Rather Be Lucky Than Good?

Quality Growth Boutique

All-star New York Yankees pitcher Lefty Gomez once said: "I'd rather be lucky than good.” Successful investing over time is, however, not a game of luck.

It requires discipline and skill and the awareness to identify signposts. In our view, there are three prominent signs that serious investors should pay attention to in the equity markets today: 1) Growth outperformance has accelerated 2) Within growth, “Lucky” stocks are outperforming, and 3) Valuations and other signs of exuberance are expanding as economic uncertainty is increasing.

This market rhymes with the late 90s technology bubble where unprofitable companies soared. More recently, the narrowing of the US market has garnered much attention among investors, specifically how fast-growing companies like Netflix and Tesla are driving the bulk of returns. While not as widely discussed, this is not just a US phenomenon – we are seeing it around the world. The conclusion is the same from Europe to the US to China – growth at any price is performing in a way that has preceded major reversals in the past. One way to prepare for a downturn is to focus on quality businesses with predictable earnings growth.

1: Growth outperformance has accelerated

Growth investors experienced a good run from the end of the global financial crisis to today, already over a decade. Had you invested $100 in global equities (MSCI AC World Index) in 2009, by the end of 2020 you would have over $286. But that same $100 invested in global growth stocks (MSCI AC World Growth Index) would have left you with just under $373. While growth did not outperform each year, growth investors would have been ahead at the end of every year on a cumulative basis.

At the end of 2018, the cumulative difference between the two strategies was not that great, only 9% as shown in Figure 1 below. But that difference widened to 30 percent over the next two years – a significant divergence.

Assuming valuations are reasonable, outperformance of growth stocks can be explained by faster earnings growth than the market overall. But the significant outperformance we have seen recently is more of an outlier and worth looking into.

