Conviction Equities

Concentrated and fundamentally driven high-conviction equity portfolios managed by four teams specialized in emerging markets, impact investing, thematic investing, and Switzerland.

This past year has been a challenging period for emerging-market (EM) equities. Following the devastating effects of the Covid-19 pandemic, emerging economies have been playing catch up to the developed world’s vaccination programs, and China has recently returned to large-scale Covid-induced lockdowns. Add in Russia’s unprovoked invasion of Ukraine as well as the slowdown in the Chinese economy brought about by policy focused on regulation and de-leveraging in the property sector, and investors in EM equities would be forgiven for feeling like they just stepped off a rollercoaster. As a result, EM equities have significantly underperformed with the MSCI EM net return index down -20.3% (1 year to May 20, 2022), a drawdown that is much larger in comparison to the MSCI World net return index (-8.4%) and S&P 500 (-4.9%).

A frequent question we get asked by our clients is: where do we see EM equities going from here? With so many variables at play, such as the possibility that the US Federal Reserve increases rates to a point where a recession in the US is inevitable, this is not a simple one to answer. However, it is clear to us that an investor’s entry point will ultimately determine how profitable a trade turns out to be. For that reason, there seems to be no better starting point than looking at valuation.

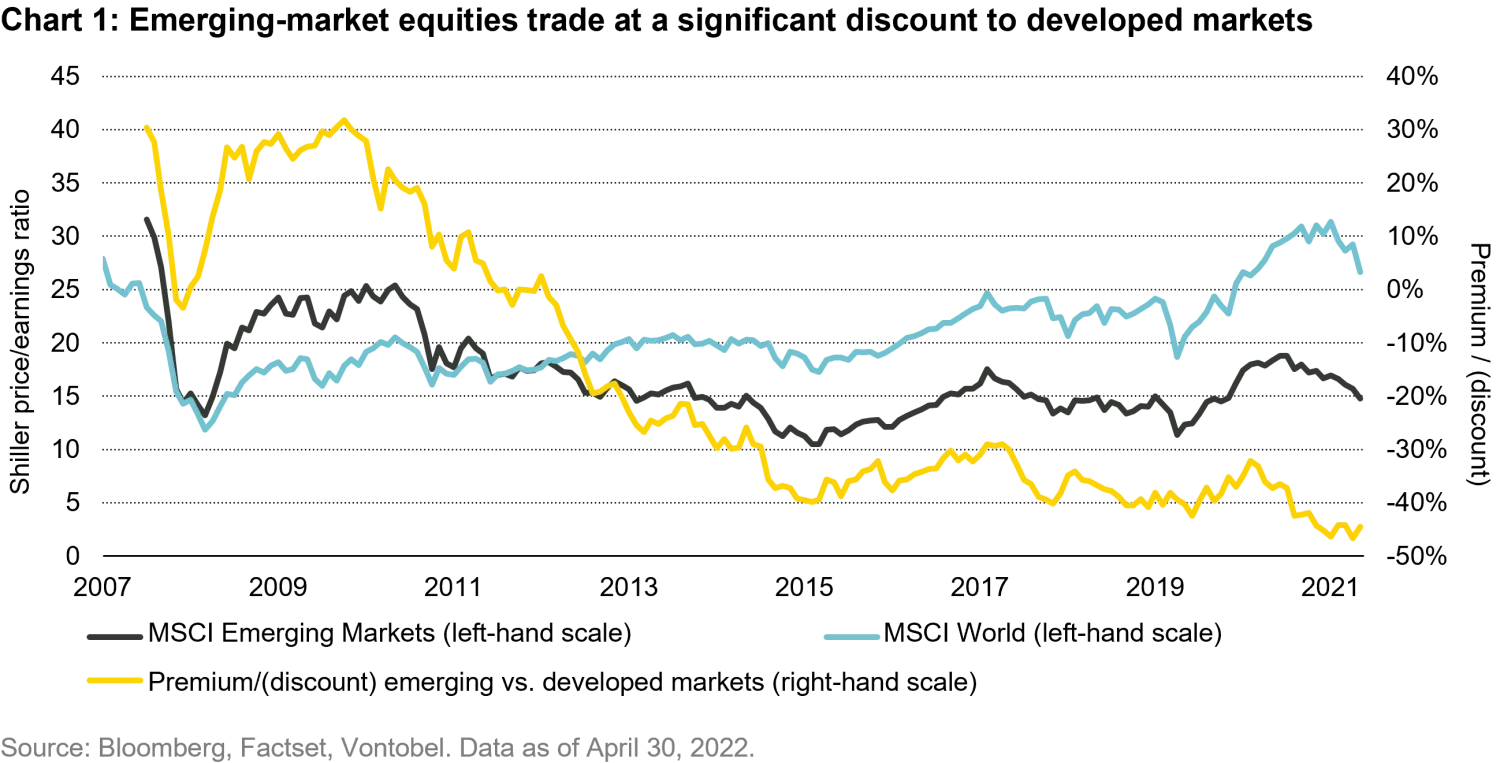

It is hard to believe that EM equities once traded at a significant premium to developed markets (DM), but that is exactly what happened at the end of the commodities super cycle in the 2000s. That premium has since evaporated and the asset class now trades at a 45% discount to DM equities based on Shiller P/E – the cyclically adjusted price-to-earnings ratio which adjusts ten years of earnings for inflation. While Shiller P/E holds no predictive power for returns over the short term, the ratio can be a powerful indicator of long-term returns and as such should not be ignored.

While EM equities certainly appear to be good value on a relative basis, there are concerns about the slowing global economy and its impact on EM growth prospects. For example, the current estimates for real GDP growth for emerging economies in 2022 are just shy of 4%, around 1% higher than the estimates for developed markets. This growth differential is certainly narrower than in the past but is expected to widen again in 2023, primarily because China is expected to get a handle on its management of the pandemic. As we recently described in our Viewpoint

China – green shoots of market stabilization

, there are signs that Chinese stocks are regaining their footing after a very difficult period. As the second-largest economy in the world and the driver of growth in emerging markets, a resurgent China that has the pandemic under control and which has perhaps reopened to the rest of the world, has the potential to spur a strong comeback from EM equities.

