Vescore Global Market Outlook December 2022

Quantitative Investments

Key takeaways

- Market volatility has decreased significantly

- The economic downturn is gaining ground across the world

- Declining uncertainty on the equity market is resulting in a slight equity overweighting

- Prospects on the bond market are neutral in the short term

- The temporary period of structural change could change the long-term face of financial markets

Waiting on the Fed

December was always a fun month for me when I was a child, with 24 little gifts waiting for me in my advent calendar. Ever since I started working in the financial sector, this fun has given way to concern that the mood might be spoiled by an announcement from the US Federal Reserve, which meets in mid-December every year, shortly before Christmas. The Fed’s monetary policy meeting promises to be particularly exciting this year, as risky asset classes have rallied considerably since early October in expectation of an imminent change of monetary policy direction. This raises the question of whether the Fed will hint at a gradual end to the cycle of interest rate hikes as early as December.

Certainly, the arguments that the cycle of interest rate hikes will come to an end soon have increased; consider, for example, declining inflation rates, the gradually flagging labor market and the overall economic downturn. Nevertheless, the US labor market is still at full employment, with wage growth of 5% falling outside the range compatible with the 2% inflation target. This is compounded by the decline in the base effect responsible for the current decrease in inflation from April 2023 and increasing structural inflationary pressure.

Essentially, the Fed has two options in its mission to tackle inflation:

- Continue the cycle of interest rate hikes until the US economy is on the brink of recession, which will likely cause inflation to decrease significantly.

- Pause interest rates for a longer period, allowing the Fed to wait and see what effect the previous hikes and balance sheet reduction will have.

While the second strategy – provided that inflation falls – would likely shore up investor risk appetite in the months ahead, the first option would probably be a hard pill for financial markets to swallow in the months ahead.

Both our risk model (SDRM) and the Wave are signaling increasing risks of recession, especially in the US. However, this recession could be comparatively mild, especially if the Fed goes for the second option. Low sensitivities of the model variables in our allocation models for equities and bonds imply that both options are highly probable and that a more neutral positioning seems appropriate.

Would you like to gain further exciting insights into our in-house business cycle model? Then register now for our monthly Wave Call.

Risk environment: Significant decline in volatility

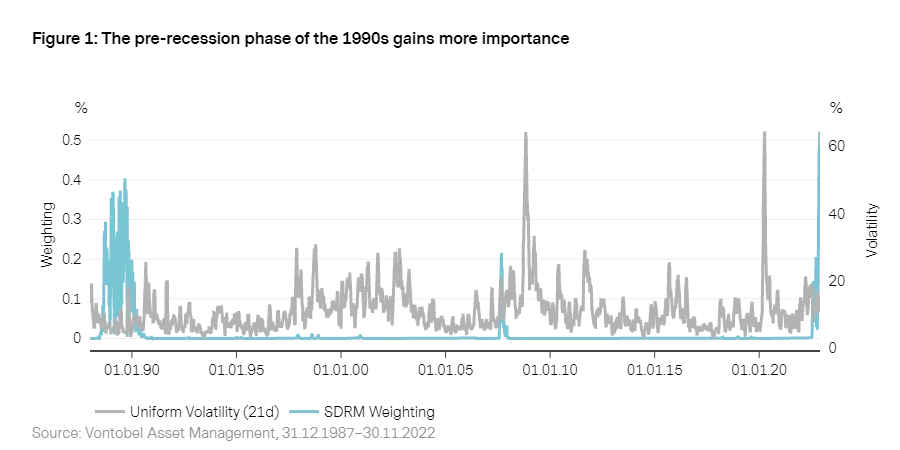

The phase prior to the recession at the start of the 1990s became far more important in our SDRM model in November, which compares the similarity of past market situations with the current market environment. Of the 50 most similar days in the past – the closest neighbors to today – almost exclusively days in September 1989 stand out.

Looking at historical events at this time, the US passed the Financial Institutions Reform, Recovery, and Enforcement Act of 1989 (FIRREA) in August 1989 in response to the savings and loan crisis of the 1980s1. This act allows the Department of Justice to prosecute and sanction banks that knowingly issue risky loans. During the crisis, thousands of savings and loan institutions went bankrupt, one of the causes of the 1990/91 recession.

