Beating Frustration in the Emerging Markets

Quality Growth Boutique

In volatile times, investing feels like a sprint, but it’s still the same long-haul marathon. Nowhere does setting the pace right matter more than in the emerging markets (EM). EM swings can be extremely frustrating. Valuations unhook from underlying value around worst-case scenarios with regularity. It’s no wonder there’s a temptation to give up on the long term and take a short cut. Maybe, buy something less volatile – like China or low yield bonds. What’s important to remember though, is that lower volatility for long-term holders does not mean lower risk. The emerging markets have been through many challenges – epidemics, political scandals, riots, inflation, deficits, oil collapses and surges, and natural disasters. They adapt, and grow.

In reward for their patience, passive holders of the MSCI EM index have received a meager 1.5% average annual return over 10 years in US dollar terms1 . That’s a lousy return for such a strong story, and many active managers have done better – as they should. Here’s our view on why the EM remains an attractive place to be, in good times and bad, and even as Covid-19 uncertainty continues to grip the world.

What are the emerging markets anyway? The 26 countries that MSCI defines as EM are not generally weak. They may be volatile, but the core EM markets have choices, and do not face the constraints more often found in Frontier markets. Combined, these 26 markets are massive geographies where supply and demand dynamics play out just as much as they do in developed markets (DM), only with 4.5 billion people, some 60% of humanity. These markets present considerable opportunity, but it is not evenly distributed.

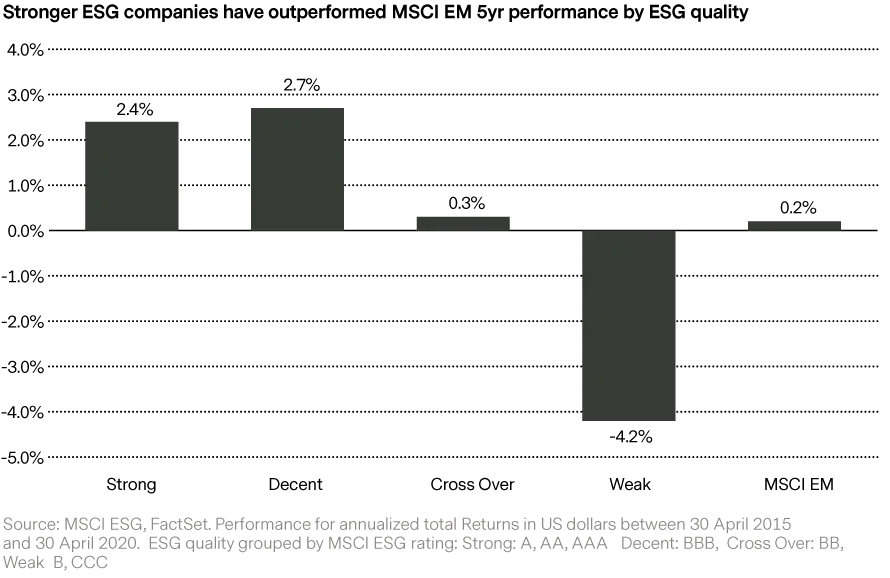

In terms of opportunity – the simple reality is that the EM has growth, huge potential, and risk all over the place. Opportunity is not evenly spread. It is concentrated in pockets. After researching a quality business with good economics, much of the remaining risk stems from the dark art of governance. There’s no magic, a risk is a risk. The chart below shows performance of MSCI EM companies relative to their ESG ratings over the last five years. Growth and staying ahead of governance issues are both vital to compound value.

Two questions EM investors need to think through:

- What playbook can deliver fair EM returns without ridiculous risk?

- Would piling into China lower risk?

EM Playbook

The EM playbook, as we see it, is based on three simple but critical concepts: establish the return and risk balance, find growth, and guard the investment from trouble. An investor of lower risk and high-quality businesses should consider a long-term dollar return in the 8 to 12% range as achievable. More than that, experience has taught us that risk seems to rise exponentially alongside small stretches in return goals – so discipline is important.

