Changing Lanes: rethinking your credit exposure

TwentyFour

For years, a popular strategy among institutional investors when trying to boost portfolio returns has been to complement their core fixed income holdings with an allocation to high yield bonds. History indicates that this strategy can work well in the good times as lower rated companies typically outperform, but it can become problematic over the course of a market cycle as downturns drag down valuations, typically at the same time as investors’ equity positions are also suffering.

In short, we think being a dedicated high yield manager is a little like being stuck in a single lane on the highway; they can tap the brakes by increasing credit quality or reducing maturities, but most cannot change lanes – they must maintain 100% exposure (or close to it) to the asset class even when the outlook appears bleak. By contrast, strategic bond strategies such as TwentyFour’s Strategic Income Strategy are able to change lanes as market conditions evolve. Strategic bond managers with truly flexible mandates are able to look for relative value in other security types - often across multiple geographies - and readjust their portfolios towards lower beta holdings during times of market volatility.

With risk asset valuations having risen so rapidly since the market turmoil of the COVID-19 pandemic, and with central banks facing the delicate task of unwinding unprecedented liquidity provision at a time of resurgent inflation, in our view a more balanced approach to credit will be required when targeting positive returns in the next several months.

TwentyFour’s SI Strategy can access the same high yield opportunities as dedicated high yield bond managers, but with the flexibility and wider opportunity set to help try to navigate an entire market cycle.

Is there a better approach to credit markets?

In the US, around 20% of institutional investors managing more than $1bn have a dedicated allocation to high yield bonds1. Typically, these investors use high yield to complement their ‘core fixed income’ allocation, which is usually invested heavily in US Treasuries and investment grade corporates. By adding a dedicated high yield strategy, allocators are clearly introducing a diversifying exposure that they hope will boost returns. However, while high yield bonds would be expected to perform strongly at certain points of the market cycle, we believe their diversification benefits can be questioned; for example, history indicates they have a high correlation to equity markets meaning they typically exhibit weakness at the same time as investors’ stock holdings.

To try to overcome these limitations, we think investors should consider a strategic bond strategy. By tactically allocating across a wider opportunity set, strategic bond strategies such as TwentyFour SI can aim to maximize risk-adjusted returns throughout the cycle.

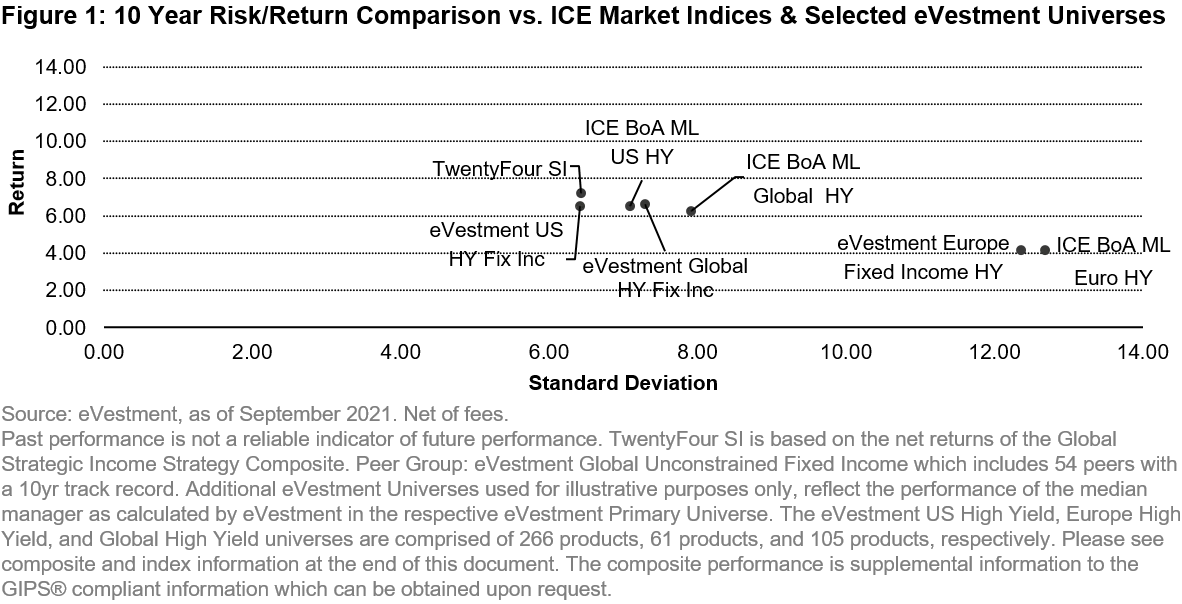

As the chart below demonstrates, an allocation to the TwentyFour SI Strategy could have delivered more return – with lower volatility – than active high yield managers or widely used high yield indices over the last 10 years.

