Empowering change: Impact Report 2024

Taking responsibility for our society and environment leads us into a better world. A growing awareness among investors, behavioral shifts among consumers, and innovative solutions in the corporate world, drive this transition. Asset owners can benefit and accelerate the change through so-called impact investing.

We aim to deliver competitive risk-adjusted equity returns over a full market cycle and to create a measurable positive effect on the environment. In our opinion, investing in listed companies focused on creating positive, measurable impact is not only about avoiding risks, but also taking advantage of the opportunities that come with the transition to a low-carbon economy. We believe our approach helps investors to achieve their objectives in terms of sustainability as well as financial returns

Of particular interest to us are companies capturing the opportunities arising from long-term structural shifts , e.g. population growth, urbanization, or rising inequalities, and whose innovative products and services provide scalable solutions to the world’s most pressing challenges such as resource scarcity, rising pollution, or hunger in some parts of the world. These companies have the potential to gain market share and outperform their peers, especially if they boast solid balance sheets and superior long-term profitability.

Our aim is to construct equity portfolios with a sound mix of established names and disruptive newcomers. Our process is based on extensive research, and we show in a transparent way what informs our investment decisions.

Over the past few years, structural views of the world have increasingly diverged between two extremes: while many investors believe we have now entered a regime of persistently higher inflation and interest rates, others are convinced the world should soon revert to its previous low growth/low inflation regime. Wherever the actual landing zone might be for the global economy, investors’ continued swing between these extreme scenarios is likely to feed regular disruptions and higher structural volatilities in a context of unprecedented transformations due to the ongoing environmental and technological transitions.

While macro top-down strategies may try to time those shifts, bottom-up fundamental stock pickers must stick to the companies most likely to muddle through such successive waves due to their specific characteristics or their solutions that address future challenges and are thus supported by new secular tailwinds.

Active investing and active stewardship of your investment requires high conviction. Conviction through research, discipline and experience.

An investment philosophy is a compass that guides you towards your goal. Over the years, we have developed our investment philosophies to deliver distinctive investment approaches.

We believe that relying on consistent style enables us to fulfill our clients' needs. A solid and respectable investment process, based on a high-conviction philosophy provides a predictability across market conditions.

Vontobel is a well capitalized company in which the Vontobel family still holds a controlling stake. Listed on the Swiss stock exchange, Vontobel has provided a solid foundation since its founding in 1924.

“In markets subject to spectacular environmental and technological transitions, rapidly moving perceptions, and structurally higher volatilities, long-term investors should focus on resilient stocks. These in our eyes ideally combine strong quality characteristics, including solid sustainability credentials, with exposure to new secular trends.”

13.4

bn4

We believe quality stocks are resilient investments, offering the best risk-adjusted return in the long term. The definition of quality, however, needs to be expanded beyond its traditional financial perimeter. Of course, it includes companies with high and stable profitability as well as strong industry positioning. But already profitable businesses with pivotal roles in themes key to the environmental, energy, social, and AI-driven transition should also be included in this universe of resilient stocks.

The Vontobel Conviction Equities Boutique, headquartered in Zurich, focuses on resilient business models, selected through unconstrained, benchmark-agnostic, but repeatable and disciplined investment processes. Its seasoned investment teams are convinced of the value added of environmental, social, and governance criteria or impact targets when such criteria or targets are defined and combined consistently with specific investment philosophies as well as distinct strategies.

This absolute-return-oriented multi-asset strategy aims to participate in rising markets and achieve steady value growth in the long term with a balanced risk profile at a target volatility of 7%.

