Is The Boss Worth $20 Million

Quality Growth Boutique

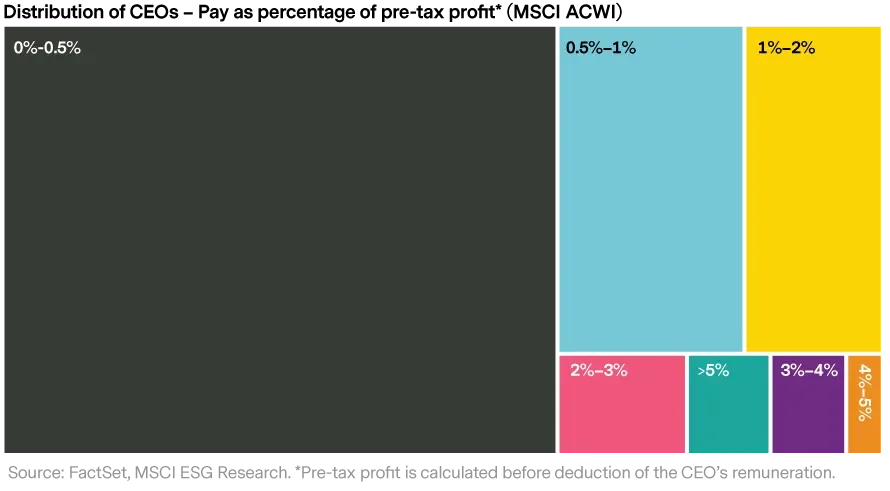

American CEOs do well. They do well because their boards agree to pay them well. Board members are voted in by shareholders. In the U.S., a $20 million payday for a CEO is not headline material anymore – yet it still makes most people queasy. A quarter of the MSCI All Country World Index (MSCI ACWI) companies’ CEOs were paid more than 1% of their company’s pre-tax profit over the past year1 – for just one employee. Over the same period, 74 CEOs took home more than $20 million, and of these 62 worked for U.S. companies. As stewards of capital with votes, we have views on the difficult balance between absolute dollars and value.

Understanding pay is made harder by often-significant differences between reported pay and actual pay received. Pay received can only be known after the completion of the performances that rewards are linked to. Reams of complex explanations from management, in reports such as the poetically named DEF14A from the SEC, can make understanding executive compensation trying.

An Ancient Conflict: Balancing Ethics and Money

Aristotle wrote that perfection of the soul and happiness were achievable through living a life of excellence and moral virtue, and that moral virtue was not gained by accumulating riches and honor. While many of us would agree – reality and the markets have for years dictated that riches and honor are often in the eye of the beholder. So, what is the right framework for paying a company’s lead employees from the eye of a shareholder? It’s a challenging question, as it is easy to get drawn into the details and miss the picture for the pixels.

Enlightened self-interest plays a big role. For the long-term sustainability of a business, owners need to balance their take with enough pay to drive the energy and loyalty of their employees. There is a natural three-way tension of interests in profit sharing between owners, senior executives and lower level employees. It’s a negotiation. Bargaining power can bring dramatic results. From time to time, we get jolted by headlines such as Disney’s 2018 proposal to pay its CEO a package potentially worth hundreds of millions of dollars. We would rather see an excellent manager become wealthy through ownership of shares in the company accumulated over the years with cash bonuses.

Sports teams, media and tech firms all have their mega buck employees for a reason, they deliver value. But CEOs of listed companies are more than standalone talented individuals— they are highly visible leaders within society. And executive behavior and remuneration can impact a company’s brand equity and, in extreme cases, the industry itself – remember Valeant?

CEO Pay: Relative or Absolute?

