A steady hand in volatile markets

Quality Growth Boutique

While the human toll of Russia’s aggression against Ukraine is horrific, it is a stark reminder to investors of the volatility inherent in emerging markets. In 2021, Russia was a top contributor to MSCI Emerging Market Index returns (despite its modest 3.6% weight) as Russian equities returned 19% on the back of higher oil prices as economies emerged from pandemic shutdowns.

Yet in a few short weeks, Russia’s brutal invasion of Ukraine was met with sanctions from the US, UK, and EU and the shutdown of the Moscow exchange. Deemed uninvestable, Russia was removed from the MSCI and FTSE Russell Emerging Markets Indices.

Global investors held Russian assets worth approximately $170 billion and foreign holdings of Russian stocks totaled $86 billion at the end of 2021. Those assets were effectively frozen overnight and some steep write downs may be on the horizon.

In the face of extreme volatility, a quality growth approach can help mitigate risks especially in emerging markets, where country turmoil can be more pronounced than in developed markets. We focus on identifying companies that can deliver consistent and sustainable earnings growth, which also involves assessing the political and regulatory context in which they operate. This has resulted in our lack of exposure to Russian companies. Close consideration of absolute risk can provide downside protection, which should lead to higher compounding of returns over the long term.

On the sidelines of Russian exposure

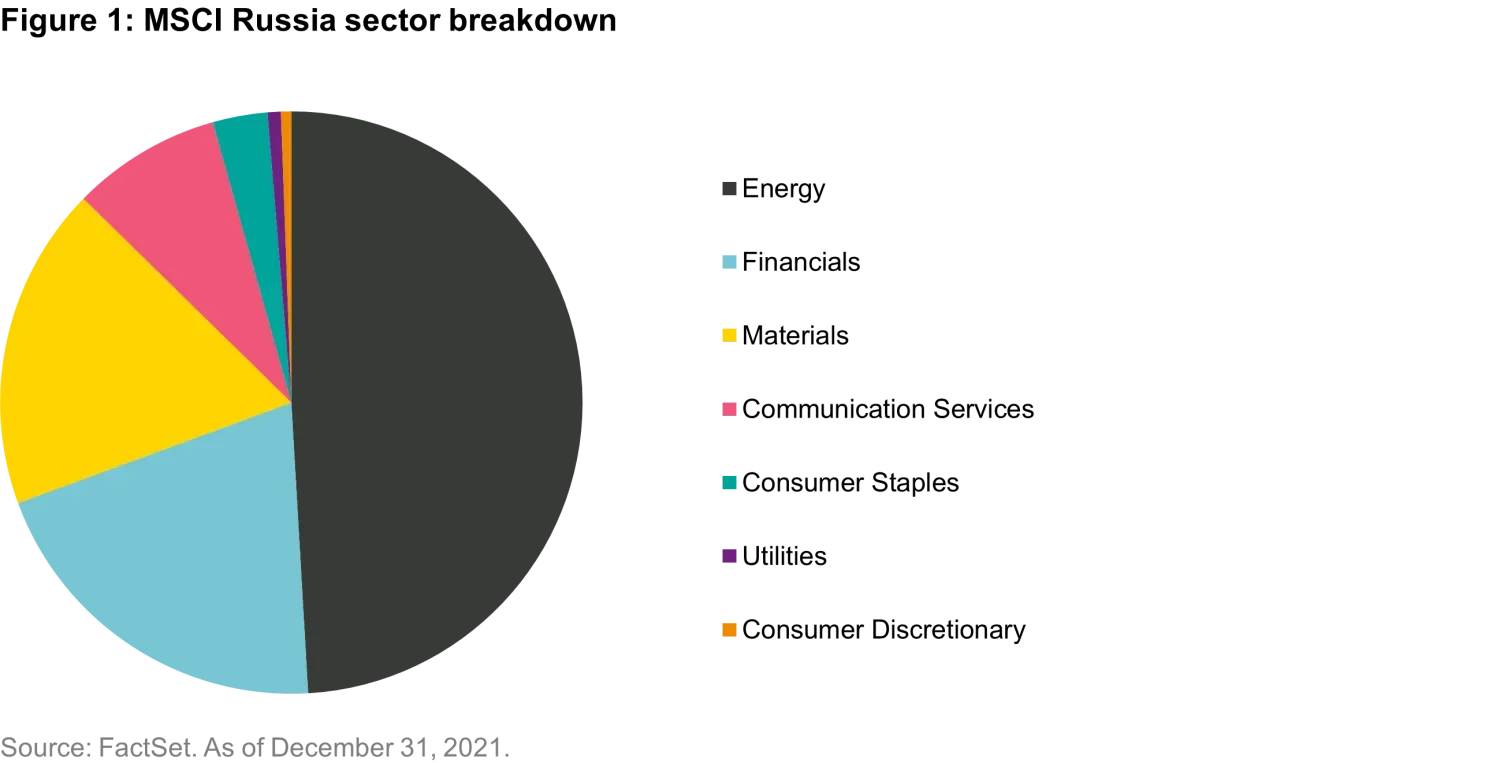

Across our portfolios, we did not have any direct exposure to Russia. Over the years, we have on occasion had a small weight – usually just one company, if any. Historically, we have been cautious for several reasons. From a style perspective, most Russian companies are not a fit. In Russia, the market is dominated by volatile energy and materials sectors – combined they accounted for nearly 70% of the MSCI Russia index. Another 20% came from financial companies and we believe caution is warranted when it comes to Russian banks.

