D&P Perspectives: Why an "all-weather" infrastructure portfolio can continue to perform in an inflationary market

Quantitative Investments

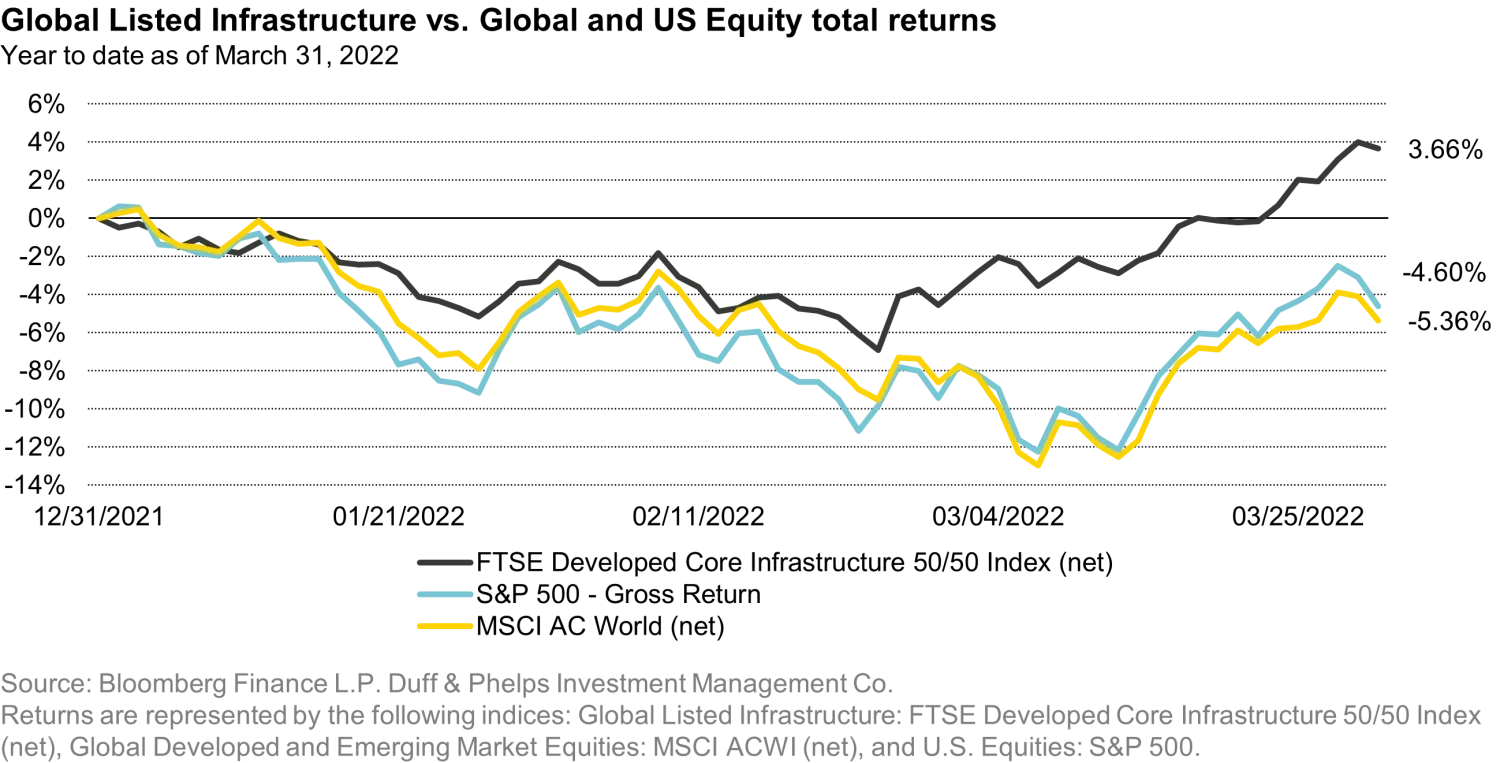

An already choppy market in 2022 has gone from bad to worse with the Russian invasion of Ukraine. The MSCI ACWI Index (net) was down -5.4% year-to-date with its lowest point on March 8. Meanwhile, the global listed infrastructure sector (“GLI”) has held up significantly better, returning 3.7% year-to-date, as of March 31, 2022, as represented by the FTSE Infrastructure Developed Core 50/50 Index (net). The combination of the sector’s inflation protection attributes, higher dividend yields, exposure to durable growth, essential services, and defensive characteristics has driven the outperformance and why we refer to this strategy as an “all weather" portfolio.