Despite increasingly strong signs of an economic downturn and a still hawkish Fed, the decline in equity volatility suggests that the market is stabilizing. The VIX Index decreased from 33 basis points in October to 22 points at present, the lowest level seen in the last three months2. Both the S&P 500 and the German benchmark DAX index made considerable gains in November. As well as lower inflation risks and reduced risks of an energy crisis thanks to low energy prices in Europe, this is also because the situation for companies in Europe has improved as a result.

Uncertainty is also easing on the bond market. However, the MOVE volatility index, which measures the implied volatility of US Treasuries with varying maturities, remains at a historically high level. Nevertheless, at 132 basis points it is still well above its long-term average. After the 2008 financial crisis until the end of 2021, it tended to range from 50 to 100.

1. The savings and loan crisis (S&L) was the largest banking collapse since the Great Depression in 1929. More than 3,000 savings and loan institutions in the US became insolvent by 1995.

2. Since the pandemic, the VIX Index has ranged from 20 to 30, compared to between 10 and 20 basis points in the 10 years before the crisis.

Macroeconomic environment: Downturn gains ground

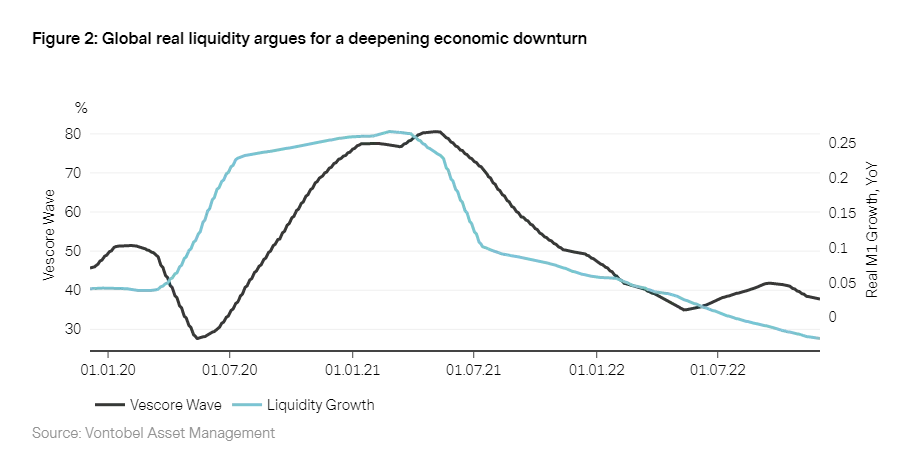

Since December 2021, the Wave has been signaling the most negative phase of the economic cycle for risky asset classes – contraction – at a global level with few exceptions. While the bear market rally between June and August was explained by tentative signs of recovery, the Wave no longer has an explanation for the rally that set in in October. In fact, with the exception of the asset prices included in our model, all sectors of the economy deteriorated in November.

Real global liquidity, the forward-looking element of our economic cycle model, even indicates that the economic downturn is getting worse. The liquidity indicator on developed markets has not experienced such a sharp decline (currently down 4.2%) since the start of the 1980s. As a result, the Wave puts the probability of remaining in “contraction” globally at 93%.

Labor market loses momentum in developed markets

Economic conditions in developed markets remain weak (contraction). Nevertheless, the labor market is now increasingly losing momentum, despite the fact that unemployment in almost all developed markets is still at a historic low. Tight monetary policy in particular is one indicator that economic conditions will not see any sustained improvement in the months ahead. Although less aggressive interest rate hikes can be assumed, the Fed’s balance sheet reduction (quantitative tightening) is becoming more aggressive. The eurozone Wave is in “recovery” for the second consecutive month thanks to lower risks of an energy crisis.

Wave of infections hurts China in the short term

Although neither the COVID strategy nor the real estate sector played a major role in Xi Jinping’s speech at the 20th National Congress of the Chinese Communist Party, the economic stimuli for the real estate industry and easing of COVID restrictions announced since are worth noting. Nevertheless, the current wave of infections in China is taking a toll on the economy, prompting stricter lockdowns and causing economic momentum to falter. The Wave is again in contraction. However, expansive monetary and fiscal policy indicates a high likelihood of recovery if the lockdowns are relaxed again. Latin America (expansion) and, recently, eastern Europe3 (recovery) are currently experiencing an economic upturn, with eastern Europe benefiting from the reduced risks of an energy crisis.