Dedicated high yield: too rigid to work through the cycle?

Dedicated high yield strategies typically focus on bonds rated below investment grade, namely BB+ and below as defined by major credit ratings agencies. Depending upon the manager (or index for those who choose to allocate that way), different segments of the high yield market will come together as a blended exposure to various sectors, regions and ratings segments of high yield. While these strategies might be used to offer investors a complementary exposure to the otherwise more conservative allocations embedded within traditional ‘Core’ or ‘Core +’ funds, results from pure-play high yield have been somewhat mixed.

On the one hand, high yield strategies have historically offered strong returns in the early phases of a market cycle. On the other, high yield bonds come with increased risk which can translate into larger drawdowns when the environment changes. This is where we think TwentyFour SI has the advantage and, over time, the results can add up.

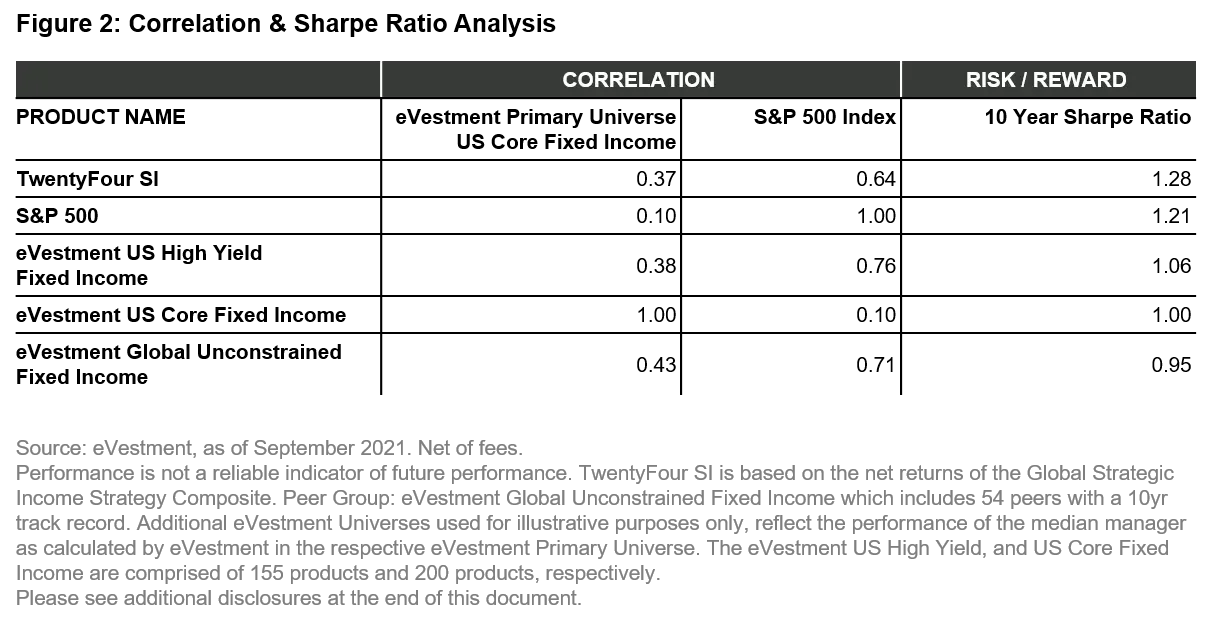

As the chart below shows, while the median US High Yield Fixed Income manager has a low correlation of 0.38 with the median US Core Fixed Income manager, the correlation with the S&P 500 Index is rather strong at 0.76. Equally important in our view, dedicated high yield strategies have on average been less efficient from a risk-reward perspective: the median US High Yield Fixed Income manager’s 10 Year Sharpe Ratio of 1.06 is well below that of the S&P 500 Index (1.21), as well as that of TwentyFour Strategic Income (1.28).