More importantly, leading academics, political economists and regional industry heads have repeatedly corroborated our view that under Russia’s authoritarian regime companies are not truly independent, despite appearances. The lack of rule of law is a looming factor. For example, in 2003, motivated by political reasons, the government seized oil giant Yukos and arrested its head, Mikhail Khordorkovsky. A legal battle for shareholder compensation ensued and continues to this day. And it’s not as if Russia’s invasion of Ukraine is unprecedented – Russia has invaded countries before, and sanctions post Crimea were hardly a deterrent.

A stark reminder of the inherent volatility in emerging markets

Emerging markets can offer a plethora of attractive opportunities – durable businesses with decades-long runways for growth and some world class companies. Volatility is the price of admission for participating in that growth, yet it is easily forgotten when markets are strong. And when things go south in emerging markets, the decline can be sharp.

Emerging market indices have expelled countries before. For example, Venezuela was a constituent until 2006. Argentina was removed from the MSCI EM index at the end of 2021 and moved to a standalone index. Its emerging markets lifespan was short lived – it was added in May 2019, a few months after which capital controls were implemented. When it was removed at the end of last year, “severe and prolonged” capital controls were cited as the reason. Pakistan is another that was recently removed and reclassified as a frontier country.

Quality isn’t just about the company, but also the regulatory and political environment

China is another recent example of how quickly tides can turn in emerging markets. Many investors who enjoyed the robust, linear returns China offered over the last several years were caught off guard in the latter half of 2021 when President Xi’s regulatory crackdown reverberated across the region. Over the course of six months, China became the worst performing major market in the MSCI Emerging Market index, sliding 22% for the year.

In the spring of 2021, the government advised more than a dozen IT companies that they may be required to “delink” their financial products businesses from their social media, gaming, and other operations. In July, private education companies were transformed into non-profit businesses overnight, sending some of those stocks tumbling. Another example is restrictions that were placed on gaming companies to address their “negative influence on young people,” reducing near term visibility.