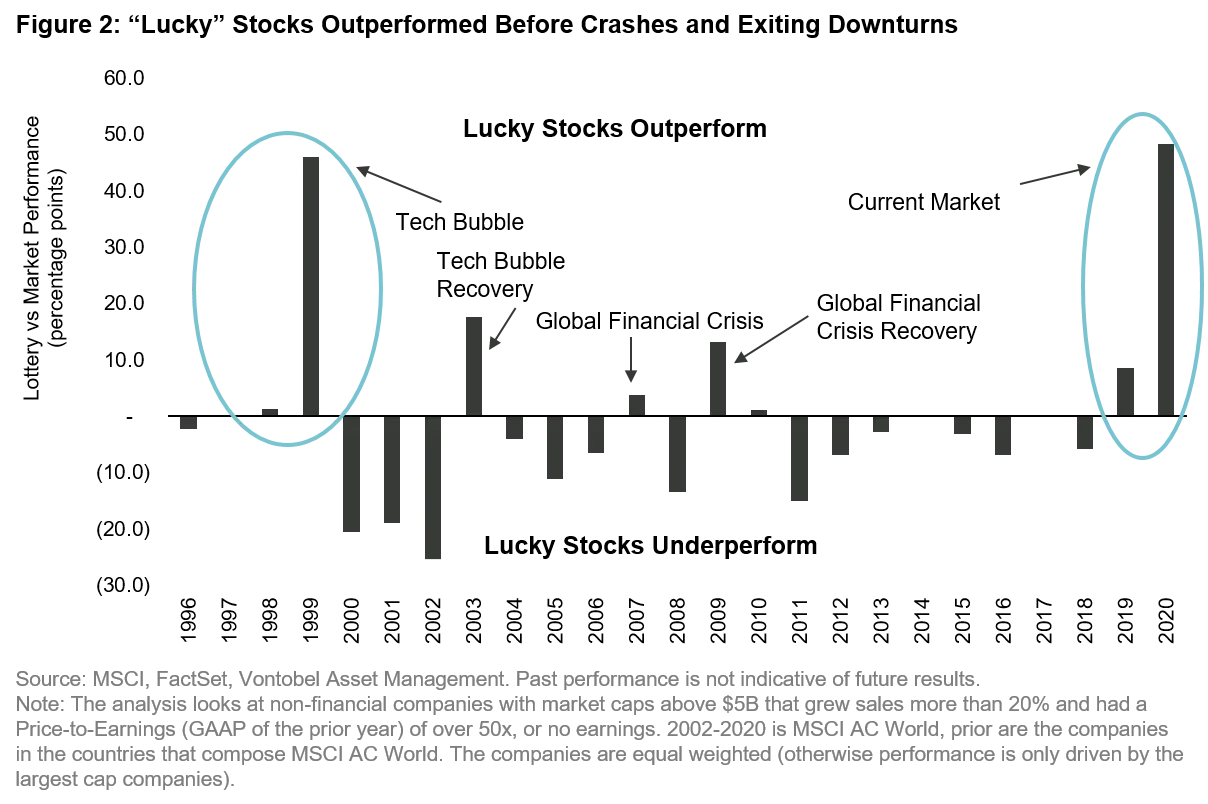

2: Within Growth, “Lucky” stocks outperforming

When we dig into the numbers, we find something that is out of the ordinary. Over the past two years, the best place to invest was in the more speculative area of growth – fast growing companies with P/E’s that are very high or nonexistent due to no earnings. We refer to these companies as “Lucky” stocks, as the businesses and their investors require a lot to go right to be successful over the long term.

Not surprisingly, there have been years where these types of companies have done best, and years where they have not, depending on investors’ risk appetite. What we have found, however, is that over the past 25 years there have only been a few cases where “Lucky” stocks have outperformed the market on a global basis. And there was only one other time period where the performance looks similar to that of the past two years: 1997-1999. Unfortunately, that puts the current market environment in poor company.

David Souccar, Quality Growth portfolio manager, recently authored Where is Your Umbrella, where he argues that caution is in order for two types of companies – those that have benefited most from low rates, and “story” stocks, those that have interesting prospects but unproven business models. Those obviously overlap with these “Lucky” stock speculations. Below we highlight some businesses you may be familiar with that fit this profile.

We also recently published our thoughts on one of these high growth, high multiple companies. In The Supercharged Sentiment Driving Tesla, research analyst Rob Hansen examined the high-flying car company and concluded that the market is making aggressive assumptions about the company’s future prospects. It does not mean that Tesla cannot be a force, both in terms of environmental change and the future of the automobile industry, but when the market looks past all risks, it is best to be cautious. A similar concept also exists today with the Chinese Electric Vehicle market leader NIO.

Shopify is another fast-growing business where its current valuation assumes everything will go right. This Canadian technology company helps largely small and mid-size businesses set up their online presence, which entails shipping, warehousing, fulfillment, payments, marketing and customer engagement. There is structural growth behind online shopping and Shopify does a great job. But everything has a price. Perhaps Shopify will grow into its valuation. But investors should remember that a client base of smaller size companies means that its clients generally have a high failure rate and will be worse off during recessions. Even if successful, the ride may be bumpier than investors currently expect, especially at today’s lofty starting point. Based on our calculations, Shopify will need to grow significantly faster than Amazon did (when Amazon was at Shopify’s size) in order to earn a decent return at today’s stock level. Amazon’s success is rare, and repeating it, let alone exceeding it, is a tall order. Shopify offers a great service, but will it make an outstanding investment? Similarly, Just Eat Takeaway, a Dutch food delivery company, needs many things to go right for several years to justify its valuation. While it is growing quickly, it operates in a very competitive space and customer acquisition costs are high.

This is not just a developed market phenomenon. We are seeing this across geographies. Interestingly, over a third of the companies that fit our “Lucky” stock profile today (non-financial company in the MSCI AC World, 20% sales growth, with no earnings or a P/E above 50x) are in China, and largely in domestic China A shares, with another 9% in Hong Kong. Almost 18% of all the Chinese companies in the MSCI AC World fit this criteria. It does not mean that investors have to avoid that region, but they should be very thoughtful about where they allocate capital in that market.

There are great opportunities in China and while we always look for growth, we also have to make sure that the investment is backed by durable, proven, businesses at sensible prices. For example, many investors try to access the growth of the Chinese Pharmaceutical sector through Jiangsu Hengrui. But this sector is unproven in China and works differently than in other countries. China is a single payer market, and while the government is expanding health care coverage, it also focuses on keeping overall health care expenditure growth in check. This results in frequent policy changes and less pricing power compared to Western markets. Drugs in China will also have more compressed lifecycles than in other markets, as they can reach peak sales more quickly but will also experience quicker and more dramatic pricing erosion. In an industry with less certainty given the nature of drug development, plus high levels of government intervention, valuations appear to embed a lot of success.

