Not So Sweet: Why Investing in Apple Might Leave a Sour Taste

Quality Growth Boutique

Key takeaways

With consistent innovation and growth, Apple has enjoyed years of strong financial and stock performance, recently becoming the first company to reach a market capitalization of $3 trillion.

While we admire the unique franchise the company has built with its mobile ecosystem, we examine the investment case of why Apple may not fit into a quality growth investor’s portfolio. Certain factors may prevent investment at this time:

- Uncertainty about future iPhone growth as it is coming off a product “super cycle.”

- A mixed track record of launching new services and regulatory risks to the current App Store model.

- Potential new product markets beyond smartphones are more speculative in nature.

- Apple’s valuation is not compelling considering the growth prospects and risk factors.

Can iPhone growth keep up after a super cycle?

Widely recognized as one of the world’s most iconic brands, Apple revolutionized the smartphone category with the launch of its first iPhone 15 years ago. Today, it is one of the most ubiquitous pieces of personal technology with an installed base of over one billion users.

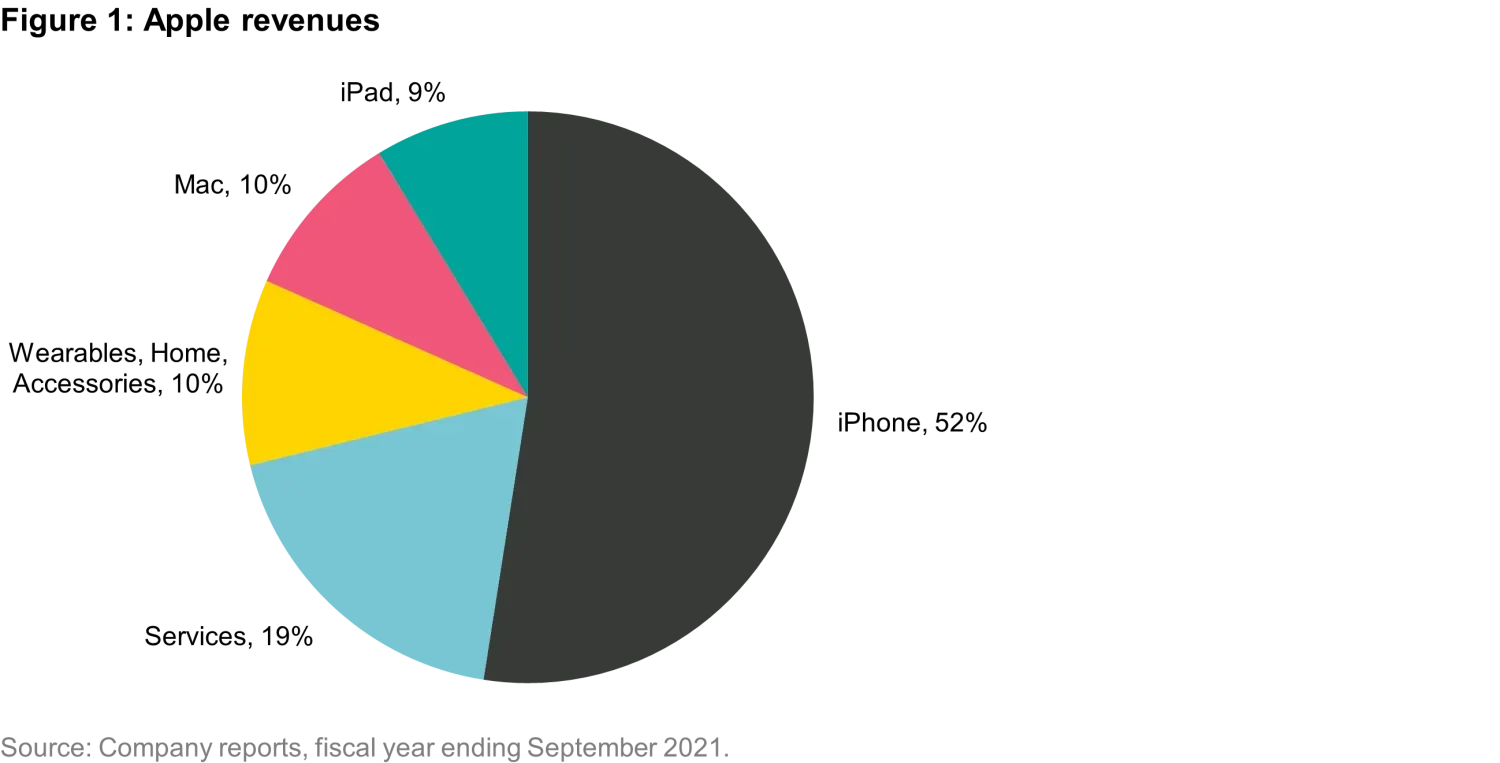

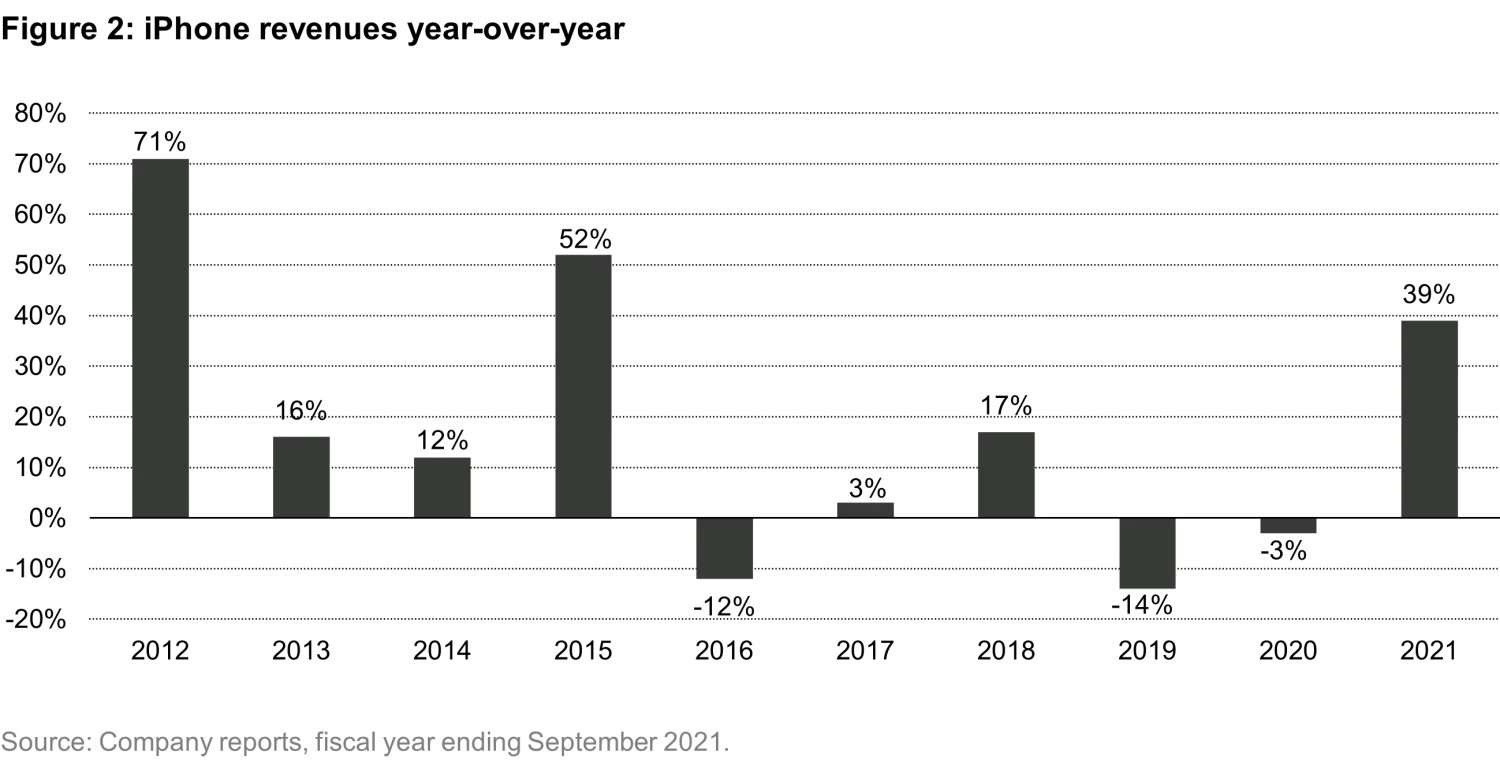

The iPhone remains at the heart of Apple’s business, generating a little more than half of total revenues. Fiscal 2021 was a banner year for the iPhone, as revenues grew 39%. Growth was boosted by a more substantial upgrade cycle with the iPhone 12, which offered the first major refresh to the phone’s exterior appearance since the iPhone X was launched in November 2017. An exterior refresh traditionally piques consumer interest and also provides an opportunity to increase monetization. For example, average iPhone selling prices increased 11% in FY15 following the launch of the iPhone 6 and