In comparison, the TwentyFour SI Strategy takes a more diversified approach as it aims to avoid the volatility risk associated with in any one sector or segment of the fixed income market, and it has historically experienced far less correlated returns. One prime example of this diversification would be in European ABS and CLOs, asset classes for which TwentyFour has a team of specialists. European ABS and CLO bonds are virtually all floating rate, making them typically less volatile than other fixed rate instruments in times of interest rate change. They also generally offer a higher yield for a given level of credit rating than more mainstream markets such as corporate bonds, while still offering greater investor protections than their US counterparts through inherent structural safeguards.

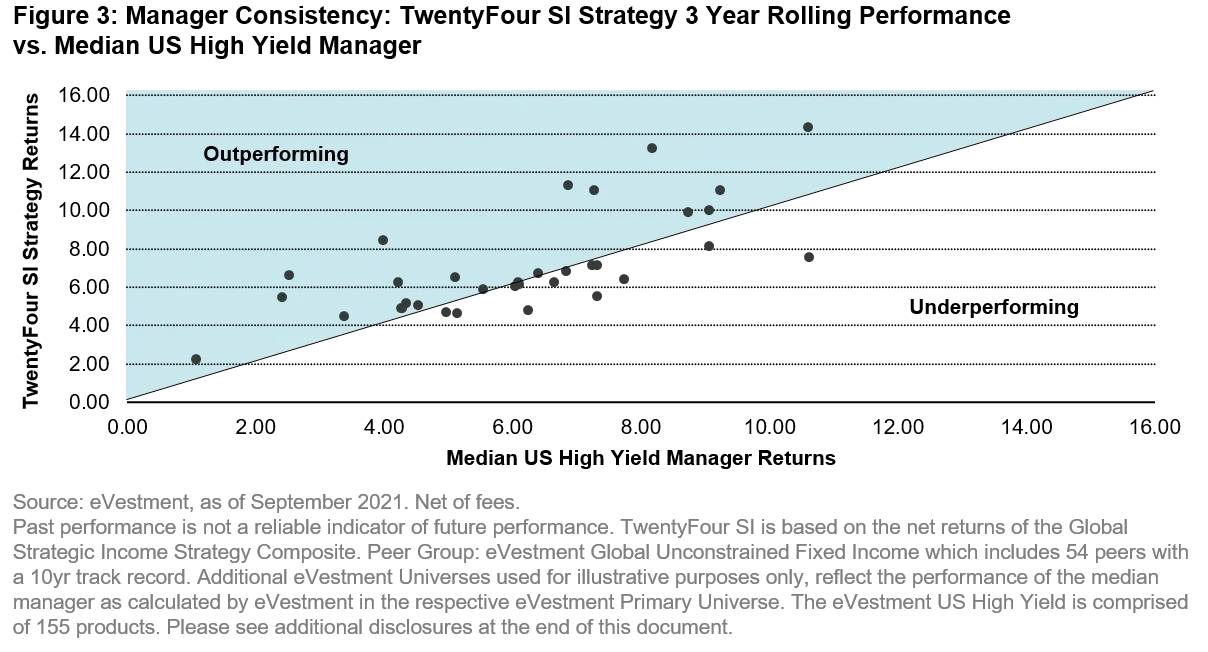

By diversifying across different sectors, ratings and regions, TwentyFour SI looks to target an attractive level of income without having to assume all the risks associated with one narrow sector. The potential benefit of this approach can be seen in the chart below, in 22 out of 34 rolling periods (or 65% of the time), the strategy has outperformed the median US High Yield manager on a rolling three-year basis as indicated by plots above the line.

As the cycle evolves, so can our risk profile

When managing towards an objective, such as delivering an attractive level of income while being mindful of downside risk, we believe that portfolio allocations, duration exposures, and overall risk positioning need to evolve – sometimes at speed – to reflect the opportunities or headwinds of the time. This is where we think manager selection can really make a difference to investors’ outcomes, and we believe those who operate with a more flexible mandate and wider opportunity set are better positioned to navigate market cycles with more efficiency, particularly so if they are balanced in their approach.

