Equities may brave war in Ukraine if global economy stays solid

Multi Asset Boutique

Key takeaways

- Most scenarios of the war in Ukraine are deeply unsettling, but equities may well prove resilient if the post-pandemic global economic recovery continues

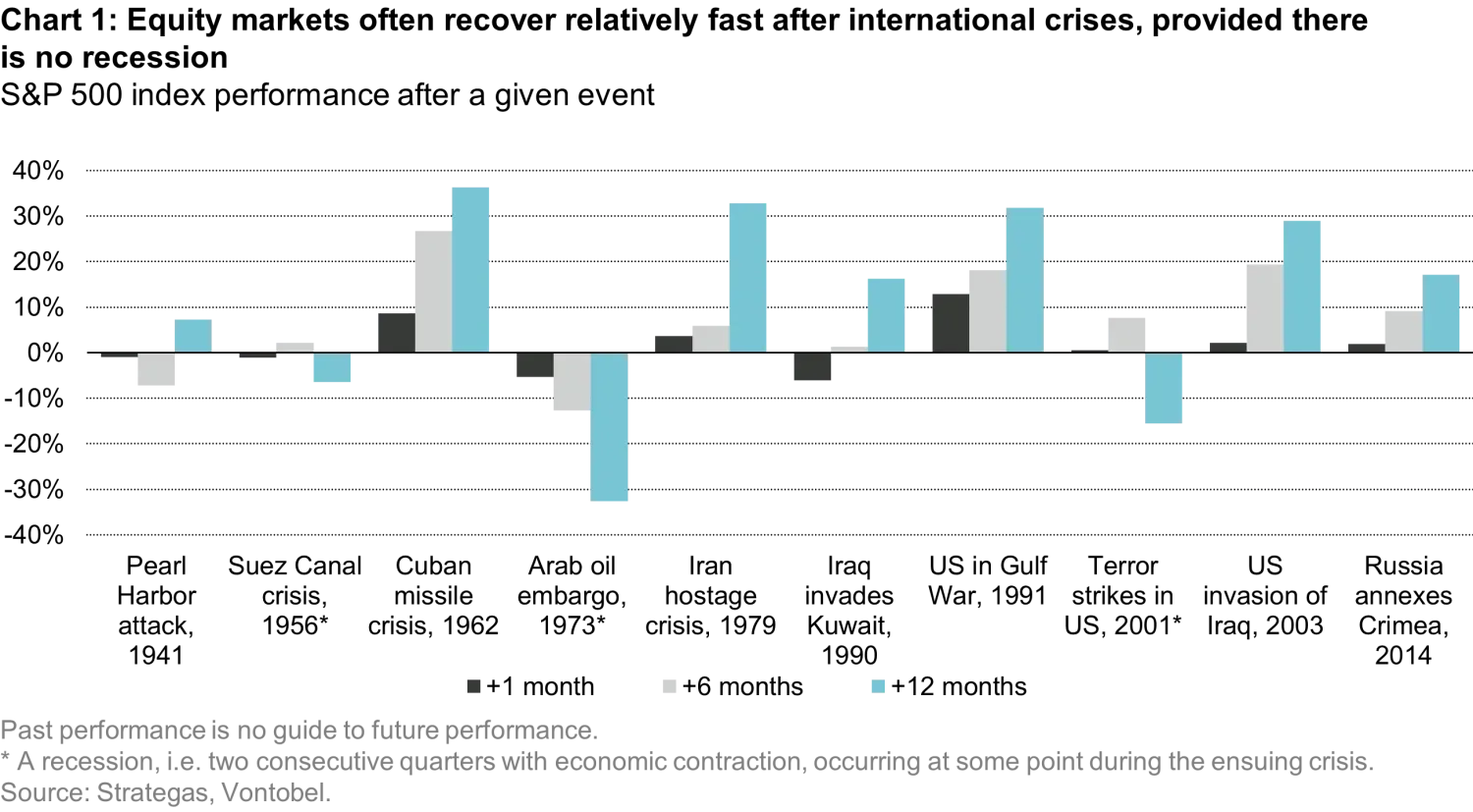

- Stock markets have shown a great deal of sturdiness during every international crisis since the Pearl Harbor attack in 1941, unless there was a global recession within 12 months after the event

- A recession is not our baseline scenario at present, but western sanctions against Russia and Russian counter-measures will have an inflationary effect

- The US Federal Reserve and the European Central Bank can’t do much about soaring energy prices

- They are likely to tighten monetary policy, walking a fine line between preserving price stability and not jeopardizing growth

Russia’s attack on its southern neighbor could result in a puppet regime in Ukraine, the division of the country, civil war, or – less likely – the downfall of the current regime in Moscow, or an escalation involving the western defence alliance NATO. However dramatic the situation for the population, equity markets may prove resilient if the global post-pandemic economic recovery remains on track, says Frank Häusler, Vontobel’s Chief Investment Strategist.

Inflationary effect is certain

The one certainty of the war, apart from the catastrophe it represents for the people affected, is that it will have an inflationary effect via higher energy, metals, and grain prices, Häusler noted. Regarding the possible consequences for investors, it is useful to remember how markets developed during past international crises, he added. Looking at the moves of the S&P 500 index in times of major conflicts starting with the Japanese attack on Pearl Harbor in 1941 and ending with Russia’s annexation of the Crimean peninsula in 2014, there are clear signs of stock market resilience (see chart 1). “Most of the time, after six or 12 months, equity markets were clearly in positive territory,” Häusler said. There were, however, three periods during which the S&P 500 remained in the red for longer: Egypt’s nationalization of the Suez Canal in 1956, the oil embargo by a Saudi Arabia-led coalition of petroleum producers in 1973, and the 9/11 terror strikes in the US. Some of these events pulled the global economy down, and stock prices with them. “It was a global recession that made the difference,” Häusler said.

Vontobel’s investment strategists currently don’t foresee any contraction of the global economy because activity is expected to rebound from the depressed level during the pandemic. The gross domestic product (GDP) is expected to rise by 2.8% (previous estimate: 4.0%) in the euro zone, 3.1% (3.5%) in the US, and 5.5% (unchanged) in China in 2022. Inflation rates are forecast to reach a yearly average of 5.7% (4.1%) in the euro zone, 6.2% (5.1%) in the US, and 2.3% (unchanged) in China.1

A “Sarajevo moment” for stocks?

With everything in flux, a darker scenario needs to be contemplated as well, Häusler said, referring to a “Sarajevo moment” for stocks in 1914. At that time, the assassination of archduke Franz Ferdinand of Austria in Bosnia-Herzegovina’s regional capital Sarajevo depressed UK and US stocks for most of the four years of global conflict that followed, although the latter equity market witnessed a temporary rally between 1915 and 1917.

Fed seen hiking rates more often than the ECB

In the months and quarters ahead, economic fortunes will to a large extent depend on the big central banks’ next moves. Häusler currently expects the US Federal Reserve to hike the key rate in several steps to stave off inflation. The European Central Bank, for its part, looks set to only increase the base rate one time this year, but end its current pandemic-linked purchase program (PEPP) as well as a longer-running asset-buying scheme called APP, according to Häusler.

1. Vontobel forecasts as of March 24, 2022