the introduction of a larger-screen Plus model. The 10th anniversary iPhone X was the first one to break the $1,000 price threshold, driving average selling prices (ASPs) up 17% in FY18. Apple no longer discloses exact iPhone volumes which makes precise pricing calculations more difficult, but iPhone ASPs are estimated to have increased in the mid to high teens percentage in FY21.

In addition to the product cycle, iPhone sales likely benefited from the unique spending environment surrounding COVID. A shift to work from anywhere drove increased demand for smartphones, as well as categories such as laptops and iPads. At the same time, a very strong consumer spending environment boosted by government stimulus was directed towards purchases of goods, as much of the services economy remained closed. Consumer electronics were a major beneficiary of this shift.

Ultimately, we see the risk of a lull in iPhone sales, with growth rates returning to more modest levels. Not only is the company coming off a larger product cycle, but COVID-related spending patterns will likely dissipate as well. Smartphones are a mature category, and have a discretionary element given high purchase prices and modest nature of annual product refreshes. While the camera has remained an area of innovation, improvements in other areas (processor, screen, smaller notch) have been more incremental in nature. With prices for the higher-end iPhone 13 Pro Max starting at $1099 and going as high as $1599, consumers may extend replacement cycles if the economy turns and they find themselves feeling less flush. We expect the same could happen for the iPad and Mac, which also experienced a demand surge during COVID. These franchises are lower margin than the iPhone, but still represent nearly 20% of Apple’s revenues and represent another area of potential demand pull-forward, particularly on the consumer side.

Lackluster services and regulatory risk on the App Store model

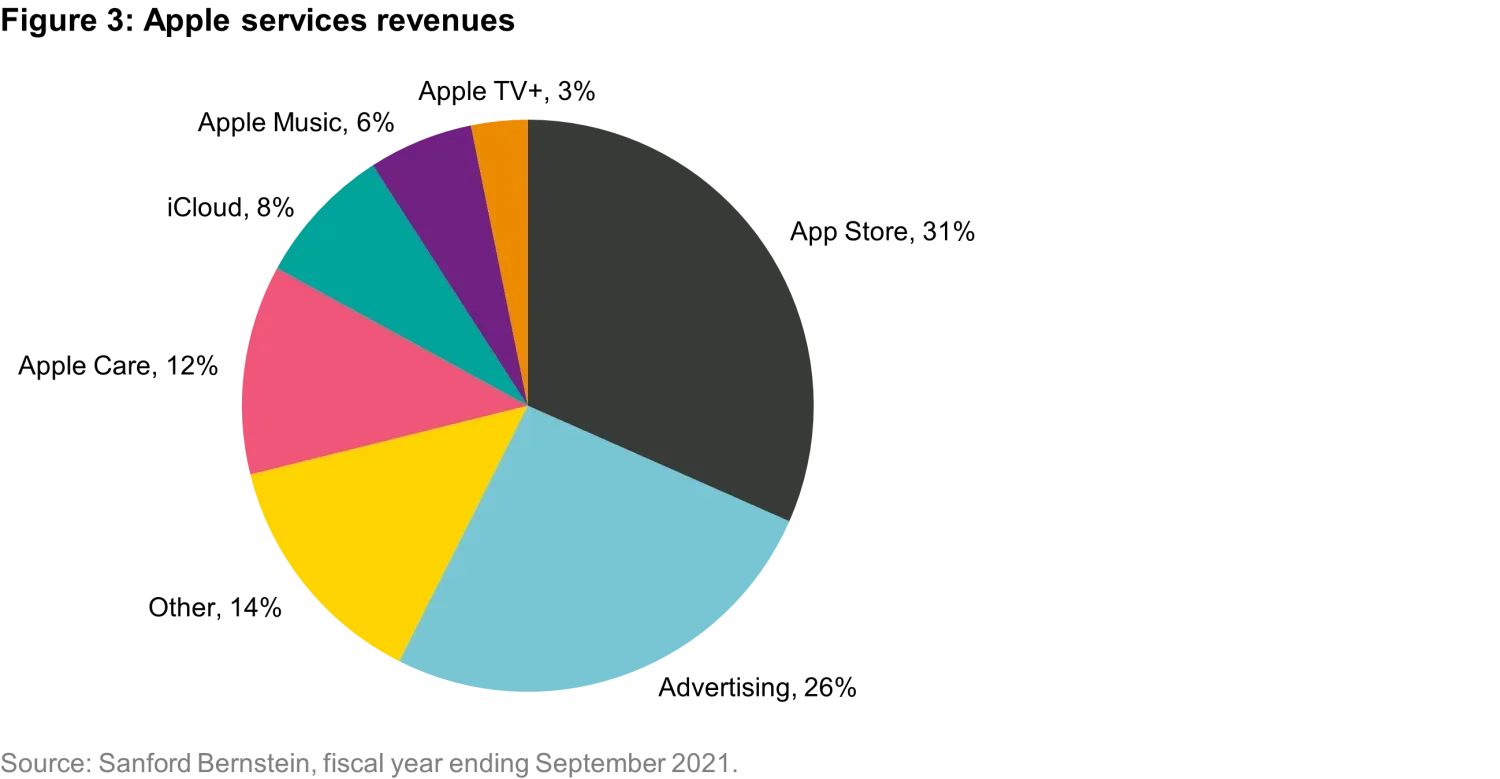

Services have become an increasingly important driver of the Apple investment thesis as smartphones have matured as a category. Services represented 19% of total revenues in FY21 while growing at a rate of 27%. They represented 31% of gross profit dollars given a significantly higher margin profile than devices. Much of Apple’s product differentiation comes from the seamless integration between the hardware and operating system. Layering on additional offerings on top of the iOS platform is a natural strategy for Apple to pursue. Early services mainstays include iCloud (online storage) and Apple Care (extended warranties), but Apple’s track record in developing actual new services has been mixed.

Products like Apple Music and Apple TV+ have achieved reasonably high subscriber bases in absolute terms, aided by the ability to attract users from its iOS device installed base with free initial trials. However, competition is intense, and it is difficult to imagine either product gaining significant ground vs. the industry leaders. According to entertainment research group MIDiA, Apple Music had a 15% share of global streaming music subscribers in 2Q21, well behind Spotify at 31% and not that far ahead of Amazon Music at 13% and YouTube Music at 8%. The Information, a technology publication, recently reported that Apple TV+ has 40 million global accounts, of which half are paying subscribers. This would place it well behind well-resourced and highly motivated players such as Netflix, Disney, Amazon, and HBO. Outside of the breakout hit Ted Lasso, the service has not carved out much of an identity outside of socially responsible programming, and usage and churn are materially worse than those of the industry leaders. Streaming is an inherently lower margin business, and in our view, Apple’s own businesses will likely remain subscale for the foreseeable future. Hence, despite the attention these businesses receive, they are unlikely to move the needle for a company that reported $365 billion of revenues and a 30% operating margin in the last fiscal year.

Apple’s services profitability is predominantly driven by the iOS App Store and advertising. The App Store reflects the 30% revenue share Apple receives on app purchases or in-app purchases of digital goods, which goes down to a 15% revenue share after the first year. Advertising revenues are predominantly licensing fees from Google in exchange for making it the default search engine in the Safari web browser. The stock market has rewarded Apple for its ability to develop such large, fast-growing, and margin-rich income streams. However, services profits are driven less by providing additional value to users and more akin to Apple placing toll booths across its iOS ecosystem. While this demonstrates the power that Apple wields and its ability to monetize its user base, we expect this to become increasingly problematic with regulators.

As smartphones have become ubiquitous, the iPhone is now one of the most important computing platforms in the world. However, in contrast to earlier platforms such as the personal computer, Apple maintains a high level of control over what can take place on its smartphone ecosystem. The company has sole decision-making authority over what apps are allowed, controls the sole distribution channel with the app store, regulates what types of activities are allowed in the apps, as well as takes up to a 30% revenue share from what it deems to be digital businesses.

To be clear, the state of Apple’s mobile ecosystem is a testament to the strength of the business it has built up over the past 15 years. iOS is one of the two major mobile operating systems and, with vertical integration into hardware and a premium positioning, is more valuable. However, this combination of financial and operational control risks being determined as untenable by governments who view the smartphone as the latest generation of computers.

Apple’s App Store policies have already attracted the attention of regulators across the world. In Asia, Japan’s Federal Trade Commission launched an investigation into the mobile operating system market, while the Korean government recently passed a law requiring app stores to allow alternative in-app payment methods. In Europe, the EU antitrust commission has announced a preliminary finding that Apple distorts competition via the mandatory use of its in-app purchase system.

In addition to antitrust investigations, the EU is in the process of finalizing its Digital Markets Act (DMA), which will more preemptively regulate behavior for certain digital platforms including operating systems. As currently written, the DMA explicitly provides for alternative forms of app distribution (including third-party app stores) as well as third-party payment systems. Finally, while we expect the US to move slower than other countries with respect to broader antitrust regulation, we note that Congress has shown greater bipartisan interest in the Open Markets Act, which would allow for third-party app stores and payment systems.

The path towards app store regulation is still in early days and can evolve in a number of directions. Timelines could also get pushed out and Apple may be able to offset the financial impact by trying to monetize its intellectual property in some other fashion. However, when it comes to app store platforms, it is striking to see so many governments across the world focusing on the exact same concerns. We think they take issue with the level of operational and financial control that Apple has over such an indispensable computing platform and fundamentally want to see it opened up. One can imagine the reaction if Microsoft attempted the same policies for Windows PC or IBM for mainframes. While material new regulation may not yet be a foregone conclusion, we think the market is being complacent about the potential risk to such an important driver of Apple’s growth.

The other major driver of Apple’s services profitability is advertising, which is predominantly the revenue share that Apple receives from making Google the default search engine in Safari. This revenue stream is effectively pure profit and fast growing as well. However, buying Apple as a way of getting exposure to Google search seems a bit convoluted as investors also have the option of purchasing Alphabet stock. Analysts at Sanford Bernstein estimate that the App Store and advertising contributed roughly 75% of the services business’s gross profit dollars. This highlights the extent to which Apple’s own services have struggled to break through despite numerous entries and underscores the importance of Apple being able to maintain its App Store model.

What will be the next major new product?

A key component of the bull case for Apple is the company’s ability to enter new markets. Automobiles have long been of interest, with the company working on Project Titan, its own electric vehicle development program, since 2014. Cars represent an appealing end market to Apple given the sheer size of the consumer spend as well as increasing digitization of automobile content. However, Project Titan has reportedly undergone numerous leadership changes and strategic shifts over the years.

Recent press reports indicate that Apple is currently focused on developing its own fully autonomous car, with a launch date as early as 2025. We would take such reports with a healthy degree of skepticism. First, the overall field of autonomous driving has consistently proved to be more challenging than previously appreciated, with timelines often pushed out. We would not be surprised if in 2025 autonomous driving were still being characterized as five years away. In addition, developing a self-driving car is a much more complicated endeavor than Apple’s other projects. Despite the obvious appeal to Apple, autonomous vehicle development requires different skill sets, and we fail to see why the company would be at the vanguard of this industry.

The emergence of virtual and augmented reality (VR and AR) is also highly anticipated, with attention intensifying and growing publicity around the metaverse. We find metaverse to be a still nebulous concept that varies quite a bit depending on the person. Some commonalities include the idea of a persistent and more immersive digital world. However, the prospect of one singular metaverse that is home to every person and organization strikes us as overly aspirational and something that will remain relegated to science fiction movies. Instead, we think it is more likely that certain attributes of a metaverse-type experience will get embedded into different digital services over time.

In contrast to autonomous vehicles, VR and AR represent a more natural product adjacency for Apple. Apple brings existing technology with smartphones and a mobile operating system, as well as its installed base of iPhone users. Between the two technologies, VR will be more readily available but likely remain niche as the headsets are cumbersome to wear and isolate the user from their physical environment. This makes VR headsets inherently inconvenient and more suitable for specific applications. AR has the potential for more expansive use cases as it allows users to remain in the real world, but the technology is further out and we expect AR glasses to cost thousands of dollars at the beginning. Initial applications may be more practical for businesses rather than the consumer. An Apple VR headset has been anticipated for some time. At one point, according to press reports, an Apple VR headset was expected to be launched in 2020. However, delays have pushed it out until likely early 2023, with AR Apple glasses now expected in 2024/25. Ultimately, while VR/AR is an area with potential and worth monitoring, we suspect that imagination has gotten ahead of reality in terms of the pace these markets can develop.

Valuation is at a premium to technology peers with higher growth

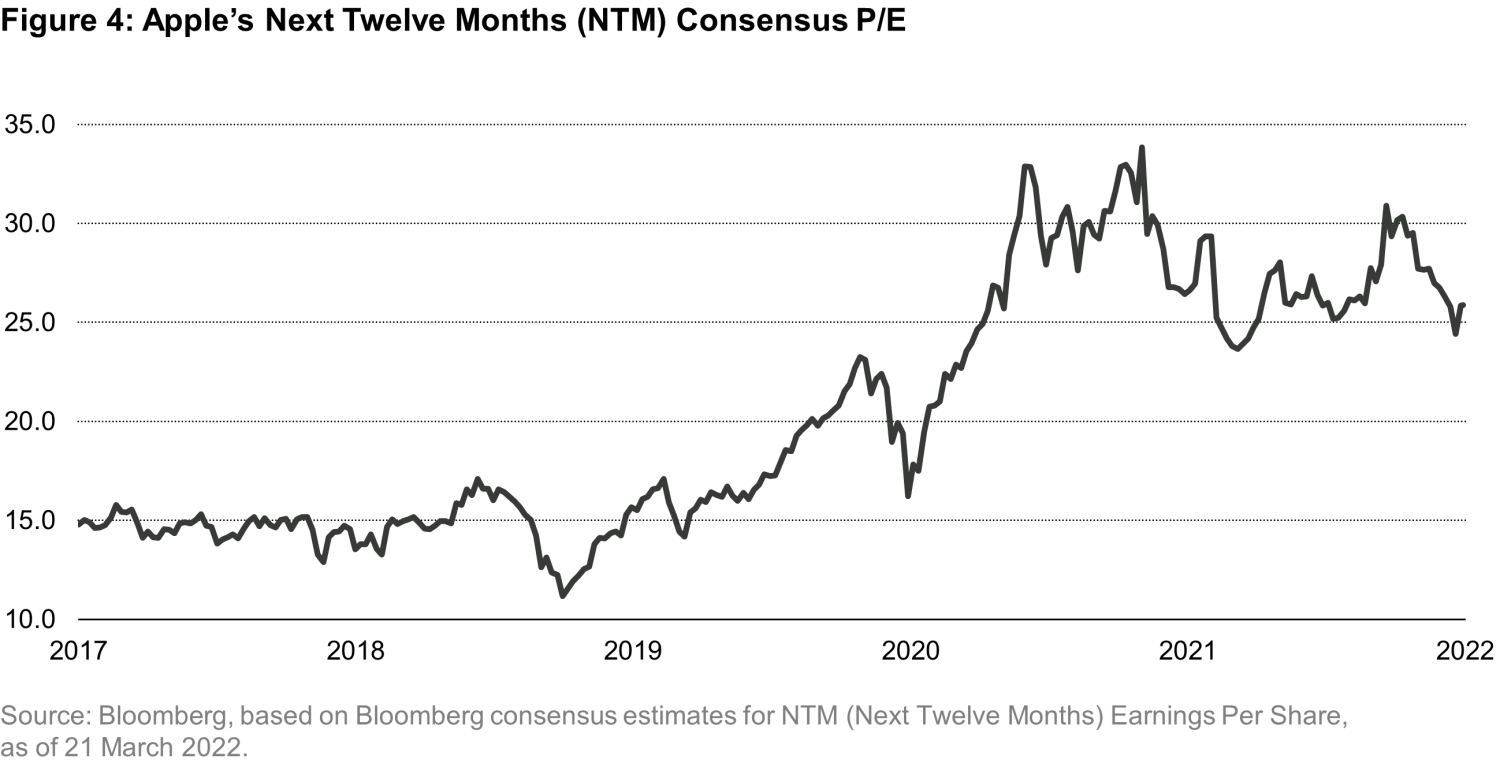

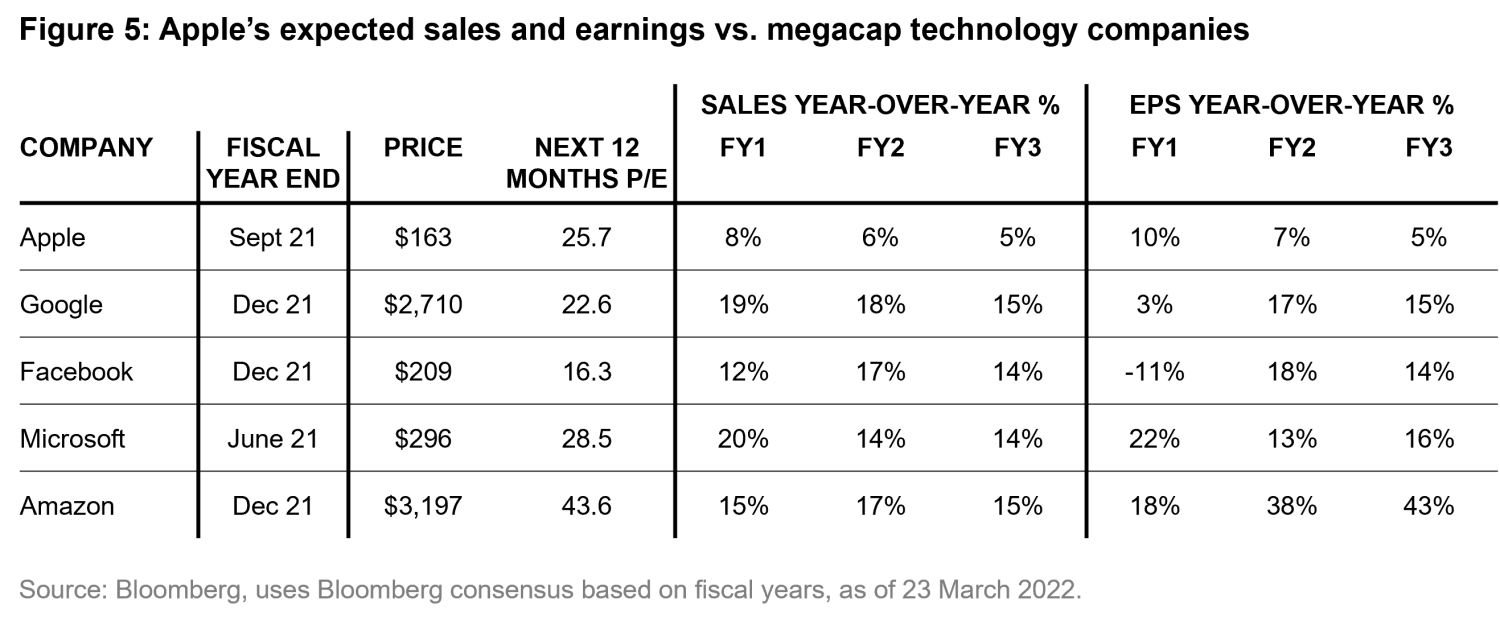

Apple is a premier technology franchise and well entrenched with the world’s most valuable mobile operating system. However, despite the quality of the business, we believe the market has been overly enthusiastic in bidding up the stock. Recent years saw a dramatic expansion in the P/E multiple from the mid-teens to as high as >30x during COVID (see Figure 4) While some re-rating is warranted given the strength of the franchise, we believe the multiple now looks to have swung too far in the other direction. Apple currently trades at a similar or higher multiple to other megacap technology names despite a slower secular growth outlook – Figure 5 below compares P/E multiples vs. revenue and EPS growth outlooks based on sell-side consensus estimates.

We view potential regulatory changes to the App store model as underappreciated, and prospects for new product markets as still nebulous. In addition, geopolitical tensions have impacted the Chinese businesses of other US multinationals, and this is another risk for Apple. Greater China represents 19% of the company’s revenues, and Apple is also highly reliant upon the region for its supply chain. These risk factors are under appreciated and could be complicated for the company to resolve. While we do not dispute the strength of Apple’s business franchise, we continue to see a disconnect between the stock and the company’s growth prospects. We believe quality growth investors can find more compelling risk reward scenarios in other areas of large cap technology that also offer higher sustainable growth.

DISCLAIMER:

Certain of the information contained in this viewpoint is based upon forward-looking statements or information, including descriptions of anticipated market changes and expectations of future activity. Adviser believes that such statements and information are based upon reasonable estimates and assumptions. However, forward-looking statements and information are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements and information.

This communication is not an offer to sell or the solicitation to buy any security. It does not constitute a recommendation to buy or sell any security. Past performance is not necessarily indicative of future performance, future returns are not guaranteed. There is no assurance that the adviser will make any investments with the same or similar characteristics to the investment presented.