Constraining the Private Sector in China

Quality Growth Boutique

Over the past months the Chinese government has instigated a far-reaching crackdown on various privately-owned businesses in China. The crackdown started last autumn when it stopped the Ant IPO, and, simultaneously, its well-known CEO Jack Ma disappeared for several months from public view. It was reported at the time that the government was concerned about the lack of regulation of loans made by private financial companies such as Ant, and the company has since made changes to its business practices. It appeared, however, that the government was also concerned that state banks were losing too much market share to the new private companies, and, as well, that Jack Ma had become too popular, in a country where Premier Xi Jinping clearly wants to be seen as the only ultimate power.

This event was followed in February by a large fine levied against Jack Ma’s previous company, Alibaba, which, the government claimed, was engaging in anti-competitive behavior. More recently, the government announced it would bar Didi Global, a ride-hailing company that had just gone public in the US, from acquiring new customers. It also suggested that other large private Chinese IT and social media companies have become too powerful and are misusing the data they gather. These actions were followed over the past weekend with the government announcement that private education companies must change how they choose and instruct their students, and that core parts of their businesses can only be conducted on a non-profit basis.

The case of ride-hailing company Didi is interesting for several reasons. The Chinese government gave it a black mark for its protection of customer data. In addition, the government was concerned that Didi’s management had chosen a US listing versus a local offering. According to the press, China’s internet regulator wanted the company to submit to a cybersecurity review before its filing. Didi ignored the government and went forward with the listing. This action may have been perceived as a challenge to the government’s authority. It brings to mind memories of how the government reacted to Jack Ma’s apparent belittling of state-owned banks – he simply disappeared from view for several months. In any event, immediately after the IPO, the Cyberspace Administration of China blocked Didi from accepting new users and ordered mobile app stores to pull Didi from circulation. The government may still impose further punitive measures.

Although almost all Chinese shares have declined in value in recent days, those listed on foreign exchanges – particularly as ADRs - have reacted the most negatively to this recent spate of increased government intervention. The ADRs of Tencent, China’s largest social media and gaming company, its largest company by market capitalization, and one of its largest collectors of customer data, have fallen 18% in the past week. Many smaller companies listed on the local market as A shares, meanwhile, have not reacted as negatively. The shares of seed and nut merchant Chacha Food, for instance, declined only 8% the past week.

To some observers it appears that the Chinese government does not particularly care about foreign shareholders. In our view, this callousness towards foreign investors could mean that the VIE structure for Chinese companies listing overseas may also be at risk. This concern aside, for foreign investors there is a more fundamental point to note regarding the Chinese Communist Party (CCP). That is, the CCP is and will remain preeminent in all aspects of life in China. Following on the Chinese Communist Party’s annual congress in October 2017, the Financial Times quoted Premier Xi from his three-hour speech to the Party Congress where he said, “Government, military, society, and schools – north, south, east and west – the party is leader of all.1 Premier Xi’s remark is one that foreign investors must take note of again today.