Growth is supported by the rising tide of demand as hundreds of millions grasp a better quality of life, providing demand for innovative and well-run companies with enduring brands. Over the course of 25 years, traditional dominant EM companies in energy, materials and utilities have been replaced by a new generation of knowledge economy and consumer facing leaders. Areas where quality growth companies can be found include:

Domestic market leaders: These unique markets offer opportunities for savvy local players to take share from inefficient state players – such as the banks in India. There is also a greater tolerance of high market share. Oligopolies can deliver benefits to multiple stakeholders, including governments, if they share common goals and remain competitive – examples include the Chinese internet names Alibaba and Tencent. Also in this group are the listed EM subsidiaries of multinationals that are often well-governed and benefit from the product portfolios and purchasing power of its parent.

Dominant regional leaders: A relatively small subset of firms that have successfully expanded beyond their home market to become regional leaders. These include the Latin American retailers Wal-Mart de Mexico and Femsa (convenience stores), and the Asian insurance giant AIA.

Global leaders: These are advanced EM-based global leaders generating diversified revenues streams from across the globe. Examples include semiconductor giants TSMC (Taiwan), Samsung Electronics (Korea), SK Hynix (Korea), and the Indian IT services giants TCS, Infosys, and HCL.

Developed market (DM) transformed to EM: A number of DM companies now generate more than half of their business from the EM. Generally, it is the result of successful targeted growth, or acquisitions of large local franchises. Examples include the brewers AB Inbev (Belgium) and Heineken (Holland), and HSBC (UK).

Guarding the growth

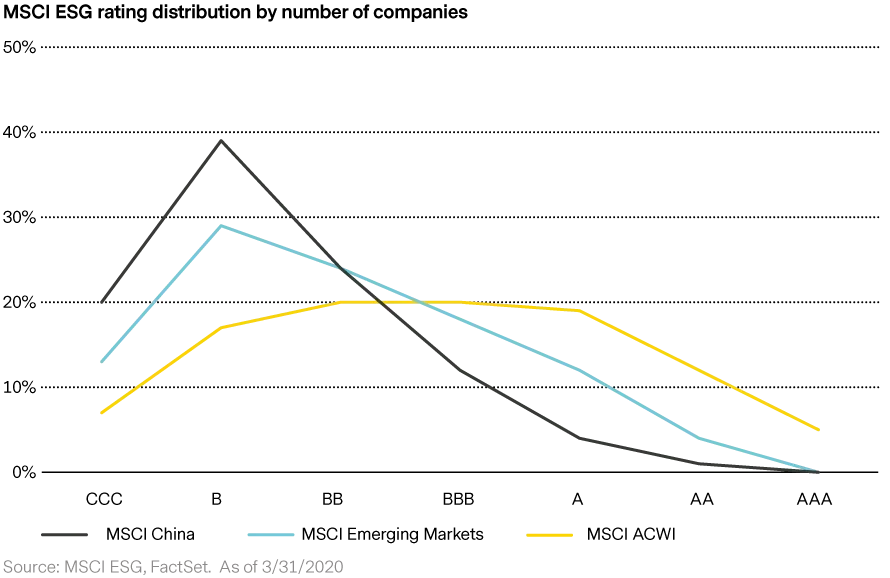

While opportunity comes in many forms, there is a concentration of risks around governance where minority shareholders are generally in weaker positions than they are in developed markets. To give an idea of EM governance in relative terms, the chart below shows the distribution of MSCI ESG company ratings across the MSCI benchmarks for China, EM and the All Country World index (ACWI). More than a third (36%) of the ACWI companies rate A or above (highest ratings), the EM is at 16%, and China at just 5%. China skews to the low end with 58% of its companies rated B or CCC (lowest).

