Coronavirus – 3 steps through chaos

Quality Growth Boutique

Highly erratic markets are similar to flying an aircraft through a storm – best avoided, dangerous, but navigable. Experienced pilots will tell you for bad weather flying, rely on the instruments and basic training because it can save you from your seat-of-the-pants instincts. An artificial horizon1 is a vital instrument to use flying through clouds, let alone a storm. To navigate highly erratic markets, investors also need a set of reliable instruments to maintain their horizon and restrain the pack sense that draws most of us.

The frightening human death toll from the Covid-19 virus during peace-time creates a disturbing disquiet for our lucky generation. Economically, it’s a black swan event. How we now frame the crisis in terms of capital preservation and time to recovery will affect investment decisions. We selected a series of three thought frameworks to share that we find useful in times of extreme uncertainty.

- Immediate triage, recognize change, get real

- Hold the horizon through the chaos

- Get ahead of structural change that will happen after the storm

1. Recognize change

Liquidity is king in a crisis. You can wait on income. With a sudden loss of earnings visibility and funding, we look to minimize exposure to holdings with low solvency, low liquidity as well as higher earnings cyclicality. Prices can fall sharply if buyers with a different buy rationale are needed to clear the sell orders, e.g. a shift from growth buyers to value buyers. Redemptions can leave managers with no choice but to sell, even in the face of once-in-a-generation bargain prices.

Solvency rules. We test how long the company’s balance sheet strength will see it through a frozen debt market alongside a sharp fall in cash flow. This could either be through enough cash in the bank, or debt maturities far enough out to avoid a cash crunch.

Then there’s the basic business itself. How sensitive is it to a downturn? Is its position predictable two years out? There is an important difference in demand structure through a crisis. Some demand is only delayed (pent-up) such as medical implants for a hip replacement, where operations are likely to go ahead when conditions allow. Other demand vanishes with time, including a fair amount of discretionary spending such spending at restaurants, bars, hotels, holiday travel, cruises, and real estate rental.

Predictability is a cornerstone. Ideally, you can sense the earnings capability at the other end of the crisis. If so, you have the added bonus of a valuation.

2. Rate of recovery – remember your return horizon

The Covid-19 crisis is firstly one of health, not economics. As the virus spreads, however, the impact on business from the economic slide will deepen rapidly. How long it takes to control the virus will obviously have a huge impact on the damage and recovery rate. A quick catch will more likely provide a snap V-shape recovery. A drawn-out pursuit will lead to greater damage and a slower recovery. While an effective vaccine would rapidly improve the economic outlook, we can only hope but not hang our hat on that.

Your investment goals are a horizon. Have you promised absolute or relative returns? The concern of a V-shaped bounce is a relative return risk. Many savers, including quality growth investors, focus on absolute returns. Investment sprinters that reset the clock annually will be absorbing minute-by-minute news hoping to ‘call’ the end of the pandemic. We do not see this as sensible, let alone a robust philosophy given the pain of downside for hard-won savings. The first order of business should always be to avoid capital loss – growing the capital follows.

Valuations follow profits over the long term. The more visible the earnings growth, the better underwritten returns should be.

3. Structural change

It would be disappointing to survive the crisis just to discover fundamental value had fallen out of an investment, and recovery was not on the cards. Following this shock of death and economic damage, we find it hard to imagine structural changes will not happen once the crisis is quelled. Regulators will want to wade in to close the door on perceived weaknesses or abuses. The markets will also adjust to the new conditions. Some will benefit from customer demand shifts from newly discovered efficiencies, others cleaning up behind failing companies. Here are a few potential shifts to consider:

i) Benchmark’s buyback driver to weaken. A shortage of cash flow is likely to lead to a sharp fall in buybacks. Buybacks have long been an important driver for returns. Last year, for instance, the yield provided from buybacks to the S&P 500 was 3.2% on a market weighted basis2. Companies that retain their strong cash flows will be in a position to buy back shares at considerably more attractive prices than last year.

ii) Capitalization of business with strategic importance. U.S. balance sheets are generally in decent shape. But bankruptcy risk of vital and naturally oligopolistic industries are prime targets for change. One example is airlines. Within a few days of the crisis gripping Europe and the US, the potential need for taxpayers’ support was clear. Raising capital requirements for airlines would bring stability along with less exciting returns through the strong end of the cycle. Looking wider, it is likely certain manufacturing industries will need to carry more inventory to avoid production halts from further unexpected disruptions. Carrying more working capital takes funds that could otherwise be invested in growth or paid out in dividends – which in turn this would lower returns generated from shareholder’s equity.

iii) Control of the supply chain. In the US, around 80% of the active pharmaceutical ingredients used in drugs are imported, mainly from India and China. In March 2020, India restricted the export of 26 drug ingredients and the drugs made from them. With globalization, companies (and certainly consumers) have lost track of their supply chain. Most large corporations have insights into their first-tier suppliers. But suppliers to those suppliers (tier 2) and beyond remain little known. In times of need, the risk of national hoarding means a country could go short of vital products or components due to a reliance on imports. Tracking and securing supply chains could lead to on-shoring of ‘strategically important’ products – notably away from export facilities in Asia. The lack of supply chain tracking from field or mine to the shelf has become a glaring oversight. This will have additional benefits in areas such as forced labor where abuse appears to be hidden in the supply chain of many Western importers.