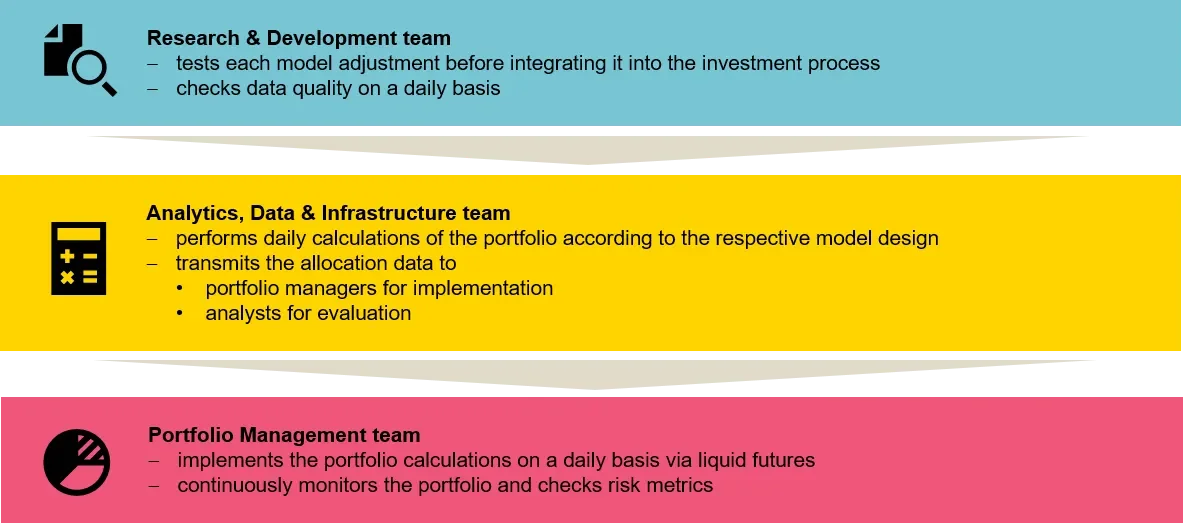

The strategy invests worldwide mainly in equity, government bond, commodity, and currency derivatives. Based on quantitative models and artificial intelligence, it systematically adapts its asset allocation to the risks and opportunities offered by the prevailing market conditions.

The investment process by Quantitative Investments combines proprietary models, cutting-edge technology, and active management. The multi-model approach used to optimize each asset class, combined with state-dependent risk management, aims to participate in up markets and limit losses in down markets across cycles. This strategy makes investment decisions without emotional bias, while ensuring systematic risk control at all times.

"We focus on four essential asset classes, avoiding complexity. Our liquid strategy, has proven successful since inception aiming at upside participation and downside management across cycles."

Academic research has demonstrated that economically justified risk premia can offer sustainable sources of investment return. Since risk premia vary over time, active investment helps add value. Research supports the quantitative models and systematic approach of the strategy and spurs continual innovation. Model-based allocation and risk management, precisely implemented, ensure optimal exposure and unbiased portfolio adjustments. The character of the models enables investment transparency for investors. We believe using liquid instruments enables efficient and cost-effective implementation.

* There is no assurance that objectives or performance target will be achieved.

Our strategy invests in global equities and government bonds with a focus on tactical asset management. The structure of the portfolio aims to optimally adapt to the risks and opportunities offered by prevailing market conditions (economic cycles) through long-term tactical management of the equity ratio and bond maturities.

The assessments of the fundamental economic risk environment on which tactical allocation management is based, and the potential returns derived from them, are grounded in the models developed by Quantitative Investments. The decisions made by these models are unemotional and comprehensible, and attention to risk is systematically maintained at all times. Usually, the equity ratio ranges between 0 and 60% and the duration of global government bonds between 0 and 10 years. The equity market weighting is more or less equally divided among North America, Europe, and Asia-Pacific. The bond markets are weighted based on model signals. Liquid, exchange-traded derivatives can be used to help efficiently implement the investment strategy and for hedging purposes.

Academic research has demonstrated that economically justified risk premia can offer sustainable sources of investment return. Since risk premia vary over time, active investment helps add value. Research supports the quantitative models and systematic approach of the strategy and spurs continual innovation. Model-based allocation and risk management, precisely implemented, aims to ensure optimal exposure and unbiased portfolio adjustments. The character of the models enables investment transparency for investors. We believe using liquid instruments enables efficient and cost-effective implementation.

We believe there are attractively valued and profitable industry leaders in emerging markets that know how to use their cash. Systematic screening helps find them.

There are some 2,100 stocks in the opportunity set and only about 1,200 pass a first filter that looks for high returns on invested capital (ROIC).

We subsequently examine the companies’ industry position which shrinks the number further to some 750, and, at a later stage, to around 150 candidates that could be included over the course of a year.

However, following a comprehensive fundamental analysis that incorporates a valuation model and an ESG evaluation, only 10 to 15 companies ultimately qualify for our focused portfolio of 30 to 50 stocks.

Dynamic growth rates in emerging markets have produced many profitable businesses in this region.

Market participants are often slow to fully acknowledge high ROICs, which we consider an important share price driver. This failure on the part of the market creates opportunities for stock pickers like us.

We use systematic screening as well as fundamental research to pursue portfolio candidates with:

We believe profitable companies with strong industry positions are able to invest into future growth – and their stocks often reflect this. Moreover, such leaders tend to stay leaders.

The investment philosophy is based on the belief that selecting the right companies help drive performance over the long term. We are bottom-up stock pickers and use a rigorous investment framework to seek to identify attractively valued industry leaders. We believe those companies can offer consistently high returns on invested capital, a strong industry position and effectively address ESG issues.

