Cloudy with a Chance of a Bear Market

Quality Growth Boutique

The global economy is, in our view, at its most uncertain point since the onset of the global financial crisis (GFC) in 2008. The world is facing multiple challenges – rising inflation, the end of monetary easing, supply chain disruptions, ongoing lockdowns in China and a tragic war in the Ukraine.

During JP Morgan Chase’s first quarter results announcement, CEO Jamie Dimon highlighted plans to build reserves to account for the increased probability of downside risk from the impact of high inflation and the Ukraine conflict. We agree with Mr. Dimon that the best way for investors to navigate macro uncertainty is to prepare.

Strangely enough, the equity market seems somewhat relaxed about the piling up of macro risks, despite numerous red flags. Valuation multiples are well above the long-term average, yet market strategists at the major investment banks are predicting the S&P500 will reach 5,200 by year-end, a 25% upside from the recent closing price.

Here are three reasons why we think investors are not discounting the possibility of a bear market. In such a scenario, we believe a portfolio of quality stocks is the best tool for investors to minimize capital loss.

1. Valuation and consensus have no margin of safety built in for increased macro risks

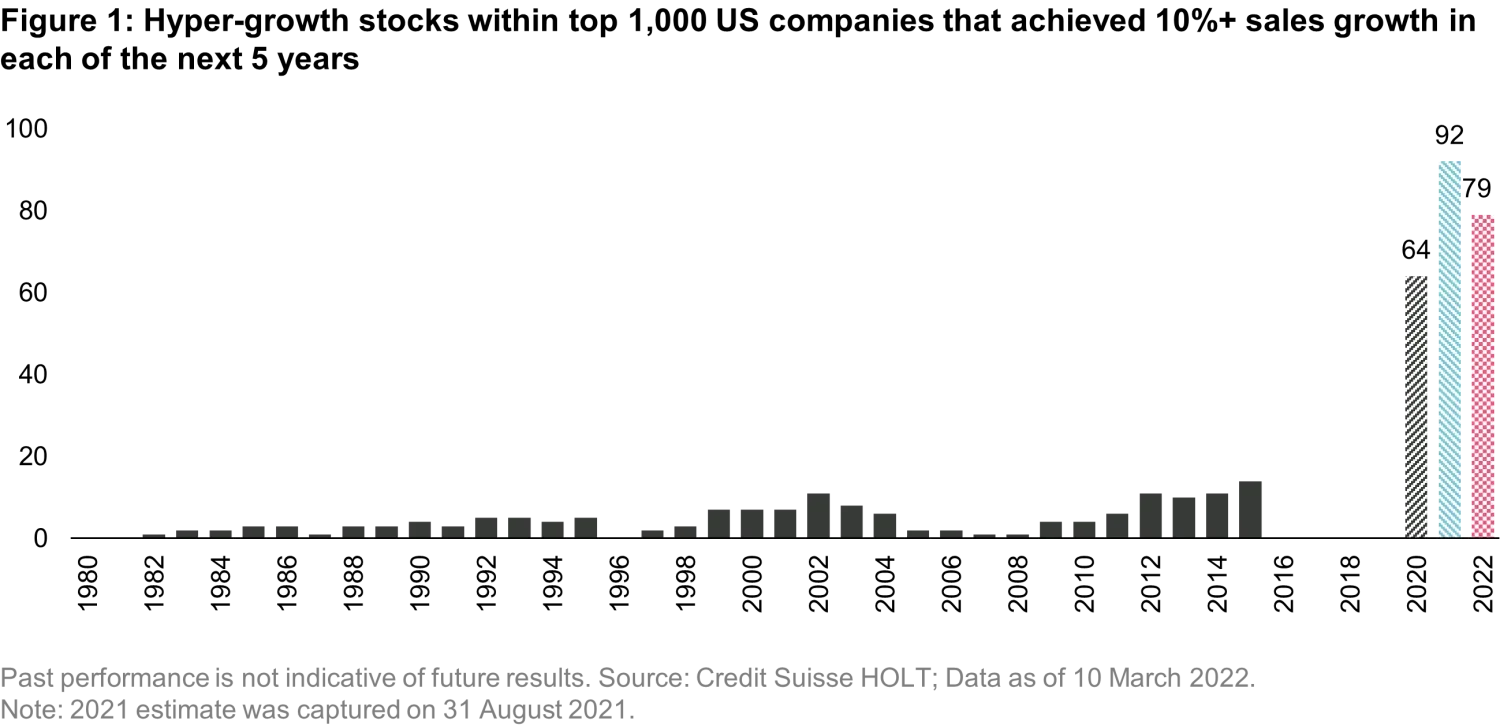

Consensus for the S&P 500 expects 12-month EPS growth of 10%, with corporate earnings forecasts to return to their pre-COVID trend by the end of this year. The expectations are particularly rosy among the hyper-growth companies, the most speculative segment of the market. Since the 1980s, the number of hyper-growth companies – those that can sustain sales growth of more than 10% a year for at least five years – has been in the low-teens, on average. Today, consensus is betting that more than 70 companies will achieve that feat (Figure 1).

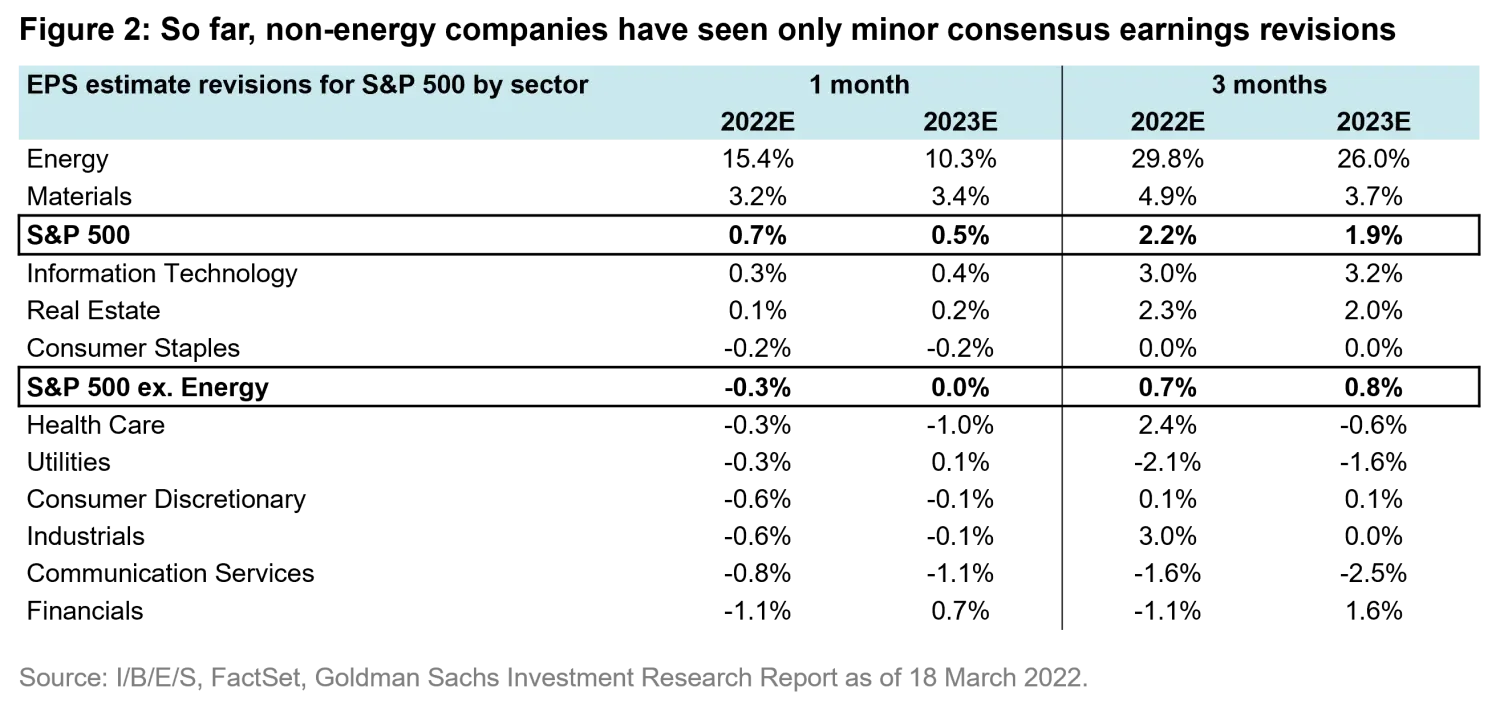

Consensus numbers for non-energy companies have barely changed in the last three months (Figure 2). In essence, consensus is betting on a return to normalcy. For now, at least, the market believes that macro headwinds are an afterthought. But it’s worth remembering that during recessions over the last 30 years, earnings declined between 20%-50%.

