3 cycles to boost Emerging Market equities going into 2023

Conviction Equities Boutique

Key takeaways

- After a difficult year for Emerging market (EM) equities in 2022, there are strong arguments for a recovery in 2023.

-

Along with compelling relative valuations of EM to developed market (DM) equities, we identify three key cycles that could bottom out and provide a boost to EM equities next year:

- 1. Chinese equity performance

- 2. Revival in semiconductor sector

- 3. US dollar softening

- As a result, we see potential for a strong rebound in the equity markets of China, Taiwan and South Korea in 2023. These countries represent over 50% of the MSCI EM and 60% of Asia ex Japan indices respectively.

EM equities have endured a difficult and volatile year. At the end of October 2022, the asset class was down 29% in USD terms. This represents a significant underperformance to both DM equities (-20%) and US equities (-19%).

Looking ahead to 2023, there are however reasons for optimism. We have identified some key cycles that could turn in the coming months and provide a welcome boost to EM equity performance in 2023.

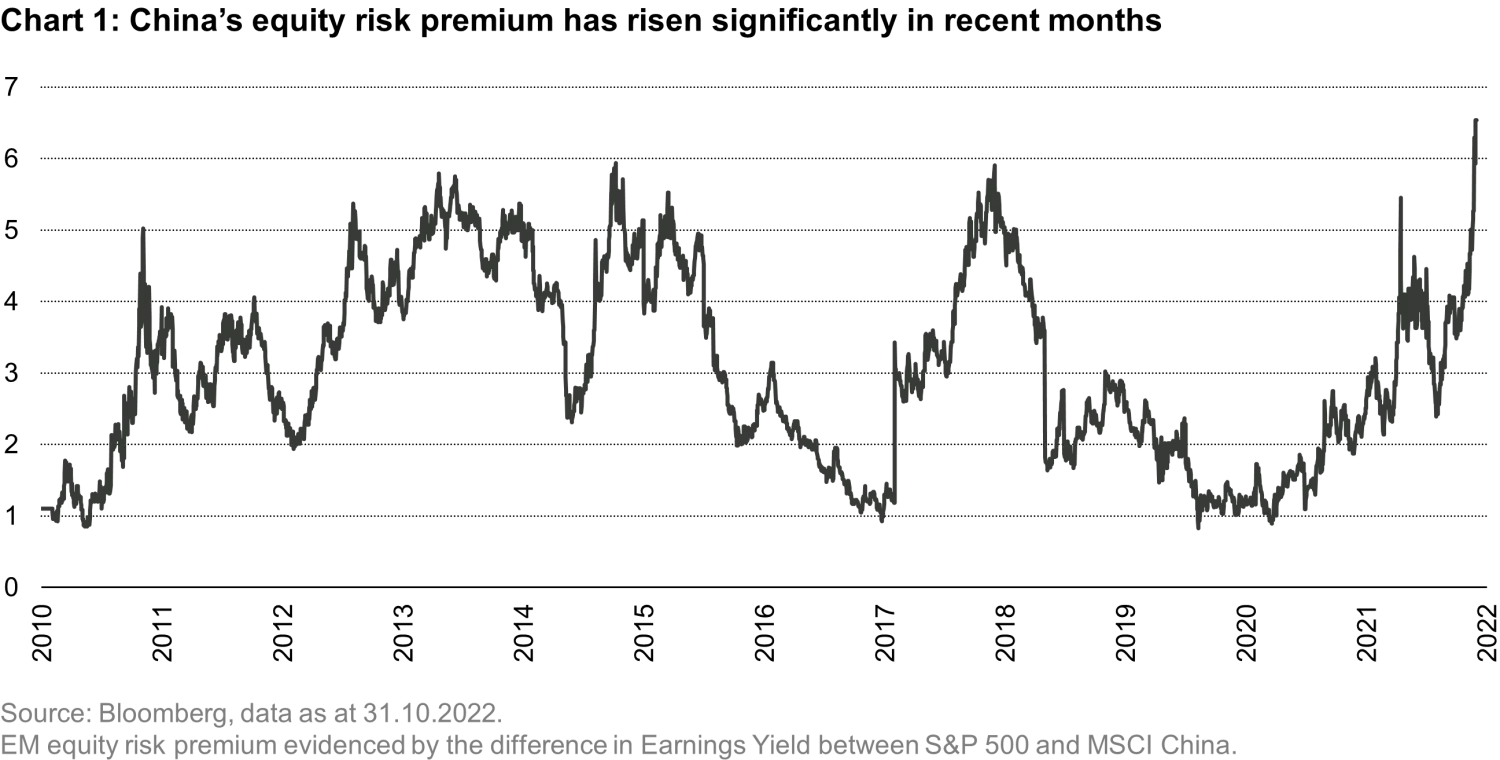

Cycle 1: The Chinese dragon could roar again

Arguably the most important catalyst for EM equities given it makes up around 30% of the index, Chinese equities have been beaten down badly. Since the beginning of 2021 to the end of October 2022, the MSCI China index has fallen by a remarkable 55%, representing a staggering underperformance of 60% compared to the S&P 500. Most recently, the market reaction to the 20th National Party Congress was in our view completely overblown. With Chinese equities now trading in the 19th percentile in terms of their historic valuation, there are strong reasons to believe that the worst is behind us.

There are some key potential catalysts for a rebound in China, most notably the country moving to a point where it is living with Covid. Despite the strong rhetoric espoused at the congress (which was to be expected), top leadership’s language regarding its zero-Covid policy has since evolved and is noticeably milder. The most recent announcement in early November discourages unnecessary policy steps and a one-size-fits-all approach, underscores efforts to maintain normal order and promotes vaccination among key groups. Quarantine time for travellers and close contacts has been reduced from 10 to 8 days and airlines are no longer being penalized for bringing virus cases into the country.

A change in approach to China living with the pandemic would be a big boost to its economy and the confidence of the Chinese consumer. We would expect this to have a positive impact in many industries, not least the real estate sector which should also receive further support from the central government.