Our experienced portfolio managers Thomas Schaffner and Raphael Lüscher are responsible for our mtx offering. As true ambassadors for the cause, they are invested themselves in the strategies they manage. They can draw upon a capable team of analysts providing comprehensive fundamental research, including quantitative and ESG analyses. In addition to the company-specific risk metrics, the team also keeps a close eye on the risk aspects related to business cycles and portfolio characteristics.

"We believe there are attractively valued and profitable industry leaders in emerging markets, including China, that know how to use their cash. Systematic screening helps find them."

There are some 700 stocks in the opportunity set but only about 500 pass a first filter that looks for high returns on invested capital (ROIC).

We subsequently examine the companies’ industry position, valuation and ESG metrics, which shrinks the number further to around 250 names, and, at a later stage, to around 100-150 candidates that could be included over the course of a year.

However, only a few eventually make it into our concentrated portfolio of 30 to 50 stocks.

Dynamic growth rates in China have produced many profitable businesses.

Market participants are often slow to fully acknowledge high ROICs, which we consider an important share price driver. This failure on the part of the market creates opportunities for stock pickers like us.

We use systematic screening as well as fundamental research to pursue portfolio candidates with:

We believe profitable companies with strong industry positions are able to invest into future growth – and their stocks often reflect this. Moreover, such leaders tend to stay leaders.

The investment philosophy is based on the belief that selecting the right companies help driveperformance over the long term. We are bottom-up stock pickers and use a rigorous investment framework to seek to identify attractively valued industry leaders. We believe those companies can offer consistently high returns on invested capital, a strong industry position and effectively address ESG issues.

Two experienced portfolio managers, Roger Merz and Thomas Schaffner, are responsible for our entire mtx offering. Being true ambassadors for their cause, they invest their own money in the strategies they manage.

They are supported by a team of 15 seasoned experts. These include professionals doing fundamental research as well as quantitative and ESG analyses.

The team constantly monitors the risk metrics not only of the companies, but also of aspects related to business cycles and portfolio characteristics.

Access to structural growth

An investment opportunity lies in bridging the funding gap on the path toward net zero and sustainable development. Environmental impact strategies may provide a way for investors to get involved by investing in companies providing scalable and economically viable solutions.

Diversification benefit

Environmental impact strategies can offer risk diversification to global equity investors, given their limited overlap with traditional core equity allocations, and may help balance a portfolio’s performance through the cycle.

Driving positive change for people and the planet

Our portfolio holdings’ products and services have the potential to generate a measurable positive effect on the environment as they contribute to addressing pressing environmental challenges.

Diversification and asset allocation do not ensure a profit or protect against loss in declining markets.

The companies we pick for our portfolio contribute to at least one of our impact yardsticks (“impact pillar”) and one or a number of the United Nations’ Sustainable Development Goals (SDGs).

The transition from fossil fuels to renewable energy sources is underway but requires massive investments in the appropriate infrastructure and advanced technology.

This impact pillar contributes to the UN SDGs 7 and 13.

While demand for water is growing, our water supply is shrinking. Substantial investment is required along the entire value chain to enable universal access to safe and affordable drinking water.

This impact pillar contributes to the UN SDG 6.

More than half of the world’s population lives in urban areas. To minimize their carbon footprint, we need solutions that improve urban planning and make cities smarter and better connected.

This impact pillar contributes to the UN SDG 11.

Our growing economy depends on a robust transportation infrastructure. Sustainable development in our world calls for a transportation system that keeps pollution low via green and resilient mobility solutions.

This impact pillar contributes to the UN SDGs 9 and 11.

Resource efficiency is needed to deal with the growing consumption of energy and materials, with solutions that are resilient, use fewer natural resources, save energy, and reduce pollution.

This impact pillar contributes to the UN SDG 9.

To offset the increasing environmental footprint of a growing economy, steering consumer behaviour toward companies offering sustainable product lifecycles is key.

This impact pillar contributes to the UN SDG 12.

Our aim is to deliver an unconstrained high-conviction portfolio. This requires an investment process focused on disciplined bottom-up security selection based on in-depth company analyses that integrate financial, impact, and sustainability criteria.

Pascal Dudle, Head of Listed Impact and portfolio manager of the Global Environmental Change strategy, has more than 20 years of investment experience. He is supported by a team of investment experts able to conduct financial as well as sustainability analyses. Being active asset managers, we rely on our own in-house fundamental research.

At Vontobel, we value the many voices within our teams. In all our business units, we strive to engage and promote talent of varying age and gender, with a diverse range of experience, from various cultural backgrounds.