On valuation, the market is trading at a forward P/E multiple of 19x compared to the long-term average of 16x. In 2018, the last time the Fed funds rate was at 2.4%, close to the current Fed target, the market traded at 14x P/E. During the GFC, it reached a trough of 11x. In contrast to that time, the banking system is much better capitalized now, and we think it is unlikely for the market to fall to such extremes. Nevertheless, as an exercise, if earnings correct to the median of past recessions (25%-30%) and multiples reverse to 14x-16x, then an equity market correction of 30%-40% is possible.

2. While consensus numbers are bullish on earnings growth, they have not been a reliable historical indicator for corrections

Bear markets do not send advance warnings. It usually takes a surprise event to push markets into correction territory – such as the failure of Lehman Brothers which spurred the GFC. We might have thought that the war in the Ukraine and its aftermath (for example, the spike in commodity prices) would be enough of a shock. The reality, however, is that consumers in the US continue to spend, the housing market is tight, and corporates are delivering on earnings expectations. Investors anchor their forecasts to recent trends and so long as backward-looking economic statistics stay positive and company managements maintain their guidance, the market will continue to chug along.

Nevertheless, we would caution investors not to get too comfortable. First, we are starting to see some companies begin to lower guidance in the low-quality segment of the market. Companies with no pricing power are struggling to offset the spike in raw material costs and the disruptions to supply chains. Vestas, one the largest manufacturers of wind-power turbines, recently guided for margins close to break-even for 2022. In the consumer space, consensus numbers for Electrolux, one of the largest home appliance manufacturers, fell by 20% after the company reported weaker-than-expected 1Q numbers. Even Domino Pizza’s 1Q results were below expectations due to significant pressure in its delivery business from a lack of delivery drivers to meet demand.