Cycle 2: The chips have been down but not out

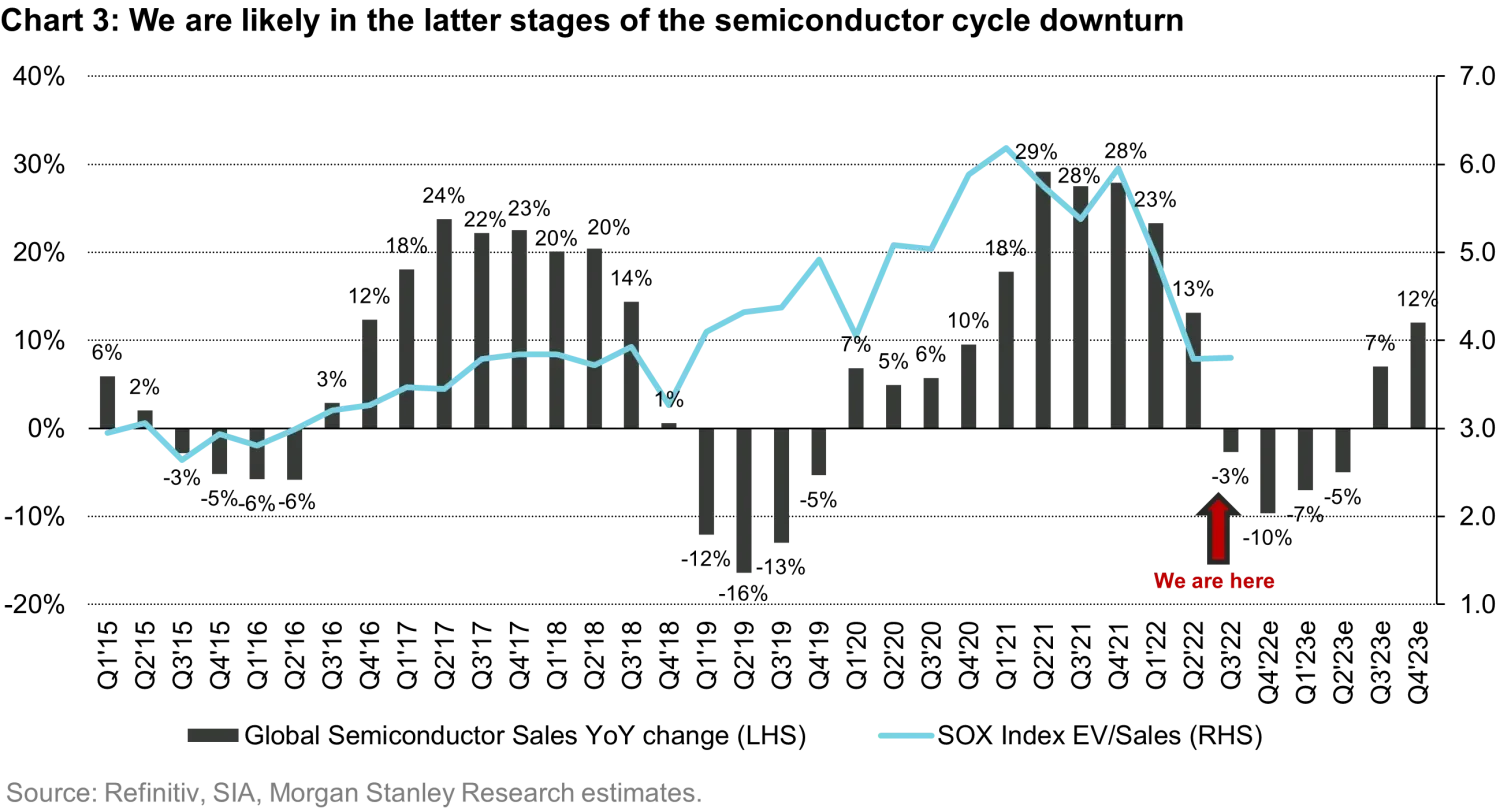

With the global economy in slowdown, many leading semiconductor names have been ruthlessly discounted by the market, as demonstrated by the Philadelphia Stock Exchange Semiconductor index (SOX) return of -39% over the year to the end of October.