Being able to move away from higher risk assets can give us a distinct advantage over those with narrow mandates when the macro backdrop is uncertain or when valuations start to look stretched. In other words, we can shift into traditionally less volatile pockets of the market to help try to balance our high yield exposures while still targeting an attractive yield, rather than being left entirely to the whims of the market and the higher beta risk that pure high yield plays can represent.

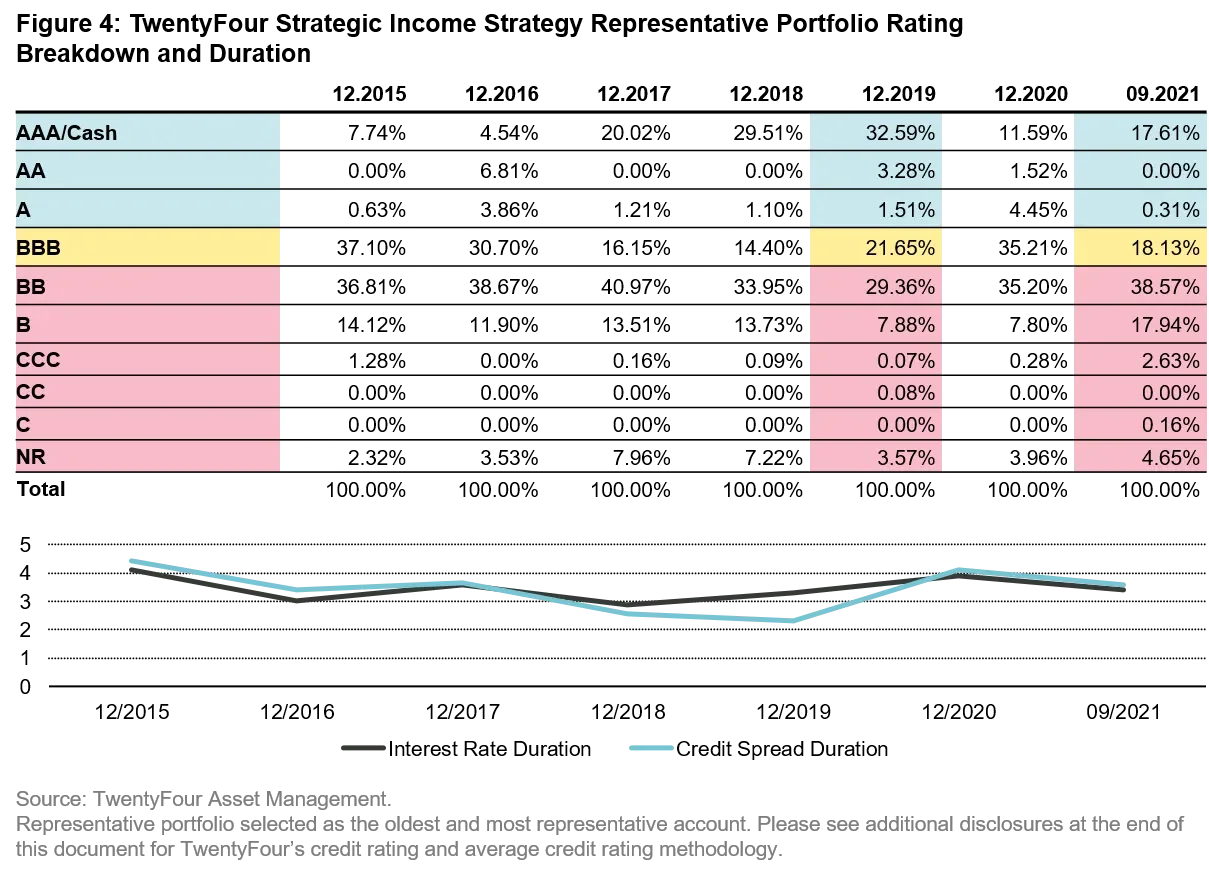

As of September 30, for example, around 64% of the representative TwentyFour SI Strategy portfolio was invested in high yield and non-rated bonds, with the remaining portions in BBBs (~18%) and US Treasuries plus Cash (~18%).