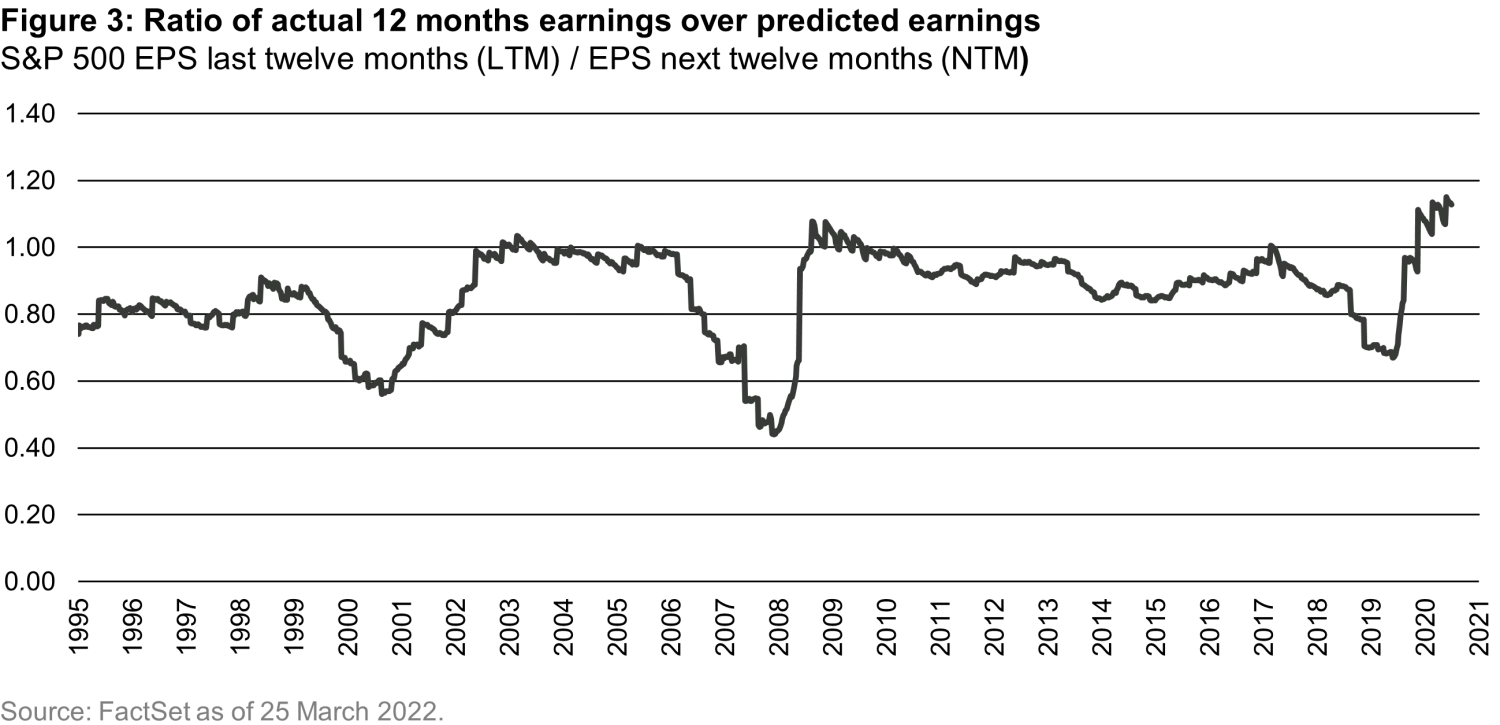

Historically, consensus numbers have been unreliable for predicting inflection points. We analyzed the relationship between predicted and actual earnings over the last 25 years by calculating the ratio between actual 12-month earnings and predicted earnings. A ratio lower than one means that actual earnings turned out to be lower than the forecast, in other words too optimistic. (Figure 3). We point to two interesting takeaways from the chart below. The first is that, on average, the ratio is below 1. The second is that the variation in the ratio is higher before recessions and recoveries (1999/2001; 2006/2008; 2017/2020).

It is impossible to predict what event will trigger a market correction but Mara Der Hovanesian, one of Vontobel’s investigative analysts and our “CSO” (Chief Skeptical Officer), has been warning us about the mushrooming volume of corporate debt, particularly in the leveraged loan market (private high-yield debt). Over the past decade, the leveraged loan market has trebled to about $1.4 trillion, while the larger corporate bond market almost doubled to about $10 trillion in 2019.

While traditional banks have faced lending and capital ratio limits because of regulation following the GFC, other so-called shadow lenders – mostly private equity, insurance companies, pension funds and CLO managers (professional loan investors) have faced fewer constraints. In its first annual risk outlook, the Office of the Superintendent of Financial Institution (OSFI), Canada’s financial system regulator, warned of the increased reliance on high-yield debt and leveraged loans, including covenant-lite loans, which contain fewer protections for lenders. The risk, according to OSFI, is that in a volatile market, those assets are more exposed to increases in financing costs, liquidity demands, and re-financing appetite. Since institutional investors (insurance companies, pension funds, etc.) are the largest owners in this asset class, a sell-off in high-yield instruments could potentially spread to the broader capital markets.

