China – green shoots of market stabilization

Conviction Equities Boutique

Key takeaways

- China’s harsh measures to bring the pandemic under control severely hamper economic activity.

- The number of cities in full or partial lockdown seems to be stabilizing.

- After a dismal March and April for Chinese equity markets, the situation appears to be improving.

- The Chinese leadership has painted itself into a corner by holding on to a strict “zero Covid” policy.

- Any moves to crank up the economy will be key.

- In such markets, we believe an active approach backed by stock picking expertise will be necessary to identify sectors and companies that could outperform.

At the recent summit of representatives of southeast Asian countries in Washington, supply chain disruptions – and the situation in China – were at the center of attention. These two issues are interlinked given the ongoing lockdowns in Shanghai, a city of 25 million – roughly the population of Australia – that generates more output than many a European economy. The standstill in the southern Chinese metropolis as well as in other cities dents the country’s GDP growth and risks becoming a major embarrassment to the political leadership, so far committed to a “zero Covid” strategy of heavy-handed measures to control the spreading of the pandemic.

What does this mean to investors active in China’s equity markets? These stock exchanges underperformed most global indices in March and April, in some cases significantly, with the recent havoc caused by the more transmissible, albeit less lethal, Omicron variant of the Covid-19 virus playing a major part.

Whilst we can’t predict what will happen, we do see signs of market stabilization. In our view, this is due to three developments.

- The wave of new infections seems to have been broken, at least for now.

- Market participants are gaining confidence in the measures announced by the government to support economic growth.

- The implied risk premium – the price investors pay in relation to the risk taken, which, if deemed excessive, can turn them away – is now falling again, allowing valuations to recover. The risk premium has risen sharply over the past few months due to concerns that many Chinese companies would have to delist their American Depository Receipts (ADRs) from the New York Stock Exchange or the Nasdaq Stock Market. Other reasons for the rise were China's position on the Russian invasion of Ukraine, and Beijing’s heavy regulatory push last year to exert more control over the Chinese private sector, particularly technology companies.

The number of new infections per week has come down from peaks of around 460,000 at the beginning of March to below 100,000. The steps taken under the dynamic zero Covid policy, i.e., varying degrees of lockdown measures, seem to have had the hoped-for effect. However, since the Omicron variant has such a high transmissibility, we don’t believe that even the strictest lockdowns can root out the virus everywhere. This sets the stage for continued local restrictions over the coming months, we believe.