However, this is dramatically different to the strategy’s holdings towards the end of 2019, immediately before the onset of the COVID-19 pandemic. As the chart below shows, pre-COVID the portfolio held roughly 33% in longer dated (5-7yrs, AAA-rated) US Treasuries, with roughly 41% in high yield and most of the remainder in BBB credit. We certainly weren’t anticipating a global pandemic or even a severe recession at this point, but we were cognizant of an aging cycle that we thought was showing signs of weakness and elevated risk asset valuations after a strong 2019. Consistent with our late-cycle reasoning, at this point we had reduced our allocation to credit risk in general and at 2.3 years, our credit duration was near a historic low for the strategy. This is another method we can utilize in trying to reduce potential volatility, by staying at the short end of the credit curve.

A closer look at TwentyFour’s Strategic Income Strategy

As the above demonstrates, TwentyFour’s SI Strategy has historically favored what our research indicates2 has been the sweet spot in credit markets when it comes to balancing risk and return, the area straddling BBB and BB rated bonds. If we add allocations to bonds rated BBB and below, our credit allocation percentage has ranged anywhere from lows in the mid-60s to highs in the 90s. In summary, at every turn of the calendar year, the strategy has comprised mostly BBB and high yield bonds. Not only can we move up and down the credit spectrum in terms of ratings quality, but our global mandate also enables us to invest in areas that may be more unfamiliar to high yield managers, especially US-oriented high yield managers. Namely, investments such as European ABS and CLOs as previously mentioned, bank Additional Tier 1 (AT1) bonds, and emerging market debt. Yet we do this without assuming any currency risk as we hedge all of our currency risk back to the base interest of the client.

Now is the time to increase flexibility in credit

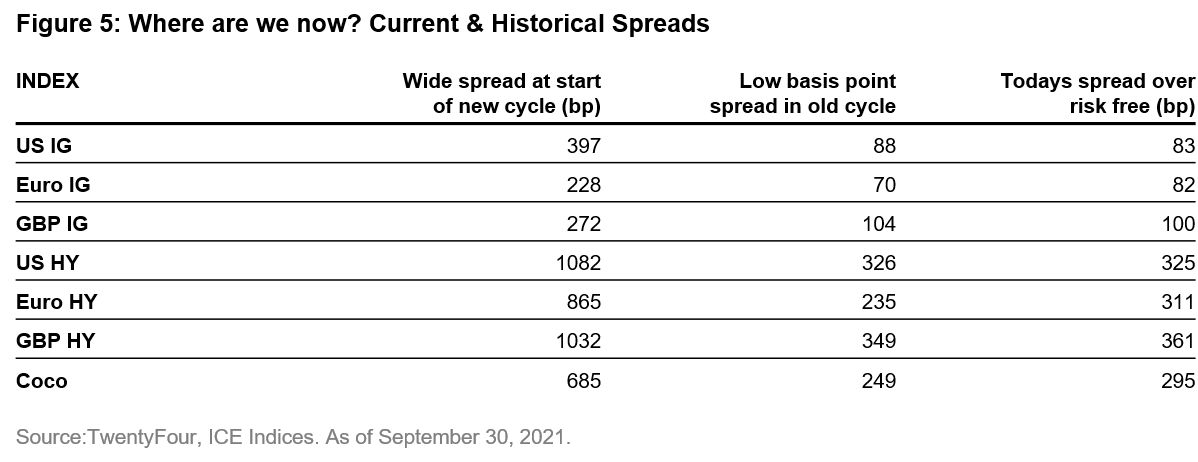

Since the lows of March 24, 2020, the ICE BofA US HY Constrained TR USD index has risen almost 40%. In our view, returns should proceed much more slowly from here with spreads in most pockets of fixed income nearing historic lows.

While this phase of the cycle may well continue to play out slowly with spreads grinding gently tighter, the new economic cycle ushered in by the COVID-19 turmoil has moved with remarkable speed. Credit spreads threatening the lows of the previous cycle has historically taken years to occur following a recession. This time around, thanks in no small part to unprecedented liquidity provision by central banks, spreads in some sectors of credit were back at their lows of the previous cycle within 12 months.

With that in mind, does it make sense to ride through the uncertainty and volatility of high yield exclusively at this particular juncture?

