Controlling the Darkside of Network Effects

Quality Growth Boutique

Few people have warm memories of government monopolies from the 1970s – no choice and terrible service. Since then, services developed dramatically, particularly with the arrival of the internet and affordable technology. Free online services made a few companies, that were able to leverage massive network effects, powerful. Things evolved, then evolved again – “they sold my information” …. “they are watching us”…. When monopolies control vital services such as communications, or private information, the actual costs to users have the potential to be very high. Payment is not always in cash, and not always innocent – how bad it gets depends on who’s running the company and who runs the regulators.

Passive investors turn a blind eye to investing in companies that profit maximize at any cost. Active investors need to provide the balance between the power of dominant companies and a healthy role in the economy. Active investors and regulators hold crucial roles. If either are absent, consumers and investors can both lose.

Becoming a monopoly without legal barriers

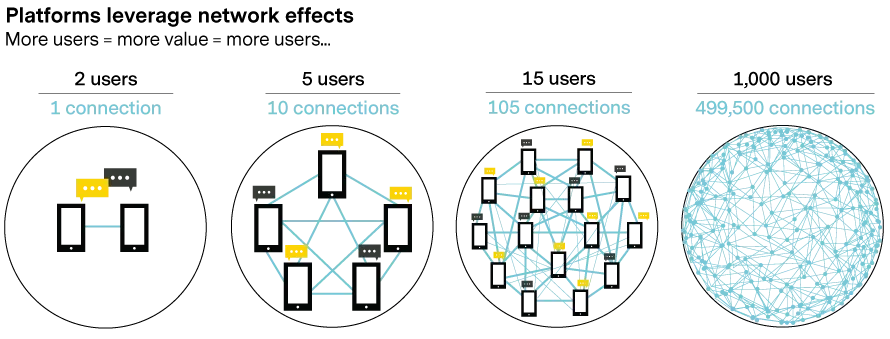

An established path to dominance is through ‘network effects’. A network effect is when many users are drawn to a platform where the value to a user increases with each new entrant. Amazon has a network effect as its sellers benefit from a huge number of buyers, and vice versa. To illustrate the effect, between 1,000 users there are some 499,500 potential connections. By the time you have 100 million users, the leverage from joining a network is significant. As the strength of the network grows, economies of scale are reinforced, smaller players cannot compete, and dominant companies rise with awesome barriers to entry.

The win

The win comes from the number of connections, and interactions, growing much quicker than the number of new users. At the same time the cost per user remains flat. Many internet monopolies generate their income indirectly through selling advertising to you, the user. To maximize revenue, they make their advertising as effective as possible. To do this, they accumulate as much information about you as possible: your location, when you wake up, what you bought, what you looked up. When users willingly give up this information, things can go sour. An example is a communications platform that becomes the broadly-accepted way to exchange private or business information. It should be possible to extract considerable value from its ‘sticky’ user base as dropping off the platform would have negative consequences for the user.

Network effect has turned nerds into dazzling celebrities at behemoths such as Microsoft, Google, and Alibaba. But network effect is not new. For example, few towns historically had a second marketplace as all the buyers and sellers were already in the first market. And, in terms of the potential we see with the technology companies today, this was recognized more than a hundred years ago. The CEO of the AT&T phone company, Theodore Vail, noted in its 1907 annual report that ‘the measure of value is not in the particular class of line connecting any subscriber to an exchange, but in the use of the exchange system as a whole’1. Not without coincidence, AT&T went on to control almost the entire U.S. telephone system. ‘Ma Bell’, as it was referred to, lasted until 1982 when it was finally broken up by regulators.

While global network effects are relatively rare outside of technology platforms, they can also be effective on a regional basis. Areas where network effects have taken hold include:

|

Utility (like): |

Comcast (Cable TV), mobile phone leaders by market, electricity distributors |

|

Shipping: |

DHL, UPS, FedEx, India Post (55,000 branch post office) |

|

Gadgets: |

Microsoft X-box, Sony Playstataion, Techtronics (power tools battery platform) |

|

Payment networks: |

Visa, Mastercard |

|

Market places: |

Amazon, Alibaba, Craig’s list (classifieds) |

Danger zone

Monopolies with network effects can be particularly dangerous both in terms of warping their original social function and extracting high value from users. Value can be pulled through prices, poor service, slower product development and intrusion of privacy. Temptation for profit maximization can be encouraged by performance-based pay. Danger also exists in emerging markets where political, or owner, influence over regulators can result in higher costs.

We see two primary constraints:

Competition – customers need choice. We believe the ideal structure is a genuinely competitive duopoly or oligopoly. Genuine competition leads to companies fighting for market share while maintaining some pricing discipline. Competition drives differentiation, pricing, product development and service. Plus, regulators watch from the sidelines while customers are quiet. However, regulators need to ensure the big 2 or 3 don’t turn into the fat 1. Examples of healthy duopoly/oligopoly competition could be represented by: Visa/Mastercard, Xbox/Sony Playstation, and Techtronics/Stanley Black & Decker (power tools).

Regulation – the less attractive cure. Generally, regulation does not appear until late in the game when damage is already done. National regulators work with blunt instruments, even in effective democracies where they are accountable to their vote hungry bosses. Following a public outcry, laws can end up over-regulating and stifling the market, moving it to a different direction. The market values a business based on an assumption of future cash flows. But if those cash flows are predicated on growing abuse of monopoly power, eventually resulting regulation could rebase cash flows in a single blow.

It’s worth noting, regulation of monopolistic power varies dramatically by market. In the U.S. for example regulation is more focused on avoiding market control through ‘combination, or conspiracy in restraint of trade’ (the antitrust law Sherman Act 1890). However, the law is light on inhibiting market power built organically. The EU has more aggressive consumer protection. Across the emerging markets, consumer protection is inconsistent.

Facebook and its data/fake news issues have brought significant public pushback. But in the U.S. it has still not faced strong new regulation. Although costs have risen – with employee numbers rising by more than 10,000 in 2018 (to 35,587 at year end) largely due to hiring for safety and content. But it’s still a long shot from being tightly regulated.

Fighting Cheap

Active investors, as stewards of capital, have an important role in society. Managing a company that has the power of network effect needs disciplined governance oversight, and competition. Companies in control of network effects can bring significant benefits to society and owners.

But when money follows broad indices unchecked, not only is stewardship (owners’ oversight) weakened through fragmentation, capital can flood into companies that may have little interest in social balance. It can be frustrating to think about how indices have ended up being used to steer cheap and disengaged forms of ownership.

The incentives of managements and their regulators should ideally align with your goals as an individual, as well as an investor.

1 https://beatriceco.com/bti/porticus/bell/pdf/1907ATTar_Complete.pdf