The fallout of the US banking crisis and how quality can provide resilience

Quality Growth Boutique

The failure of a few US regional banks and the teetering of some others in recent months were unintended consequences of one of the most aggressive monetary tightening cycles in recent memory. The implications include the likelihood of further tightening of financial conditions and an increased chance of a hard landing. In the challenging times ahead, quality businesses whose profitability is less dependent on macroeconomic factors can offer resilience to investors.

The interwoven issues facing banks today stem from the dramatic rise of interest rates over the past year as the Federal Reserve continued to fight persistently high inflation. Firstly, the duration mismatch between banks’ assets and liabilities that caused runs on more exposed lenders is a confidence problem. In a world where deposits can move at the touch of a screen, the trust that underpins the fractional reserve banking system can break more quickly than in the past. We believe that this trust, while not fully restored, has been healed with measures regulators have taken that implicitly back deposits above the $250,000 FDIC cap, while also providing liquidity to the banks that were facing deposit outflows. If confidence continues to waver, the government could institute a more aggressive policy, such as guaranteeing all deposits in the banking system. While this is a last resort that is not without moral hazard issues, it could effectively control any panic.

Since the height of the crisis in March, a clear pattern of flows has not emerged in the weekly deposit data. In the throes of the Silicon Valley Bank failure, there was a shift in deposits from smaller banks to larger banks. That has somewhat subsided, and the flows have been inconsistent since that period, potentially highlighting a return to calmer waters.

At the core of this most recent banking crisis in the US was the duration mismatch between the institutions’ assets and labilities. The banks that failed had a significant proportion of their assets in fixed rate bonds and loans, which declined in value when interest rates rose. For accounting purposes, the recognition of those losses varies depending on the category in which they are placed. Accounting recognition aside, the marked to market impact on the value of fixed rate assets has been significant, effectively wiping out the equity of many financial institutions. But as long as banks are not forced to sell, those unrealized losses due to higher interest rates would eventually reverse. Provided banks can hold onto their deposits, the losses on the asset side will not be realized. In addition, the value of banks’ deposits has grown as rates have moved higher. Given not all deposits will move to higher yielding accounts as many of the balances are transactional, such as checking accounts that businesses use for cashflow purposes, banks in theory could earn enough spread to offset the paper losses over time.

Tightening lending standards

In addition to a confidence issue, banks also face credit concerns. Potential defaults or markdowns of loans to commercial real estate or retail properties cannot be rectified with the benefit of time. Instead, losses on these loans could impair bank earnings for a few quarters and further exacerbate the tightening of financial conditions as banks pull back from risk taking. While the problem would impact earnings of some banks, it is unlikely the losses would be large enough to represent a systemic issue, but there’s no way to be completely certain. The implications for the wider economy are also relevant as it could increase the chances of a recession as lending standards increase.

The growth in private credit over the past decade has in part taken much of the riskiest lending activity off the table for the banking system and placed it on investors in these strategies, such as pension plans, who have increased their exposure to these alternative assets. Much of these loans issued in recent years were at variable rates, which are now beginning to be reset higher. The companies taking on the debt are typically lower quality, which calls into question their ability to repay in a higher rate environment when the economy contracts. Any potential losses would notably not fall on the banks as the pools of assets are owned outside of the traditional banking system. However, banks do lend to smaller businesses, typically at variable rates, so higher interest rates would put more pressure on those businesses. Lastly, the spread that lenders charge for the riskiest debt could also widen, further exacerbating the lending squeeze.

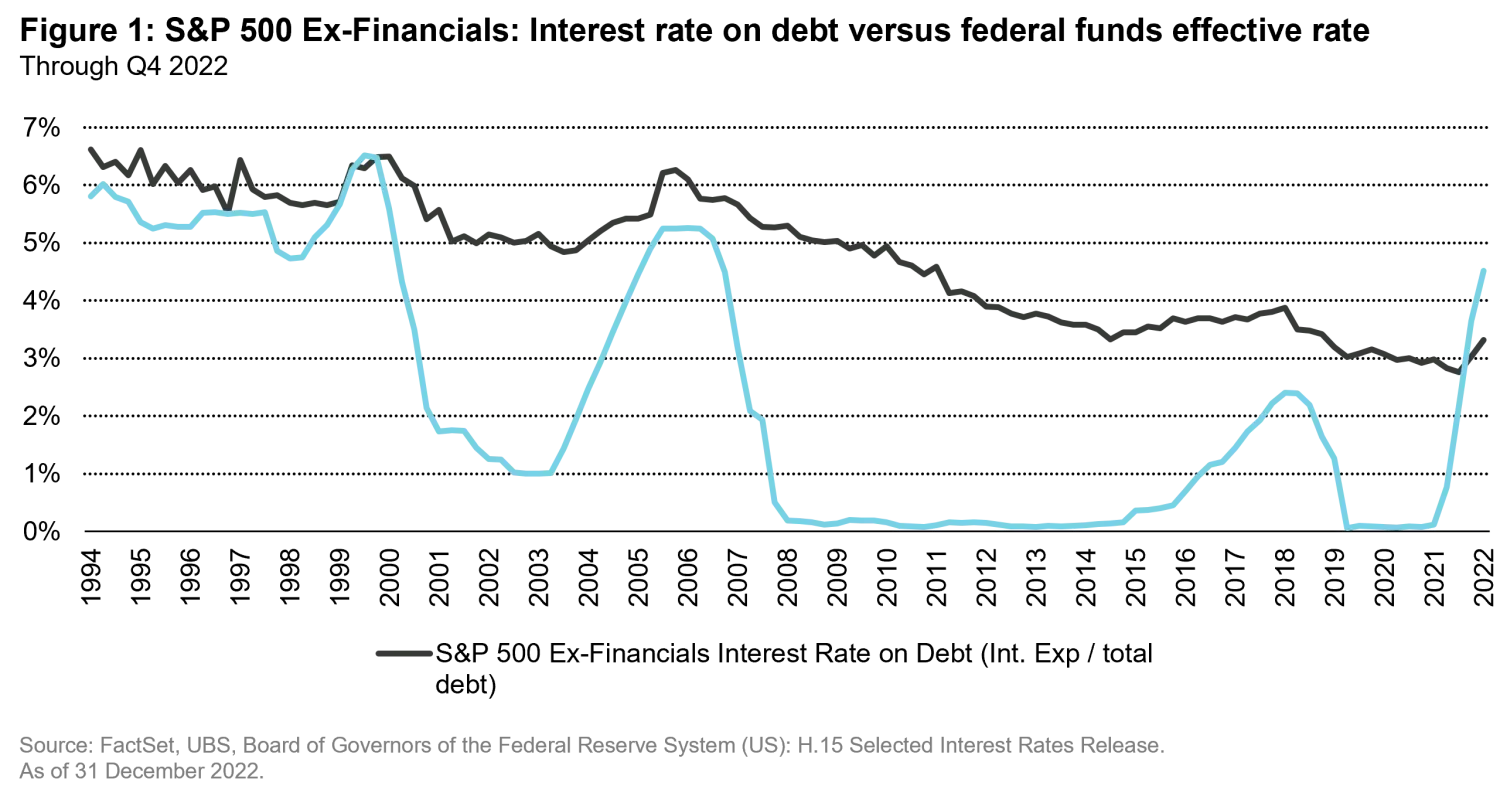

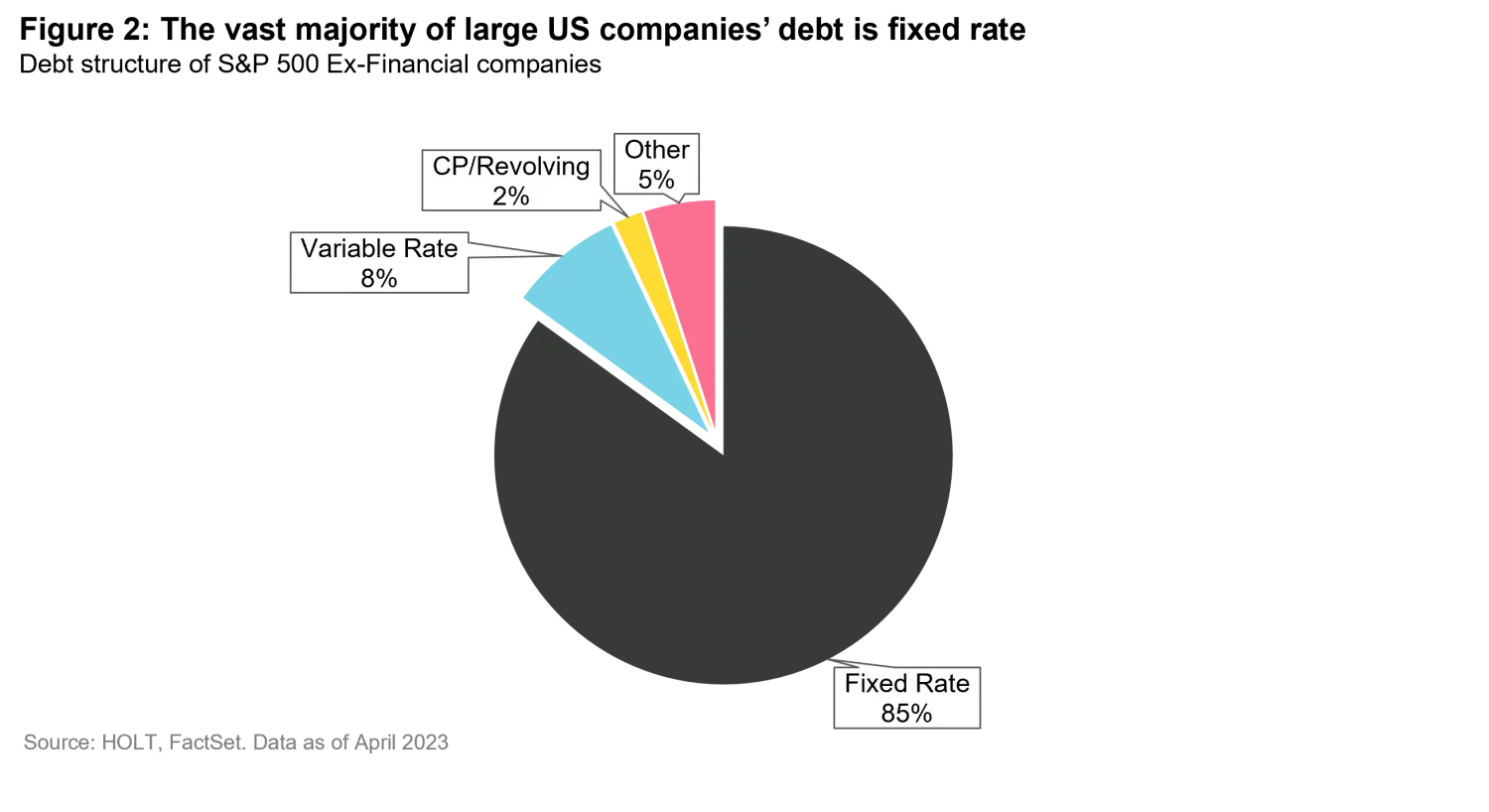

Rises in interest rates do not have the same impact on large cap publicly traded companies in the S&P 500 as they do for smaller or lower quality borrowers. That is since most of the lending takes place in the bond market where yields are generally fixed at the time of issuance. For companies that have taken on leverage to buy back shares or fund acquisitions, the cost of debt does not increase dramatically over the course of a year given the longer maturity period and fixed interest rates. However, companies that have been over-reliant on low rates to fund growth over the past decade will be in a tougher spot going forward with the cost of capital being materially higher than what they have become accustomed to.

In this article, we make the case for why now may be an opportune time to own quality companies that do not rely on leverage and whose earnings tend to be more resilient during times of economic weakness. The Vontobel US and Global Equity portfolios do not have exposure to banks. As a by-product of our investment philosophy and process, we have avoided the banking sector for some time as earnings growth tends to be lower than what we can find elsewhere and there are clear risks in the space. While we focus primarily on the bottom up, it is fair to say that the macro backdrop has become more favorable for our style of investing, and we remain focused on our goal of outperforming over a full market cycle with less risk for our clients.