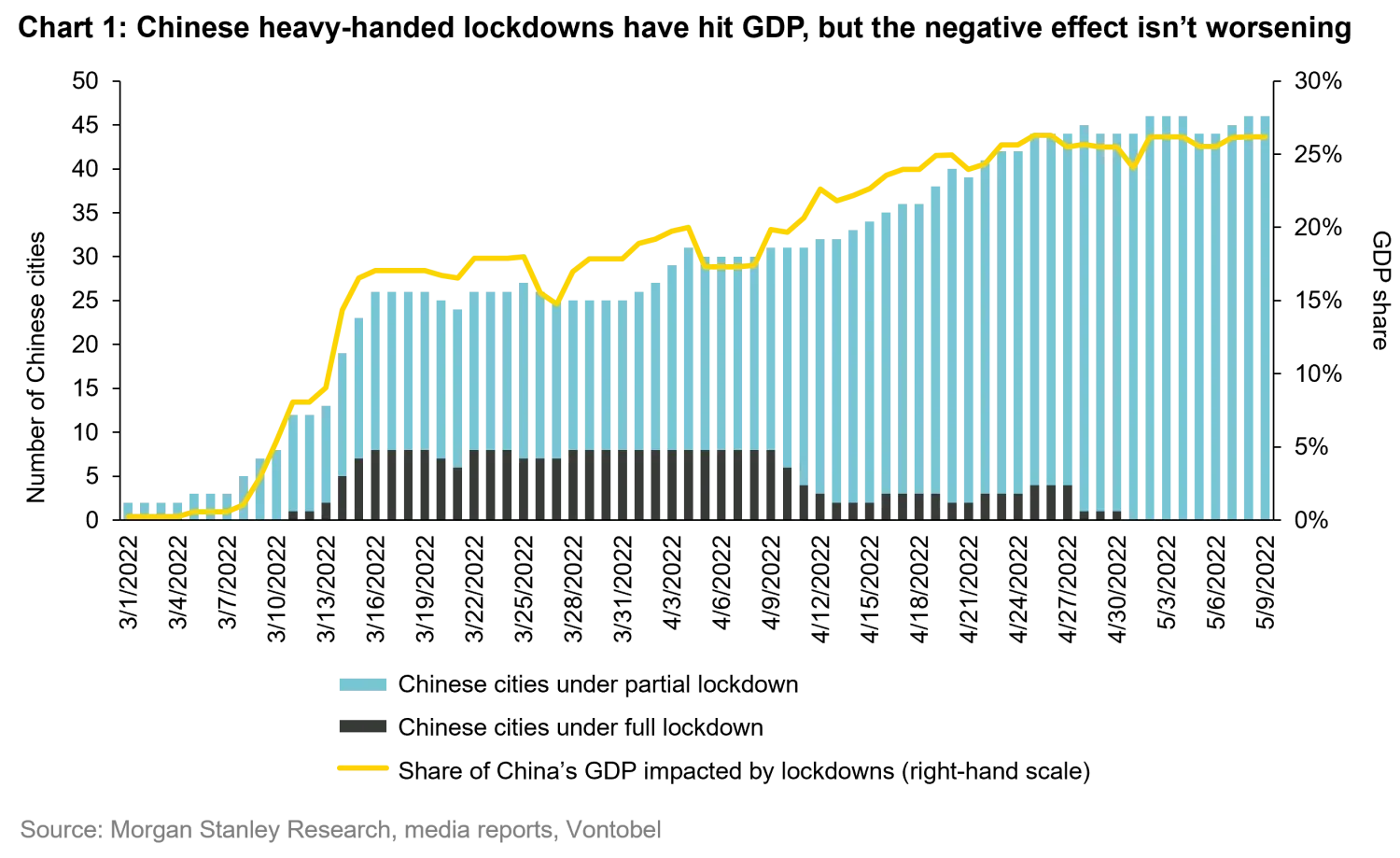

Morgan Stanley Research has pointed out that since the end of April, the number of cities under full or partial lockdown has been stable between 40 and 45. Taken together, they represent about 25% of the nationwide GDP (see chart 1). The bank also highlighted a significant fall in the number of cities classified as risk areas to ten from 50 at the beginning of April.

Chinese leadership in a tight spot

Much will depend on how the Chinese government will handle the health crisis. It may only soften its stance once at least 80% of the vulnerable elderly population is fully vaccinated. According to projections based on the current vaccination rate, this could be the case in October 2022. New scientific studies suggest that an immediate repeal of the zero Covid policy would cost up to 1.5 million lives. This demonstrates the pickle that the Chinese leadership finds itself in. It has long declared victory over the virus and described its imposition of strict lockdowns as superior to the western approach of managing the pandemic. Any sign of weakness would, therefore, be a loss of face to Beijing.

According to local market commentators, it seems that the Chinese people are now coming to terms with the severe restrictions, for better or worse. Their behavior will be followed closely as China is preparing for the most important political event in years, the 20th congress of the Communist Party, due to take place in November. At this gathering, President Xi Jinping is expected to be handed an unprecedented third term as the party’s General Secretary, consolidating his power.

Chinese stocks regain footing but terrain remains slippery

Where will Chinese equities go from here? A further large-scale increase in infection rates could well shake up the stock markets again. But because the price/earnings ratio based on expected earnings for the next 12 months is currently at a relatively low 9.5, signalling investor caution regarding Chinese companies’ prospects, the potential for further setbacks seems to be limited.

In our view, however, the government's next moves to support and stimulate the economy will be decisive. In mid-April, the market reacted favorably to confirmation of the 5.5% GDP growth target. Similarly positive for stocks were announcements regarding an expanded urbanization in rural areas, news of a more normal level of regulatory supervision over the financial activities of Chinese internet companies, the central bank’s looser monetary policy, as well as local stimulus measures underpinning real-estate markets.

Large differences in returns between sectors

The improved sentiment is also apparent in the performance of the various sectors. For example, over the course of a month, shares of infrastructure and construction companies have rebounded, as have food, utility, and telecommunication stocks. This has occurred against the backdrop of widely varying sector returns over the past three months. For example, there is a gap of nearly 30% between the result for the best-performing sector, oil and gas, and that of the worst-performing sector, hotels. This illustrates that there is still potential for stock picking despite the adverse economic environment.