3. Value stocks may not be as cheap as you think

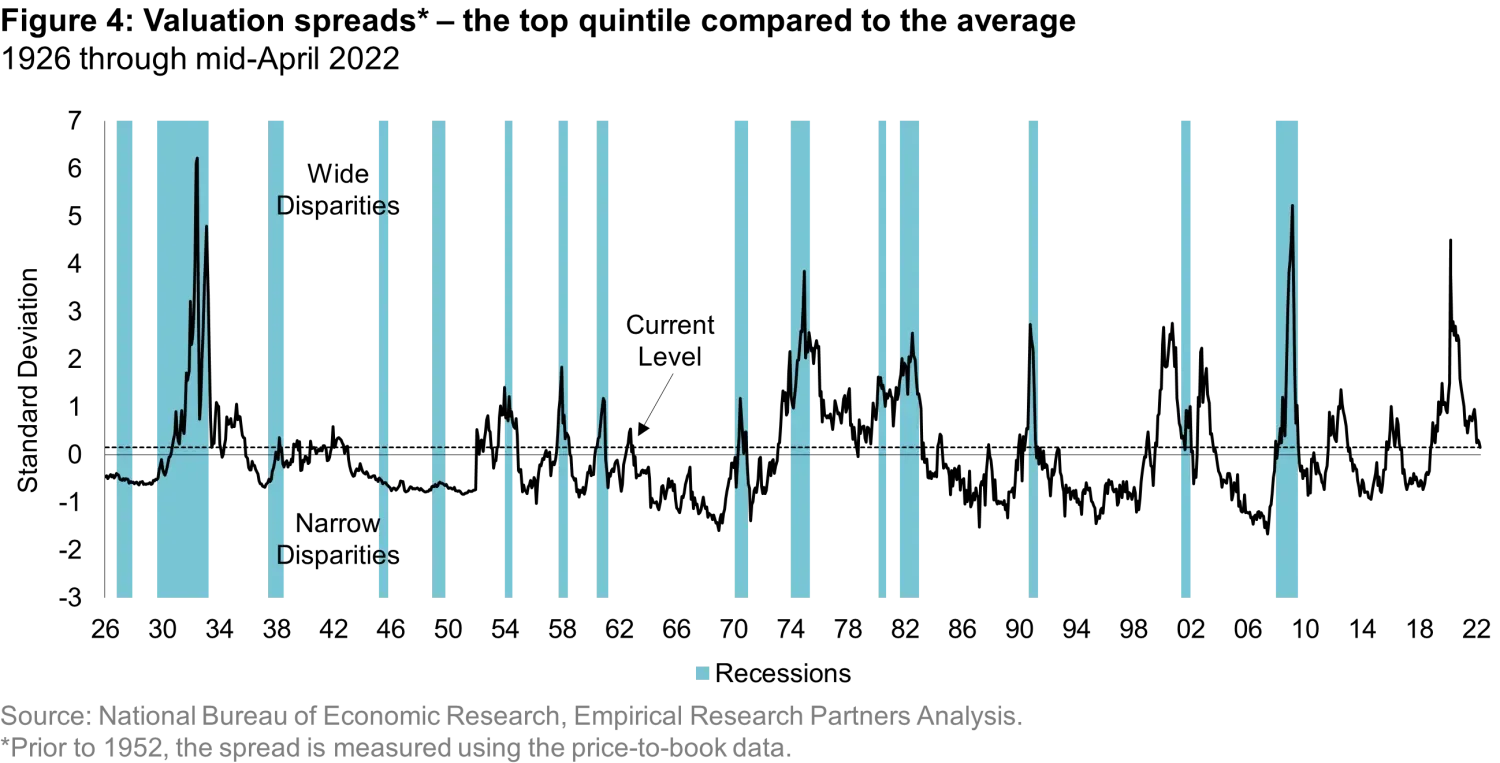

The stocks of low-quality businesses, also known as value stocks because they trade at a lower P/E than the market, have outperformed in the last couple of years, as the market re-priced the reopening of the economy after COVID and factored in the impact of higher interest rates on valuations. While value stocks, on average, continue to trade at a discount to the market, the discount has narrowed in comparison to the long-term average (Figure 4).

We believe multiple outperformance between quality and low-quality stocks will become less relevant for total relative performance in a steady-eddy economy. Therefore, outperformance will most likely come from relative outperformance (dividend yield + earnings growth). This is great news for quality growth investors who rely on predictable total returns, rather than multiple expansion, for stock selection.