We would argue a more diversified mix of bonds can serve investors better, both at this point of the economic cycle and for the longer term. There will undoubtedly be periods when better diversified strategies will trail pure high yield plays, but when provided with the benefit of time and over different phases of the cycle, history has shown the value of the flexibility behind TwentyFour’s Strategic Income Strategy.

1. S&P Money Market Directory, 2Q 2021

2. TwentyFour: ‘BBBs and Fallen Angels: Hellish Risks or Heavenly Returns?’, March 2019

eVestment and its affiliated entities (collectively, "eVestment") collect information directly from investment management firms and other sources believed to be reliable; however, eVestment does not guarantee or warrant the accuracy, timeliness, or completeness of the information provided and is not responsible for any errors or omissions. Performance results may be provided with additional disclosures available on eVestment’s systems and other important considerations such as fees that may be applicable. Not for general distribution. * All categories not necessarily included; Totals may not equal 100%. Copyright 2012-2021 eVestment Alliance, LLC. All Rights Reserved.

Please remember that all investments come with risk. Past performance is not a reliable indicator of future performance. Positive returns, including income, are not guaranteed meaning your investment may go down as well as up and you may not get back what you invested. Prospective investors are reminded that the actual performance realised will depend on numerous factors and circumstances, some of which will be personal to the investor. Asset allocation, diversification and rebalancing do not ensure a profit or protection against possible losses in declining markets. Commissions, fees and other forms of remuneration may affect the performance negatively. This document does not disclose all the risks and other significant issues related to the strategies discussed. Investing in fixed income securities comes with risks that can include but are not necessarily limited to credit risk of issuers, default risk, possible prepayments, market or economic developments, inflation risk and interest rate risk. The issuer of ABS products may not receive the full amounts owed to them by underlying borrowers, which would affect the performance of related securities. Credit and prepayment risks also vary by tranche which may also affect the performance of related securities. Investments in high-yield bonds may be subject to greater market fluctuations and risk of loss of income and principal than securities in higher rated categories. Investments in foreign securities involve special risks, including foreign currency risk and the possibility of substantial volatility due to adverse political, economic or other developments. Similarly, investments focused in a certain industry may pose additional risks due to lack of diversification, industry volatility, economic turmoil, susceptibility to economic, political or regulatory risks and other sector concentration risks.

All information contained in this document, particularly any share prices, calculation data and forecasts, are based on the best information available at the date indicated in the document. The information in this document is not intended to predict actual results and no assurances are given with respect thereto. Unless otherwise stated, any performance data will be calculated in GBP terms, inclusive of net reinvested income and net of all portfolio expenses but does not take into account any commissions and costs charged when the investment is issued or redeemed. Similarly, unless stated otherwise, references to portfolio or similar are to a representative portfolio and was selected as is the oldest and most representative account within the strategy. Equally, references to performance figures, metrics or similar will be based on that same representative portfolio. TwentyFour claims compliance with the Global Investment Performance Standards (GIPS®). To receive a complete list and description of TwentyFour’s composites and a presentation that adheres to GIPS standards, please contact TwentyFour via telephone on +44 (0)20 7015 8900 or via email to salessupport@twentyfouram.com.

TwentyFour's Global Strategic Income Strategy Composite contains fully discretionary fixed income portfolios that obtains exposure to global debt instruments from the whole range of fixed income assets including, but not limited to, high yield bonds, investment grade bonds, government bonds, asset-backed securities and other bonds. The Composite has no restrictions to corporate bond exposures per industry. The Composite may use financial derivative instruments in both rising and declining rate environments throughout the economic cycle. The ICE BofAML Euro High Yield Index tracks the performance of Euro denominated below investment grade corporate debt publicly issued in the euro domestic or eurobond markets. The ICE BofAML US High Yield Index tracks the performance of USD denominated below investment grade corporate debt publicly issued in the major domestic markets. The ICE BofAML Global High Yield Index tracks the performance of USD, CAD, GBP, and EUR denominated below investment grade corporate debt publicly issued in the major domestic or eurobond markets. The S&P 500 Index tracks the stocks of 500 large-cap U.S. companies. It is not possible to invest directly into an index and it will not be actively managed.