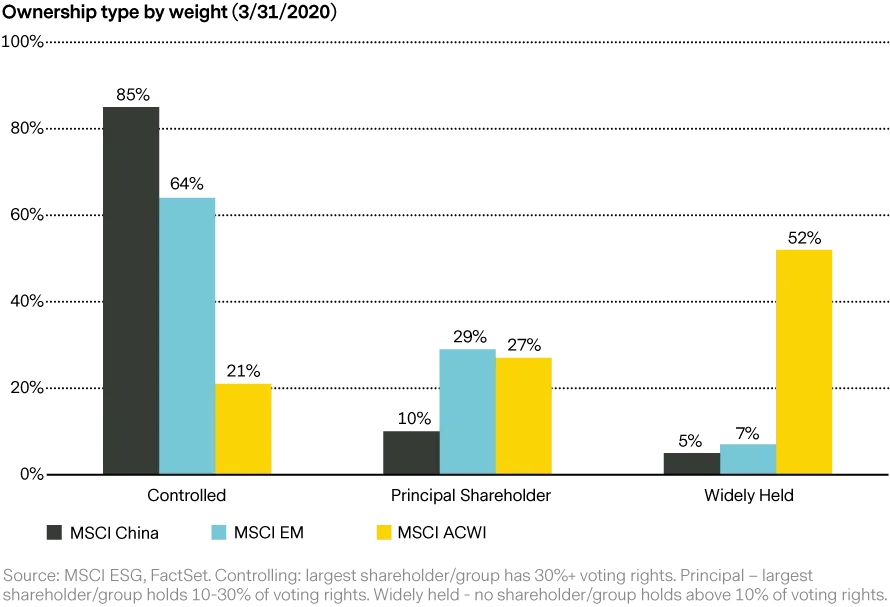

Governance problems are often rooted in who controls the business. The main ‘controlled’ businesses types are State Owned Enterprises (SOEs) and family businesses. In controlled businesses, minority shareholders have less, or in many cases, effectively no control. The MSCI China has 85% of its weight in controlled companies.

Governance issues with SOEs start with alignment of interests between government, politicians and minority shareholders. A challenge for long-term investors is that government decision makers, and priorities, can change with little notice. The issues around family businesses are different. The financial goals are usually closer aligned, but challenges often lie around decisions about capital allocation (acquisitions), executive selection (family vs professional) and accountability. Investors in controlled businesses need to remain vigilant and react if they sense trouble.

Better off in China?

Throughout the pandemic, China has offered a picture of discomfort but also stability on a seemingly sure economic footing. It was Ground Zero for the virus, but seems to be the first out as well. China’s currency is stable, supported by a closed capital account keeping savings in the country. It is the workshop exporter of the world and its domestic economy seems to grow like Jack’s beanstalk. Sure it’s got lots of debt, but if they never go bust, what’s the problem? Does it make sense to weather the storm in China, and venture back out when it’s cleared up?

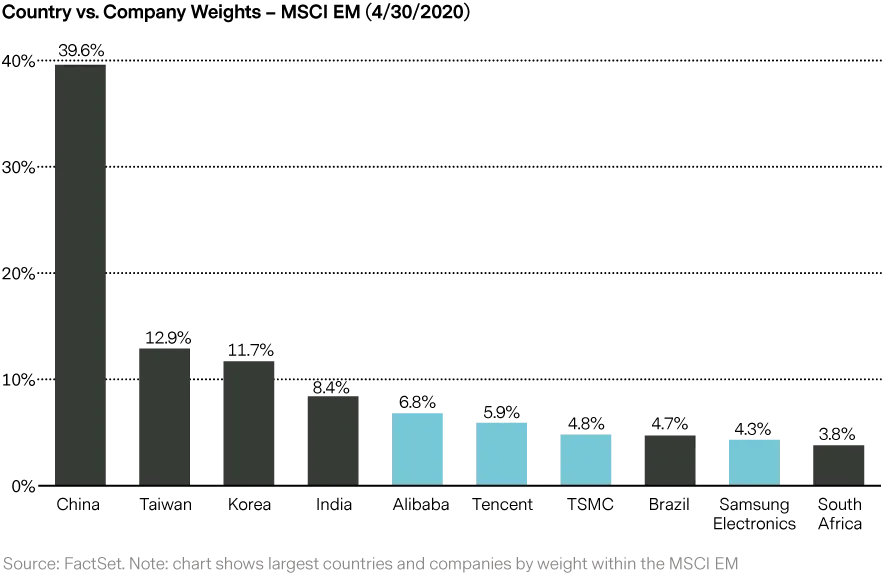

It would be great to have a serene EM island of growth and stability. Unfortunately, it’s not that simple. China is a big part of the benchmark and investible choices appear narrow. With China making up 41% of the MSCI EM benchmark, not many would suggest that overweighting China will bring diversification. For a sense of how big China has become, it now has two companies that individually have greater weight in the index than Brazil.

