ESG: Active Stewardship at the Quality Growth Boutique

Quality Growth Boutique

Why should investors care about ESG and why has the focus on ESG increased over the last several years?

We believe the answer lies partly in the uncertain times in which we live. The world is a tumultuous place, evidenced by political unrest, populations that feel disenfranchised and pockets of rising populism. Tensions were already running high and growing disparities have come into sharper focus in the wake of the Covid-19 pandemic. Climate change further brings into question the sustainability of natural resources. In a period of global uncertainty, ESG shines a light on stability, something we at Vontobel Quality Growth care about deeply.

Businesses, their employees, and society are inextricably linked. Employees of companies are not only important resources, but also savers and investors. Asset management sits at a pivotal point of this interconnected world, determining how capital is allocated across the economy. With this seat comes responsibility and opportunity. We believe ESG plays a key role in the analysis of a company’s operational stability.

"ESG is not a luxury, or a “nice to have” consideration, but a critical part of risk management. Weak ESG standards can boost short-term returns, but at the expense of a less certain future."

Our ESG risk analysis improves the long-term visibility of downside risk and value creation for the businesses in which we invest. As long-term investors, we consider ourselves owners of companies, not renters of stocks. We adopt an active ownership mindset that requires a deep understanding of our businesses and we recognize that ESG issues are dynamic.

ESG is a thread woven throughout our process

Our ESG process is thoughtful, not rigid. ESG scoring is not a key driver of our investment process, but it is a part of our research due diligence. We find broad ESG scores from third-party providers to be informative as a starting point search for red flags, rather than swallowed hook line and sinker as an end-point conclusion. They can also provide context with respect to how a company stacks up relative to its industry peers, and rating services give credit for performance improvement over time.

However, ratings do not provide a glimpse into the future changes a company is expected to implement that will impact its outlook down the road. And these aspects are critical, after all, demonstration of a good track record is important, but investing is based on future expectations. Hence, reliance on scoring alone is simply not enough. For example, it would not have alerted investors to the accounting fraud and governance issues at Germany’s Wirecard, whose MSCI ESG rating was upgraded to a respectable BBB in 2018 (AAA is the highest ESG rating and CCC the lowest) and was reaffirmed in March of 2020. Scores alone can impart a false sense of security and are not a substitute for rolling up one’s sleeves for a deep dive into the issues that are most relevant to a particular company and industry.

ESG assessment is not a step in our process, but a thread that is woven throughout our involvement, starting with our initial analysis and continuing through the entire period of ownership. When we evaluate investment opportunities, we look for those companies that have minimal ESG risk. When we consider a business’ future prospects, we ensure that the company can sustain and balance its benefits to its stakeholders for many years to come.

"We look for forward thinking managements that are proactive in addressing risks."

For example, the sustainability of water resources would be relevant for some of our consumer staples companies but would be less pertinent to our technology investments. Likewise, the integrity of related-party transactions might be a paramount consideration when investing in one company, but less relevant to others.

Engagement & voting

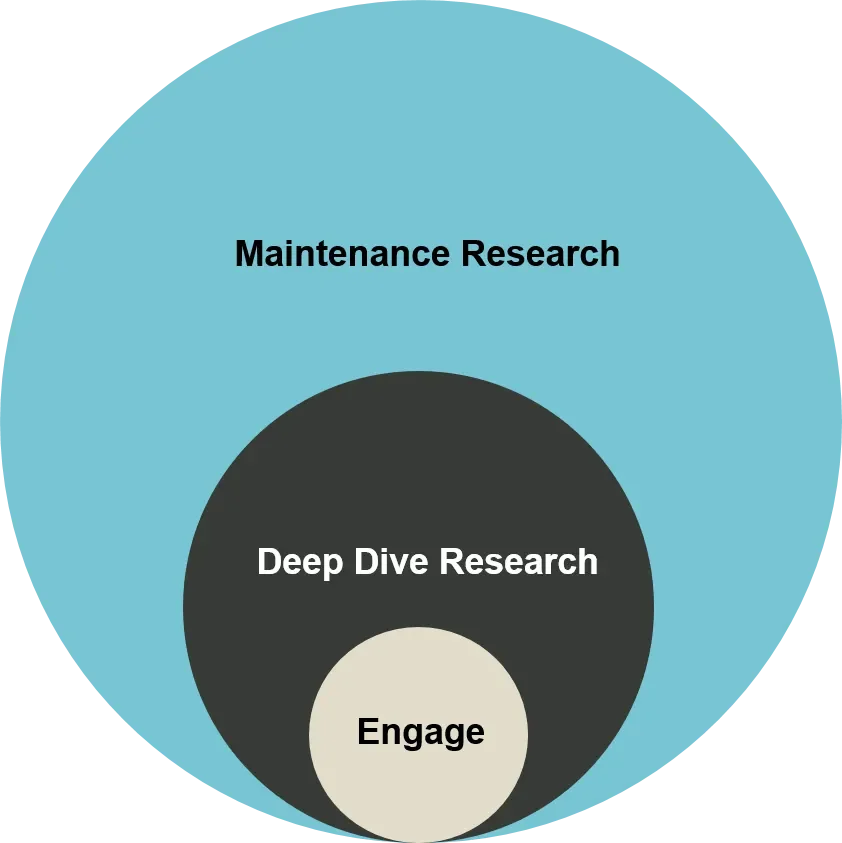

With engagement, we move beyond market observer and maintenance research to conduct deep-dive analysis and, on occasion, influence managements when we believe a change would be advantageous to long-term value.