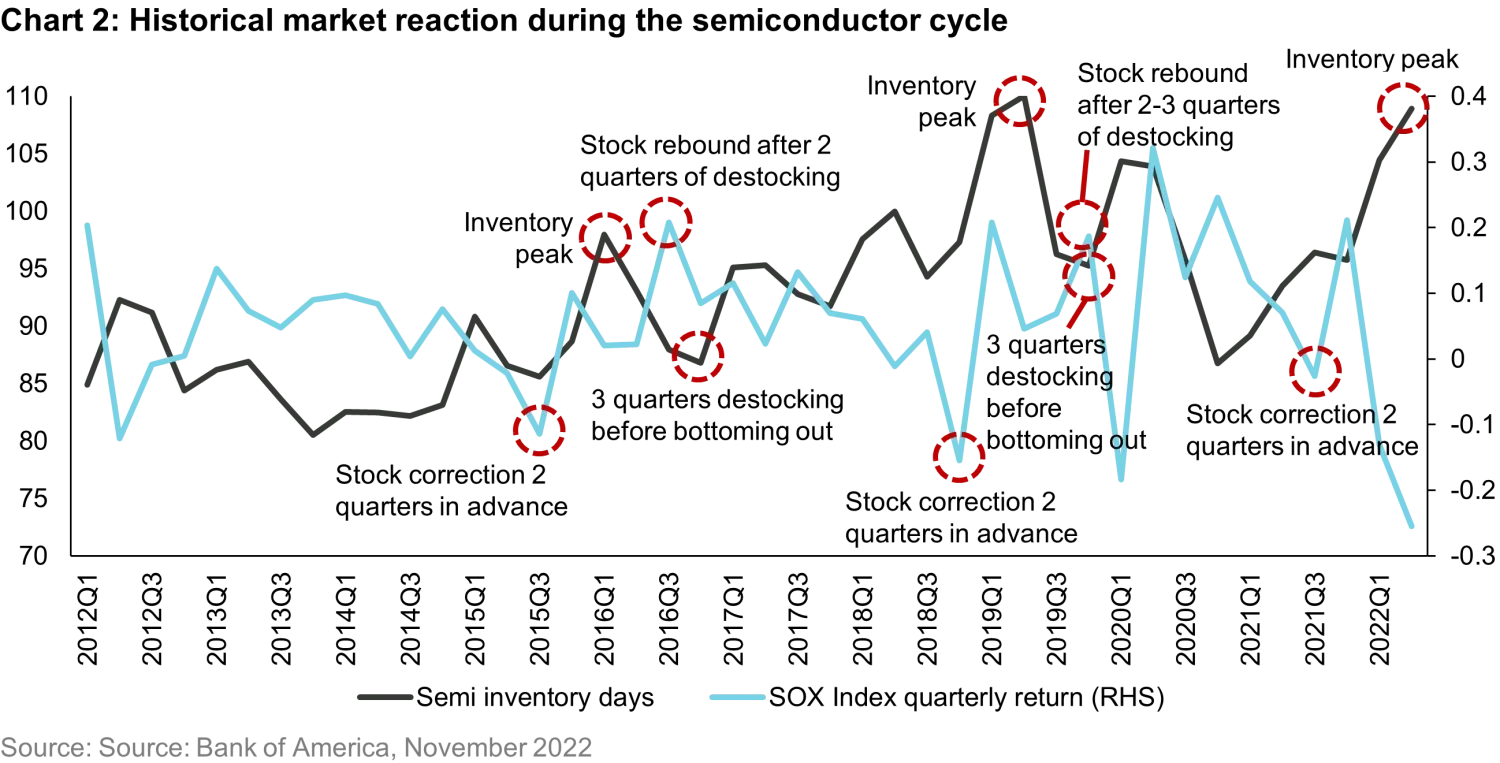

To make sense of this scale of underperformance, it is important to understand how the market typically behaves during the cycle. On the way down, the market has historically corrected two quarters in advance of inventory levels peaking. In the context of this year, we can clearly see in the following chart that the stock prices for semiconductor stocks have been in free-fall since January 2022, well in advance of the inventory peak. The same logic applies on the way up with the market typically starting to rebound 1-2 quarters ahead of the inventory trough.

Given that the market has already discounted the fall-off in sales during the latter stages of 2022 and first half of 2023, it will start to focus on the up cycle expected to come during the second half of next year and into 2024. For this reason, we expect to see a rerating of semiconductor names during the first half of next year.

We are 5 quarters into a downturn period that typically lasts 4-6 quarters (see chart 4). Even if we assume a longer downturn due to a recession that is worse than feared, the arguments for a rerating next year are compelling. In that scenario, we can expect the equity markets of Taiwan and South Korea to rebound significantly in 2023 given their exposure to the industry, with semiconductor names making up 50% of the MSCI Taiwan index, for instance.

Cycle 3: US Dollar could soften now the Fed has completed most of its heavy lifting