iv) Real estate – catalyst for change. Brands strong enough to drive direct-to-consumer sales have the potential to further stretch their share of profit pools. A sustained absence of shoppers from marginal shopping malls and chain stores could prove the final straw. This would signal a further step in retail’s structural shift from physical to cyber. Companies such as Nike, Microsoft, Apple, Starbucks and LVMH are well placed for this step of the consumption evolution.

v) Risk pricing returning to the high-yield market. Balance sheet strength will remain an important focus for a while. The risk of the lowest rung Investment Grade (BBB) rated bonds slipping a notch into the smaller High Yield demand pool has been well flagged (shale oil). As the supply of high yield increases, prices should fall and push up spreads – increasing the cost of refinancing for lower credit quality borrowers. We see the repricing of risk as overdue and generally beneficial in that it will reduce the incidence risky short-term return strategies such aggressive use of cheap debt for the hostile acquisitions of conservatively run businesses.

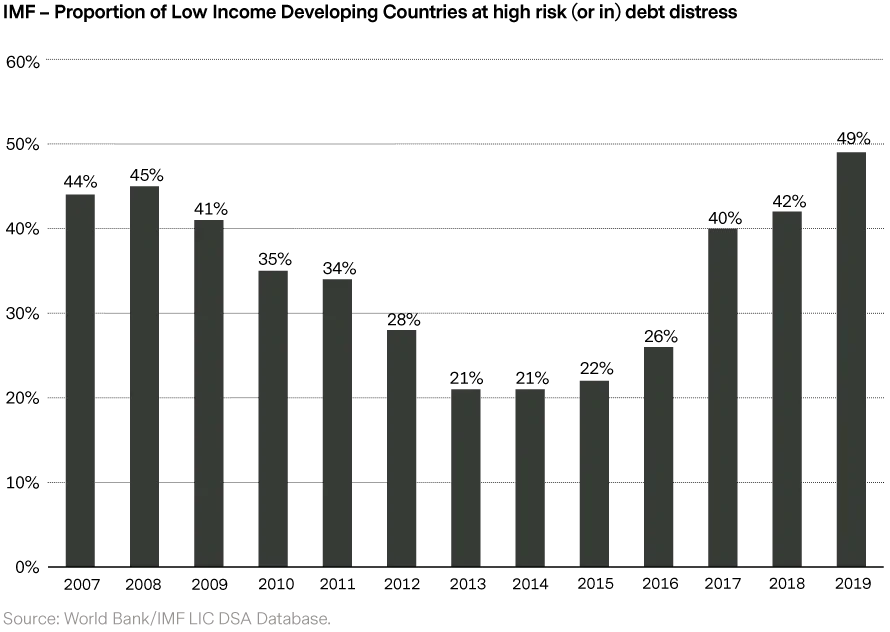

Repricing will likely also hit certain emerging and frontier sovereign issuers. In February 2020, the International Monetary Fund estimated the proportion of Low Income Developing Countries (LIDCs) at high risk of, or in, debt distress stood at 44%. That was before the crisis and broad sell off in commodity prices.

In sum, the speed of recovery is key for minimizing damage, but change will happen. The less time it takes to control the virus the lower the debt/GDP we will be left with following the necessary stimulus packages - and the shallower the recession the economy will have to dig out of.

We have no satisfactory way of estimating the time for recovery beyond epidemiologist estimates of curve flattening (of contractions and fatalities) and as observed in China and South Korea. At the time of writing, the US is still at the early stage of its curve. The actions of authorities have an important role in cornering the virus. We currently assume control can be achieved in 3-4 months, enough for economic activity to restart by mid-summer in the US and Europe. If this works out, economic activity should be back on a steady recovery path through 2021, following a brutal slowdown lasting a third of 2020. We anticipate this shock will lead to significant structural changes for many businesses.

Don’t forget to keep an eye on the horizon when the noise is deafening.

Some helpful links:

John Hopkins

– Coronavirus Dashboard

World Health Organization

Nextstrain Genomic Epidemiology

(German non-profit with outstanding visual maps)

US CDC

European CDC

BBC

– Coronavirus update page

Google Trends Search

– Coronavirus

1. The artificial horizon, gyro horizon, or attitude indicator, is an aircraft instrument that provides an artificial horizon to a pilot showing the angle at which the aircraft is banking - which is not something most people can sense when the real horizon is out of the field of vision. The instrument is driven by a gyroscope that due to the natural phenomena of the gyroscopic effect spins at a constant angle to earth’s axis.

2. Buyback yield calculation: weighted average of 2019 buyback value as a proportion of year-end 2018 market capitalization by company.