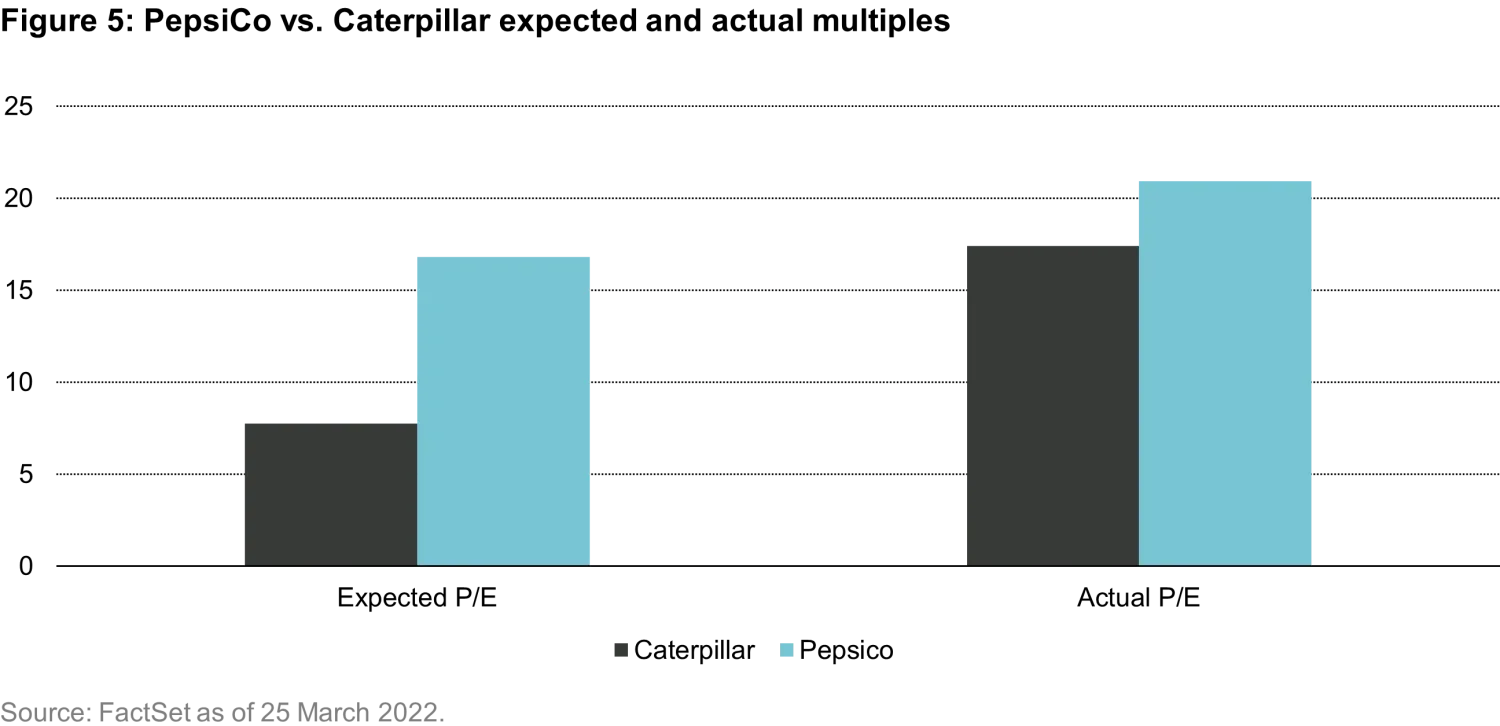

If, however, the economy falls into a recession, negatively impacting consensus earnings, we would argue that earnings of quality businesses should defend better than low-quality ones, and the valuation premium between high-quality and value stocks may not turn out to be as large as the current multiples indicate. To better illustrate this point, we compared the P/E multiples of PepsiCo and Caterpillar before and after the GFC. Before, PepsiCo stock traded at a premium of 117% to Caterpillar, and afterwards at a much narrower premium of 20%. But while Caterpillar revenues and margins contracted by 37% and 700 bps respectively over the period, PepsiCo’s were flat. Thus, PepsiCo outperformed significantly during the GFC, despite its much higher initial P/E multiple.