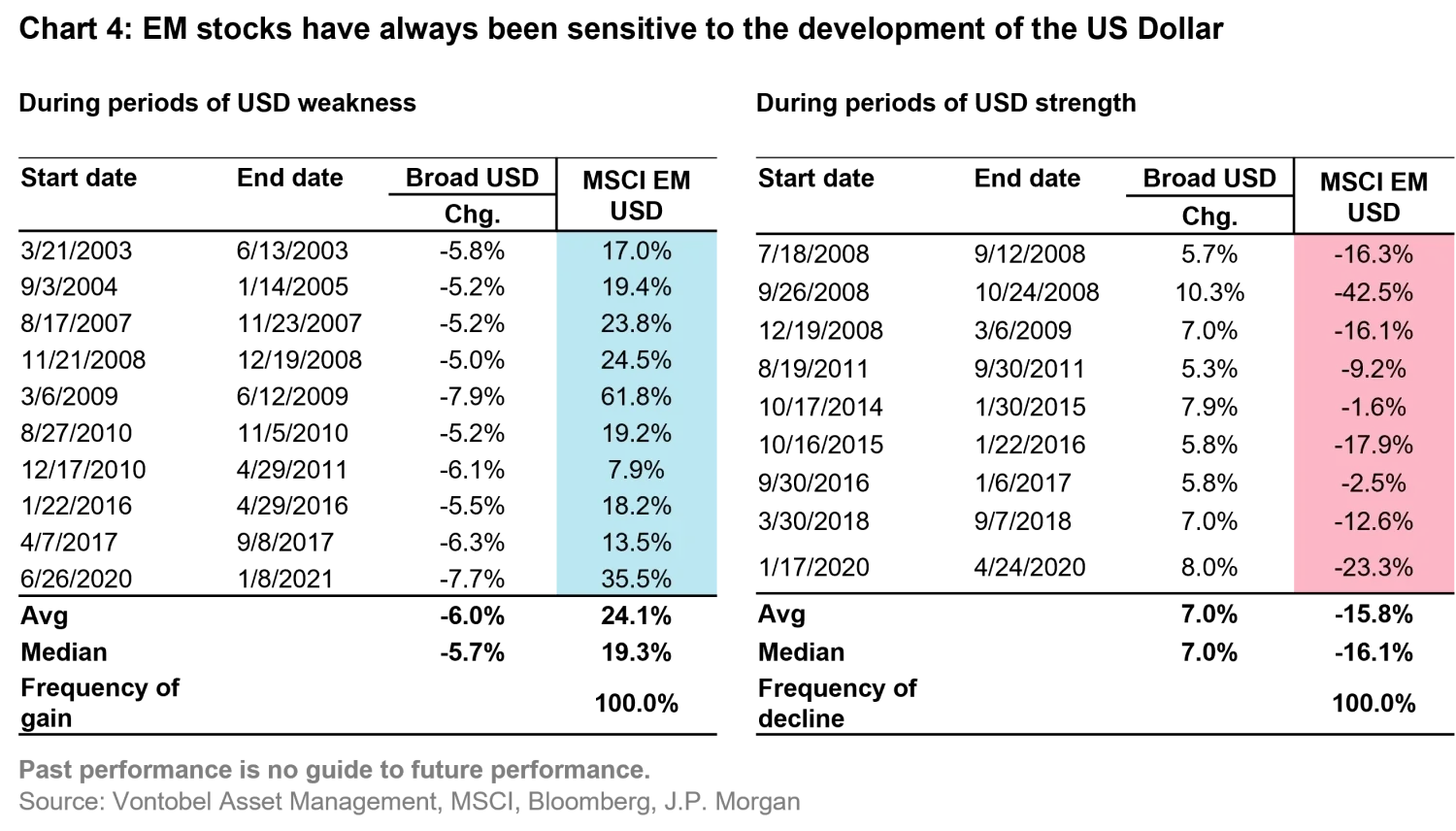

Given the speed at which the US Federal Reserve has increased interest rates this year, it is no surprise that the greenback has strengthened significantly. US Dollar strength is a negative for EM equities and vice versa. However, with the latest CPI figures in October indicating a slowing in the rate of US inflation, the Fed may be able to start taking its foot off the pedal in terms of future rises.

This could be very good news for EM equities and with investor allocations to EM equities 2.5% below their long term average of 9%, an uptick in sentiment could signal large flows into the asset class. To put this opportunity into context, JP Morgan estimates inflows of approx. $750bn would provide a return to the average long term allocation of 9%.

Conclusion

Following a difficult 2022, there are sound reasons to believe that EM equities could deliver a strong rebound in 2023. A bottoming of the 3 cycles we identified, could act as a catalyst for a strong recovery in the asset class, driven by Asian equities given the combined index weight of China, Taiwan and South Korea. Importantly, active managers can take advantage of these opportunities and position their portfolios to benefit their clients.