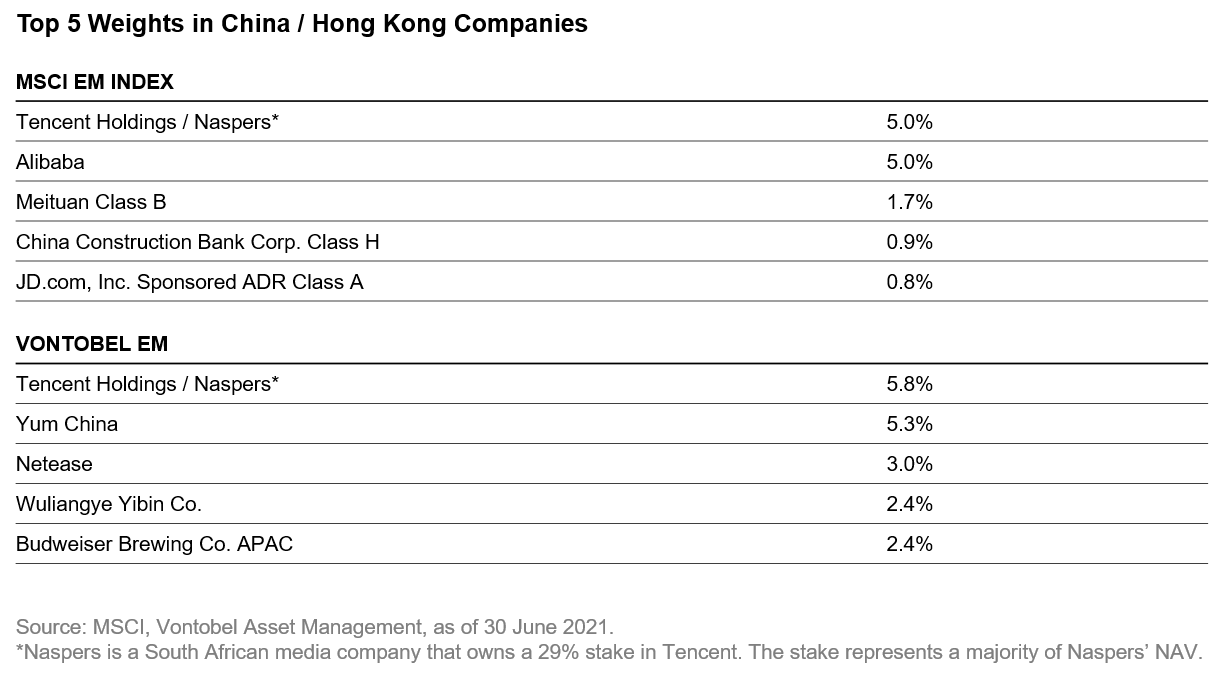

The Vontobel Emerging Markets (EM) Equity strategy is generally underinvested in the large Chinese IT, e-commerce and social media names; as well, we are absent from the Chinese financials. Instead, we maintain a relatively high exposure to Chinese consumer names, and to a limited number of IT and social media companies. As of 30.06.21, the five largest Chinese/ HK-listed names in the MSCI EM Index vs. our five largest holdings are listed below.2

To continue with some basic data, as of 30.06.21, the country weight in the MSCI EM Index for China, including Hong Kong, was 38.03%. In total there were 686 Chinese and HK-listed companies in the Index. The year-to-date performance of the Index for China was -2.51% and for Hong Kong was 2.10%.

Total weighting in China and HK in the Vontobel Emerging Markets Equity representative portfolio were 33.96% at 30.06.21. In total we held 24 Chinese/ HK-listed companies in the EM portfolio. Our performance in China year-to-date was 3.77% and in HK 6.57%, e.g., we have outperformed thus far this year.3

We will continue to invest prudently in China and Hong Kong, well-aware of our commitment to our clients to grow, as well as to protect, their capital over the long term.

Background articles:

https://www.wsj.com/articles/chinas-tutoring-rules-slam-education-stocks-11627276804?mod=article_relatedinline

– Chinese education companies

https://www.ft.com/content/9f958def-6657-4283-8998-2954909a3465

- Sell-off in Tencent and IT cos

https://www.ft.com/content/206435e1-294d-43f2-96d2-5207ecf8afcc

-CCP predominance

https://www.foreignaffairs.com/articles/china/2021-06-22/xis-gamble

- Premier Xi and China’s place in the world

1. Financial Times, “Xi Jinping, China’s New Revolutionary Hero”, Mitchell, Tom, 20.10.17.

2. Factset, MSCI EM Index Constituents, Vontobel Rep. Portfolio Constituents

3. Factset, Based on total return of the respective country, 30.06.21. Based on cumulative gross performance (USD) of a representative portfolio. The basis upon which the representative portfolio was selected is that the portfolio is the oldest and most representative account. The gross rates of return are presented before the deduction of investment management fees, other investment-related fees, and after the deduction of foreign withholding taxes, brokerage commissions and transaction costs. An investor’s actual return will be reduced by investment advisory fees. Past performance is not indicative of future results.

Disclosure

Past performance is not indicative of future results. Any companies described in this commentary may or may not currently represent a position in our client portfolios. Also, any sector and industry weights described in the commentary may or may not have changed since the writing of this commentary. The information and methodology described in this commentary should not be construed as a recommendation to purchase or sell securities. Please contact a Vontobel representative for more information.

Any projections, forecasts or estimates contained in this commentary are based on a variety of estimates and assumptions. There can be no assurance that the estimates or assumptions made will prove accurate, and actual results may differ materially. The inclusion of projections or forecasts should not be regarded as an indication that Vontobel considers the projections or forecasts to be reliable predictors of future events, and they should not be relied upon as such.

In the event a company described in this commentary is a position in client portfolios, the securities identified and described do not represent all of the securities purchased, sold or recommended. The reader should not assume that an investment in any securities identified was or will be profitable or that investment recommendations or investment decisions we make in the future will be profitable.

For information about how contribution was calculated for any such securities, or to obtain a list showing the contribution of each holding to overall performance, please contact a Vontobel representative.