Quality stocks can defend better in recessions

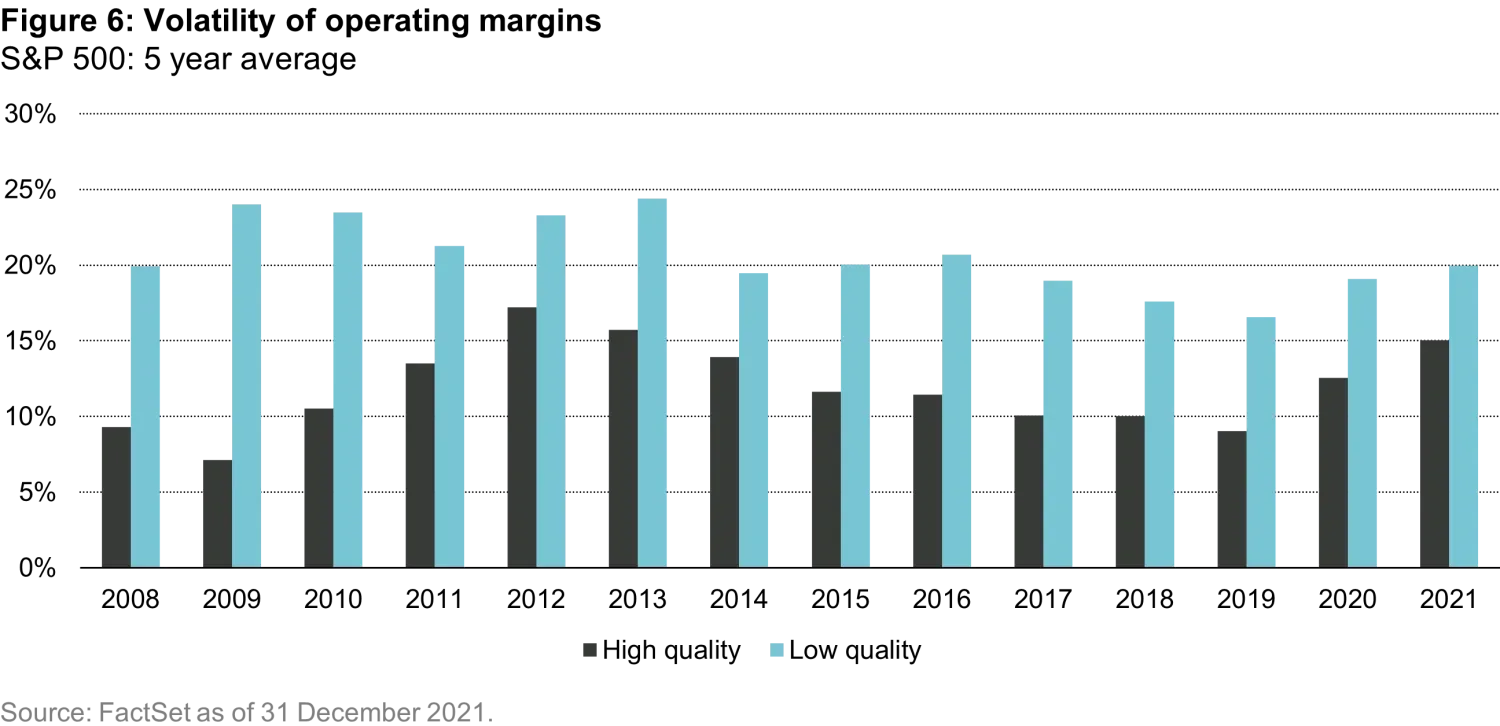

Quality companies tend to have more pricing power and lower demand elasticity, which can lead to lower earnings volatility (Figure 6). In the 1Q22, Sherwin Williams (SHW), the largest US coating company reported better-than-expected results because its pricing power more than offset the spike in raw material costs. Rob Hansen, the analyst who covers Sherwin Williams at Vontobel, explains that the pricing power is due to low elasticity of demand and branding. Paint is small in relation to the total cost of a paint job, in which labor costs account for the largest proportion (~85%.) Furthermore, SHW is the leading promoter of its own brand, whereas competitors often rely on large home centers and distributors.

