Conviction Equities Boutique

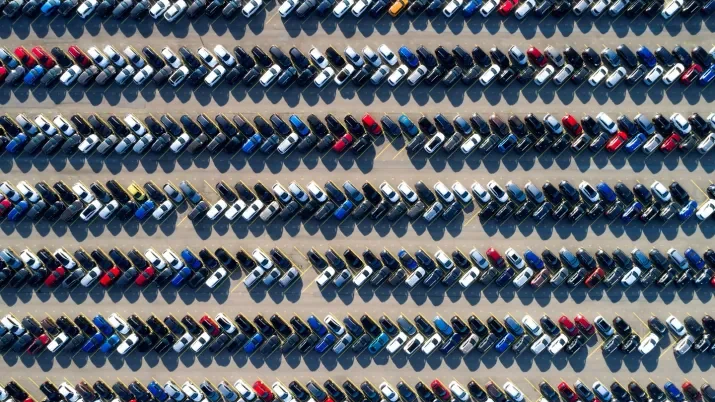

Circular economy makes the wheels go round

The circular economy, popularized by expressions such as “zero waste”, “right to repair”, or “from farm to fork”, is rooted in the knowledge that resources are finite. Companies that manage to reduce their consumption of raw materials are likely to increase their profits and market share, which will ultimately benefit investors. Past examples of corporate successes based on the circular economy include the Italian Vespa scooter.