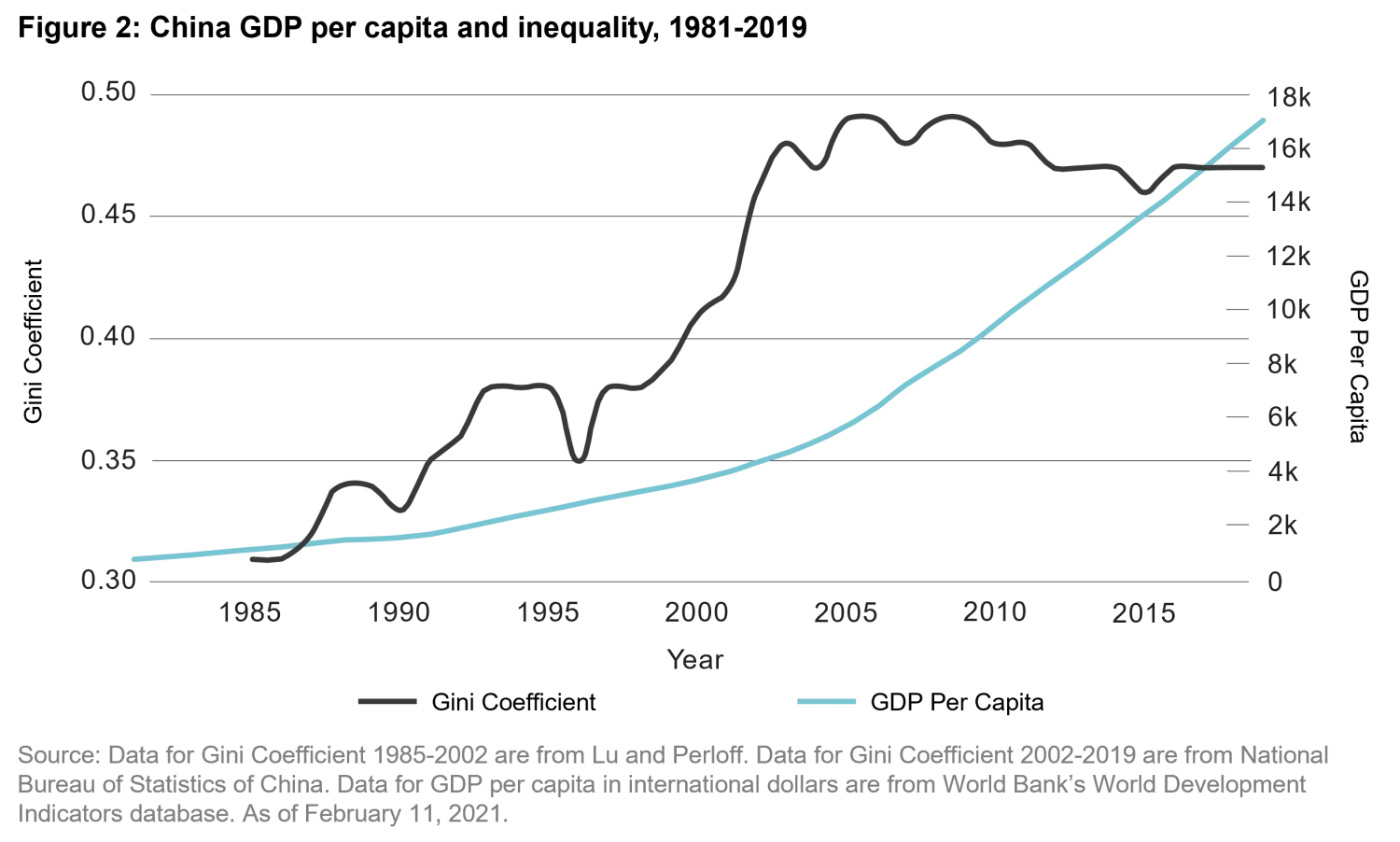

Was China’s regulatory crackdown unfathomable? While conditions had changed, we believe the motivations were well telegraphed over many years. China’s GDP per capita has significantly improved over the last several decades and millions of people have been lifted out of poverty. Nonetheless, income disparity has been persistent. The Gini coefficient is one measure of income inequality and Chinese leaders had insisted numerous times that inequality above 0.40 was considered potentially destabilizing. The social agenda and regulation to combat anti-competitive practices should not have been too surprising to investors.

We believe China offers investors a lot of opportunity. However, it is not just the quality of the companies that matters, but also the unique environment in which they operate. For example, we have long avoided China-based banks as we generally view them as policy tools of the government. The interests of investors, management, and the government are simply not aligned.

We believe opportunity exists in domestic consumption and in companies that lie outside of regulators’ crosshairs. Operating environments can evolve and investors must adapt. While there are some high-profile targets of regulation, there are also companies that may be beneficiaries. For example, measures to end anti-competitive practices such as exclusivity agreements in e-commerce will negatively impact the leading company but should help level the playing field for competitors. The bottom line is that it is not just the quality of the company, but the context in which they operate. Russia is another example where rule of law and governance are important issues. In Russia, the rights of shareholders have been suspect for some time and government actions can be unpredictable. Emerging markets require careful consideration.

What does Russia’s invasion of Ukraine portend for China and Taiwan?

Russia’s invasion of Ukraine begs the question of whether China could take over Taiwan. While there are clear geopolitical tensions, there are also important differences that make the likelihood more remote. For one, the sanctions placed on Russia are severe and are likely to have a drastic impact on its economy. The international backlash is substantial and may serve as a cautionary tale of what can befall aggression. Taiwan’s chip production has become integral to everyday life across the globe. Its semiconductor industry is important on a global scale and makes it less likely to be a target of aggression. Moreover, China has been enjoying economic prosperity and although there have been trade tensions with the US, China has worked to integrate further with Europe. While we will continue to monitor the geopolitical climate, we do not believe this is an imminent threat.

Being mindful of absolute risks on a country level

We aim to invest for all scenarios, in companies that can successfully navigate a variety of economic backdrops and challenges. In emerging markets, country risk is more relevant than in developed markets. There are times when the macro environment is so challenging that we determine a country is in what we call an ‘off-switch’ position. We have always been wary of Russia, however we were additionally cautious in recent months when the risk of invasion was high. Some felt that Putin was posturing to obtain concessions and some quality names in the internet space came down to levels which looked attractive. While it appeared that an invasion was a low probability event, we did not want to take significant event risk, and Russia was clearly in the ‘off switch’ position for us.

There are other countries that have both significant fiscal and current account deficits or political strife. Turkey, South Africa and Argentina have been in the ‘off-switch’ position for some time. There are periods when this may mean foregoing near-term returns in order to preserve returns for our clients over the long run. Should circumstances improve, we can revisit turning the switch back on. In the meantime, there are plenty of opportunities to find quality businesses at reasonable valuations in markets where we feel the risks are manageable. As investors, we believe close consideration of absolute risk is essential to long-term returns and adherence to this philosophy has contributed to lower volatility versus our peers.