Why invest?

- A bottom-up driven approach with rigorous proprietary analysis to help optimize the credit and security selection, enabling us to aim for higher performance for a given credit risk.

- Experienced and high conviction portfolio managers, backed by a compact, multi-disciplinary, and independent Fixed Income boutique.

- A contrarian and value-investing style in order to help capitalize on irrational, herd-like investor behavior, while monitoring liquidity and diversification of our portfolio exposure.

"We aim to consistently deliver value to our clients by seeking to identify price discrepancies and invest with high conviction."

Investment process

We take a five-step process that brings together top-down with bottom-up. We develop market thematic and country views and then dive into bottom-up credit selection to help improve yields and spread without penalizing the average rating of the portfolio.

By maximizing the payoff/credit risk ratio we aim to find recurring, low risk means of generating excess returns.

Typical behavior during consolidating markets

- During significant widening of spreads, mispricings present themselves and we tend to reinforce our exposure as bonds are easier to buy.

- We accept that reinforcing right at the bottom is almost impossible.

- We may underperform in periods of a deep correction as we add risk, but when markets stabilize and rebound, the portfolio performance tends to accelerate.

Typical behavior during rallying markets

- Invariably, mispricings continue to exist across regions, countries, curves, currencies, etc.

- We tend to be overweight the market to help capture these mispricings

Typical behavior in overheating markets

- When we sense that the “dash for trash” is exaggerated, and investors are gobbling up anything they can get their hands on, we tend to exit, reduce exposure to spread duration, increase average rating, etc.

- We find at these times it is easier to sell bonds

Investment opportunity – seeking the best long-term risk-return rations

The emerging market bond asset class tends to be driven by short-term news flow, which often takes precedence over fundamentals, resulting in irrational investor behavior. This creates mispricing scenarios which can be exploited by active investors who are able to take a contrarian view when markets behave whimsically.

Despite its perception as an asset class with high volatility and greater risks, emerging market debt (in hard currencies) has historically delivered elevated long-term, risk-adjusted returns compared to other traditional asset classes. In comparison – while offering a greater return – emerging market debt volatility has been lower than US and global high-yield bonds. On the risk spectrum, emerging market hard-currency debt sits between traditional fixed-income segments and equities, making it a viable performance-generating addition to a well-diversified portfolio, in our view.

Investment philosophy – inefficiencies can lead to opportunities

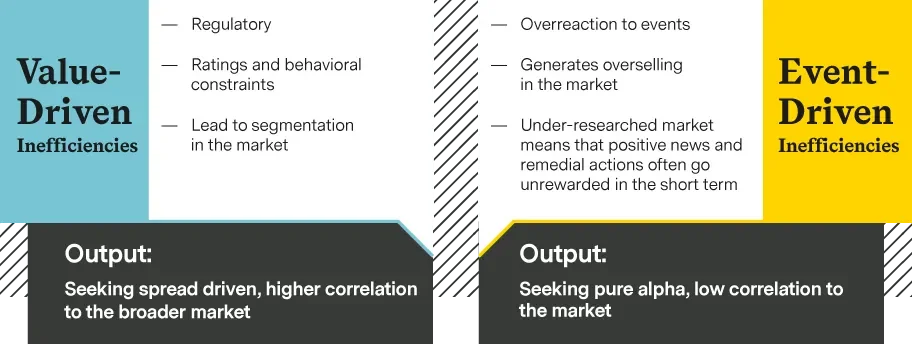

Segmented markets and risk aversion can offer high return, low volatility and uncorrelated opportunities. Our investment philosophy rests on two inefficiencies and sources of performance

Investment team

The strategy is managed by Luc D’hooge who is assisted by the Vontobel Emerging Market Bonds team, comprising of experienced portfolio managers with strong track records. The team also has at its disposal the full capabilities of the Zurich based Fixed Income boutique. We believe this optimal team structure enables proactive early idea generation and implementation.