To cover quality hurdles such as earnings predictability and governance, it’s tough to find conviction with large chunks of the Chinese market. This is normal in any market. Few businesses offer long-term growth with decent predictability, and it is no different in China. But with such a large market, and such a narrow selection, you need to watch for risk accumulation.

Geopolitical pressure is building against China at the same time its long bull run has left households and companies highly levered. Barring a major blow up with the US, there are companies that should have the structural growth and strength to manage fine through a recession. The challenge for stock pickers is visibility in terms of governance and understanding the goals of the regulators. The regulators are an important part of company analysis in China.

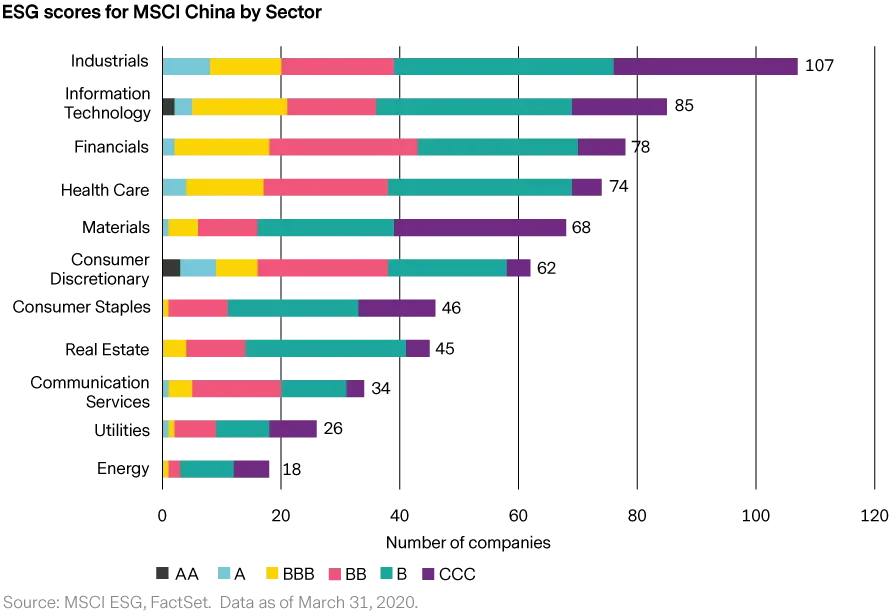

The chart below takes a look at governance through ESG scores (by sector) of the MSCI China. We have lumped the ratings into groups: A-and-above as strong, BBB decent, BB crossover territory, and B and CCC as weak. The strong/decent groups account for just 17% of the companies. The IT sector has the most with 21 companies. Without visibility, good or a mirage, we have no way to differentiate resilience if we cannot see the sustainable dynamics driving a business.

Conclusion

We continue to see a strong case that high quality businesses across the EM can provide multi-decade growth with diversified return drivers. For investors who find the investment opportunities, an important element that guards compounding from trouble is to focus on governance and the alignment of interests with minority shareholders in particular. The challenge, of course, is putting up with the volatility during downturns. Low volatility is not the same as low risk, and that’s important to remember on the long run towards investing results.

1. Total return over 10 years between 30 April 2010 and 29 April 2020 (FactSet)

Certain information ©2020 MSCI ESG Research LLC. This report contains “Information” sourced from MSCI ESG Research LLC, or its affiliates or information providers (the “ESG Parties”). The Information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. Although they obtain information from sources they consider reliable, none of the ESG Parties warrants or guarantees the originality, accuracy and/or completeness, of any data herein and expressly disclaim all express or implied warranties, including those of merchantability and fitness for a particular purpose. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such, nor should it be taken as an indication or guarantee of any future performance, analysis, forecast or prediction. None of the ESG Parties shall have any liability for any errors or omissions in connection with any data herein, or any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages.