Are EM bonds about to shine?

Fixed Income Boutique

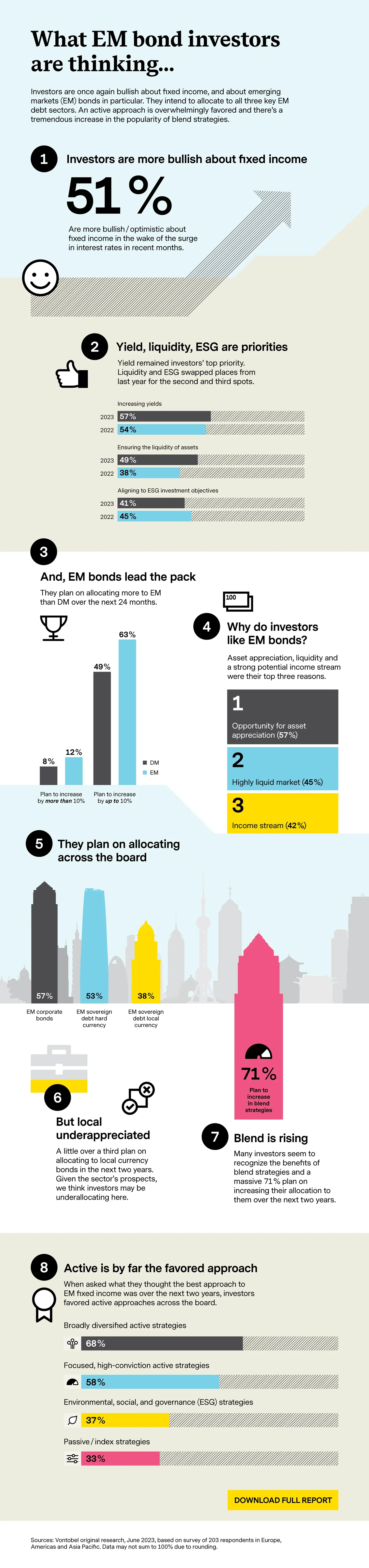

In this second edition of our annual fixed income survey, we once again spoke to sophisticated investors across the globe to canvas their views on emerging-market (EM) fixed income.

And, what a difference a year can make. After a very disappointing 2022, this year promises an upswing in EM bonds, including sovereign and corporate bonds, that could last for years. Investors told us that they are once again bullish on fixed income in general, but across all regions, a majority are planning to increase their allocations to EM fixed income in particular

What's the current attraction of EM Fixed income?

The most pressing reasons behind an increase in EM FI overall have evolved a lot since last year and vary from one region to the next, but for one: the opportunity for asset appreciation comes in the top 3 reasons across all regions.

Managing allocations across the EM fixed income segments can be difficult, and this is boosting the appeal of blend approaches, which can offer advantages in terms of positioning and ease of access to valuable opportunities.

Finally, our respondents confirmed that active approaches remain as popular as ever for EM investing strategies.

The second edition of our global investor study, surveying more than 200 investment decision-makers in Europe, the Americas and Asia Pacific, gives deep insights into investors’ EM fixed income views and expectations.

Discover what your peers are thinking and what, and why, they're planning on investing in over the next two years.