Swiss equities: Value should rebound

Quantitative Investments

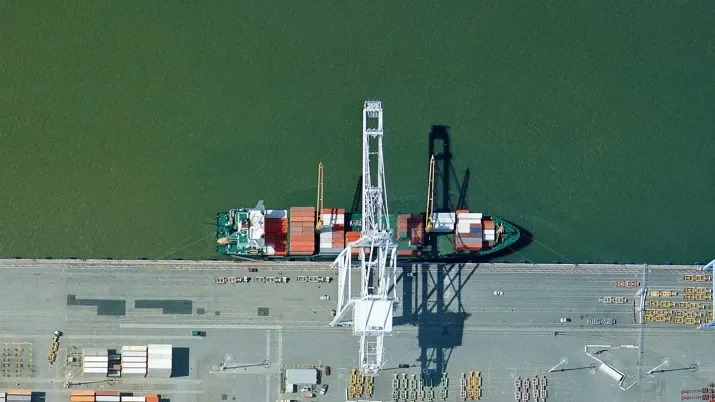

The ongoing Covid-19 outbreak has caused fears of global supply chain disruptions and triggered a historic market correction, raising comparisons with the great crash of 1929. Nevertheless, the prompt intervention from central banks and the massive stimulus packages from governments around the world have eased investors’ concerns and facilitated a market bounce-back.

If we take a closer look at the performance of Swiss equities this year so far, the SPI reference index has weathered the recent market turmoil relatively well by effectively limiting damages (YTD: -5.97% as of May 27, 2020). Yet, everything has a price in life. In the case of the SPI, it is the severe loss of diversification and consequent exposure to specific risks, as the three Swiss champions Nestlé, Roche, and Novartis (commonly named NRN) together account for nearly half of the index market capitalization.

To illustrate this point, we construct a hypothetical version of the SPI reference index, which targets diversification by introducing a 5% cap on the NRN stocks index weights. It is clear from Figure 1 Panel A that the SPI outperformed this “diversified” SPI index during the recovery phase from the recent market sell-off. Nevertheless, as the old saying goes, you cannot see the forest for the trees. When taking a look at the performance since January 2016, the “diversified” SPI strikes back and actually dominates the SPI for most part of this time period, see Figure 1 Panel B.

Will the value factor repeat itself?

The recent market correction has seen investors rushing to sell stocks of cyclical companies, which have experienced a significant revenue contraction and deterioration of their financial position following the virus outbreak. Figure 2 shows that the one-year rolling excess return of the value factor reached -22.45% at the peak of the market sell-off. In other words, value stocks experienced an unprecedented 3-sigma event (standard deviations) when looking at the history of the past 15 years.

To put this into context, the rolling excess return of value was only two standard deviations lower from its historical mean during the 2008 stock market crash. This also shows that it happened before, and it is likely to happen again in the future, as overreaction to short-term events is a typical trait of human behavior.

We know how it ended back then. When negative investor sentiment faded away, and the economy picked up steam again, value stocks led the stock market recovery in the aftermath of the global financial crisis. Currently, the easing of lockdown measures and the possibility to assess the economic consequences of the pandemic more clearly have significantly contributed to the resolution of uncertainty.

Conclusion

We believe that value stocks are at a turning point, being cheaper than any time in recent history and having a lot to gain from the substantial liquidity injections into the economy.