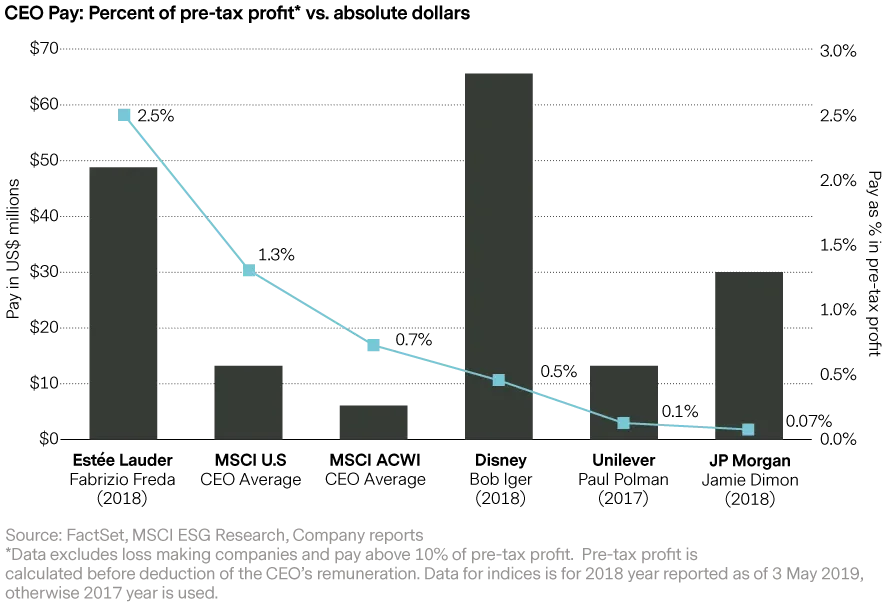

As shareholders, it makes sense to tie CEO pay to medium-term earnings growth, or total shareholder returns (TSR), to align interests. However, the way a deal is structured can lead to wildly different outcomes. The first question is: should pay be calculated relative to TSR or in absolute dollars? Poor visuals of a large payday can look significantly smaller when plotted against profits – the same way a large tree can look small against the backdrop of a mountain. Bob Iger, Disney’s CEO, is getting heat for his new 2019 deal which is a large step up from the $66 million he was awarded in 2018. $66 million was already high in absolute terms, but as a proportion of profits, and considering how much he has delivered, his cost of 0.45% of pre-tax profits is not an outlier and it is well below the MSCI ACWI benchmark average of 0.72%. The chart below compares absolute dollar awards to CEOs vs. the cost as a percentage of pre-tax profits (excluding the cost of CEO pay). Notably, the MSCI U.S. average CEO pay relative to profits is nearly double that of the MSCI ACWI.

Relative pay boils down to the impact on earnings per share. The larger the company, the higher the pay for the same percentage share. It’s a clean logic that is popular with managers, and easily defended by consultants using comparisons to other (often well-healed) ‘peers’.

But the public generally relates more closely to absolute terms. This is important because not only is the general public the end holder of most equity, tainted public opinion can also attract risks to the company, including:

- Social impact – inequitable pay can send poor messages to staff and, at its worst, can attract negative attention from the press, customers and regulators, particularly as wealth dispersion has become a broad and divisive public issue.

- Asset allocation – can provide an incentive to empire build as the CEO can win a free ride on a larger (shareholder owned) capital base.

- Missed alternatives – paying $10 million over what a CEO might otherwise be worth is cash not paid to incentivize other employees, reinvested into the business, or paid out to shareholders.

We believe both relative and absolutes matter.

Many people look at pay relative to what they make or would strive to make. When a CEO earns $20 million in one year, it would take someone making $100,000 a year more than four lifetimes to earn the same amount – it matters.

But we also need to balance this against rare talent and competition. There is always the private equity market offering large equity slices to talented managers – and sometimes top executives are tempted, or sometimes they may choose to spend their last 20 years enjoying their savings in retirement. Boards are fully aware of this – there is a balance as some executives are just better than others and have proven themselves.

As executive compensation continues to come under public scrutiny, progress has been made on giving shareholders a voice to the board. Say-on-pay votes were introduced in the U.S. under the Dodd-Frank act in 2011. They are non-binding votes on proposed compensation to a minimum of five named executive officers: the CEO, CFO and the three highest paid executives. Say-on-pay votes must be held at least once every three years, although most hold them annually. We pay close attention to these, and the market is starting to follow them more closely.

When thinking of CEO pay, investors and companies need to balance society’s sensitivities with competition in the marketplace.

1. Based on latest available data as of May 2019.