3. Excluding Ukraine and Russia

Equities: Declining uncertainty results in slight overweighting

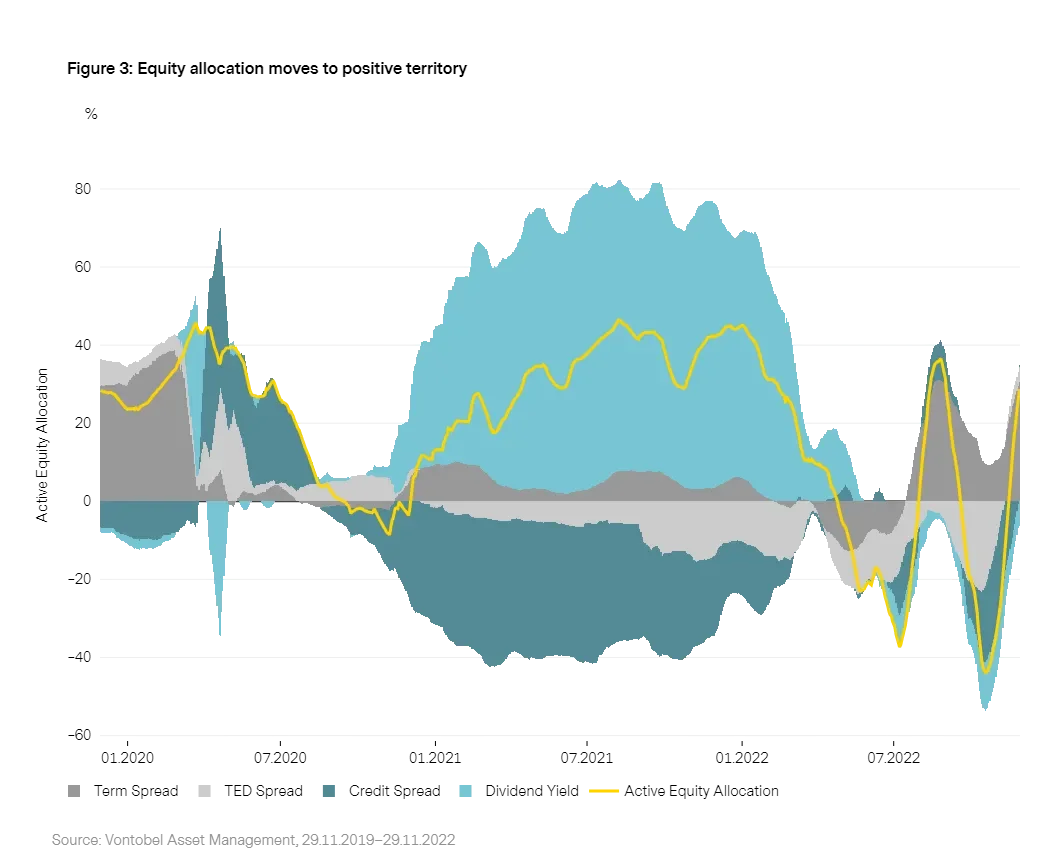

Uncertainty on equity markets has reduced considerably over the last month. At 22 basis points, the VIX Index reported its lowest level in the last three month. This development suggests that investors consider the risk of an energy crisis and thus a severe recession increasingly unlikely.

Our equity allocation model shares this more optimistic view: In November, the tactical equity weighting shifted from underweight to overweight and is now 76,2% (previous month: 37.8%). Both the TED spread and the term spread contributed to this new overweighting. The latter has been in negative territory since this month and represents the most important individual allocation contribution at 24.3%.

The credit spread, which has declined over the last month, and the dividend yield still have a negative contribution. Sensitivities in the model that shows the sensitivity of the allocation to variation in the four instrumental variables are currently very low. As a result, the model is not strongly convinced about the correlation of the variables and so does not take major risks.

