Shareholders Deserve Undivided CEO Attention – Many Don’t Get It

Quality Growth Boutique

Could you do your job better if you had less time and took on a large new project? Sounds like a daft question. But CEOs have been diluting their focus with part-time paid work as board members of unrelated companies, across the world, for years. Board jobs are heavy time commitments at around a month per board1 in the U.S. We believe focus drives performance. Yet 44% of S&P 500 CEOs sit on the boards of unrelated companies. Shareholders deserve the undivided attention of the CEO they pay for.

To drive change, investors must first separate board seats that help the company from those that don’t. Then as shareholders do not generally get a vote on CEO choice or governance policy, it needs to be recognized that engagement with management and (if needed) the strategic use of votes are the primary levers to encourage change. Regulators are drifting towards shareholders, but slowly.

Multi-seating makes sense if a CEO’s second seat is on the board of a subsidiary, or a company with strategic value to the business. We see the benefit of Disney’s CEO, Bob Iger, sitting on the board of Apple. Disney’s content needs distribution, and being close to how electronic distribution evolves should be valuable to Disney. But we are not so sure how the shareholders of Marathon Petroleum, the $100 billion revenue refiner/retailer, benefit from sharing Gary Heminger (CEO and Chairman) with the boards of Fifth Third Bank and PPG Industries.

Focus versus Performance

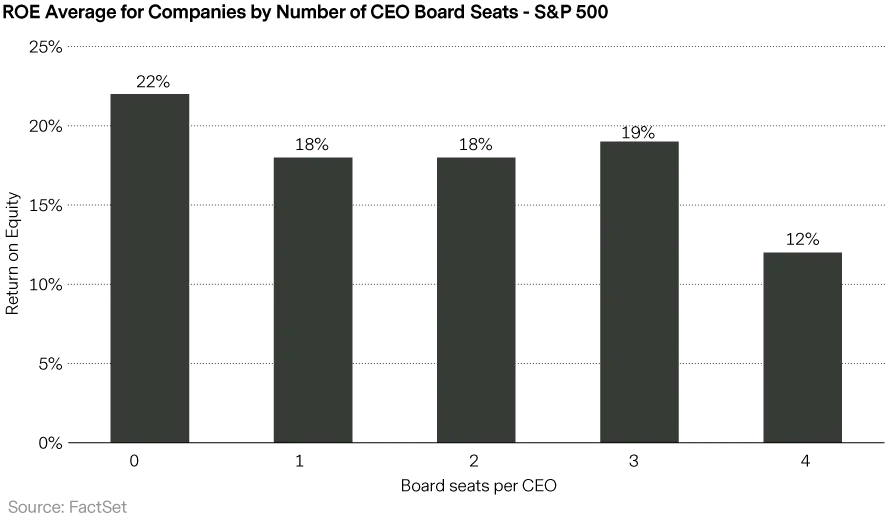

If focus helps performance, the relationship between the number of board seats a CEO has and a company’s profitability as measured by Return On Equity (ROE) is an interesting place to start. Looking at the S&P 500, as board seats held by the CEO increase - profitability declines.

While a simple observation is not proof of cause, it’s notable that within the broad MSCI All Country World Index (MSCI ACWI), of the 79 CEOs on 4 or more boards, Diversified Financials is the most represented industry. Diversified Financials have ROEs well below the benchmark average but are also diversified businesses. Broad diversification has not been an effective strategy for investors, and most of the well-known developed market conglomerates have been broken up. If diversification can dilute leadership focus – why would it be different for CEOs?