Engagement is usually undertaken by direct conversations in person, on the phone or by email. However, for more significant issues we will write letters to the Board Chair, the full board as well as senior executive officers to start a more formal dialogue.

"We look to engage through positive dialogue highlighting our views on how value might be enhanced."

We aim to be long-term partners offering constructive suggestions and to avoid an “us and them” posture. We believe change is more likely to occur for minority shareholders when it makes sense to both parties rather than by force.

As investors, we express our views through votes. During 2019, we voted on 2,322 proposals across our quality growth strategies in aggregate. While we use the research and services of proxy advisory firms, we have full independence to vote in the way we see fit to represent the best interests of our investors.

ESG case studies:

| On the sidelines in Chinese banks: alignment of interests – governance |

|---|

|

China presents some unique challenges when analyzing past results and looking to minimize ESG risks. Transparency can be low and research resources scarce. China’s A-share companies are one example where we tread cautiously for these reasons. Additionally, many companies are state-owned enterprises and, as a result, there may not necessarily be a full alignment of interests between controlling shareholders and minority shareholders. In China, in particular, we want to make sure that there is alignment of interests between minority shareholders, management, and the government. For this reason, we have long stayed on the sidelines with respect to Chinese banks, which we see as highly-leveraged vehicles that serve a strategic role within government policy. Our investments in China have tended to focus on domestic consumption and technology. For example, we see better alignment in communications and retail, where consumers, government and shareholders all benefit from a strong business. |

| Nestlé: sustainability of natural resources – environmental | |

|---|---|

|

This Swiss-based company has 48 brands and is the world’s largest bottled water company. Yet, Waters is the smallest of Nestlé’s divisions accounting for 8% of revenues. In recent years, one industry issue that has come under scrutiny is water sustainability. Water scarcity is a particularly sensitive issue as its impact reverberates throughout local communities, especially during periods of draught. In the United States, municipalities issue water permits and each jurisdiction has its own set of unique circumstances. Over the years, Nestlé Waters has occasionally clashed with jurisdictions over water extraction. Municipalities often grant water permits for lengthy periods, and historically rates have tended to be low. This can become an issue when municipalities later need to reinvest in aging water infrastructure. Municipalities can potentially wind up selling high-cost water to its residents while selling low-priced water to private bottling companies. To better understand water risks and how they might develop over time, we spoke with industry veterans, water rights attorneys, a lobbying group, and scientists across various municipalities. We wanted to understand the pressure points and how Nestlé’s water business might be impacted down the road. We concluded that the potential for operational damage is not significant at this moment. However, we did have some concerns around possible reputational or brand damage in the near term. |

|

| Engagement: | We met with Mr Bulcke, Nestlé’s Chairman, in Dec 2019. Discussions were cordial and his concern was that Nestlé’s ground/spring water business had become commodity-like and ultimately may not be the right business for the company. |

| Results: | We came away with the impression that Nestlé could shift away from ground/spring water to premium waters only. In fact, seven months later, in June 2020, the company announced it is considering the potential sale of its commodity US-bottled water business. |

| Wells Fargo: compliance and customer welfare - social | |

|---|---|

|

During several years of the last decade, this US bank became embroiled in a scandal involving its selling practices. The banks’ senior managers had pressured their staff to “aggressively cross-sell products to enhance sales and revenue to meet certain quotas” (Forbes). Wells Fargo employees, incentivized with higher year-end bonuses, created millions of savings and checking accounts for customers without their knowledge or approval. Eventually customers did catch on and the bank has paid to date over $6 billion in penalties. The bank has also changed its CEO twice since the scandal first broke. |

|

| Engagement: | Between 2016 and 2019, our research team held numerous meetings with the bank’s managers. We emphasized our view that managers must institute a culture change to focus on customer service, as well as better risk control procedures to avoid such mishaps in the future. Additionally, we visited branch offices to gauge consumer sentiment after the scandal had been well-publicized. |

| Results: | We decided to sell the Wells position due to several issues, one of which was our concern that the bank would not be able to follow through on its plans to institute fundamental change, while simultaneously dealing with Covid-19. |

| Zee Entertainment: concerns over board independence – governance | |

|---|---|

|

Zee Entertainment is India’s largest non-sports broadcaster with roughly 20% market share. The company operates 42 channels and has an extensive content library of regional language programming. |

|

| Engagement: | Over the past year, we held several discussions with management of this media conglomerate on operational and governance issues: 1) rising advances to content-buying agents, and 2) board independence following the sell down from former controlling shareholder, the Essel Group. Due to external obligations, the Essel Group significantly reduced its holding in Zee from approximately 40% at the start of 2019 to roughly 5% in November. We believed the board should become proportionately more independent due to Essel’s reduced stake. |

| Results: | Management sufficiently explained its content-buying practices. The company has made some progress towards a more independent board, though it has been slower than we would like. We continue to monitor developments in board composition. |

Active management has an important role to play in ESG analysis

In sum, as pressure on the global economy rises, the need for strong ESG is clearer than ever. At Vontobel Quality Growth, our ESG mission is based on enlightened self-interest of better returns relative to risk. ESG is not a step in our investment process, but a thread woven throughout our involvement with a company. Seeking to identify companies with sustainable earnings for many years to come means that we not only assess the risks but that we actively engage as issues arise, and that we are forward thinking as to how risks may develop. Engagement is an important part of being an owner of a company. Vontobel Quality Growth acts as stewards for our clients (the ultimate owners), and works with the managements of companies where we have identified specific issues. When clients’ require specific exclusions, our boutique can offer alternatives.

"Our goal is to be responsible investors who can provide strong returns while keeping a careful eye on the ESG issues important to our customers."