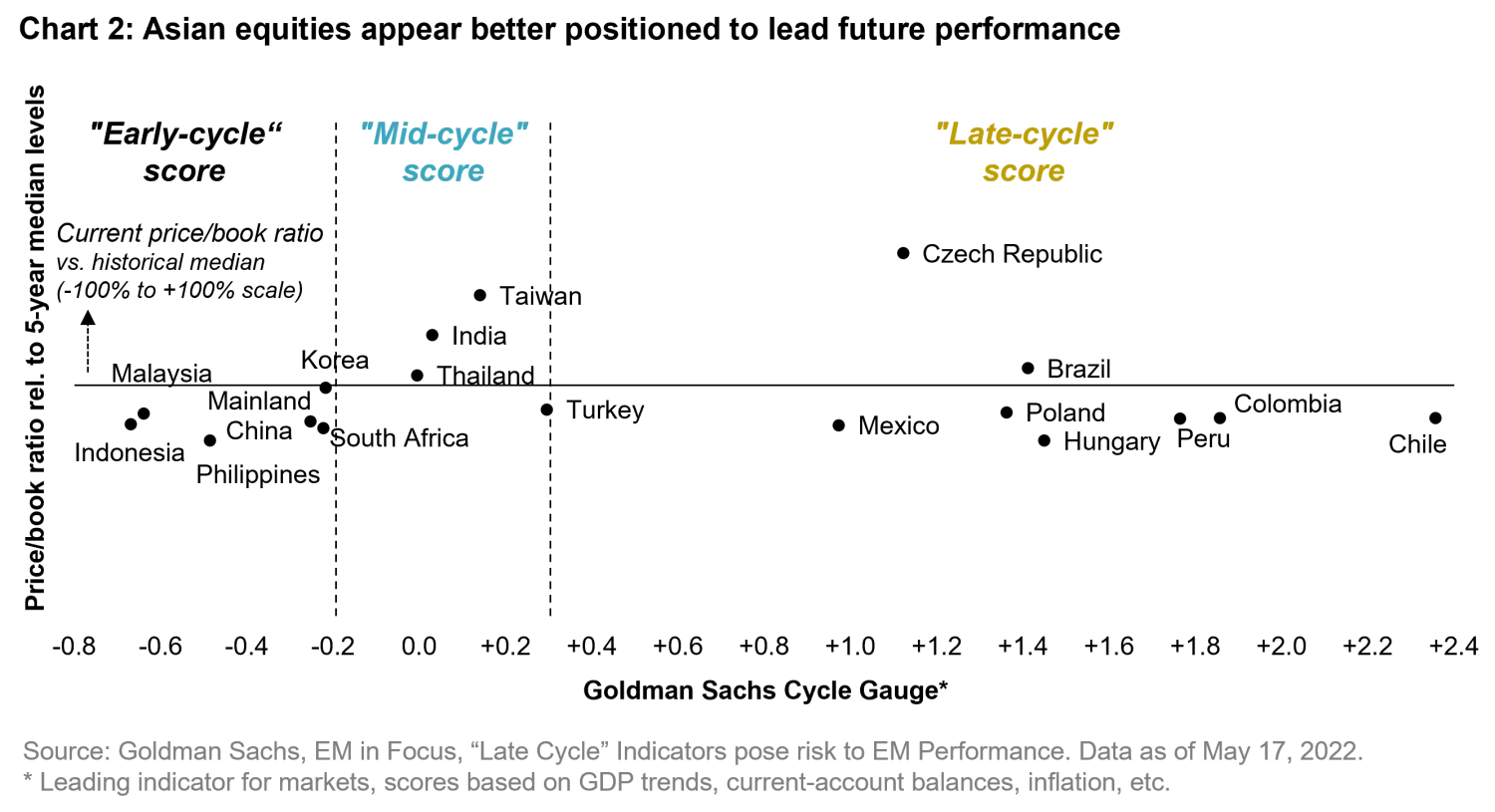

Another question we often get asked is: where are the opportunities within EM equities? To answer this question, we believe it is prudent to ask where various EM economies are in the economic cycle. In its paper, “Late Cycle” Indicators pose a risk to EM Performance, Goldman Sachs (GS) uses a range of macro indicators, such as GDP trends and current-account balances to signal how economies are positioned. Its thesis is that countries in “late cycle” territory are more vulnerable to growth downgrades and US recession risks. Based on the GS analysis, Asian stocks, underpinned by an “early cycle” or mid-cycle” score in many countries, are predominantly positioned to perform strongly whereas those in Latin America and Eastern European are more vulnerable.

Despite the immediate risks and headwinds, we believe that EM equities offer a compelling opportunity to the long-term investor. Valuations appear attractive, growth remains elevated compared to the developed world (and set to diverge even more in 2023) while the dispersion of countries at different stages of the economic cycle provides a ripe environment for active stock pickers. For these reasons, we believe emerging market equities are on the road to recovery and any further short-term pain will be outweighed by the opportunity for longer-term gain.

Note: Information, opinions and estimates provided herein are subject to change and not intended to predict actual results and no assurances are given with respect thereto. Some of the information herein may contain projections or other forward-looking statements regarding future events or future financial performance of countries, markets and/or investments. These statements are only opinion and actual events or results may differ materially. The reader must make their own assessment of the relevance, accuracy and adequacy of such information and make such independent investigations as they consider necessary or appropriate for the purpose of such an assessment.