Quality Growth Boutique

Beyond the AI bubble: finding predictable growth in video game stocks

Leaders in the video game industry, such as Tencent Holdings, NetEase, and Capcom, offer a distinct blend of predictability and growth through a combination of "Evergreen" titles and new game pipelines. These firms have generated recurring revenues and compounded earnings at approximately 20% annually over the past decade.

TwentyFour

CLOs are finally pricing the tail

For some time now, collateralised loan obligations (CLOs) have in our view been one of the standout risk-adjusted opportunities in all of fixed income, and in recent years (including this one) their performance has lived up to that billing.

TwentyFour

Stakes are high but Fed in control as it ends QT

In 2017, when the Federal Reserve (Fed) was preparing to shrink its balance sheet, then-chair Janet Yellen famously described the process of quantitative tightening (QT) as being "like watching paint dry."

TwentyFour

Solvency II transition leaves insurers (and bondholders) in better place

This year will go down as an important period for the European insurance sector, which is concluding its effort to phase out capital instruments issued under the old Solvency I framework and replace them with more modern Solvency II structures.

Multi Asset Boutique

The top 2%

Can the top 2% make all the difference? The quantitative team tested an AI-powered stock picker across 20 years of data. By analysing hit rates alongside market concentration and dispersion, they uncovered fresh insights into portfolio management. Discover how AI reshapes investing in our latest article.

TwentyFour

Should bond markets fear an AI bubble?

There is an emerging sense of unease in the markets around the scale and productivity of corporate investments in AI. As fixed income investors, not equity or tech managers, we will not aim to assess the longevity or possible applications of these nascent technologies, and nor should we opine on when or by how much equity markets might go up or down.

Asset management

Under Pressure: Checks and balances in central banks

Political influence over monetary policy can undermine long-term economic stability, with a potential impact on investor confidence, bond markets, and the broader economy. This article explores scenarios ranging from zero influence to a mild erosion of US Federal Reserve independence to outright political capture.

TwentyFour

Fed tension limits scope for UST rally

Jerome Powell and his Federal Reserve (Fed) colleagues decided to cut the Fed Funds rate by 25bp to 3.75-4% at last week’s policy meeting, marking 150bp of cuts since the cycle began in September 2024.

TwentyFour

Beyond the noise, conditions favour fixed income

Amid tariffs, bankruptcies, and uncertainty, credit fundamentals remain strong. Elevated yields and solid corporate balance sheets favour income-focused fixed income strategies over government bonds, even as volatility persists.

TwentyFour

Falling oil prices and what it means for credit markets

Oil prices have been gathering headlines in the last few weeks. After falling below the $60 per barrel mark, the West Texas Intermediate price (WTI) bounced back strongly as a result of fresh sanctions announced against the two Russian giants, Lukoil and Rosneft.

Quality Growth Boutique

Is your seatbelt fastened? Quality as a safeguard in a momentum market

AI-driven momentum trades and non-US value dominated markets in 2025. However, the sustainability of these trends remains uncertain, particularly given unproven ROI of AI investments. Amid this backdrop, quality stocks emerge as a prudent choice, offering both resilience and steady growth potential.

Multi Asset Boutique

Backtesting Done Right

Backtests can mislead—or unlock real edge. In Part II of our mini-series, we show how to avoid common pitfalls, cut through bias, and turn backtests into a reliable tool for decision-making. Practical, actionable, and built for real-world investing.

TwentyFour

The compelling case for short-dated bonds

As we begin the final stretch of 2025, market conditions appear challenging. Inflation remains sticky across a range of economies, preventing major central banks from enacting rapid rate cuts to support GDP growth.

TwentyFour

Cooling inflation offers relief amid US data blackout

Amidst an economic data blackout caused by the US government shutdown, markets received a bit of positive news on Friday with the release of the US CPI report which showed consumer prices in September increased at a slower pace than expected.