Bonds: Neutral weighting for bond model

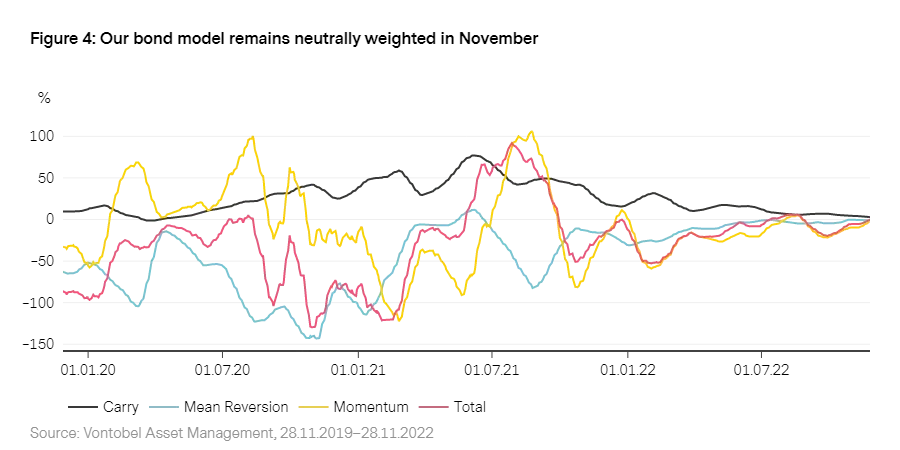

On the bond market, investors are continuing to focus on inflation, with price developments in the next year dependent on how stubborn inflation proves to be and how much the global economy slows down. Meanwhile, the yield curve inversion has been at its highest level since the start of October due to the sharp decline in long-term bond yields, sending the clearest signal so far that the economy could be facing a downturn.

Our bond model weighting remains neutral in November. While the sub-model carry4, which we use to forecast future changes in the yield curve, still envisages a slightly positive positioning, the mean reversion sub-model5 currently rates bonds neutrally. The momentum component6, which responds to market sentiment, rates bonds slightly negatively and has continued to decrease the short positioning over the last month. In the current environment, Canadian and US government bonds are negatively allocated.

4. Carry strategies generally assume no or only minor changes in the yield curve.

5. Mean reversion strategies are based on the idea that short-term interest rates signal convergence to a dynamic equilibrium.

6. The momentum component takes account of the fact that yield curves could change very substantially and permanently in a short period of time as a result of major announcements by central banks and political decisions.

Current topic: The new face of markets in 2023?

The financial markets are currently experiencing a period of structural change, characterized by high volatility, low real yields and changing correlations between key asset classes. These changes are down to a well-known factor: inflation. To the displeasure of investors accustomed to liquidity, this forces central banks to focus on price stability at the expense of economic growth.

If this current trend continues, it could result in structural change and, in turn, a new regime on financial markets. This would result not only in changes to key features of market risk and yields that have been considered self-evident for the last few decades, but also to investor requirements. Investment solutions thus also need to adapt to the new market conditions if attractive investment performance is to be maintained.

The future face of markets hinges largely on how inflation develops. We assume that it will settle at a high level this year and potentially beyond this. This means that investors will have to grapple with three fundamental changes:

- Higher interest rates

- Higher volatility

- Higher correlations

This has profound consequences for how successful investment strategies tap sources of yields and manage risks. Provided that the new market conditions are taken into consideration, asset price performance will likely continue to offer high value to investors who are willing to move away from outdated assumptions and embrace the new face of markets in 2023 and, potentially, beyond.7

7. See “Breaking with the past: the new face of financial markets in 2023 and beyond”, https://am.vontobel.com/insights/breaking-with-the-past-the-new-face-of-financial-markets-in-2023-and-beyond

Important Information:

Past performance is not a reliable indicator of current or future performance. Indices are unmanaged; no fees or expenses are reflected; and one cannot invest directly in an index.

Any projections or forecasts contained herein are based on a variety of estimates and assumptions. There can be no assurance that estimates or assumptions regarding future financial performance of countries, markets and/or investments will prove accurate, and actual results may differ materially. The inclusion of projections or forecasts should not be regarded as an indication that Vontobel considers the projections or forecasts to be reliable predictors of future events, and they should not be relied upon as such. Diversification and/or asset allocation neither assures a profit nor eliminates the risk of investment losses.

Vontobel reserves the right to make changes and corrections to the information and opinions expressed herein at any time, without notice. This document is for information purposes only and does not constitute an offer, solicitation or recommendation to buy or sell any investment instruments, to effect any transactions or to conclude any legal act of any kind whatsoever.