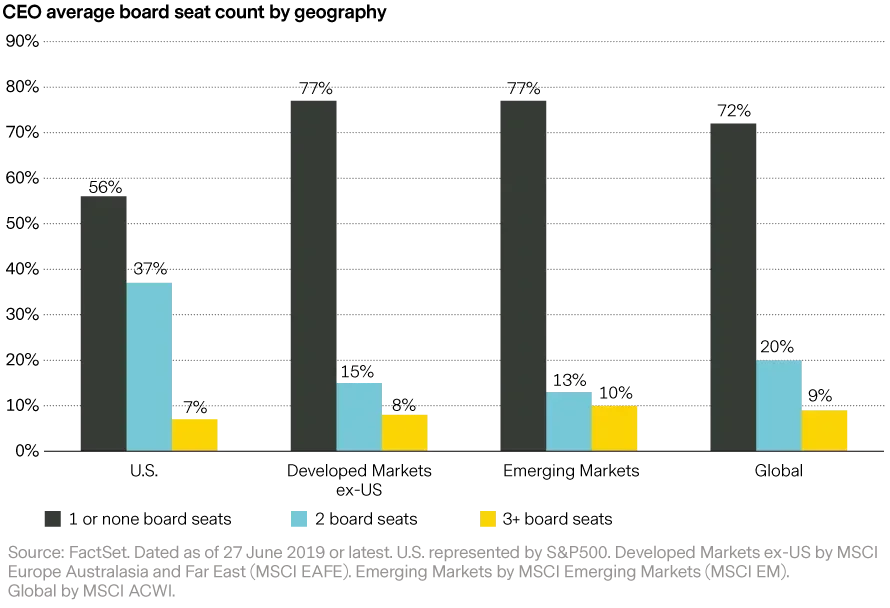

Multi-seat CEOs are found across the globe. But, alongside tolerance for high pay , the U.S. also gives leeway on focus. By our count, 44% of the S&P 500 companies have CEO’s on two or more boards, well above the 29% of the MSCI ACWI. Even after removing the 44 names from the S&P 500 sample where we felt that multi-seating appeared to have some business logic, still 36% of CEOs were on multiple boards. Better, but still maybe 36% too many.

Benefits to the CEO

In a market where average CEO tenure continues to fall, Plan B options have value. Average (median) tenure for S&P 500 CEOs fell from 6.0 years in 2013 to 5.0 in 2017 according to consultants Equilar – that’s a 17% decline in just 4 years. In getting a new top job, being hired by the board has its advantages. A common concern for senior executives is age. Given the average S&P 500 board position paid $300,000 in 2018, a retirement sitting on 3 or 4 boards is an attractive landing following the C-suite role. Other potential benefits include: learning from other executives, staying on top of industry developments, the social aspect, and self-esteem.

Benefits to Shareholders

The primary benefit we see is strategic leverage, or control of an affiliated business. Another often quoted benefit is exposing less seasoned executives to thinking as a board member and rubbing shoulders with experience. By the time the person reaches the CEO post though, the argument looks weak.

What holds them back?

Self-enforced governance – companies that limit the boards their CEOs can sit on understand the problem. Nearly all those in the S&P 500 that limit board seats contained the number to 1 or 2. The problem is only 22% of S&P 500 companies have a limit according to executive search firm Spencer Stuart.

Engagement – we believe that direct input from investors who share the interests of the company is the most powerful way to directly communicate the downside assumed with multi-seat CEOs. As there is no vote on the CEO, the only levers are indirect.

Proxy voting services – proxy vote research specialists ISS and Glass Lewis, have raised their focus on the number of boards a CEO can sit on. ISS limits unrelated board seats to 2 and may recommend withholding votes for an individual from any unrelated board seats they are running for. Glass Lewis generally recommends voting against a director who is a public company CEO with seats on more than two public company boards.

Law - regarding lack of focus from board members or a CEO, to our knowledge there is little legal protection for shareholders from a corporate responsibility perspective. Post the Enron and Worldcom blow ups in the early 2000s, the Sarbanes Oxley Act was passed in the US. This brought focus to shareholder interests, but more in areas such as audit committees and board independence, rather than commitment. However, in search of regulation shift, we take note of the successful 2018 legal action in San Francisco against the U.S. bank Wells Fargo. The bank suffered a scandal where employees had opened accounts for customers without authorization to hit quota numbers. The judge (Jon Tigar) approved a settlement with shareholders who had accused the board of missing ‘numerous red flags’ from employee warnings, regulator investigations etc. While slowly evolving, the legal avenue does not appear as a strong driver at this point – not in the U.S. at least.

Where to from here?

Fragmented ownership and familiarity of multi-seating has led to some leadership behavior that is unfavorable to many listed company stakeholders. Shareholder and consultant pressure has reduced the level of multi-seat CEOs in the S&P 500 from 51% ten years ago to 44% in 2018. But we believe there is still a long way to go. We view the role of the professional CEO as one that comes with great personal responsibility. Stakeholders deserve the full-time best efforts of the board’s chosen leader. Shareholder engagement is of great importance in bringing a sense of grounded responsibility back to the lead officer’s post, across the board…

1. The National Association of Corporate Directors (NACD) annual survey averaged 248 hours in 2016/7 for U.S. public company directors. That’s a month of 9 hour days, 6 days a week.