TwentyFour

Flash Fixed Income: Fiscal Friction - Sovereign heat, Corporate insulation

France’s chronic government paralysis repeatedly created headlines this month, and fixed income markets are rightly worried about the sustainability of French government borrowing levels. Meanwhile, forecasts of a £50bn blackhole in the UK’s public finances are keeping gilt yields elevated and have made this November’s UK Budget a potential flashpoint.

TwentyFour

T-Bill and Chill: Running out of steam?

Earlier this month, we wrote about the high cost of staying in cash in the Euro market. In that note, we argued that a combination of inflation, low front-end rates and steeper curves, favoured a rotation out of cash and cash like instruments into other alternatives that delivered better real returns, including credit. Building on this argument, we wanted to extend this perspective to the US dollar market and highlight a few key points.

Multi Asset Boutique

Backtesting Gone Wrong

Backtesting can reveal powerful insights—or create dangerous illusions. In Part I of our mini-series, we show how biases and shortcuts can inflate results, using a simple momentum strategy as an example. Learn why careful design matters before moving from simulation to real-world investing.

TwentyFour

Maybe the stars align for an earlier cut from the Bank of England?

The labour market in the UK continues to cool off along the lines of what the Bank of England (BoE) expects. Yesterday, the Office for National Statistics (ONS), released its monthly labour market data report, highlighting a rise in the unemployment rate and a reduction in some wage inflation measures.

Conviction Equities Boutique

Impact Report 2025: Staying the course

ESG frameworks have faced rising political pushback and growing skepticism, with some investors questioning the feasibility of climate goals under current political and economic conditions. We believe, even during turbulent times, the transition to a low-carbon economy is here to stay. Read the latest Impact Report for more insights.

Conviction Equities Boutique

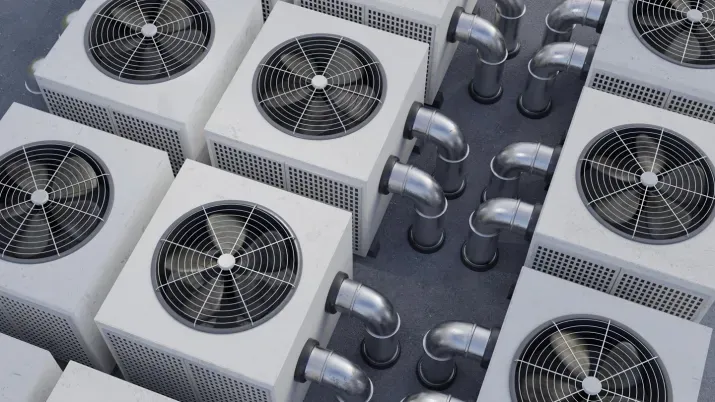

Cooling our heated world – harmonious adaptation and mitigation

With rising temperatures, many investors are drawn to companies that offer adaptation solutions. While adaptation is essential, mitigating climate change and decarbonizing the economy also remain vital. Discover where adaptation and mitigation intersect – particularly in the realm of cooling – and how they can interact to create a more sustainable world.

TwentyFour

Investment Grade Quarterly Update – October 2025

As fixed income investors face inflation surprises, tariff rhetoric and growing concerns around central bank independence, Gordon Shannon, Partner and Co-Head of Investment Grade, explains why the focus remains on resilience.

TwentyFour

Multi-Sector Bond Quarterly Update – October 2025

In our latest Multi-Sector Bond quarterly update, Jakub Lichwa, Portfolio Management, discusses why we retain a favourable view on credit despite tighter spreads.

TwentyFour

Asset-Backed Securities Quarterly Update – October 2025

In our latest Asset-Backed Securities (ABS) quarterly update, Aza Teeuwen, Partner and Co-Head of ABS, explains how strong CLO issuance, robust investor demand and tightening spreads have driven a standout year for the European ABS market.

TwentyFour

CLOs prove resilient amid First Brands loan rout

The sharp sell-off in loans tied to First Brands Group, a US auto-parts supplier, has rippled through credit markets in recent weeks — but for investors' outstanding senior secured loans held in Collateralised Loan Obligations (CLOs), the damage appears modest and distinct from reported off balance sheet financings.