TwentyFour

Tracking Trump’s tariffs

Markets had their first taste of Trump Tariffs 2.0 on Monday after levies on Mexican, Canadian and Chinese exports were announced over the weekend.

Quality Growth Boutique

Navigating the tech market steamroller: Will DeepSeek’s efficiency gains prompt a reversal?

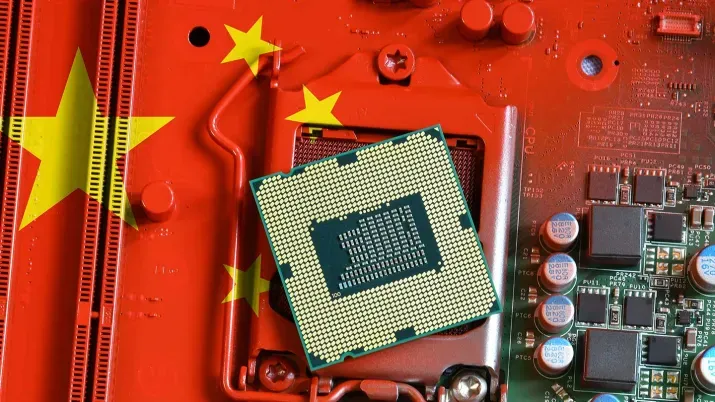

Is the tech market’s bull run, much like a steamroller, starting to reverse course? Efficiency gains recently announced by DeepSeek have raised questionsabout the commoditization of LLMs and the potential overinvestment in data centers, shifts that could significantly impact the industry and investors.

Quality Growth Boutique

Companies poised for growth amid DeepSeek and other AI advancements

The massive efficiencies achieved by DeepSeek’s recently launched Large Language Model have prompted investors to reevaluate the power, data center, and chip requirements for the development of AI models. As AI becomes more widely adopted, we identify companies poised to benefit.

TwentyFour

Fed and ECB meetings point to divergence in paths

Federal Reserve (Fed) chair Jerome Powell had the honour of kicking off the 2025 season for the major central banks this week, swiftly followed by the chore of having to plead the fifth every time he was asked about a President Trump policy.

TwentyFour

CLO popularity growing but secondary could offer better value

It has been two weeks since the primary market for collateralised loan obligations (CLOs) re-opened and 2025 has already proven to be quite a year from multiple angles.

Asset management

From campaign to presidency: Trump’s early days in office Webinar Replay

You can now watch the replay of our webinar, From campaign to presidency: Trump’s early days in office.

Fixed Income Boutique

Emerging markets debt: Where have all the flows gone?

Emerging markets hard currency sovereign debt (EMD) has long held the promise of opportunity, but investor enthusiasm has waned in recent years. Could the tide be turning?

Conviction Equities Boutique

DeepSeek’s strong new AI model – AI’s Sputnik moment?

Shares in Nvidia and ASML have plummeted due to concerns that Chinese AI startup DeepSeek's new model could disrupt the current AI business model. DeepSeek's R1 model, released on January 20, exhibits performance similar to top US large language models (LLMs), but at a fraction of the cost.

TwentyFour

Tariffs are the noise. Housing is the signal.

Much of the discussion around inflation over the past few months has centred on the potential for US tariffs, a focus that has only intensified following Donald Trump’s inauguration.

TwentyFour

Asset-Backed Securities Quarterly Update – January 2025

As the fourth quarter of 2024 comes to a close, TwentyFour Asset Management’s Douglas Charleston reflects on the past year’s events and explains why, in his view, the record supply of European ABS and CLOs in 2024 is likely to be matched in 2025.

TwentyFour

Investment Grade Quarterly Update – January 2025

In what has been a busy start to 2025, TwentyFour Asset Management’s Gordon Shannon looks back on the final quarter of 2024.

TwentyFour

Multi-Sector Bond Quarterly Update – January 2025

It has been a busy year in fixed income markets, with Q4 2024 proving to be a pivotal period marked by significant global events, including the US election. TwentyFour Asset Management’s Eoin Walsh looks at the path for interest rate cuts in 2025.

TwentyFour

Corporate sector on solid ground entering 2025

One of the key reasons we see credit continuing to outperform government bonds over the medium term is corporate fundamentals.

TwentyFour

Flash Fixed Income: Three big themes for 2025

Will volatility in government bonds continue? Has fixed income seen “peak ESG”? And what will be the biggest driver of returns?

TwentyFour

Q1 2024 déjà vu as inflation data soothes rates sell-off

Global rates markets rallied sharply on Wednesday after fixed income investors received some long-awaited good news in the shape of Consumer Price Index (CPI) data for December, which came in below consensus in both the US and the UK.

TwentyFour

Servicers key as UK rates put pressure on pre-crisis RMBS

Last week Fitch Ratings published a report concerning asset performance deterioration in UK residential mortgage-backed securities (RMBS) originated prior to the global financial crisis (GFC).

TwentyFour

European ABS 2025: Income will remain king

Given modest interest rate cut projections, a stable if not stellar macro backdrop and better relative value than corporate credit, we think European ABS investors can expect another strong year of supply and returns in 2025.

TwentyFour

The slightest of cracks in the US labour market

The latest non-farm payrolls (NFP) data on Friday showed ongoing resilience in the US labour market. To quote the president of the Federal Reserve Bank of Chicago, Austan Goolsbee, “the labor market seems to be stabilizing at something close to a full employment rate.” Is he right?

TwentyFour

How do higher Gilt yields impact banks and insurers?

Last week’s rise in UK government bond yields prompted the bonds of UK financial institutions, both banks and insurers, to underperform other regions, a trend also seen in the equity market.

TwentyFour

Trump dunks on the NZBA with Wall Street exodus

The Net Zero Banking Alliance (NZBA) has been the flagship climate initiative for banks to advertise their commitment to aligning their investment and lending portfolios with net-zero targets by 2050 or sooner. However, in recent weeks the NZBA has been hit with the withdrawal of all its major Wall Street banks.

TwentyFour

Gilt yields gap higher

We saw a sell-off across the UK Gilt curve on Wednesday with yields rising by 4bp at the short end and 11bp at the long end. This took the 10-year Gilt to 4.80% and the 30-year Gilt to 5.35%, with the latter bringing the unwelcome headline that UK borrowing costs are at their highest since the last century.

TwentyFour

Busy primary shows fixed income’s strong technical backdrop

It has been a busy start to 2025 in fixed income markets. After the Federal Reserve’s (Fed) hawkish December dot plot, which added fuel to a sell-off in rates last month, you might have thought primary market activity would be more cautious than both issuers and investors would have anticipated a month ago.

Conviction Equities Boutique

Global equities in 2025: Balancing structural drivers with opportunistic exposures

2025 is poised to be another positive yet complex year for equities. Balancing core positions in industries driven by secular trends – like semiconductors, AI hyperscalers, and the energy transition – with opportunistic exposures that can benefit from cyclical or policy-induced rebounds can help navigate the challenges ahead.

Quantitative Investments

Will AI ever crack investing?

AI has dominated games like chess and Go, but the markets are far more complex. In our latest Expl(AI)ning article, we explore why investing’s complexity remains unmatched, where AI stands today, and what’s next for finance.