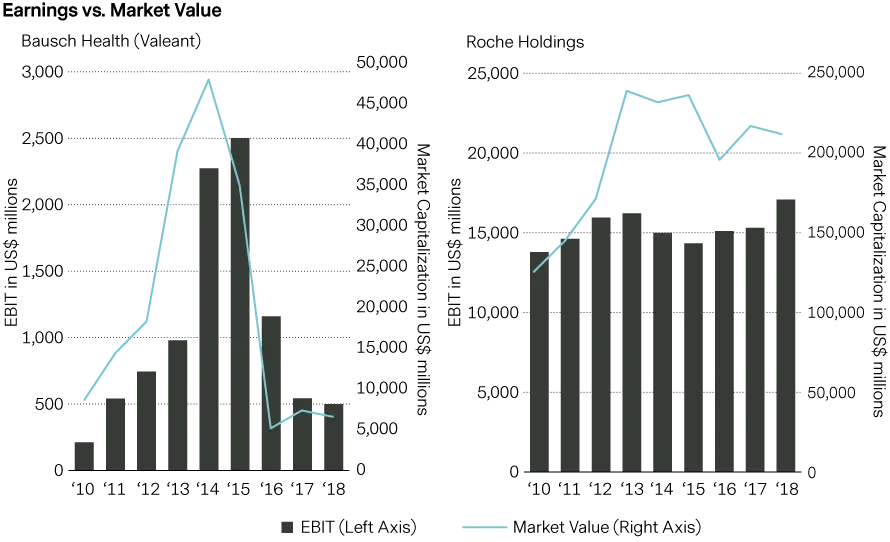

A quick comparison illustrates the different approaches within the same industry – in this case towards customers and purpose. The charts below compare two pharmaceutical companies both with U.S. operations. We regard Roche (Switzerland) as a company that operates with a balanced stakeholder approach. The other, Bausch Healthcare (Canada) was previously known as Valeant Pharmaceuticals. Valeant was an aggressive profit maximizer through the early part of this decade. Its basic strategy was top-line growth through leveraged acquisitions. This was followed by lifting profit margins through slashing costs such as R&D, and lifting the prices of the acquired products to the maximum the market could sustain in the short term. Roche, by contrast, maintained pricing between the U.S. and Europe at similar levels, even though they could have charged higher prices in the U.S. Valeant was lifting its margins at the same time Americans were struggling with rising healthcare costs. This caught the attention of politicians and, when the regulators took the company to task over its aggressive pricing, the business collapsed and was only saved by rapid asset sales by a new management team. They also changed purpose by cutting the development of new treatments along with the R&D budgets. The goal was to maximize the ‘tail’ value of the acquired businesses. Roche’s relative prudence helped the company sustain its growing business, despite the deteriorating pricing conditions in the U.S. and the company continues to invest heavily into new treatments.

Source: FactSet

Potential for purposeful impact

- Social – establishing a corporate purpose can motivate employees to be part of a greater mission. Changes could include: improved training (e.g. German apprentice model), rising pension contributions – the shift from defined benefit to defined contribution has dimmed the retirement outlook for many. Potential benefits include increased engagement, creativity, and improved customer satisfaction.

- Suppliers – many large companies have squeezed working capital from suppliers over the past 20 years. This has caused pain to small and mid-sized business, which employ a large numbers. Potential benefits of better supplier treatment, include; broader offers of new products, improved quality control and better information sharing.

- Environment – planning not just for potential climate change, but the management of scarce resources. For example, companies that are able to adjust local fresh water extraction with depletion rates will be better placed should climate change or new regulation unexpectedly cause issues.

- Executive behavior – we anticipate increasing pressure to reduce rewards to senior executives, particularly in the U.S. This is unlikely to make a large impact on earnings. ( Is the Boss Worth $20 Million? ) Corporate leaders being paid what for most is unimaginable wealth, based on shareholder primacy incentives, increasingly does not hold up in the court of public opinion – and the public are the end owners.

Purpose of a company

It’s hard to ignore the fact that companies operate in an interdependent economy. The employees of one company are the customers of another. The environment changes when abused at scale. It is in their own self-interest for a sustainable growth company to broadly benefit society – including the owners. A company that treats its major stakeholders well is better placed to sustain its growth over the long run. While this simple observation is not shared by some corporate leaders and analysts, who seem to see companies as wealthy islands, others see the light. Change is afoot. Increasingly, we hear CEOs arguing their businesses need to re-find their purpose, which we think is both good for companies that have managed to create a growth franchise while balancing the rewards, and should be worrisome to those sticky hands living behind a façade of sustainability.

1. Aggregate pre-tax profit for the companies within the MSCI All Country World benchmark was just 15% of that paid for input goods, sales expenses and administrative overhead - latest data as of August 2019, source Factset.

2. Household Wealth Trends in the United States, 1962 to 2016: has Middle Class Wealth Recovered by Edward N. Wolff, NBER

3.

https://www.warren.senate.gov/imo/media/doc/Accountable%20Capitalism%20Act%20One-Pager.pdf

4.

https://opportunity.businessroundtable.org/wp-content/uploads/2019/08/BRT-Statement-on-the-Purpose-of-a-Corporation-with-Signatures.pdf