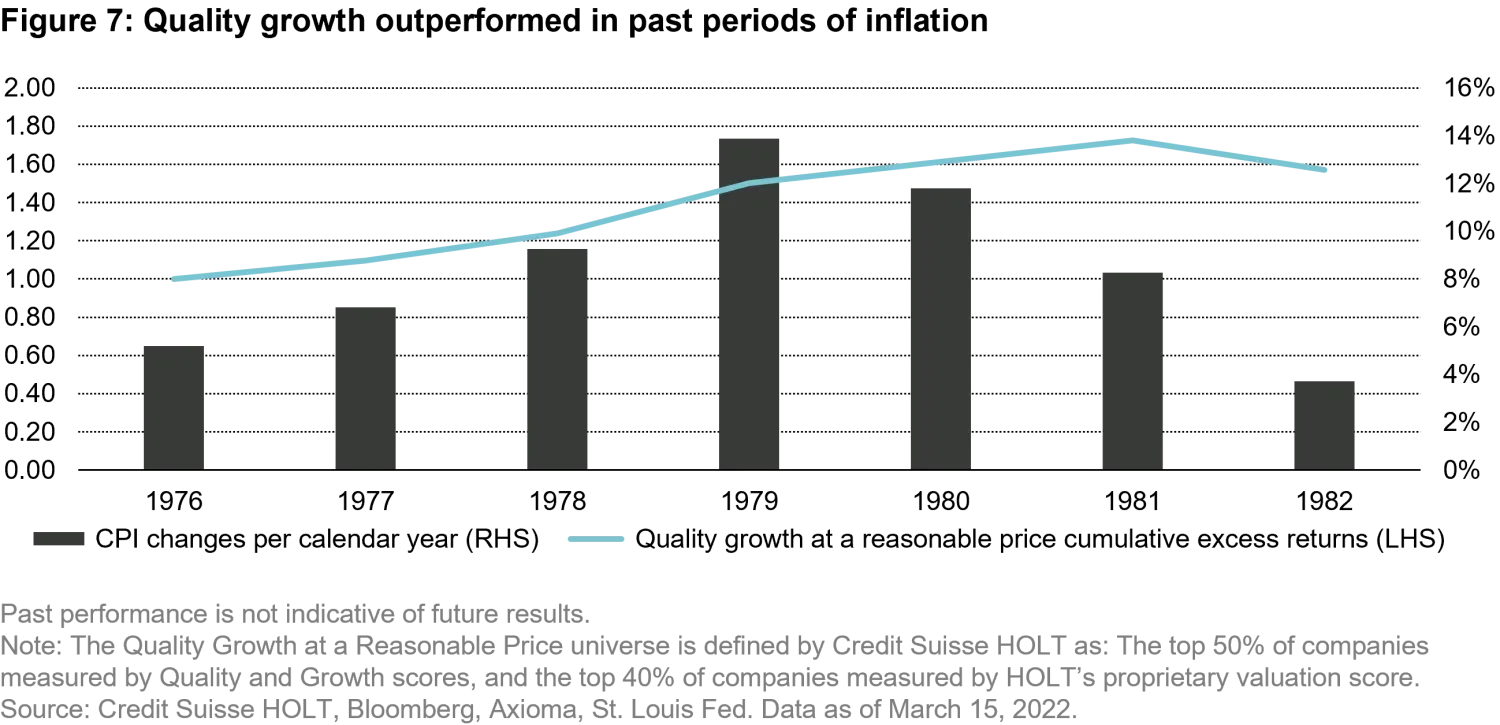

Quality companies operate with higher margins, so if high inflation persists, margins should be less impacted. Between 1976-1982, a period of high inflation, quality stocks outperformed the market by 800 bps on average (Figure 7).

Conclusion

In the last year or so, pundits in the media and on Wall Street have spilled large amounts of ink debating whether the US economy will experience a hard or soft landing. We are not sure which scenario will materialize in the coming months. What we know, however, is that protecting capital on the downside is extremely important for long-term performance. The math is straightforward. If your investment is down by 50%, you will need to double your capital just to return to your initial position. The less you lose, the more capital you accumulate over a long period of time.

As outlined in our recent whitepaper The “Not so Secret” Sauce of Portfolio Construction , it is one of our core principles to invest in companies that we understand. Rather than relying on macro calls to make investment decisions or deluding ourselves in our ability to forecast the price of commodities, we aim to pick stocks and build portfolios with downside protection in mind.

Disclaimer:

Any investments discussed may or may not be held in in of one of our strategies and are for illustrative purposes only. There is no assurance that Vontobel will make any investments with the same or similar characteristics as any investments presented. The investments are presented for discussion purposes only and are not a reliable indicator of the performance or investment profile of any composite or client account. Further, the reader should not assume that any investments identified were or will be profitable or that any investment recommendations or that investment decisions we make in the future will be profitable.

Certain of the information contained in this article is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Vontobel believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.