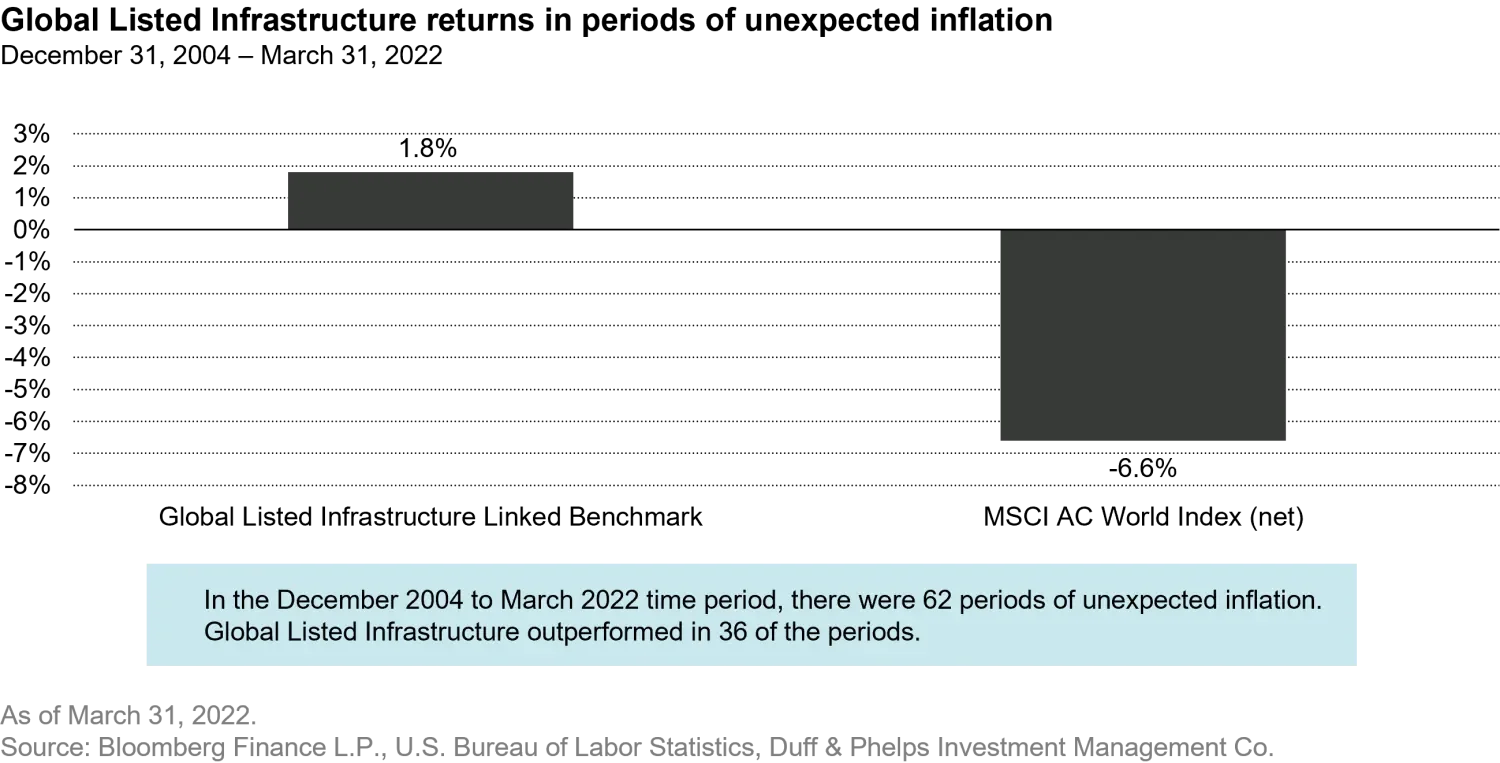

As inflation re-emerges after being dormant for so long, we would like to highlight the inflation-protection characteristics of GLI. Companies in the sector feature physical assets that generate real returns, long-term contracts with inflation escalators, and largely fixed-rate debt. As a result, they tend to be much less affected by inflation. Hence, as inflation statistics continued to climb in the first quarter of 2022 and both the European Central Bank (ECB) and the US Federal Reserve (Fed) laid out plans to raise interest rates, it is not surprising that GLI attracted investor interest and outperformed.