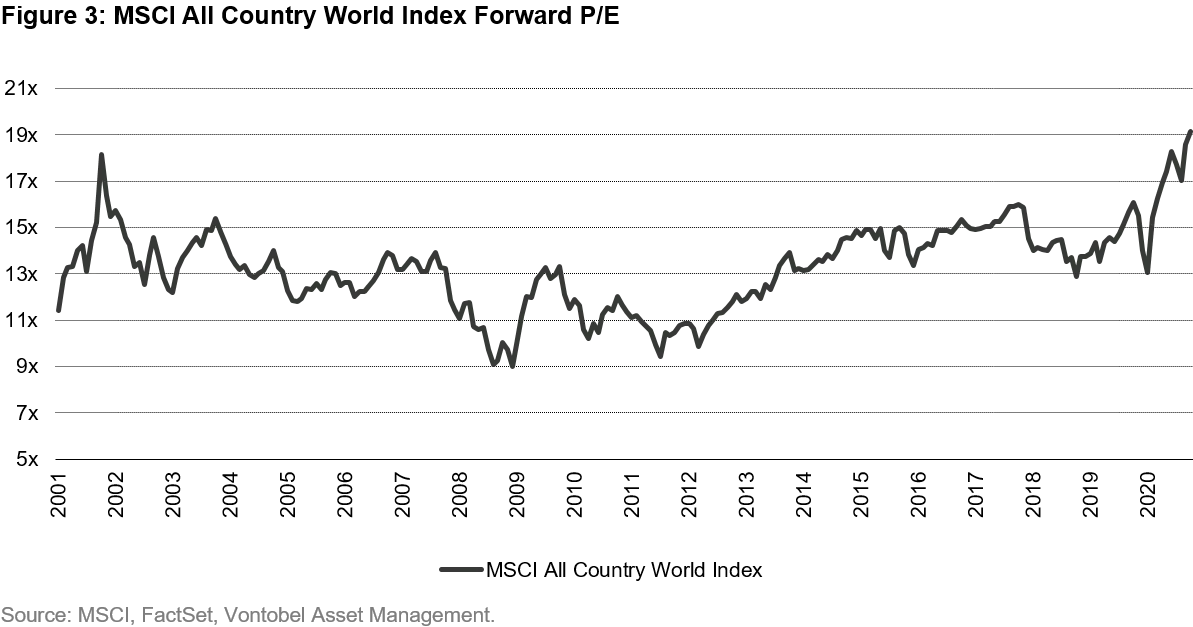

3: Expanding valuations and other signs of exuberance at a time of rising uncertainty

At a time when soaring Lucky stocks are concerning, we also note other items that warrant caution. Valuations have expanded overall (Figure 3) and the economic outlook looks murky and is skewed to the downside. The number of global IPOs and the amount of cash chasing those IPOs is enormous. Within the IPO space, the rise of Special Purpose Vehicles (SPACs), investors bet on a manager or team to not only run a business well, but first find a business to run. The market is not acting rationally. Anecdotally, GameStop, a traditional retailer that has seen sales decline for years (and therefore does not fit the mold of company discussed above) as video games are increasingly downloaded, saw its stock increase many times over in the first few weeks of this year driven by retail investors causing a short squeeze. Gamestop is referred to as a “meme stock”, one that has gained notoriety due to internet popularity. This, along with the rise of other meme stocks, is a sign that investors should heed caution, reminding us that markets are not always efficient. Risks do not go away when they are out of mind – it is quite the opposite – risks increase the more they are ignored.

One way to protect against a potential reversal is by not focusing on growth to the exclusion of all else. This is not to imply that a given business cannot be on the path to greatness, but when the market only looks at a company’s potential and ignores the risks, it pays to be wary. Growing companies that also have a proven, high return business model today, and trade at reasonable valuations, are a more conservative, and historically fruitful way to protect in a market downturn, and can provide a smoother ride through the cycle. In our view, a quality growth manager should not singularly focus on growth, but look for quality businesses first. While this approach may exclude some of the fastest-growing companies, we believe investing in growth for the sake of growth is not a great strategy. Profitable growth is.

Ultimately, successful investing over time is not a game of luck, but an endeavor that requires discipline and skill.

DISCLAIMER:

Certain of the information contained in this viewpoint is based upon forward-looking statements or information, including descriptions of anticipated market changes and expectations of future activity. Adviser believes that such statements and information are based upon reasonable estimates and assumptions. However, forward-looking statements and information are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements and information.

This presentation is not an offer to sell or the solicitation to buy any security. It does not constitute a recommendation to buy or sell any security. Past performance is not necessarily indicative of future performance, future returns are not guaranteed. There is no assurance that the adviser will make any investments with the same or similar characteristics to the investment presented.