TwentyFour

Your Lufthansa Coupon Has Been Delayed, But Not Cancelled

Last week there was a rare occurrence in the high yield market as German airline Lufthansa announced it would be deferring the coupon on a hybrid bond issued in 2015.

TwentyFour

What Does US Wage Data Say About Inflation?

From our perspective, the potential wage pressures we see make us uncomfortable with 10-year Treasury yields at current levels, despite their significant rise since the start of the year.

TwentyFour

Reaching For The Risk Dial as Valuations Stretch

Having witnessed the most remarkable turnaround in risk markets over the last 14 months, it makes sense to take stock as fundamentals look to us to be approaching optimal levels. Credit spreads have ground into levels not far from the prior cycle’s tights, and while we remain confident in the underlying fundamentals and a good technical backdrop, recent developments mean that despite this constructive view, our risk appetite has ticked down slightly.

TwentyFour

What’s Really Going On With US Jobs?

At 8.1m, the number of job openings as of March 31 was the highest it has been since the data series began some 20 years ago.

TwentyFour

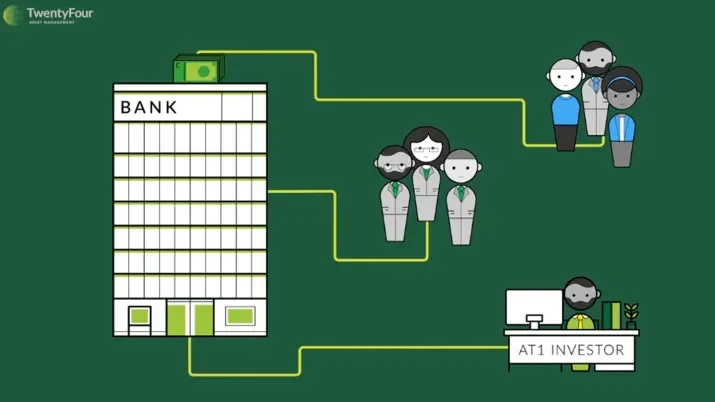

What are AT1 bonds, and how do they work?

Additional Tier 1 bonds, or AT1s for short, are part of a family of bank capital securities known as Contingent Convertibles or ‘Cocos’. They are bonds issued by banks that contribute to the total level of capital they are required to hold by regulators.

TwentyFour

Classic Late-cycle Issuance…in Mid-cycle

Markets can often be tricky for investors in May as bond issuers take advantage of a window of opportunity following the Q1 earnings season and ahead of the typical summer lull. This often results in heavy supply in late April and early May, hence the old trader adage of “sell in May and go away”.

TwentyFour

Is Shunning Coal a Good Policy for Capital Markets?

As long as coal usage is not illegal, a private buyer of any origin will be able to purchase these assets cheaper and run them for as long as possible with no regard for ESG matters.

TwentyFour

What's Happened to the Brexit Premium?

There has been a lot of focus on the performance of the high yield markets since the start of the year, particularly in Q1 when many rates markets were selling off aggressively.

TwentyFour

Beware a Second Wave of Treasury Selling

Crucially while the Fed may wait to see the evidence, markets won’t, and we therefore expect a ‘second wave’ of Treasury selling to happen well before then.

TwentyFour

CoCo Re-rating Underway as Euro Banks Prove Mettle

Having been at the heart of the GFC and then contributing to the Eurozone sovereign crisis, we have long argued the European banking sector would have to prove its newfound resilience to investors by successfully navigating a challenging period.

Quality Growth Boutique

100 days Biden: Economic recovery and growth now have to be the market’s tailwind

While higher interest and inflation rates may more predominantly impact owners of long-duration assets in a variety of ways, they are also simply a positive signal of strong economic growth, which is a good thing. They also should enable for a more generally healthy pricing environment for risk assets. Higher interest rates are not necessarily something terrible to be only feared.

TwentyFour

Tobacco Bonds Volatile as Investors Chew On ESG Risks

Tobacco company bond spreads were volatile last week on news that the Biden administration is exploring a ban on menthol cigarettes and may pursue a policy to reduce nicotine levels in all cigarettes to non-addictive or minimally addictive levels. Rumours about an increased tobacco tax also surfaced, further shaking up the industry.

TwentyFour

Credit Suisse Pulls Levers to Shore Up Capital

What is most interesting about the CS situation though is that to us it illustrates the ability of large banks to bolster capital when such events occur, and the range of options they have to do it.

TwentyFour

Strategic Income Quarterly Update – April 2021

George Curtis discusses how credit markets have performed in Q1 2021 and provides his outlook for the year ahead.

TwentyFour

A Taper Without a Tantrum

Had this happened a month ago, we suspect the move would be materially more pronounced, and the muted reaction indicates to us that markets are now quite comfortable with the current levels of expected growth, forecast inflation, and yields.

Quality Growth Boutique

Will US stimulus spending lead to greater inflation and higher interest rates?

With US President Biden’s $1.9 trillion Covid relief package, alongside the recently proposed $2.25 trillion in infrastructure projects, there is growing concern about the impact these programs could have on inflation and interest rates globally. In the investment world, we have been operating amid declining rates and low inflation for so long that few may realize the impact rising rates would have on investment returns.

TwentyFour

Barclays' Prison Break

ESG conscious investors, ourselves included, of course, are applauding this brave decision by Barclays to put their conscience before profit, but they are not the first to do so.

TwentyFour

Short Term Bond Quarterly Update – April 2021

TwentyFour partner and portfolio manager Gordon Shannon looks at the developments we saw in investment grade credit in the first quarter of 2021 and provides his outlook for the rest of the year.

TwentyFour

Asset-Backed Securities – Quarterly Update – April 2021

TwentyFour AM partner and portfolio manager Douglas Charleston discusses how ABS markets have performed in the first quarter of 2021 and provides his outlook for the rest of the year.

TwentyFour

Volatility in Rates Eased For Now

This recent stability in the rates curve suggests to us that for now the market is listening to the Fed’s rhetoric and as a result the UST market feels better balanced.

TwentyFour

Negative ‘Bond’ Headlines Belie the Reality of Credit’s Strong Performance

With treasury yields moving aggressively higher this year, anyone reading or listening to the financial press will have become very accustomed to headlines highlighting the negative performance of “Bonds”.

TwentyFour

Sustainability To the Fore as SFDR Kicks In

There are many other aspects of SFDR to discuss and we expect the market to take some time to fully adjust.

TwentyFour

A New Low for Investor Protection in Euro High Yield

Primary deals launched in the European high yield market over the last two weeks have been diverse, and at times opportunistic.

TwentyFour

Brass Builds Momentum in ESG ABS

In terms of execution, it is difficult to assess any ‘ESG premium’ in Brass 10 given the overall strong demand, and in our view it’s still early to weigh the importance of a ‘social’ label for ABS investors.