When we look at the broader market so far in 2022, two factors have stood out. First, with higher inflation and additional rate increases on the horizon, we have seen a significant shift from growth stocks to value stocks. Through March, as can be seen in the US, the Russell 2000 Value Index was down -2.4% while the Russell 2000 Growth Index was down -12.6%, which has benefited GLI because the strategy does not rely on large cap growth stocks and is a well-diversified allocation away from high priced growth stocks. A second factor has been the outperformance of higher-yielding stocks. The MSCI US High Dividend Yield Index (net) was down -1.7% at the end of March versus a -4.6% drop for the S&P 500.

GLI’s defensive characteristics and energy exposure have helped it outperform since the Russian invasion of Ukraine. On the defensive side, GLI tends to have a little lower beta than the rest of the market. A good portion of this is driven by significant exposure to regulated utilities. They tend to have much more stable earnings than the broader market and are much less affected by changes in the economy such as inflation or a slowdown. US utilities also came into 2022 near a historically low relative price-earnings ratio versus the broader US market after meaningfully underperforming last year.

GLI has also been helped by exposure to energy infrastructure. While this sub-sector makes up only about 10% of GLI, it has significantly outperformed the broader market this year. Up approximately 24% year-to-date through March 31, as represented by the Alerian Midstream Energy Index, energy infrastructure has benefited from rising oil and natural gas prices and exposures such as shipping LNG from North America to Europe.

Ultimately, we believe the GLI sector will remain highly relevant to investors who believe that inflation may accelerate over the coming months, and who are thus looking to “weatherproof” their portfolio. In our view, a material allocation to GLI makes a lot of sense at this time in the cycle.

GLI offers exposure to four broad areas: communications, utilities, transportation, and energy infrastructure. Not surprisingly, some of these areas, such as wireless communication and European airports, have struggled against the broader market so far in 2022. Nevertheless, what makes GLI attractive is the combination of these sectors and geographies. This mix helps give the portfolio the defensive growth and inflation protection it offers. Additionally, we believe active management and the ability to shift sector exposures according to the expected economic environment offers further upside opportunities, not only in the past quarter but in the quarters to come.

As of March 31, 2022. Source: Bloomberg Finance L.P., U.S. Bureau of Labor Statistics, Duff & Phelps Investment Management Co.

The Linked Benchmark returns are compiled by linking returns from the FTSE Benchmark beginning October 1, 2016 through March 31, 2022 with returns of the MSCI World Infrastructure Sector Capped Index for the period September 1, 2008 through September 30, 2016 with returns from a blended benchmark comprised of 65% MSCI U.S. Utilities Index, 20% MSCI World Telecom Services Index and 15% MSCI World ex-U.S. Utilities Index for the period from inception to August 31, 2008. The Duff & Phelps strategy inception date is December 31, 2004.

Rising inflation measured as a positive difference between the year-over-year realized inflation rate and the lagged 1-year expected inflation rate. Realized inflation measured by the year-over-year change in the Consumer Price Index for all urban consumers, published by the U.S. Bureau of Labor Statistics. Expected inflation measured by the University of Michigan survey of 1-year-ahead inflation expectations. Results are compiled based on rolling monthly basis comparisons of the annual measures. In periods of unexpected inflation, as defined, monthly performance index returns are linked with the next monthly period of unexpected inflation. Periods not included may have had different results.

This material has been prepared using sources of information generally believed to be reliable; however, its accuracy is not guaranteed. Opinions represented are subject to change and should not be considered investment advice or an offer of securities. Forward-looking statements are necessarily speculative in nature. It can be expected that some or all of the assumptions or beliefs underlying the forward-looking statements will not materialize or will vary significantly from actual results or outcomes. An increase in interest rates can cause markets to decline and certain companies and sectors may be adversely impacted.

Past performance is not indicative of future results. Index returns include the reinvestment of dividends. Indices are not available for direct investment and do not reflect the deduction of any fees.

Duff & Phelps Investment Management Co. services are not available in all jurisdictions and this material does not constitute a solicitation or offer to any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation.